Market Size & Trends

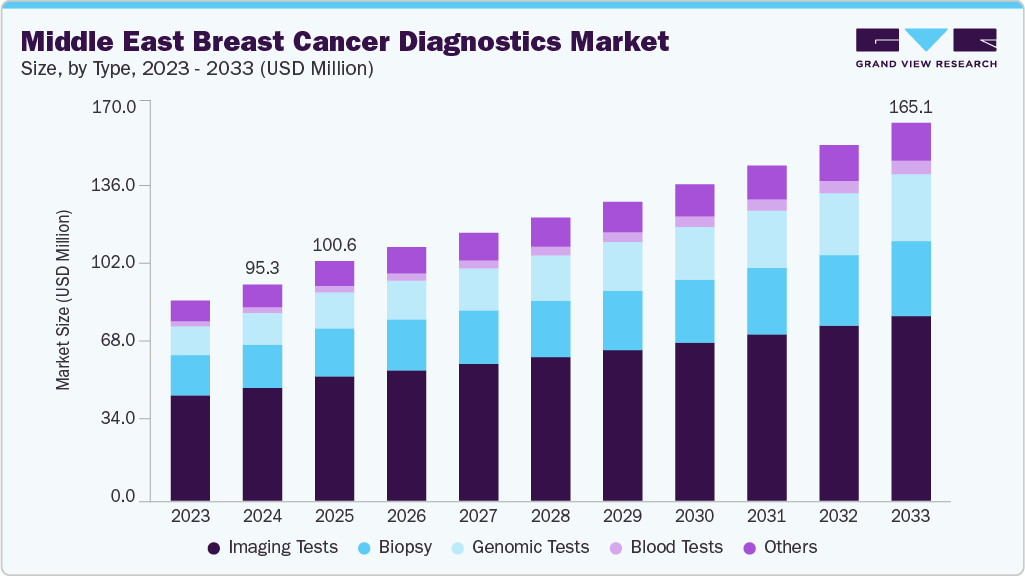

The Middle East breast cancer diagnostics market size was estimated at USD 95.25 million in 2024 and is projected to reach USD 165.10 million by 2033, growing at a CAGR of 6.39% from 2025 to 2033. The market is primarily driven by the rising incidence of breast cancer, which remains the most common cancer among women in the region. Increasing government-led screening initiatives, awareness campaigns, and early detection programs are improving uptake of diagnostic tools. Growing investments in advanced imaging technologies, molecular diagnostics, and genetic testing fuel demand. Favorable collaborations between regional health ministries and global diagnostic companies, coupled with expanding access to private healthcare, are accelerating market growth and supporting the shift toward precision-based diagnostics.

The market is growing steadily, supported by rising cancer incidence, increasing awareness, and strong government-led screening initiatives. Across the region, breast cancer remains the most common cancer among women, with cases often diagnosed at younger ages compared to global averages. Early detection has become a central focus, as technological advancements in diagnostics significantly improve survival rates, recovery outcomes, and overall quality of life. Governments are investing in digital health, AI-powered solutions, and nationwide awareness campaigns, which are expected to accelerate the adoption of advanced diagnostic tools and expand access to early screening.

Saudi Arabia represents the largest share of the regional market and is actively transforming its breast cancer diagnostic landscape. In 2024, the country recorded more than 61,000 breast cancer cases, underlining the urgency of early detection and screening. The Ministry of Health (MoH) has launched multiple initiatives, including an AI-enabled breast cancer screening program in collaboration with the Saudi Data and Artificial Intelligence Authority. In addition, the Seha Virtual Hospital partnered with Saudi Telecom Company in October 2022 to introduce one of the first oncology e-platforms in the region, designed to support healthcare professionals in diagnosis and patient management. Saudi Arabia’s robust regulatory ecosystem, led by the Saudi Food and Drug Authority (SFDA) and supported by centralized procurement from the National Unified Company for Medical Supplies, ensures the safety, quality, and accessibility of diagnostics. These measures and insurance oversight by the Cooperative Council of Health Insurance create a strong framework for long-term market growth.

