Photo credit: Zakharchuk / Shutterstock

The market for clean energy tax credits more than doubled in size in 12 months, from $8.5 billion in the first half of 2024 to more than $20 billion in the first half of this year. This growth is driven in part by diversification: More investors are buying tax credits for more types of technologies.

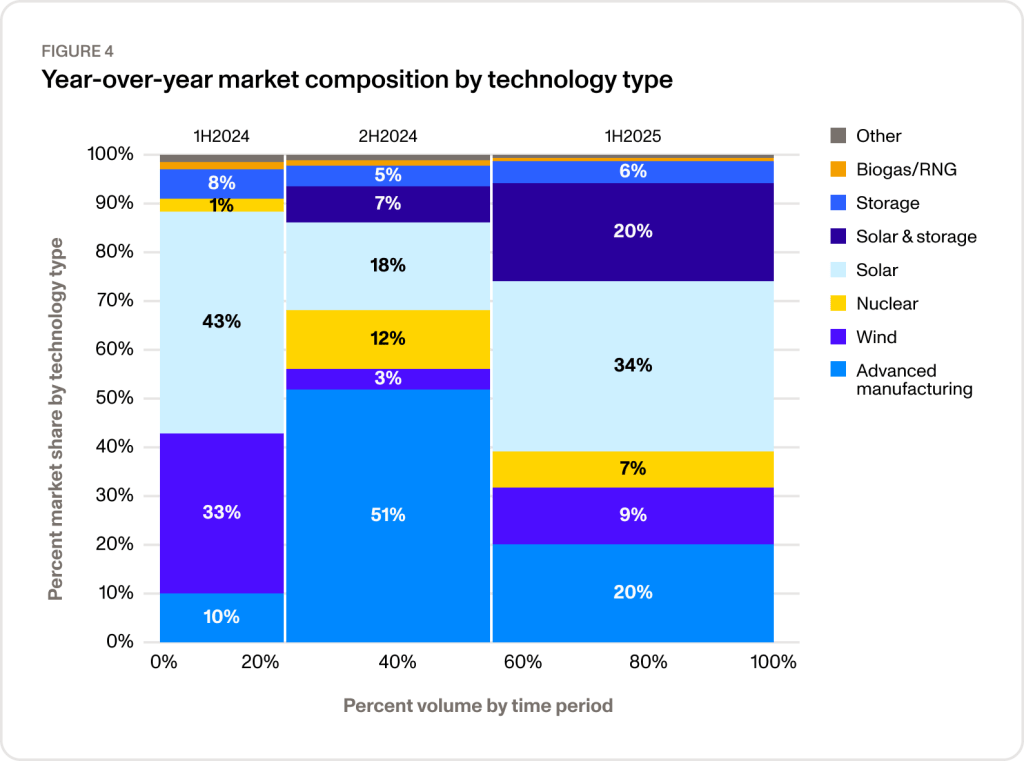

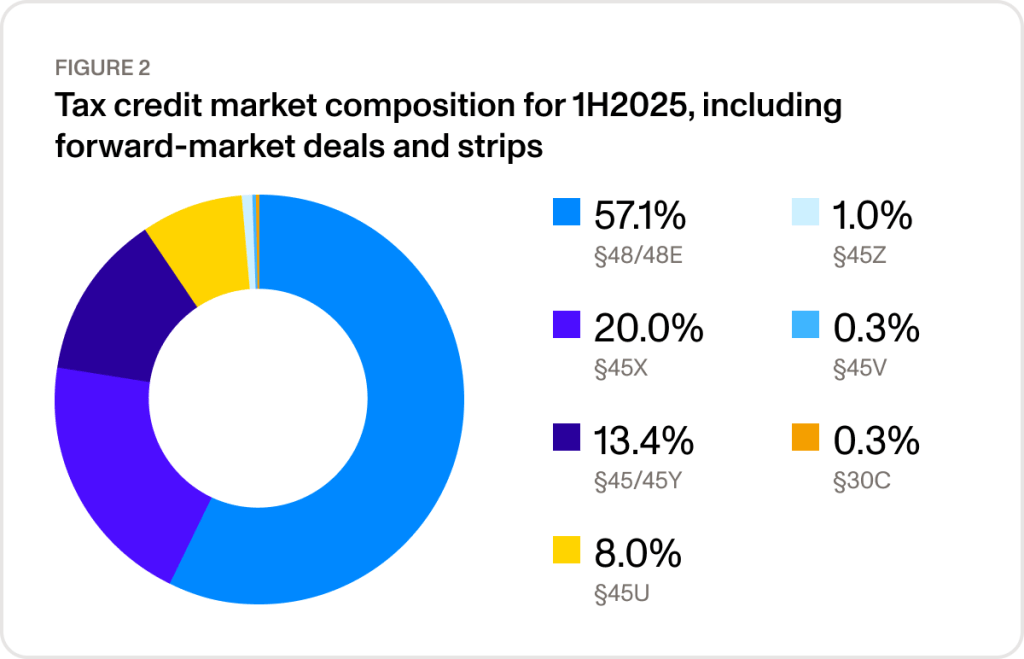

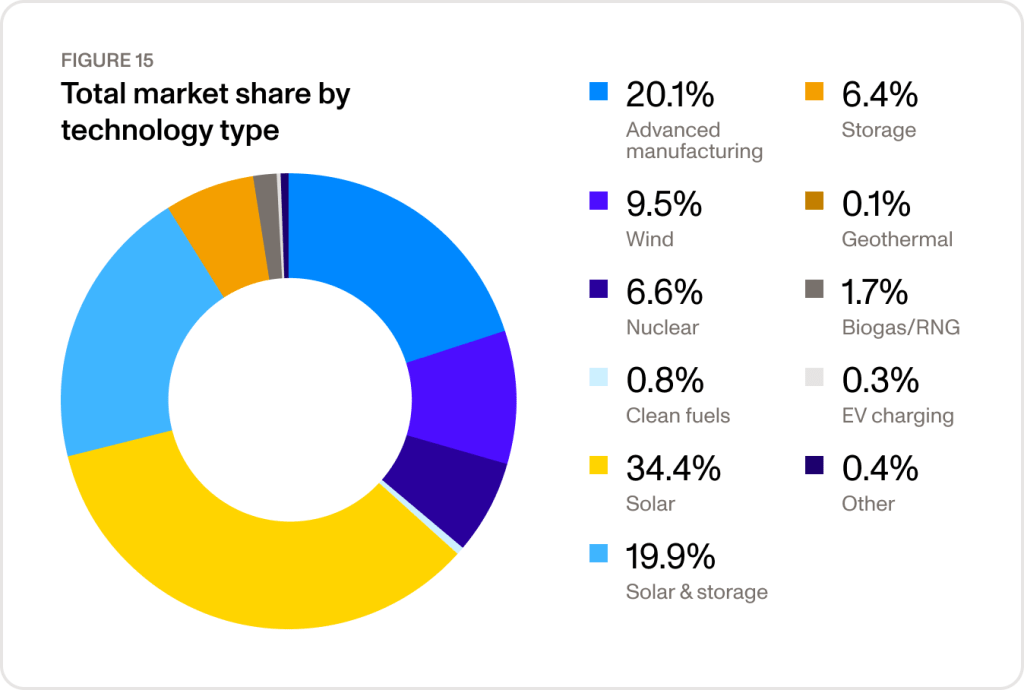

These are among the findings of a mid-year market analysis by Crux, a platform with marketplaces for both tax credit transfers and other clean energy finance products. The report, out this week, outlines a shift in market composition underway — one that is more a reflection of the pre-Trump implementation of the Inflation Reduction Act than it is of the present policy landscape of 2025. Credits for advanced manufacturing, nuclear, hydropower, geothermal, and especially energy storage are ascendant; together, these newly eligible tax credits made up about 36% of transfers, up about 50% compared with a year ago.

Combined, solar-plus-storage and standalone storage deals made up 26% of the transactions in the first half of 2025.

Meanwhile, wind credits make up a shrinking portion of the market. (Solar is also technically shrinking as a share of the market, but only because the market is growing so rapidly; the number and size of those transactions are holding roughly steady.)

However, credits for the more mature technologies are getting more favorable terms; Crux found that investment-grade sellers saw higher prices on tax transfers, while the rest of the market saw prices drop in the first half of the year: Investment-grade sellers averaged 94 cents per dollar, while non-investment grade sellers averaged 91 cents. Those pushing credits for newer technologies or less experienced developers saw higher costs of capital this year, as well as less access to financing.

This comes amid a shift in policy in the U.S., as the Trump administration and GOP-led Congress shakes up the tax credit landscape. The so-called “One Big Beautiful Bill, passed in July, preserved the ability to transfer clean energy tax credits, but it complicated the market by adding regulatory hurdles like the new “foreign entity of concern” rules. And because the law sunsetted key wind and solar credits earlier than anticipated, experts expect that the makeup of the transferability will continue to shift — especially as the 45X advanced manufacturing credit gets more use.

Though the report itself only covers the first half of 2025, through June, Crux CEO Alfred Johnson said he has observed “a slowdown in buyer activity in July and August that was definitely correlated with buyers understanding and adjusting to a new tax liability.”

