Flavoring Cosmetic Formulation Agents Market Size and Share Forecast Outlook 2025 to 2035

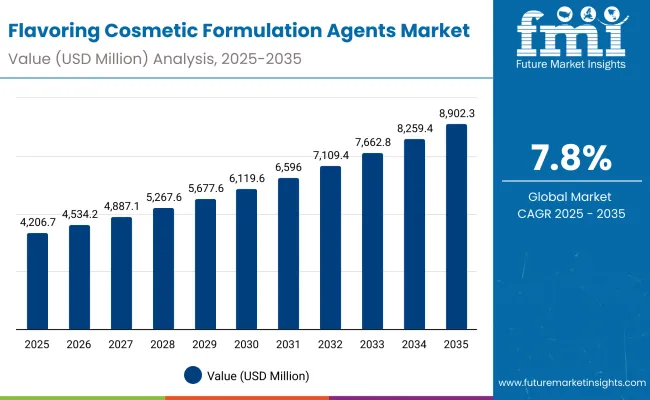

A valuation of USD 4,206.7 million is projected for the Flavoring Cosmetic Formulation Agents Market in 2025, which is expected to advance to USD 8,902.3 million by 2035. This represents an absolute increase of USD 4,695.6 million, nearly doubling the market size over the decade. Growth across this period translates into a CAGR of 7.8%, underscoring the sustained demand for functional and clean-label formulations.

Quick Stats for Flavoring Cosmetic Formulation Agents Market

Flavoring Cosmetic Formulation Agents Market Value (2025): USD 4,206.7 Million

Flavoring Cosmetic Formulation Agents Market Forecast Value (2035): USD 8,902.3 Million

Flavoring Cosmetic Formulation Agents Market Forecast CAGR (2025 to 2035): 7.8%

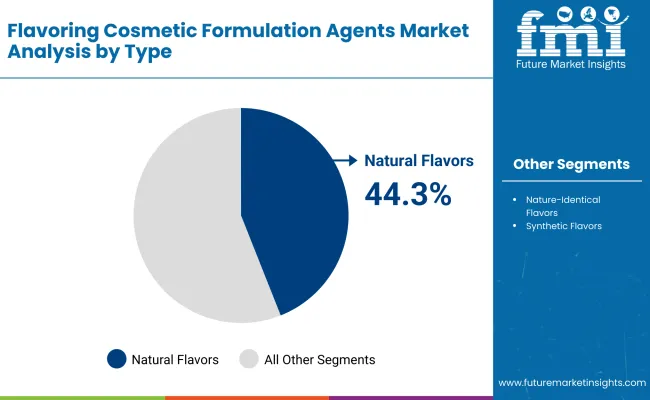

Leading Segment in Flavoring Cosmetic Formulation Agents Market in 2025: Natural Flavors (44.3%)

Key Growth Regions in the Flavoring Cosmetic Formulation Agents Market: North America, Asia-Pacific, Europe

Top Key Players in the Flavoring Cosmetic Formulation Agents Market: Givaudan, Firmenich (DSM-Firmenich), Symrise, Takasago, Mane, IFF, Sensient, Robertet, Kerry, Bell Flavors & Fragrances

Flavoring Cosmetic Formulation Agents MarketKey Takeaways

Metric

Value

Flavoring Cosmetic Formulation Agents Market Estimated Value in (2025E)

USD 4,206.7 Million

Flavoring Cosmetic Formulation Agents Market Forecast Value in (2035F)

USD 8,902.3 Million

Forecast CAGR (2025 to 2035)

7.80%

Between 2025 and 2030, the market is expected to expand from USD 4,206.7 million to USD 6,119.6 million, reflecting an addition of USD 1,912.9 million that accounts for more than 40% of total growth. This phase will be characterized by rising consumption in oral care and medicated balm categories, where flavor innovation is increasingly used to strengthen compliance and product appeal.