Breast cancer is the leading cancer among women in the UAE, with most cases detected in women below the age of 50, creating a significant public health concern. Government and nonprofit collaborations are driving awareness and access. For example, Friends of Cancer Patients (FOCP), the UAE Ministry of Health and Prevention (MoHAP), and pharmaceutical companies such as Pfizer and MSD have launched large-scale awareness and free screening campaigns. In 2023, Emirates Health Services (EHS) initiated free mammogram screenings for low-income women, reflecting a strong commitment to equitable healthcare access. The UAE regulatory framework, overseen by MoHAP, has formalized breast cancer screening programs across emirates, while insurance coverage is gradually expanding to include diagnostic services, signaling a shift toward improved reimbursement and adoption.

In Kuwait, rising awareness campaigns and the government’s growing emphasis on early detection are shaping the market trajectory. The National Campaign for Cancer Awareness launched an extensive breast cancer initiative in 2022, while the Kuwait Cancer Control Center introduced novel diagnostic services in 2021 to strengthen screening programs. The Ministry of Health’s Department of Medical Devices and Supplies regulates IVD imports and approvals, ensuring high standards for safety and quality. However, challenges remain in reimbursement, as precision diagnostics are still not widely covered, with public healthcare spending accounting for over 80% of total expenditures. Despite these limitations, insurance providers such as GIG-Kuwait are expanding coverage for essential medical needs, and with the population projected to grow, demand for accessible and accurate breast cancer diagnostic solutions is expected to increase.

The UAE is emerging as a regional leader in breast cancer diagnostics, driven by strategic collaborations, technological innovation, and national awareness programs. In June 2025, M42, in partnership with AstraZeneca and SOPHiA GENETICS, launched a nationwide liquid biopsy initiative to integrate advanced genomic profiling into clinical care. Using SOPHiA GENETICS’ MSK-ACCESS® powered with SOPHiA DDM™, this program enables non-invasive cancer detection through a simple blood draw, complementing traditional biopsies and expanding access to precision oncology nationwide. Following validation at Cleveland Clinic Abu Dhabi, the program will roll out nationwide, initially targeting lung, breast, ovarian, colorectal, and pancreatic cancers, while laying the foundation for wider Middle East expansion.

In parallel, AI is reshaping breast cancer screening. In March 2025, Lunit secured a five-year contract with SEHA, the UAE’s largest healthcare network, to deploy its INSIGHT MMG solution across 14 hospitals and 70 clinics. This AI-driven mammography platform will analyze over 100,000 mammograms, improving diagnostic efficiency and supporting SEHA’s national screening programs. The initiative builds on a successful proof-of-concept launched in 2022 and underscores the UAE’s role in advancing AI-driven radiology.

These efforts align closely with the Ministry of Health and Prevention’s (MoHAP) annual national awareness campaigns, organized in collaboration with the Friends of Cancer Patients’ Pink Caravan. Campaigns such as “Screen and Reassure Us” (2022) and “Powered by You” (2023) have expanded access to free mammograms, mobile screening services, and public education initiatives, with examinations conducted across universities, malls, workplaces, and community hubs. By integrating awareness, screening, and diagnostics, these programs have raised early detection rates and significantly improved survival outcomes.

Adding further momentum, Koning Corporation marked its UAE entry in June 2025 by installing the Koning Vera 3D Breast CT system at the Family Health Promotion Center in Sharjah. Unlike traditional mammography, this no-compression imaging system offers high-resolution isotropic 3D images in just seven seconds, improving diagnostic accuracy, reducing unnecessary biopsies, and enhancing patient comfort. The system, distributed in partnership with FourMed Medical Supplies LLC, highlights the UAE’s focus on integrating next-generation imaging solutions into its healthcare system.

