Equity Rally Broadens in August

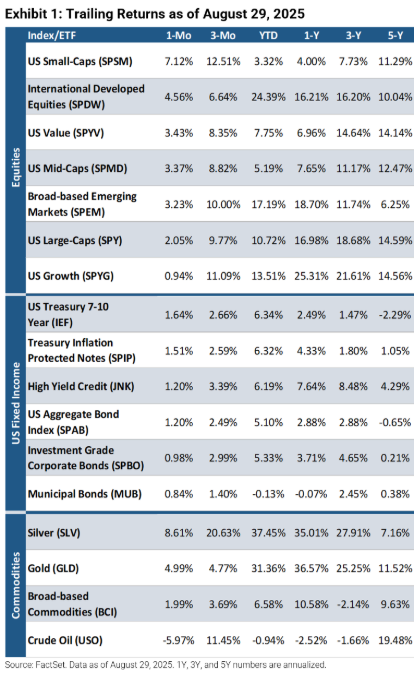

Despite tariff uncertainty, a slowing consumer, and continued inflation worries, equities posted positive returns in August amid a healthy Q2 earnings season and renewed hopes for interest rate cuts. The S&P 500 Index gained 2% for the month, reaching a new all-time high on August 28th. With the Federal Reserve hinting at near term monetary easing, equity performance broadened in the month. Small-caps (+7.1%) were among the best performers, followed by international developed equites (+4.6%) and US value (+3.4%). Bonds also fared well as 7-10 year US Treasuries gained 1.6%, Treasury Inflation Protected Notes rose 1.5%, and high yield credits were up 1.2%. Aside from crude oil (-6.0%), commodities posted positive returns as silver increased 8.6%, gold was up 5.0%, and broad-based commodities rose 2.0%.

Fed Chair Powell’s Jackson Hole Speech Leans More Dovish than Expected

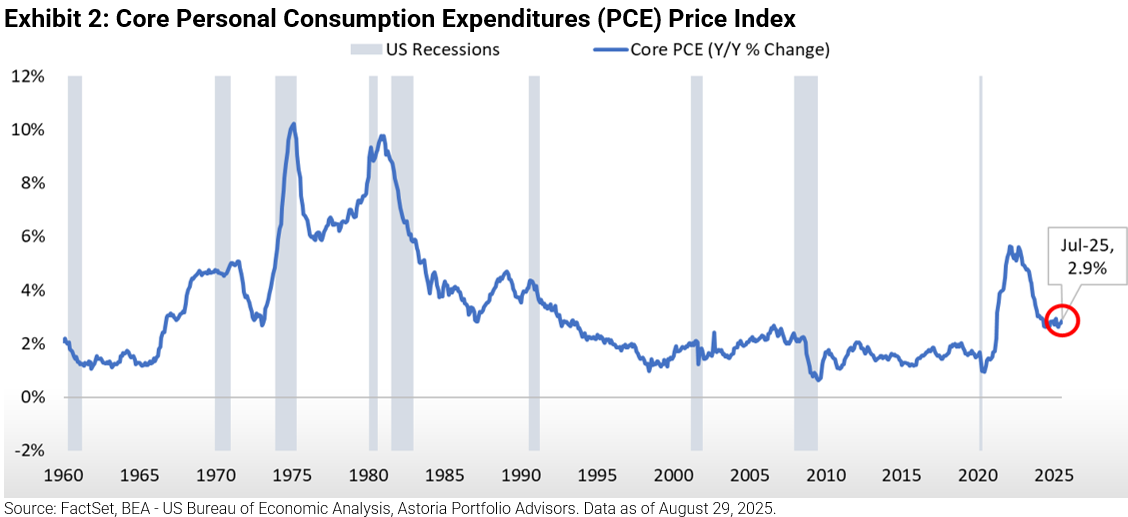

At this year’s Jackson Hole symposium, the Federal Reserve acknowledged a shifting in the balance of risks. Chair Powell emphasized that “downside risks to employment are rising” and noted that with policy already restrictive, the outlook may warrant adjusting the Fed’s stance. Although inflation via July Core PCE (Personal Consumption Expenditures Index) printed 2.9% and increased from June’s 2.8% reading, GDP growth has slowed to 1.4% in the first half of the year and job gains have weakened sharply. Such data likely caused Powell to reiterate that it is a “reasonable base case” to assume tariff effects on prices will be short-lived. Markets interpreted his remarks as opening the door to rate cuts, sparking a rally in rate-sensitive stocks and bonds. As of August 31st, markets are pricing in an 86% chance for a 25 bps rate cut at the September FOMC Meeting.