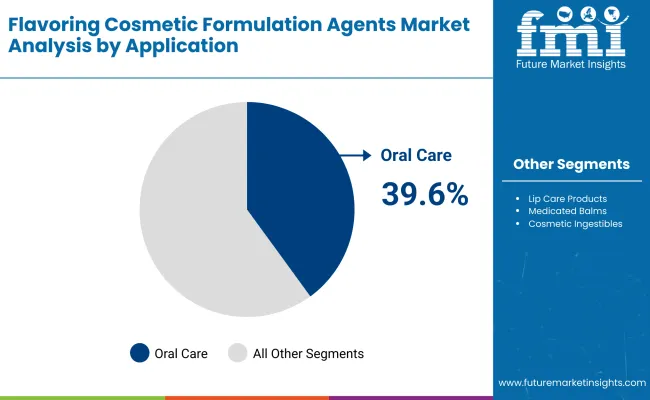

Natural flavors are forecast to dominate with 44.3% of market share in 2025, while oral care applications are anticipated to lead with 39.6%, reaffirming the role of flavor as a driver of consumer loyalty.

From 2030 to 2035, an additional USD 2,782.7 million is expected to be generated, equating to nearly 60% of total growth. This acceleration will be powered by nutracosmetic expansion and enhanced adoption of flavored delivery systems such as beauty gummies.

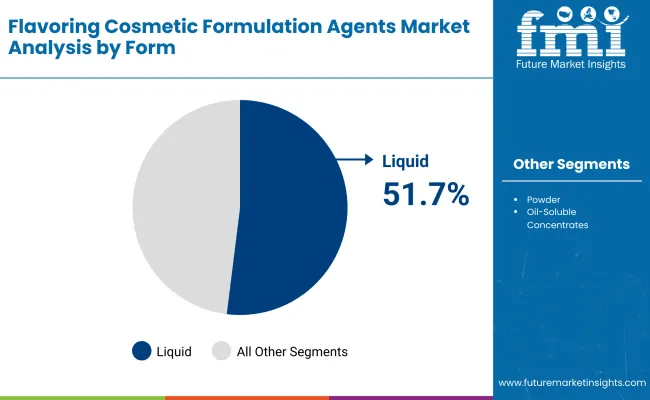

Liquid formats are projected to remain the leading form with 51.7% share in 2025, sustained by their compatibility with diverse applications. With Asia-Pacific markets such as China and India demonstrating double-digit CAGRs, regional contributions are expected to intensify, reinforcing global market momentum through 2035.

From 2020 to 2024, steady adoption of flavoring solutions was observed across oral care and personal care categories, driven by the rising demand for natural and nature-identical formulations. During this phase, leading players captured strong positions through innovation pipelines and regional expansion, with Europe and North America providing mature demand while Asia-Pacific markets accelerated uptake. Competitive advantages were established through diversified product portfolios and consistent investments in natural ingredient sourcing.

By 2025, the market is expected to reach USD 4,206.7 million, supported by the growth of oral care applications that account for 39.6% share. Looking ahead to 2035, the market is forecast to double to USD 8,902.3 million, with expansion anchored by nutracosmetic adoption and the rising role of liquid formats that already dominate with 51.7% share.

Competitive strategies will increasingly shift toward localized innovation, AI-driven formulation support, and partnerships with nutracosmetic and personal care brands. The focus is expected to transition from ingredient supply alone to ecosystem-based solutions that deliver enhanced consumer experiences.

Why the Flavoring Cosmetic Formulation Agents Market is growing?

The growth of the Flavoring Cosmetic Formulation Agents Market is being driven by evolving consumer preferences and increasing demand for functional formulations. Rising interest in natural and nature-identical ingredients has been observed, as clean-label positioning and regulatory scrutiny encourage a shift away from synthetic options. In oral care, flavoring agents are being adopted to improve product compliance and enhance user experience, while lip care and medicated balms are benefitting from flavor-led differentiation.

Nutracosmetic products such as beauty gummies are also gaining traction, as flavor is leveraged to elevate consumer acceptance of ingestible formats. Technological advancements in flavor extraction and formulation have enabled higher stability, extended shelf life, and improved versatility, further supporting widespread adoption.

Regional growth is being powered by Asia-Pacific markets, where double-digit CAGRs are expected due to expanding middle-class consumption and localized innovation. Overall, market expansion is anticipated to be reinforced by cross-category application, innovation pipelines, and evolving health-and-wellness trends.

Segmental Analysis

The Flavoring Cosmetic Formulation Agents Market has been structured across type, application, and form, each presenting unique growth dynamics. By type, natural flavors are projected to hold the leading position with a 44.3% share in 2025, reflecting the strong shift toward clean-label and health-oriented products.

Within applications, the “Others” category, which includes lip care, medicated balms, and nutracosmetics, is expected to dominate with 60.4% share, underscoring the broadening use of flavoring agents in wellness-driven and lifestyle formulations.