And other provisions of the OBBB means that corporate tax liability will be lower overall this year, by as much as 20% to 30%. This is “weighing heavily on buyer demand” at the moment, according to Crux, and causing prices of these transactions to drop. However, Crux expects demand for these transactions to surge again toward the end of 2025.

That said, this report on the first half of the year does not necessarily reflect the response to the Trump administration. As Johnson put it, the transfer market is like light years, where “the light that you see comes from a prior time.” The report’s findings are “reflective of dynamics in project finance that happened over the last few years, because it takes a long time to build projects,” Johnson said.

The rise of energy storage transfers, for instance, isn’t a result of the sector’s tax credits being spared in the OBBB negotiations this summer. Rather, he added, “storage received tax credits for the first time in the IRA and that contributed to a significant volume of storage that was planned and deployed over that period,” and is being realized this year. There have also been technological improvements and more demand due to load growth.

Similarly, the rise of nuclear deals is in part due to far more “very large” transactions of over $300 million than in previous years, Crux found. These are largely thanks to the update to the nuclear production tax credit under the IRA, which took effect at the beginning of 2024 — and not necessarily to the rising demand for nuclear as a result of load growth in 2025 and the latter half of 2024. (That said, as nuclear capacity prices rise like they are already doing in the PJM Interconnection, it’s likely the U.S. will see fewer tax credits; the credits are typically available only when power market revenue is below a certain threshold.)

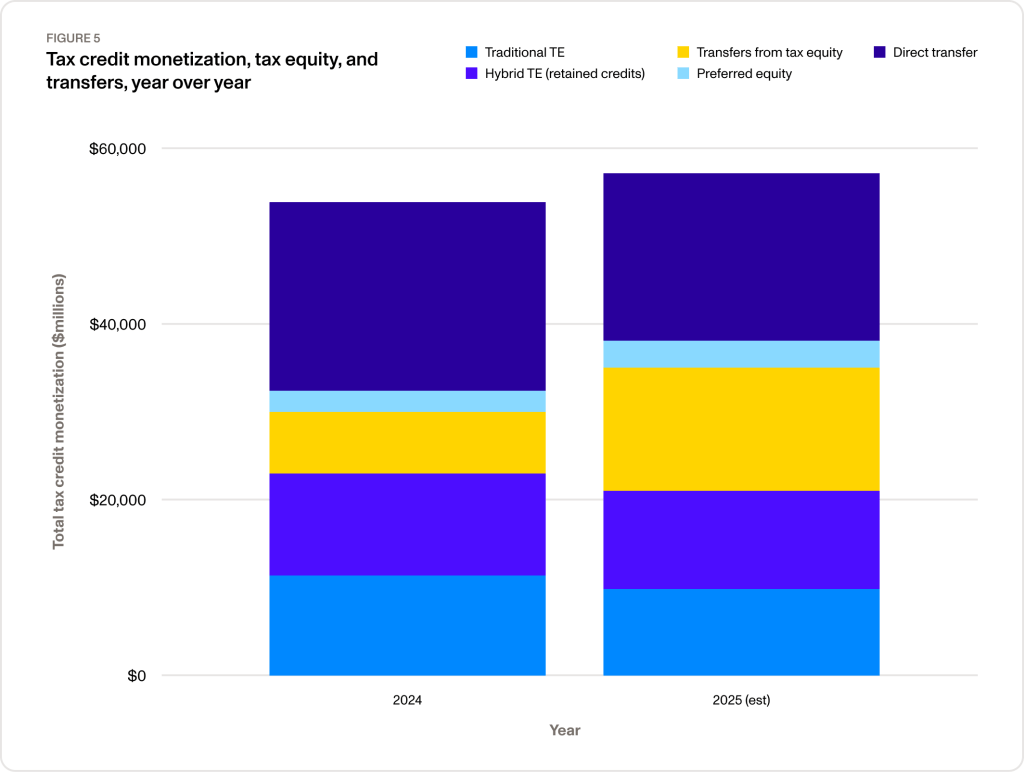

In the second half of the year, Crux expects the market size to jump further, to between $55 billion and $60 billion total for 2025. This estimated increase is in part due to the seasonal nature of the market; most credits tend to be bought and sold in the second half of the year as companies rush to complete projects within the tax year.

So far, the majority of tax equity investments, 60%, have been hybrid deals; these are structured to transfer just a portion of tax credits. Transferring credits out of tax equity is the market’s fastest-growing segment, expected to reach between $11 billion and $13 billion for the year. This is up from $7 billion in 2024.