A few hours ago (12:01 EDT) the government shutdown began – the first since Trump’s last term in office in Dec-Jan 2018-19 with no indication as of yet on who will back down in order to get a stop-gap bill agreed to re-commence government funding. The last shutdown lasted 35 days and I doubt many would be surprised at this stage if this shutdown was to last a considerable length of time as well. Still, as of now the financial market fallout is marginal. The S&P 500 finished up 0.4% while the 2-year Treasury yield fell just 1bp. The shutdown from 2018-19, which furloughed workers, was estimated by the Congressional Budget Office to have taken 0.1% Q/Q from GDP (non-annualised) in Q4 2018 and a further 0.2% Q/Q in Q1 2019. When the rebound in growth is then factored in the CBO estimated the permanent loss to GDP from the shutdown was 0.02% on calendar year growth in 2019. This explains the current degree of indifference to the start of this shutdown.

A few differences though are worth considering that could mean the markets do respond at some stage going forward if this shutdown gets extended. Firstly, President Trump is in his second term in office and is likely a lot more determined to get his way. His 2nd term in office so far has gone well and he has been a lot more aggressive in implementing his policies. He may not be willing to compromise like he did in the last shutdown. Secondly, and partly a reflection of this more aggressive approach, President Trump has threatened to fire rather than furlough government employees. In 2013 about 850k workers were furloughed in a shutdown that lasted 16 days while in 2018-19 the number furloughed was a little less, 800k but included workers working without pay. The 2013 episode was seen as impacting more workers. There is the potential then for this to be as large as the last examples but on this occasion the White House Office of Management and Budget could follow through with its threat and fire workers – likely ensuring a bigger drag on growth this time.

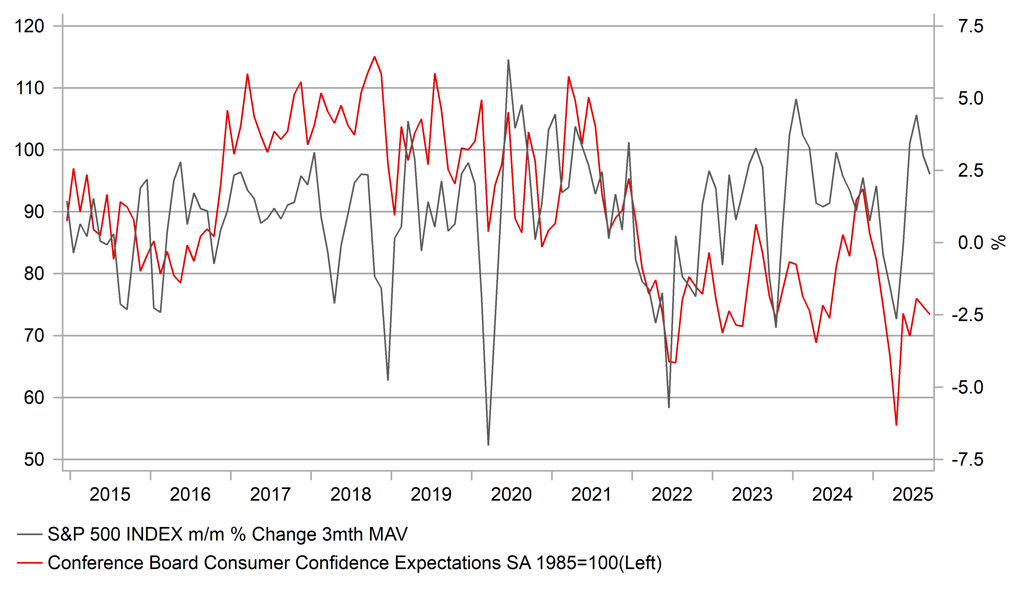

So the markets will be monitoring the risk of this more aggressive action. The economy also appears to be in a weaker position than in 2018-19. The 6mth average of payrolls growth into the October 2013 shutdown totalled 204k, in 2018-19 shutdown the same average was 146k while currently the 6mth average is a mere 64k. Another wave of unemployed workers would be entering a much weaker labour market. Consumer confidence is also fragile. In November 2018 consumer confidence was at 136.4, close to the highest level since 2000. Consumer confidence was lower in 2013 than the level reported yesterday, 94.20, but yesterday’s level remains well below the average over the last ten years (110.20).

If Trump does follow through with firing workers and the shutdown becomes prolonged, the rates market will at least look to price a greater prospect of a rate cut in October and December, a scenario still not fully priced, which will likely weigh on dollar performance over the short-term.

US CONSUMERS DEPRESSED – EQUITY GAINS NOT HELPING

Source: Bloomberg, Macrobond & MUFG GMR