In terms of form, liquid solutions are anticipated to account for the largest share of 51.7% in 2025, highlighting their adaptability, stability, and ease of integration in both oral care and nutracosmetic products. These dominant categories will continue to shape innovation strategies, anchoring the market’s forward trajectory through 2035.

Insights into the Type Segment with Natural Flavors Leading in Market Share

Type

Market Value Share, 2025

Natural flavors

44.3%

Others

55.7%

Natural flavors are projected to dominate the type segment with 44.3% share in 2025, equating to USD 1,863.57 million. Growth in this category is being reinforced by the global shift toward clean-label and health-conscious formulations, where natural ingredients are prioritized for consumer trust and regulatory compliance. Oral care, lip care, and nutracosmetic applications are increasingly relying on natural flavors to differentiate products and enhance user experience.

Regulatory favorability in key markets such as North America and Europe is expected to further strengthen adoption. While the “Others” category remains larger in absolute value, natural flavors will represent the most strategic growth avenue as brands align with transparency, sustainability, and consumer-driven demand for authenticity in taste solutions.

Insights into the Application Segment with Others Dominating the Demand

Application

Market Value Share, 2025

Oral care

39.6%

Others

60.4%

The “Others” category in applications is anticipated to dominate with 60.4% share in 2025, worth USD 2,540.85 million, while oral care contributes 39.6% or USD 1,665.85 million. Lip care, medicated balms, and nutracosmetics are fueling this leadership, with flavoring agents being adopted to enhance consumer compliance and product differentiation.

Nutracosmetic innovations such as beauty gummies are expanding rapidly as flavor becomes integral to consumer acceptance and repeat purchases. Medicated and therapeutic lip care products are also increasingly flavor-driven, reinforcing adoption.

While oral care retains importance, the broader “Others” category showcases higher adaptability to emerging wellness and lifestyle preferences. This leadership reflects the evolving role of flavoring agents in extending far beyond traditional oral hygiene categories.

Insights into the Form Segment with Liquid Leading in Market Share

Form

Market Value Share, 2025

Liquid

51.7%

Others

48.3%

Liquid formulations are anticipated to dominate the form segment, holding 51.7% share in 2025 with USD 2,174.86 million in sales. Liquids are widely favored due to their high solubility, stability, and ease of incorporation into oral care and nutracosmetic applications. Their compatibility with diverse flavor delivery systems allows for consistent performance in toothpaste, mouthwash, and functional beauty products.

Manufacturers are prioritizing liquid flavor solutions for their efficiency in scaling production and ensuring uniform distribution in formulations. While other formats such as powders and oil-soluble concentrates account for 48.3%, liquid formulations will remain the backbone of the market. The continued preference for liquid solutions reflects their versatility and alignment with innovation pipelines focused on wellness and consumer convenience.

What are the Drivers, Restraints, and Key Trends of the Flavoring Cosmetic Formulation Agents Market?

Despite significant opportunities, the Flavoring Cosmetic Formulation Agents Market is shaped by complex dynamics where cost pressures, regulatory frameworks, and consumer health priorities converge. While innovation accelerates adoption in oral and nutracosmetic applications, challenges persist around compliance, sourcing, and evolving sensory expectations.

Integration of Flavor Science with Functional Wellness

The convergence of flavoring agents with functional wellness solutions is being emphasized as a critical growth driver. Flavor compounds are no longer positioned solely as sensory enhancers but as enablers of adherence in therapeutic oral care and nutracosmetic categories.

The incorporation of scientifically validated, bioactive-compatible flavor systems is allowing manufacturers to expand into health-linked applications where palatability defines product acceptance. By aligning flavor development with clinical research and wellness positioning, long-term partnerships between ingredient suppliers and consumer brands are being fostered. This integration is expected to elevate market credibility, differentiating premium formulations while sustaining consumer trust in wellness-oriented products.

Volatility in Natural Ingredient Supply Chains

A persistent restraint is being observed in the volatility of natural ingredient supply chains, particularly for botanical and plant-derived sources. Seasonal disruptions, regional agricultural dependencies, and sustainability concerns create pricing instability and limit scalability for natural flavors.

Compliance-driven reliance on authenticated sourcing further intensifies exposure to fluctuations in crop yields, transportation constraints, and environmental regulations. As consumer preference shifts toward clean-label formulations, reliance on natural flavors amplifies vulnerability to these challenges.