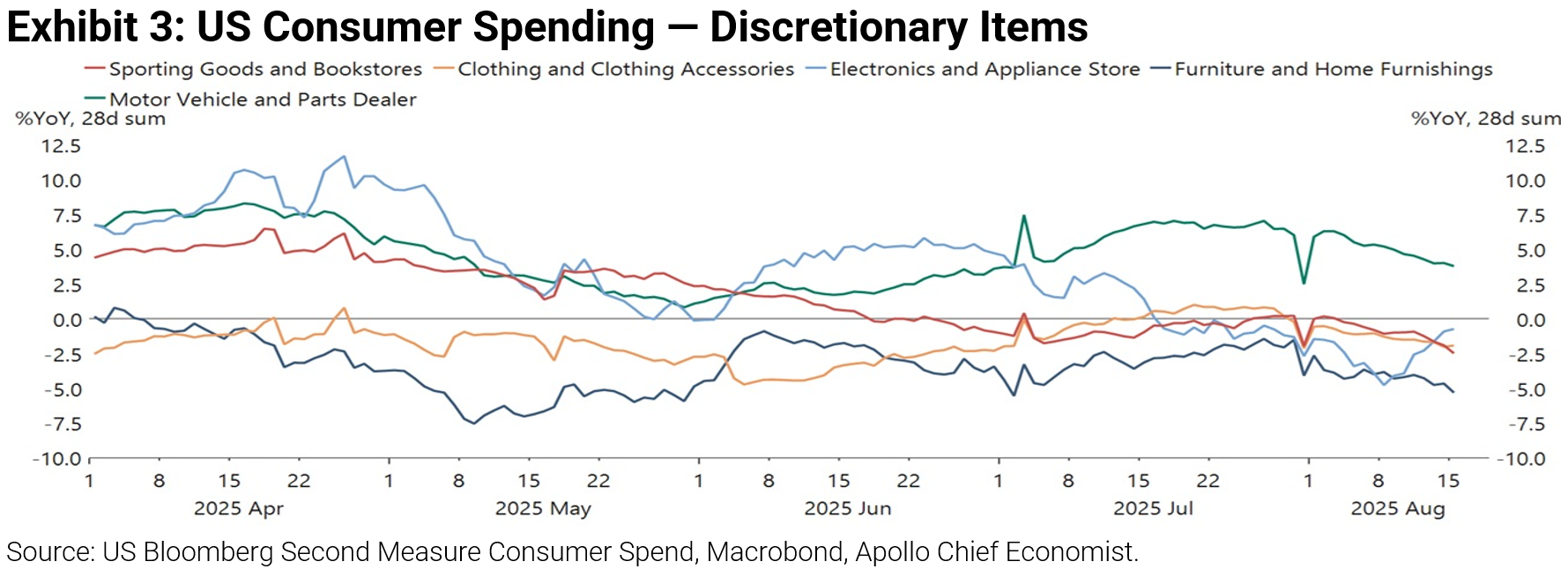

Discretionary Spending Starts to Slow

Recent data show slowing year-over-year growth in consumer spending across tariff-impacted discretionary sectors such as autos, apparel, furniture, and sporting goods. This suggests emerging weakness in discretionary demand that could weigh on overall consumer activity.

