Zevra Therapeutics (ZVRA, Financial) is presenting significant research on its treatments, MIPLYFFA and OLPRUVA, at the 42nd Annual Meeting of the Southeastern Regional Genetics Group. This event is taking place from July 17 to 19, 2025, in Asheville, North Carolina. MIPLYFFA is authorized in the U.S. for addressing Niemann-Pick disease type C, while OLPRUVA is approved for certain urea cycle disorders.

The studies on MIPLYFFA highlight its unique mechanism targeting the core pathology of NPC, resulting in prolonged disease stabilization for patients over multiple years. Meanwhile, OLPRUVA’s data demonstrate its capability to be administered through a gastrostomy tube, a crucial feature for managing urea cycle disorders in specific patients.

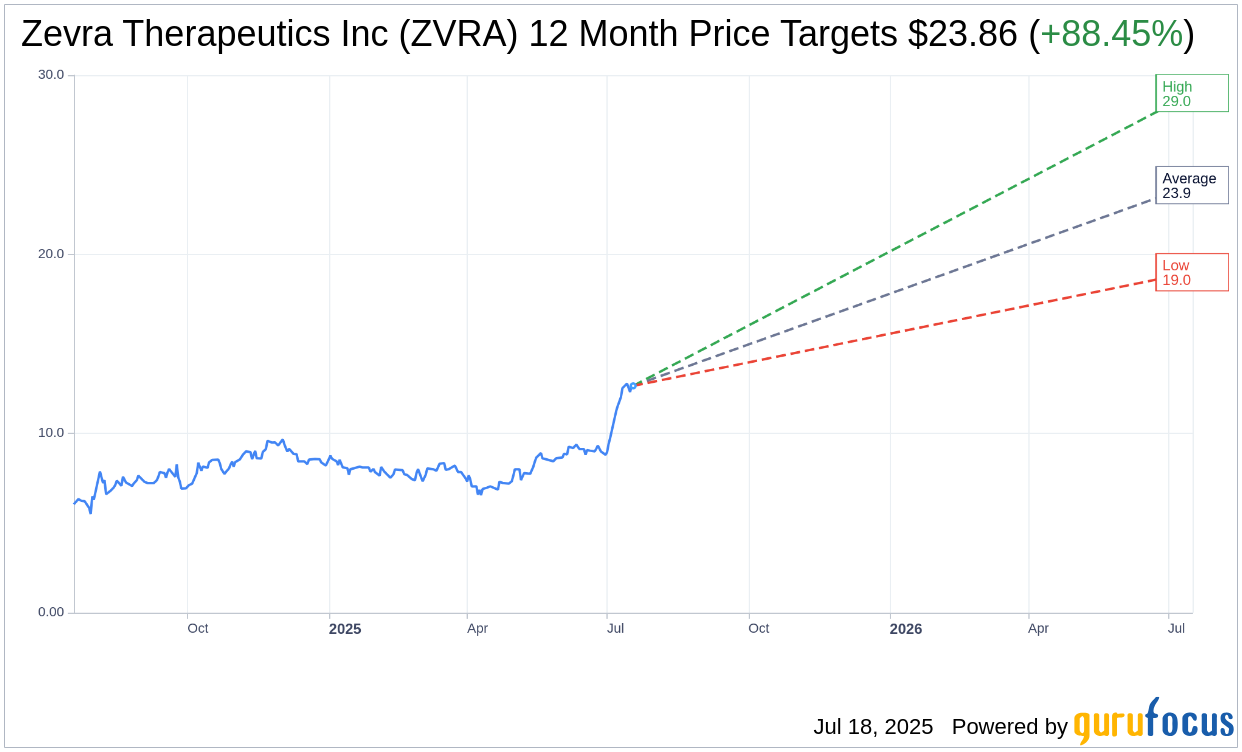

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Zevra Therapeutics Inc (ZVRA, Financial) is $23.86 with a high estimate of $29.00 and a low estimate of $19.00. The average target implies an

upside of 88.45%

from the current price of $12.66. More detailed estimate data can be found on the Zevra Therapeutics Inc (ZVRA) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Zevra Therapeutics Inc’s (ZVRA, Financial) average brokerage recommendation is currently 1.8, indicating “Outperform” status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Zevra Therapeutics Inc (ZVRA, Financial) in one year is $33.89, suggesting a

upside

of 167.69% from the current price of $12.66. GF Value is GuruFocus’ estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business’ performance. More detailed data can be found on the Zevra Therapeutics Inc (ZVRA) Summary page.

ZVRA Key Business Developments

Release Date: May 13, 2025

Net Revenue: $20.4 million for Q1 2025.MIPLYFFA Revenue: $17.1 million.OLPRUVA Revenue: $0.1 million.Operating Expense: $22.8 million for Q1 2025.R&D Expenses: $3.3 million, a decrease from the previous year.SG&A Expenses: $19.5 million, an increase of $9.6 million from the previous year.Net Loss: $3.1 million or $0.06 per share for Q1 2025.Cash, Cash Equivalents, and Investments: $68.7 million as of March 31, 2025.Total Debt: Approximately $60 million.Prescription Enrollment Forms for MIPLYFFA: 122 total, with 13 in Q1 2025.Prescription Enrollment Forms for OLPRUVA: 28 total, with 5 in Q1 2025.Covered Lives for MIPLYFFA: 38% coverage achieved by end of Q1 2025.Covered Lives for OLPRUVA: 78% coverage achieved.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points Zevra Therapeutics Inc (ZVRA, Financial) exceeded internal expectations for the MIPLYFFA launch, enrolling over one-third of diagnosed Niemann-Pick disease type C (NPC) patients in the US.The company added $148.3 million of non-dilutive capital to its balance sheet through the monetization of a pediatric rare disease Priority Review Voucher, enhancing financial strength.Zevra Therapeutics Inc (ZVRA) was recognized on Fast Company’s Top 10 Most Innovative Companies list in the medicines, therapeutics, and pharmaceuticals category.The Phase 3 DISCOVER trial for Celiprolol, targeting Vascular Ehlers-Danlos syndrome (VEDS), is progressing with patient enrollments, supported by Orphan Drug and Breakthrough Therapy designations.The company is actively expanding MIPLYFFA’s availability outside the US, with plans for a Marketing Authorization Application in Europe, targeting approximately 1,100 people living with NPC. Negative Points Despite the progress, Zevra Therapeutics Inc (ZVRA) faces challenges with payer reimbursement, with only 38% of covered lives achieved for MIPLYFFA.The launch of OLPRUVA has been slower than expected, with only 28 prescription enrollment forms received since its availability in July 2023.The company reported a net loss of $3.1 million for the first quarter of 2025, although this was an improvement from the previous year.Zevra Therapeutics Inc (ZVRA) is facing challenges in enrolling patients for the Phase 3 DISCOVER trial for Celiprolol, with only 32 patients enrolled out of a target of 150.The company has moderated expectations for OLPRUVA’s launch pace due to unique dynamics in the UCD commercial landscape, indicating potential hurdles in market penetration.