Strategic investment in resilient supply models, controlled cultivation, and biotech-driven alternatives will be required to overcome these constraints. Without such measures, inconsistent availability of natural raw materials may hinder growth momentum in the decade ahead.

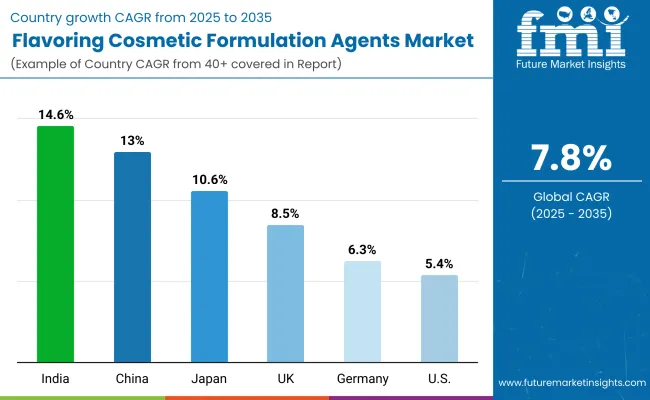

Analysis of Flavoring Cosmetic Formulation Agents Market By Key Countries

Country

CAGR

China

13.0%

USA

5.4%

India

14.6%

UK

8.5%

Germany

6.3%

Japan

10.6%

The global Flavoring Cosmetic Formulation Agents Market is projected to expand at varying growth trajectories across key countries, influenced by consumer health priorities, regulatory frameworks, and regional innovation ecosystems.

Asia-Pacific is expected to emerge as the fastest-growing hub, anchored by India at a remarkable 14.6% CAGR and China at 13.0% CAGR through 2035. India’s momentum will be shaped by its expanding nutracosmetic sector, rising disposable incomes, and cost-competitive manufacturing that accelerates flavored product penetration across oral care and wellness brands. China is expected to strengthen its position through large-scale production capabilities and a growing middle-class preference for premium flavored personal care products.

Japan is forecast to grow at 10.6% CAGR, supported by advanced R&D integration and a strong heritage in functional beauty formulations. In Europe, moderate but steady growth is anticipated, led by the UK at 8.5% CAGR and Germany at 6.3%, where regulatory compliance and consumer preference for natural flavors reinforce market stability.

Europe overall is projected at 7.9% CAGR, highlighting resilience in a mature but innovation-driven market. By contrast, the USA is expected to record a slower 5.4% CAGR due to market maturity, though opportunities will be fostered by demand for sustainable and natural ingredient portfolios.

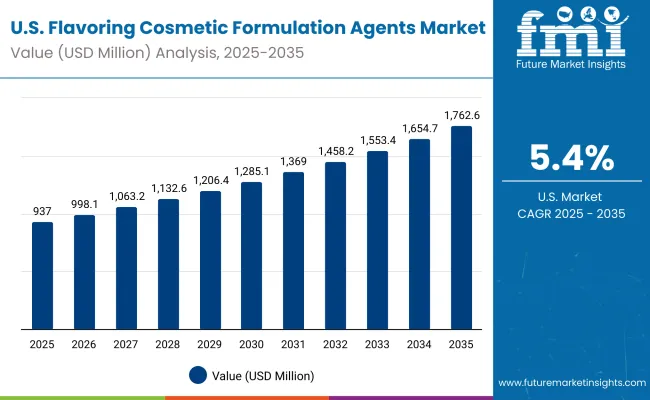

Sales Outlook for Flavoring Agents In the United States

Year

USA Flavoring Cosmetic Formulation Agents Market (USD Million)

2025

937.04

2026

998.16

2027

1063.26

2028

1132.61

2029

1206.49

2030

1285.18

2031

1369.00

2032

1458.29

2033

1553.41

2034

1654.73

2035

1762.66

The Flavoring Cosmetic Formulation Agents Market in the United States is projected to expand at a CAGR of 6.6% between 2025 and 2035. Growth will be shaped by the integration of natural and functional flavor systems into oral care, lip care, and nutracosmetic products.

Regulatory-driven preference for clean-label solutions is expected to amplify adoption, while innovation pipelines will continue to favor liquid and natural formulations. Industry leaders are anticipated to strengthen partnerships with nutracosmetic and personal care manufacturers to accelerate flavor-driven differentiation.