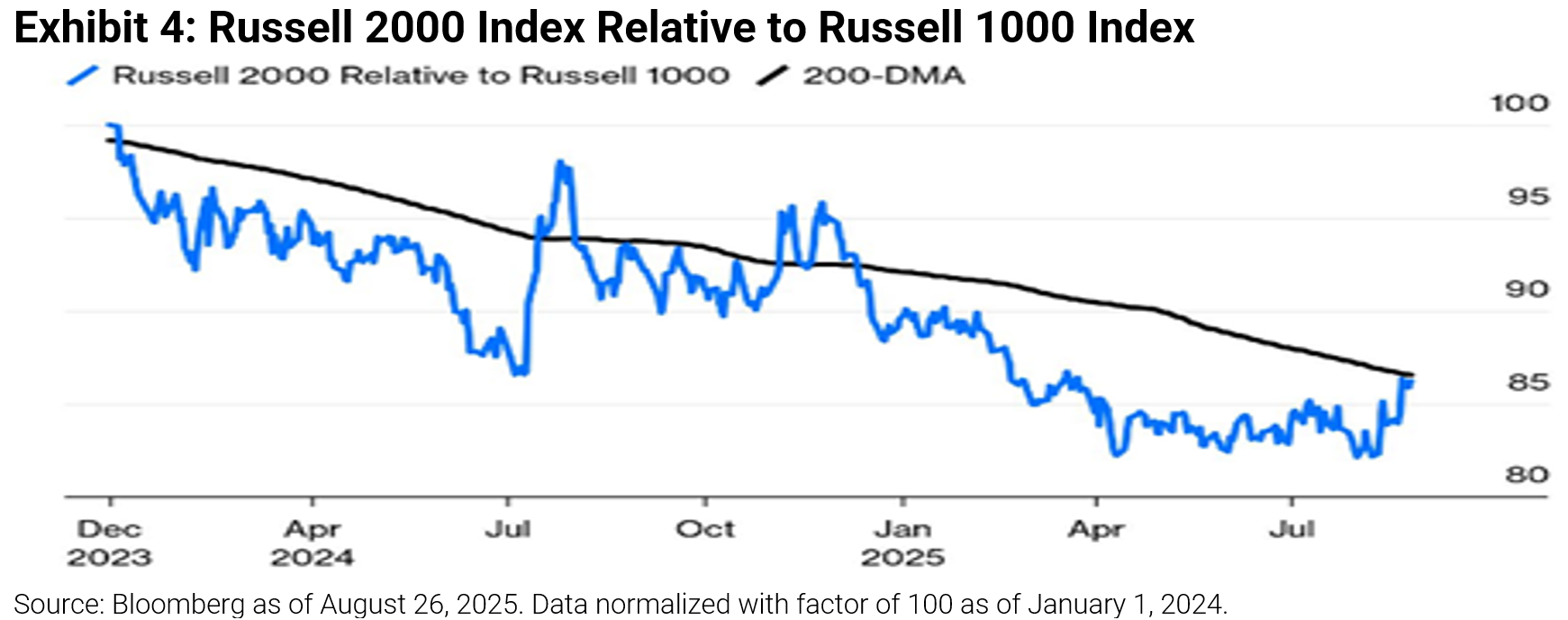

Small-Caps Gain Ground on Large-Caps

Small-caps, as measured by the Russell 2000, have recently outperformed their large-cap counterparts in the Russell 1000 by the largest margin this year, driven in part by growing expectations of looser financial conditions ahead.