These initiatives-spanning AI-powered imaging, liquid biopsy innovation, advanced 3D breast CT, and nationwide awareness campaigns-illustrate the UAE’s multi-pronged strategy to strengthen breast cancer care. By fostering public-private partnerships, scaling new technologies, and promoting early detection, the country is positioning itself at the forefront of precision oncology and patient-centered diagnostics in the Middle East.

Market Concentration & Characteristics

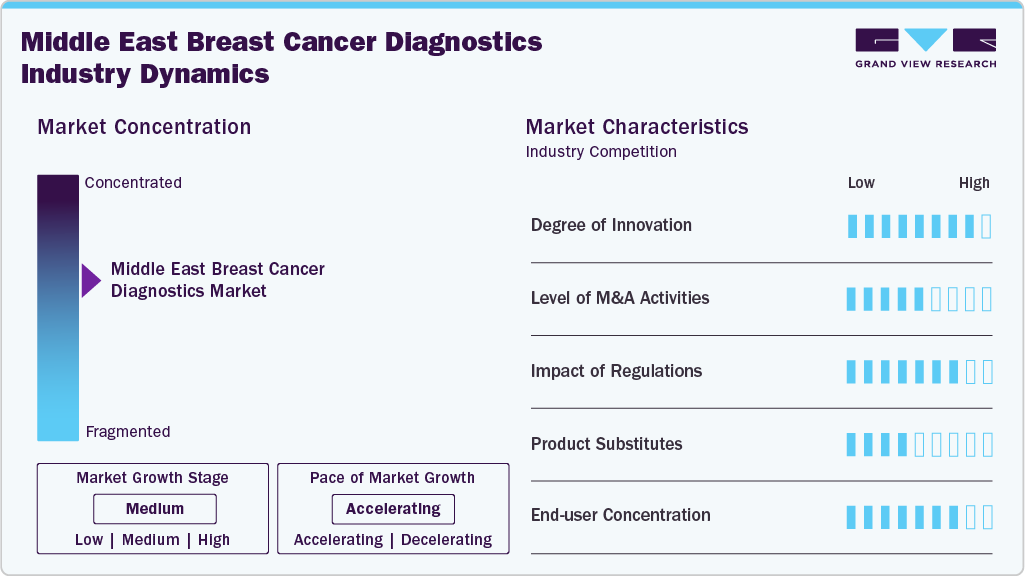

The breast cancer diagnostics industry demonstrates a high degree of innovation, emphasizing AI-powered screening tools, liquid biopsy, and genomic profiling. Solutions like blood-based diagnostics and fluorescence-guided imaging are reshaping early detection, offering non-invasive, faster, and more accurate results compared to conventional mammography. Companies are also integrating digital health platforms and oncology e-portals to strengthen accessibility. These technological shifts improve survival rates and expand adoption among underserved populations, positioning innovation as a key growth driver.

Mergers and acquisitions (M&A) are shaping the competitive landscape of the breast cancer diagnostics industry, as leading players seek to expand technological capabilities and geographic reach. Companies such as Roche, QIAGEN, and Thermo Fisher Scientific actively pursue acquisitions to integrate advanced liquid biopsy, AI-driven detection, and companion diagnostics solutions. Such activities enhance product pipelines, secure regulatory approvals, and improve patient access to precision diagnostics. M&A activity reflects consolidation in a highly competitive market, ensuring scalability and faster adoption of cutting-edge breast cancer diagnostic technologies.

Regulation plays a crucial role in ensuring the safety, quality, and accessibility of breast cancer diagnostic solutions. In the U.S., the FDA oversees approvals for tests and devices, while the CMS enforces CLIA standards for laboratory operations. The Saudi Food and Drug Authority (SFDA) and the UAE MoHAP regulate IVD imports, licensing, and compliance in regions like the Middle East. Regulatory frameworks often mandate strict quality controls, breast density disclosures, and accreditation, which build clinical trust but can also slow market entry for emerging diagnostic innovations.

