Key Takeaways

Nvidia Corp.’s (NVDA) outsized role in the market means that index and target-date funds tracking the S&P 500 are heavily invested in this single company.

AI hype could be cooling, China trade tensions are heating up, and the Federal Reserve’s walking a tightrope—any of these could send your “diversified” retirement fund on a wild ride.

Options include looking for overlapping funds, choosing equal-weight options, or adding international stocks, which can dial down your Nvidia risk without missing the next rally.

Nvidia is the most overweight stock in U.S. stock indexes ever—and by extension, in the retirement plans of millions of Americans that track them. That’s leading some retirement savers to wonder if their portfolios are too concentrated in one stock.

In fact, Nvidia already makes up nearly 8% of the S&P 500, while the “Magnificent Seven”—Alphabet Inc. (GOOGL; GOOG), Amazon.com Inc. (AMZN), Apple Inc. (AAPL), Broadcom Inc. (AVGO), Meta Platforms, Inc. (META), Microsoft Corporation (MSFT), and Nvidia—account for one-third of the S&P, levels that increase the concentration risk for investors saving for retirement in index-heavy 401(k)s and target-date funds.

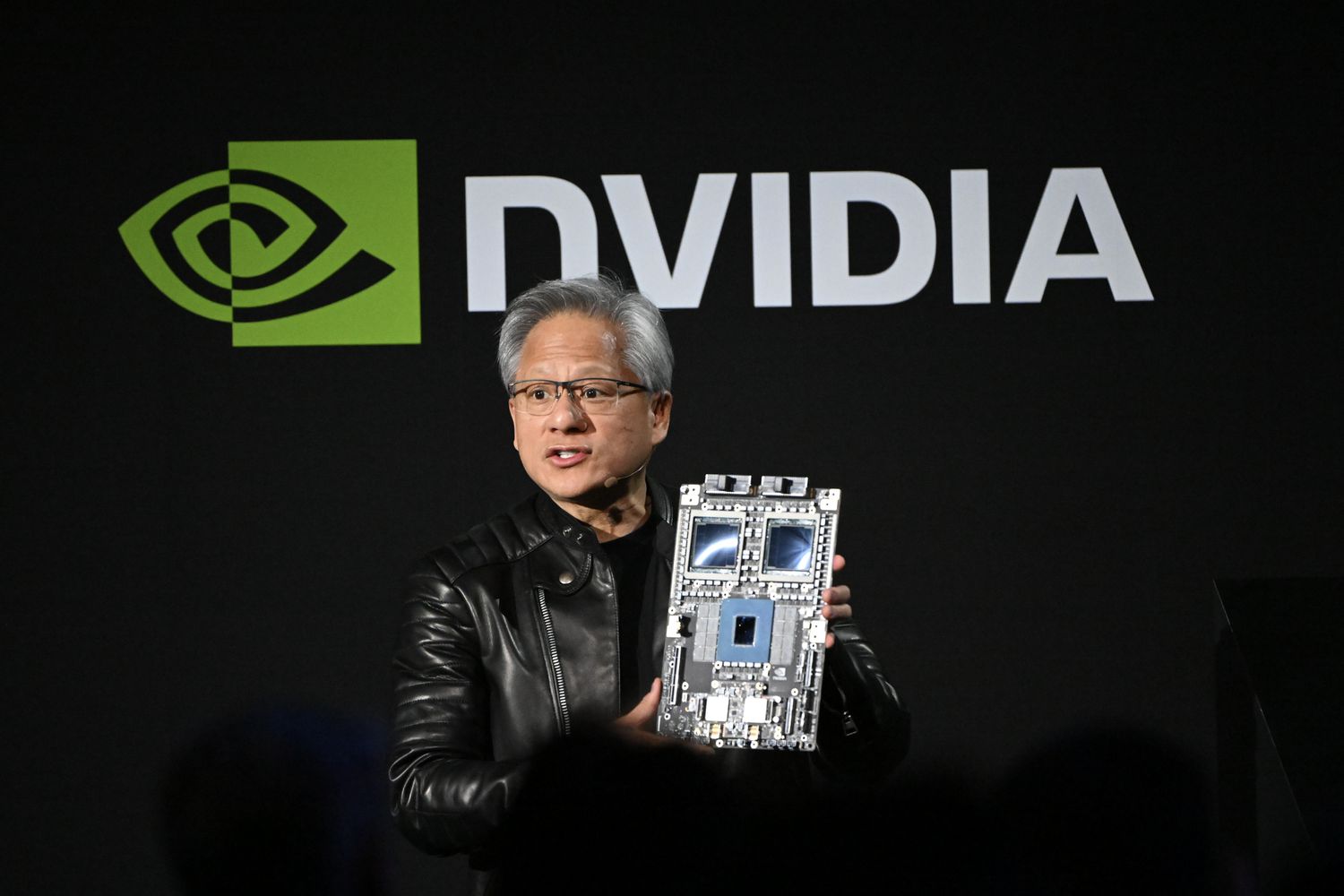

Nvidia Looms Large

Nvidia is riding a wave of success fueled by semiconductors that power computer gaming, crypto mining, and AI number-crunching, all of which constitute a significant part of today’s digital economy.

When index funds track the S&P 500, they automatically invest more money in the biggest companies—so every new dollar flowing into these funds gives Nvidia an even larger slice. As the company’s market capitalization vaulted well past $4 trillion in 2025, its weight in the S&P 500 climbed to a record 7.95%, beating the previous record set by Apple. The result is that Nvidia is the most important stock in many portfolios because index funds are commonly used in Middle America’s retirement plans.

Policy Risk Meets AI Fatigue

While Nvidia’s latest results were solid, skeptics warn that much of the AI boom is already priced in, and unresolved trade issues or rising competition could slow growth. The company faces real headwinds, from China export restrictions to new competitors nipping at its heels. If demand slows or regulators tighten the screws, your 401(k) could feel the pain.

Markets are hovering near all-time highs just as the Fed navigates inflation data and the political turmoil of Washington, D.C. Even a slight shift in interest rate expectations could hit high-flying tech stocks hard—and when those stocks make up a third of the S&P 500, that means your retirement savings could take a hit too.

What Retirement Savers Can Do

Concerned investors can take some smart steps:

Look under the hood: Review the “Top Holdings” on your fund fact sheets. If you have multiple funds in your account, look for overlap doubling or tripling up on your holdings of Nvidia and other big-tech companies. If your core U.S. fund is S&P 500–based, know that a big chunk of your 401(k) may rise or fall with just a few names.

Choose “total market” over only S&P: A total-market index will typically dilute mega-cap dominance with more companies from across the economy. If you don’t already have one, pairing 80% of your stock portfolio in the S&P 500 with 20% in an “extended market” (completion) fund will get you close. However, should the economy get rocky, the small and mid-cap companies you’ve added are likely to take a hit.

Opt for “equal-weight” or “revenue-weight”: Reduce the influence of the biggest stocks by either giving every company the same portfolio weight or, instead, weighting by company sales and revenue.

Go global: Big U.S. tech isn’t the only game in town. An international stock fund gives you exposure to companies across the world. (Just watch out for currency risk if you’re close to retirement.)

Rebalance: Schedule a regular portfolio checkup. When one investment grows faster than others, trim it back to your target mix.

The Bottom Line

Nvidia’s market dominance has been a huge winner for those invested in index funds, but the company’s sheer size puts more of your fate in the hands of one company. Rebalancing, careful diversification, and prudent management can help keep long-term portfolios on track, no matter how Nvidia performs in the coming years.