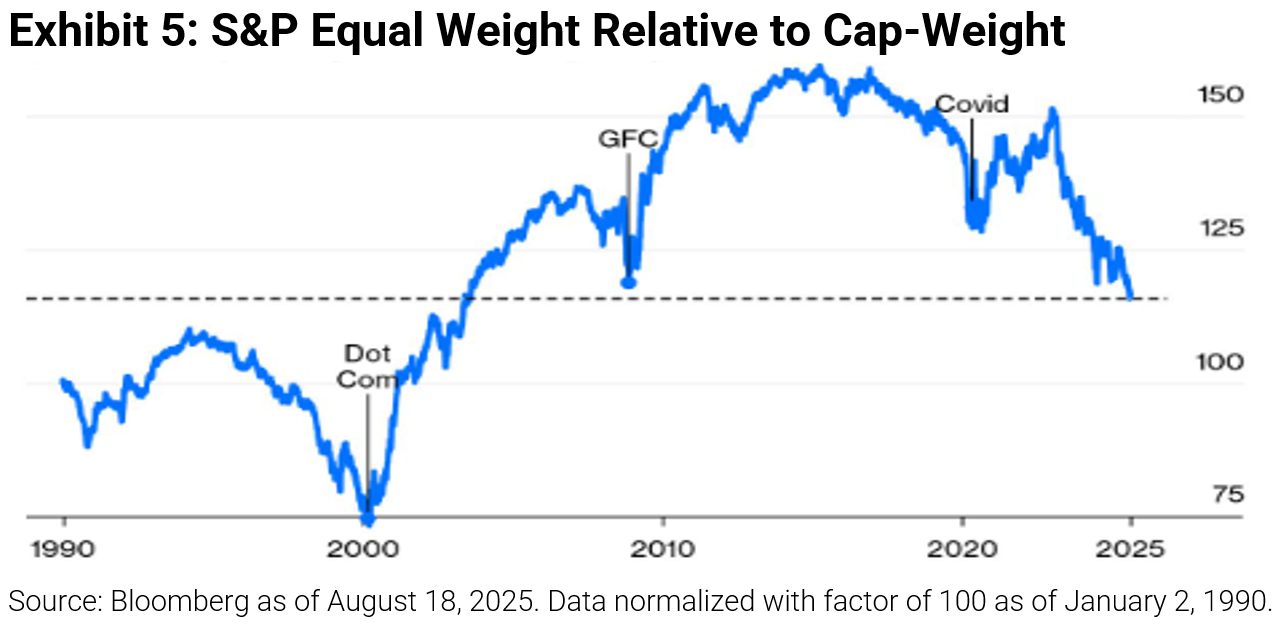

Is Equal Weight Poised to Outperform Market-Cap Weight?

Relative to its cap-weighted counterpart, the equal-weighted S&P 500 Index has fallen to its weakest level in over two decades. This underscores the elevated concentration of market leadership in a handful of mega-cap stocks, with the average company significantly lagging the index.

Early-Cycle Themes Emerging—Is It Time to Leg In?

The business cycle has started to signal its shift from a late-cycle phase to an early-cycle phase. While monetary policy remains restrictive, Chair Powell’s speech at Jackson Hole opening the door to rate cuts is likely to be an important tailwind to markets. As a result, market participation has begun to broaden with small-caps, mid-caps, banks, and other rate-sensitive areas of the market trending relatively higher than the overall equity market. Moreover, earnings have been broadly resilient, helping to counter softer macro data, and we believe this strength can extend through year-end despite the potential for seasonal volatility in September. Meanwhile, the leadership of gold and Bitcoin highlights the market’s ongoing search for hedges against fiscal expansion and inflation risk, while the rapid advancement of AI represents a powerful structural force that has the potential to shape long-term winners and losers. Against this backdrop, we continue to favor diversified equity exposure while legging into attractive early cycle cohorts, as well as thoughtful inflation and deficit hedges to aid in navigating both near-term risks and longer-term opportunities.

Click here to view this report as a PDF.

Originally published by Astoria Advisors

For more news, information, and strategy, visit the ETF Strategist Content Hub.

Warranties & Disclaimers

As of the time of this publication, Astoria Portfolio Advisors held positions in SPYG, SPY, SPYV, SPDW, SPMD, SPSM, SPEM, SPBO, SPAB, MUB, IEF, SPIP, GLD, SLV, USO, and BCI on behalf of its clients. There are no warranties implied. Past performance is not indicative of future results. Information presented herein is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. The returns in this report are based on data from frequently used indices and ETFs. This information contained herein has been prepared by Astoria Portfolio Advisors LLC on the basis of publicly available information, internally developed data, and other third-party sources believed to be reliable. Astoria Portfolio Advisors LLC has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to the accuracy, completeness, or reliability of such information. Astoria Portfolio Advisors LLC is a registered investment adviser located in New York. Astoria Portfolio Advisors LLC may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements.

Earn free CE credits and discover new strategies