Product substitutes in the breast cancer diagnostics industry mainly include alternative diagnostic approaches such as MRI, ultrasound, and emerging AI-driven imaging that complement or replace traditional mammography. Liquid biopsy and genomic profiling are substitutes for invasive tissue biopsies, offering non-invasive and real-time diagnostic insights. While substitutes provide varied advantages in terms of speed, accuracy, and patient comfort, the market’s reliance on multiple modalities indicates that substitution is more complementary than absolute, with combined approaches increasingly used to ensure diagnostic precision and better patient outcomes.

The breast cancer diagnostics industry shows a moderate-to-high degree of end-user concentration, with demand largely driven by hospitals, specialty cancer centers, and diagnostic laboratories. In developed regions like the U.S. and Europe, well-established hospital networks dominate testing volumes, supported by reimbursement coverage. In emerging regions such as the Middle East, government hospitals and public screening programs play a leading role in adoption, while private clinics and reference laboratories are gradually expanding. This concentration among large institutional end-users provides stability but limits smaller providers’ influence in the market

Type Insights

The imaging segment led the market in 2024, accounting for the largest revenue share of 52.8% as mammography, ultrasound, and MRI remain the most widely used diagnostic tools. Strong government-led awareness campaigns and national screening initiatives in countries such as Saudi Arabia and the UAE continue to drive adoption, with advanced technologies like 3D breast tomosynthesis, molecular breast imaging (MBI), and PET being increasingly integrated into tertiary hospitals. These tools are particularly effective in women with dense breast tissue, improving detection accuracy and clinical outcomes.

Blood tests is expected to record the fastest growth, propelled by the adoption of liquid biopsy and ctDNA assays, which offer non-invasive, highly sensitive alternatives. Such innovations address accessibility challenges in rural and underserved populations. Imaging and blood-based diagnostics are shaping the future of precision oncology in the region, enhancing early detection, survival outcomes, and healthcare efficiency.

Product Insights

The instrument-based products segment dominated the market in 2024, accounting for the largest revenue share of 72.5%. These products remain central to diagnostic practices as they deliver high precision and accuracy in detecting and characterizing breast tumors. Equipped with advanced imaging technologies and molecular analysis tools, instrument-based systems provide clinicians with detailed insights into tumors’ presence, size, and biological profile, supporting more informed treatment decisions and improving patient outcomes. Their role in routine breast cancer screening is pivotal, with mammography machines continuing to be the most widely adopted tools for early detection. Identifying tumors at a treatable stage significantly contributes to survival rates and long-term disease management.

The platform-based products segment is projected to record the fastest CAGR during the forecast period. These products integrate multiple diagnostic modalities within a single system, streamlining workflows, saving time, and reducing costs. Increasing adoption of next-generation sequencing (NGS) platforms such as Ion GeneStudio S5, GeneReader NGS, and QIAseq assays is further driving growth, as they enable comprehensive genomic profiling and precision diagnostics, aligning with the industry’s shift toward personalized oncology care.

Application Insights

The diagnostic & predictive segment dominated the market in 2024, accounting for 66.8% of revenues. Diagnostic applications remain central in the region, where governments increasingly prioritize early detection through national screening programs in Saudi Arabia, the UAE, and Kuwait. Mammography, ultrasound, and MRI are widely deployed in public hospitals, often subsidized or offered free of cost, ensuring greater access to women across different socioeconomic backgrounds. Technological advancements, including the adoption of AI-driven mammography and pilot projects using liquid biopsy, are improving early cancer detection and addressing limitations of conventional imaging, particularly in women with dense breast tissue.

Prognostic is anticipated to grow at the fastest CAGR over the forecast period. With the rising adoption of precision oncology in GCC countries, prognostic tests are gaining importance in tailoring treatments and improving survival outcomes. Regional healthcare systems are increasingly collaborating with international companies to adopt companion diagnostics such as BRAC Analysis CDx and FoundationOne CDx, enabling personalized treatment decisions. Clinical studies conducted in collaboration with leading oncology centers in Saudi Arabia and the UAE also explore the role of genomic profiling and recurrence monitoring assays. These efforts align with global trends and highlight the region’s transition toward advanced prognostic solutions that can reduce overtreatment and enhance long-term patient management.