Oral care products are anticipated to remain a major contributor to sustained adoption of flavoring agents.

Nutracosmetic brands are integrating advanced flavor systems to enhance consumer compliance and repeat purchase behavior.

Liquid-based formulations are being prioritized by manufacturers for ease of incorporation and superior product stability.

Growth and Expansion Outlook for Flavoring Cosmetic Formulation Agents Marketin the United Kingdom

The Flavoring Cosmetic Formulation Agents Market in the United Kingdom is projected to grow at a CAGR of 8.5% between 2025 and 2035. Expansion will be reinforced by increasing alignment with sustainability targets and consumer preference for natural formulations. Regulatory frameworks encouraging transparency in ingredient sourcing are anticipated to accelerate the shift toward clean-label flavor systems. Premiumization trends in oral care and nutracosmetic products will also shape innovation strategies in the region.

Clean-label mandates are fostering demand for natural flavor systems across personal care portfolios.

Nutracosmetic brands are expected to leverage flavoring agents for differentiation in beauty-from-within formats.

Oral care companies are incorporating advanced flavor systems to sustain consumer compliance.

Local innovation centers are being utilized to create formulations suited to evolving European consumer preferences.

Growth and Expansion Outlook for Flavoring Cosmetic Formulation Agents Marketin India

The Flavoring Cosmetic Formulation Agents Market in India is projected to grow at a CAGR of 14.6% between 2025 and 2035. Growth will be fueled by rapid expansion in nutracosmetics, functional personal care, and cost-efficient manufacturing. Rising disposable incomes and a growing middle class are expected to boost consumption of flavored health and beauty products. India’s positioning as a key manufacturing hub is anticipated to support export opportunities for regional players.

Nutracosmetics such as flavored gummies are driving acceptance of beauty-from-within solutions.

Large-scale manufacturing capabilities are positioning India as a global supplier for flavor-infused products.

Regulatory flexibility and cost competitiveness are reinforcing demand for diverse flavor systems.

Domestic and global brands are forming partnerships to capture growth across both premium and mass-market categories.

Sales Outlook for Flavoring Agents In China

The Flavoring Cosmetic Formulation Agents Market in China is projected to grow at a CAGR of 13.0% between 2025 and 2035. Expansion will be propelled by a rapidly expanding middle class, premiumization in personal care, and increasing demand for functional wellness products. Government initiatives to strengthen domestic ingredient supply chains are also anticipated to reduce dependency on imports.

Premium oral care and nutracosmetic segments are driving higher penetration of natural flavor systems.

Domestic production is being scaled to ensure stable supply and competitive pricing in the region.

Partnerships with international players are fostering innovation in natural and functional flavors.

Rising consumer awareness of product safety and quality is shaping demand for transparent, clean-label offerings.

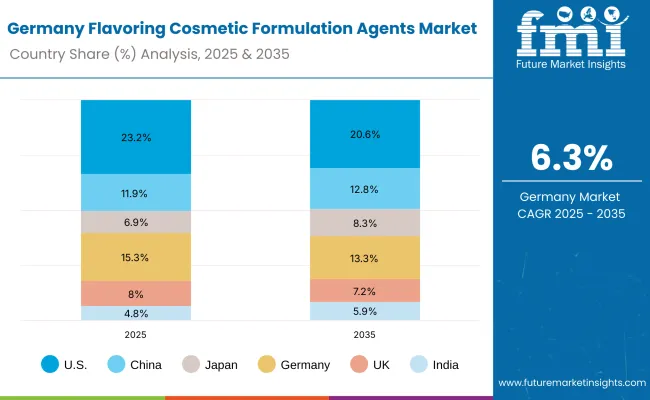

In-depth Analysis of Flavoring Agents In Germany

Country

2025

USA

23.2%

China

11.9%

Japan

6.9%

Germany

15.3%

UK

8.0%

India

4.8%

Country

2035

USA

20.6%

China

12.8%

Japan

8.3%

Germany

13.3%

UK

7.2%

India

5.9%

The Flavoring Cosmetic Formulation Agents Market in Germany is projected to grow at a CAGR of 6.3% between 2025 and 2035. Market expansion will be shaped by strong regulatory frameworks, consumer preference for sustainability, and the dominance of clean-label trends. Manufacturers are expected to prioritize high-quality, traceable flavor systems aligned with EU standards.

