Real-world pricing information is necessary to support vehicle fleets and financing institutions with purchasing decisions, but this data is not readily advertised, hindering market transparency to support vehicle fleets and financing institutions with purchasing decisions. In this working paper, the ICCT developed an international database of real-world pricing data for battery electric Class 2B–8 commercial vehicle prices and analyzed the trends across markets, vehicle segments, and powertrain types in Canada, China, the European Union, India, and the United States. The analysis aims to highlight pricing trends in battery electric commercial vehicles to support the growth of a healthy and sustainable market.

The analysis identified several pricing trends in the dataset:

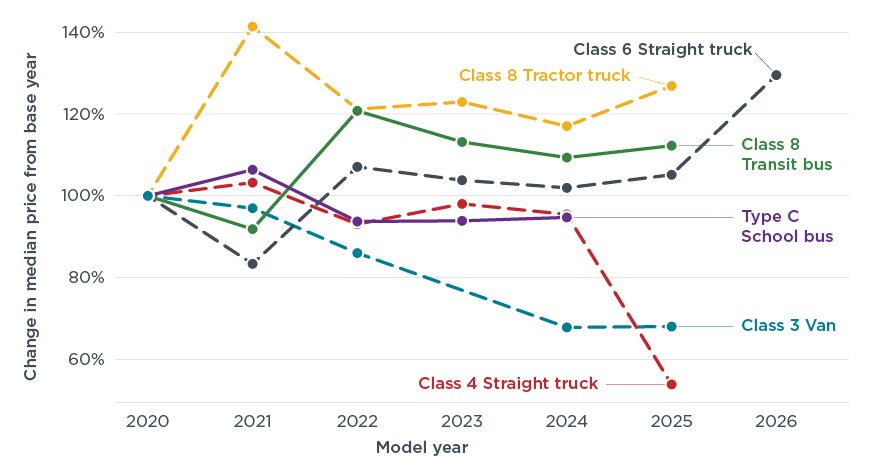

In the United States, prices for battery electric Class 5 vehicles and smaller are decreasing.

The prices of battery electric trucks of Class 6 and larger are increasing more often than decreasing.

The median price of battery electric Class 8 tractor trucks increased 27% since model year 2020 in the United States, with the largest price increase of 40% occurring between 2020 and 2021.

The median price of battery electric Class 8 transit bus prices in the United States increased by 13% from model year 2020 to 2025.

In the European Union, battery electric commercial vehicle prices have generally decreased.

Figure. Battery electric commercial vehicle price trends in the United States

In summary, the median purchase prices of Class 6 and larger battery-electric commercial vehicles have risen since 2020, despite declines in battery costs and declining prices in other vehicle categories and regions. Equivalent vehicles in the European Union became less expensive.

While determining the causes for price increases is outside the scope of this study, the working paper offers recommendations to improve price transparency and summarizes reactions from industry stakeholders.