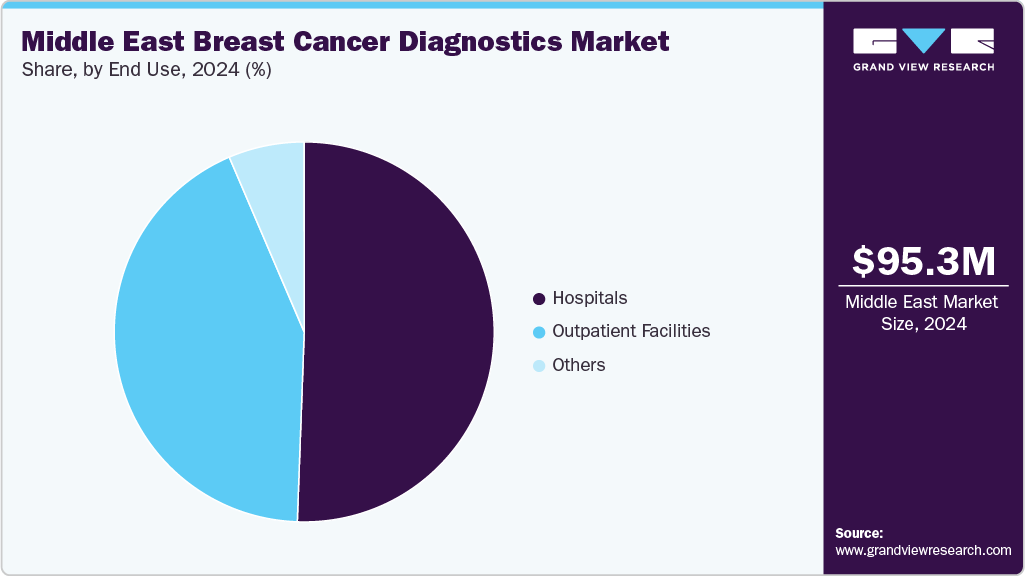

End Use Insights

The hospitals and clinics segment is projected to record a steady growth rate of 5.88%, driven by the rising number of hospitalizations and the increasing burden of breast cancer cases worldwide. These facilities play a central role in comprehensive patient care, offering advanced diagnostic services such as biopsy procedures following initial screening and imaging modalities including PET, CT, and MRI for monitoring disease progression and treatment response. Hospitals and clinics typically operate within a multidisciplinary framework, where oncologists, radiologists, surgeons, pathologists, and nurses collaborate to deliver integrated cancer care. This team-based approach ensures patients receive accurate diagnostic evaluations, personalized treatment planning, and long-term management, significantly improving survival outcomes.

The medical laboratories and diagnostic centers segment is expected to witness the fastest CAGR during the forecast period. Their growth is supported by higher test volumes, strong market penetration, and government-backed initiatives to expand diagnostic access through reimbursement schemes and public screening programs. Many healthcare systems are partnering with labs to consolidate services across mammography, ultrasound, MRI, and emerging liquid biopsy techniques. For instance, in January 2025, Laredo Medical Center launched a dedicated Women’s Imaging Center to expand access to mammography, ultrasounds, biopsies, and bone densitometry-addressing gaps in availability where only 40% of women had previously received timely screenings. Such initiatives underscore the pivotal role of diagnostic centers in expanding reach, reducing backlogs, and improving early detection.

Regional Insights

The Middle East breast cancer diagnostics market is witnessing strong growth, driven by rising cancer prevalence, government-led screening initiatives, and expanding healthcare infrastructure. Countries such as Saudi Arabia, the UAE, and Kuwait are prioritizing early detection through national mammography programs, AI-powered diagnostic platforms, and awareness campaigns. Hospitals and diagnostic centers are increasingly adopting advanced imaging modalities such as 3D tomosynthesis, MRI, and PET, alongside emerging blood-based tests like liquid biopsy. Supportive regulations from authorities such as the Saudi Food and Drug Authority (SFDA) and the UAE MOHAP further accelerate adoption, positioning the region for significant advancements in precision oncology.