Strict compliance requirements are reinforcing trust in natural and authenticated flavor systems.

Oral care and medicated balm brands are relying on advanced flavor solutions to enhance consumer loyalty.

German nutracosmetic producers are incorporating flavoring agents to strengthen brand differentiation.

Sustainability commitments are accelerating adoption of plant-derived and bioengineered flavor alternatives.

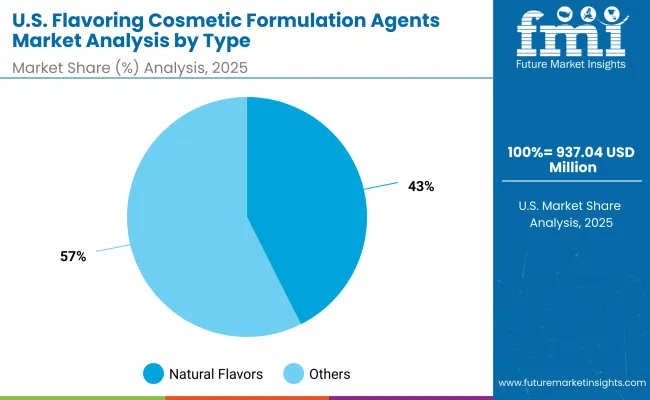

Growth Outlook for Flavoring Cosmetic Formulation Agents Marketin USA

USA By Type

Market Value Share, 2025

Natural flavors

42.6%

Others

57.4%

The Flavoring Cosmetic Formulation Agents Market in the United States is projected at USD 937.04 million in 2025. “Others” contribute 57.4%, while natural flavors account for 42.6%, highlighting the dominant role of broader categories including nature-identical and synthetic flavors. This structural lead reflects the entrenched use of cost-efficient formulations across oral care, lip care, and functional wellness products, where stability and scalability are prioritized.

However, the notable share of natural flavors signals a decisive consumer shift toward clean-label and transparent sourcing. As compliance frameworks strengthen and sustainability gains prominence, natural flavors are expected to steadily increase their contribution.

Strategic emphasis will likely shift toward balancing affordability with authenticity, supported by localized innovation hubs and biotech-enabled ingredient development. The interplay between value-driven “Others” and consumer-trusted natural flavors will define the USA growth trajectory.

Market in the USA valued at USD 937.04 million in 2025.

“Others” lead with 57.4% vs. 42.6% for natural flavors.

Growth is shaped by cost efficiency alongside rising clean-label priorities.

Natural flavor innovation is expected to reinforce future competitive positioning.

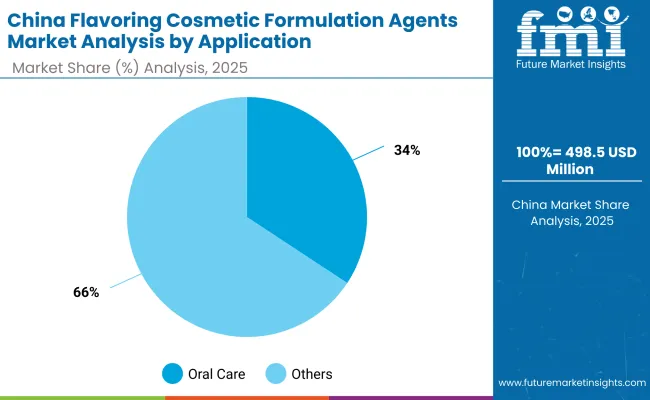

Opportunity Analysis of China Flavoring Cosmetic Formulation Agents Market

China By Application

Market Value Share, 2025

Oral care

34.3%

Others

65.7%

The Flavoring Cosmetic Formulation Agents Market in China is projected at USD 498.58 million in 2025. “Others” dominate with 65.7%, while oral care applications contribute 34.3%, reflecting the country’s diversified adoption across lip care, medicated balms, and nutracosmetic categories. This leadership underscores how lifestyle-driven consumption and the popularity of beauty-from-within products are shaping the market.

Oral care remains a significant contributor, with flavoring agents being integrated into toothpaste and mouthwash to improve user compliance and sensory appeal. However, the broader “Others” category reflects stronger momentum as functional wellness, beauty innovation, and therapeutic applications expand rapidly. The interplay between these segments will define China’s growth path, where domestic innovation and global partnerships are expected to accelerate scaling opportunities.

Market in China projected at USD 498.58 million in 2025.