Saudi Arabia Breast Cancer Diagnostics Market Trends

The breast cancer diagnostics market in Saudi Arabia is leading regionally, supported by national screening programs, AI-powered platforms, and government investment in oncology care. In 2024, breast cancer accounted for more than 60,000 cases, making it the most prevalent cancer among women. The Ministry of Health, in collaboration with the Saudi Data and Artificial Intelligence Authority, has rolled out AI-enabled early detection programs. Hospitals are also integrating advanced imaging technologies such as MRI, PET, and 3D mammography, while liquid biopsy and genomic testing are gaining traction. Strong regulatory oversight from the SFDA ensures quality and accelerates market expansion.

UAE Breast Cancer Diagnostics Market Trends

The breast cancer diagnostics market in the UAE is expanding rapidly, fueled by awareness campaigns, robust healthcare infrastructure, and government-private partnerships. Breast cancer remains the most common cancer among women, particularly those under 50, driving demand for advanced diagnostics. The Ministry of Health and Prevention (MOHAP) and initiatives like Friends of Cancer Patients (FOCP) offer free mammography screenings, while Emirates Health Services has launched outreach programs targeting underserved populations. The adoption of AI-based imaging solutions, digital pathology, and liquid biopsy assays is increasing, and they are supported by mandatory health insurance coverage. These developments and investments in precision oncology are expected to sustain strong growth in the coming years.

Qatar Breast Cancer Diagnostics Market Trends

The breast cancer diagnostics market in Qatar is strengthening through the National Cancer Program and Qatar National Cancer Screening Program (QCS), emphasizing early detection. The government has expanded access to mammography and ultrasound services in public and private hospitals. Education campaigns led by the Ministry of Public Health and NGOs highlight the importance of breast self-examination and early screening. Growing adoption of digital mammography, MRI, and molecular testing is evident in major hospitals like Hamad Medical Corporation. With a younger demographic and increasing awareness, demand for advanced diagnostics, including genomic profiling and non-invasive tests, is expected to accelerate over the forecast period.

Oman Breast Cancer Diagnostics Market Trends

The breast cancer diagnostics market in Oman is witnessing significant growth, supported by the National Oncology Center and Ministry of Health programs focusing on screening and awareness. Breast cancer is among the most prevalent cancers in Omani women, with increasing incidence driving investment in mammography, ultrasound, and MRI facilities. Campaigns like Pink Ribbon Oman are actively raising awareness and promoting regular screenings. Diagnostic services are expanding in tertiary hospitals, while the government is also exploring molecular and liquid biopsy technologies for precision care. Efforts to improve early detection and integrate advanced imaging are expected to strengthen Oman’s diagnostics market growth.

Key Middle East Breast Cancer Diagnostics Company Insights

The major market players are focused on adopting strategic initiatives such as launches, mergers, acquisitions, partnerships, etc. Furthermore, several players are focusing on developing testing services, thereby boosting demand.

Key Middle East Breast Cancer Diagnostics Companies:

Hologic Inc.

Genomic Health (Exact Sciences Corporation)

BD

Danaher

Koninklijke Philips N.V.

QIAGEN

Thermo Fisher Scientific Inc.

Argon Medical Devices, Inc.

Myriad Genetics

F. Hoffmann-La Roche Ltd.

Recent Developments

In March 2025, Lunit, a global leader in AI-powered cancer diagnostics, entered into a multi-year strategic agreement with Abu Dhabi Health Services Company (SEHA), the UAE’s largest healthcare network and part of PureHealth. Under this five-year contract, Lunit INSIGHT MMG will be deployed across SEHA’s 14 hospitals and more than 70 primary and ambulatory care clinics, enhancing the analysis of over 100,000 mammograms. This initiative builds on a successful proof-of-concept launched in 2022 and reflects SEHA’s commitment to AI-driven innovation in breast cancer screening. By integrating Lunit’s solution into radiology workflows, SEHA aims to improve diagnostic efficiency, expand early detection coverage, and strengthen outcomes for women across the UAE. The partnership aligns with the UAE’s broader national cancer control strategy, including the Ministry of Health and Prevention’s annual breast cancer awareness campaign, and positions the country at the forefront of AI adoption in healthcare, within a regional market projected to reach USD 1-1.5 billion by 2030.

In June 2025, M42, a global health technology leader, announced a strategic partnership with AstraZeneca and SOPHiA GENETICS to launch a nationwide liquid biopsy initiative in the UAE, marking a transformative step in precision oncology. The program will integrate SOPHiA GENETICS’ MSK-ACCESS® powered with SOPHiA DDM technology into M42’s infrastructure, enabling non-invasive genomic profiling through a simple blood draw. This initiative aims to advance cancer diagnosis, guide targeted treatment decisions, and enable real-time monitoring of disease progression in a cost-effective and less invasive manner. Initially focused on lung, ovarian, breast, colorectal, and pancreatic cancers, the program complements traditional biopsies while expanding access to precision diagnostics for patients who cannot undergo solid tumor testing. Following validation studies at Cleveland Clinic Abu Dhabi, the program will roll out in late Q2 2025 across leading hospitals in the UAE. Over the next year, the initiative is expected to strengthen the UAE’s cancer testing ecosystem and lay the foundation for broader Middle East expansion, excluding Saudi Arabia.

Middle East Breast Cancer Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 100.62 million

Revenue forecast in 2033

USD 165.10 million

Growth rate

CAGR of 6.39% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 – 2023

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, end use, region

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Kuwait; Oman; Qatar

Key companies profiled

Hologic Inc.; Genomic Health (Exact Sciences Corporation); BD; Danaher; Koninklijke Philips N.V.; QIAGEN; Thermo Fisher Scientific Inc.; Myriad Genetics; Argon Medical Devices, Inc.; F. Hoffmann-La Roche Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Middle East Breast Cancer Diagnostics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East breast cancer diagnostics market by type, product, application, end use, and region:

Type Outlook (Revenue, USD Million, 2021 – 2033)

Imaging

Biopsy

Genomic Tests

Blood Tests

Others

Product Outlook (Revenue, USD Million, 2021 – 2033)

Application Outlook (Revenue, USD Million, 2021 – 2033)

Screening

Diagnostic & Predictive

Prognostic

Research

End Use Outlook (Revenue, USD Million, 2021 – 2033)

Regional Outlook (Revenue, USD Million, 2021 – 2033)

Middle East

Saudi Arabia

UAE

Kuwait

Qatar

Oman

Frequently Asked Questions About This Report

b. The Middle East breast cancer diagnostics market size was estimated at USD 95.25 million in 2024 and is expected to reach USD 100.62 million in 2025.

b. The Middle East breast cancer diagnostics market is expected to witness a compound annual growth rate of 6.39% from 2025 to 2033 to reach USD 165.10 million in 2033.

b. The instrument-based segment held the largest share of 72.5% in 2024 due to government initiatives to promote screening and favorable reimbursement scenarios for diagnostic and screening tests.

b. Some key players operating in the Middle East breast cancer diagnostics market include Hologic, Inc.; Exact Sciences Corporation; Becton Dickinson, and Company; Koninklijke Philips N.V.; Qiagen; and Myriad Genetics.

b. The Middle East breast cancer diagnostics market is primarily driven by the rising incidence of breast cancer, which remains the most common cancer among women in the region. Increasing government-led screening initiatives, awareness campaigns, and early detection programs are improving uptake of diagnostic tools. Growing investments in advanced imaging technologies, molecular diagnostics, and genetic testing are further fueling demand. Favorable collaborations between regional health ministries and global diagnostic companies, coupled with expanding access to private healthcare, are accelerating market growth and supporting the shift toward precision-based diagnostics.