“Others” dominate with 65.7% vs. 34.3% for oral care.

Growth supported by rising demand in nutracosmetics and functional wellness.

Oral care remains significant for maintaining compliance and consumer trust.

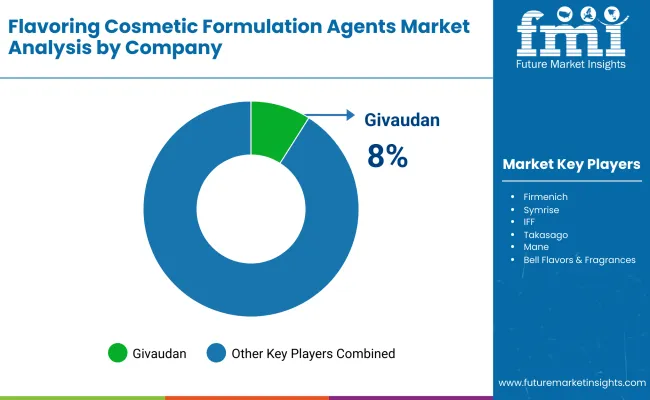

Competitive Landscape of Flavoring Cosmetic Formulation Agents Market

Company

Global Value Share 2025

Givaudan

8.0%

Others

92.0%

The Flavoring Cosmetic Formulation Agents Market is moderately fragmented, with global leaders, regional innovators, and niche-focused players competing across oral care, lip care, and nutracosmetic applications. Global ingredient leaders such as Givaudan, Firmenich (DSM-Firmenich), Symrise, IFF, Takasago, Mane, Sensient, Robertet, Kerry, and Bell Flavors & Fragrances hold strong positions due to broad product portfolios, advanced R&D, and global reach.

Among these, Givaudan is the clear leader, capturing 8.0% of global value share in 2025, while the remaining 92.0% is distributed across other players. This leadership is reinforced by Givaudan’s investments in natural and nature-identical flavor systems, which are aligned with clean-label and wellness-driven demand.

Mid-sized companies such as Takasago, Mane, and Sensient are increasingly emphasizing specialization in regional markets, supported by agile innovation and localized production capacities. These players are expected to strengthen their positions by focusing on niche segments such as nutracosmetics and functional lip care.

Smaller, specialized firms including Robertet and Bell Flavors & Fragrances are prioritizing customized flavor solutions, highlighting adaptability to regional consumer trends. Competitive differentiation is shifting from pure flavor portfolios to integrated solutions that combine natural sourcing, biotech-driven innovation, and sustainability-focused supply chains. Strategic collaborations and acquisitions are anticipated to accelerate, as players seek stronger footholds in fast-growing regions such as Asia-Pacific.

Key Developments in Flavoring Cosmetic Formulation Agents Market

On February 5, 2025, Sensapure Flavors introduced its OMVE pilot plant for Flavoring Agents.The facility was designed to accelerate small-batch innovation, enabling rapid prototyping of natural flavor systems. Industry experts highlighted it as a major step in bridging lab-scale formulation with commercial beverage applications.

On February 13, 2025, researchers published TastePepAI as an AI-driven tool for Flavoring Agents. The framework allowed de novo design of taste peptides, integrating toxicity prediction for safer flavor development. Analysts described it as a breakthrough for precision-based flavor discovery, redefining how natural taste solutions are engineered globally.

Scope of the Report

Item

Value

Quantitative Units

USD 4,206.7 Million (2025E); USD 8,902.3 Million (2035F)

Type

Natural Flavors, Nature-identical Flavors, Synthetic Flavors

Application

Oral Care, Lip Care Products, Medicated Balms, Cosmetic Ingestibles (Beauty Gummies)

Form

Liquid, Powder, Oil-soluble Concentrates

End-use Industry

Oral Care Brands, Lip Care Manufacturers, Nutracosmetic Producers

Regions Covered

North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa

Countries Covered

United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa

Key Companies Profiled

Givaudan, Firmenich (DSM-Firmenich), Symrise, IFF, Takasago, Mane, Sensient, Robertet, Kerry, Bell Flavors & Fragrances

Additional Attributes

Market share by type, application, and form; adoption trends in nutracosmetics and oral care; increasing demand for natural and clean-label flavors; technological advances in liquid formulations; regional growth led by Asia-Pacific; competitive focus on sustainability and biotech-enabled flavor solutions