For more than 70 million Americans, Social Security is still the most important source of retirement income. For a lot of people, it’s their main or only source of money to pay for food and keep the lights on. But as the cost of living goes up, especially housing costs, it is getting harder and harder to live comfortably on Social Security alone.

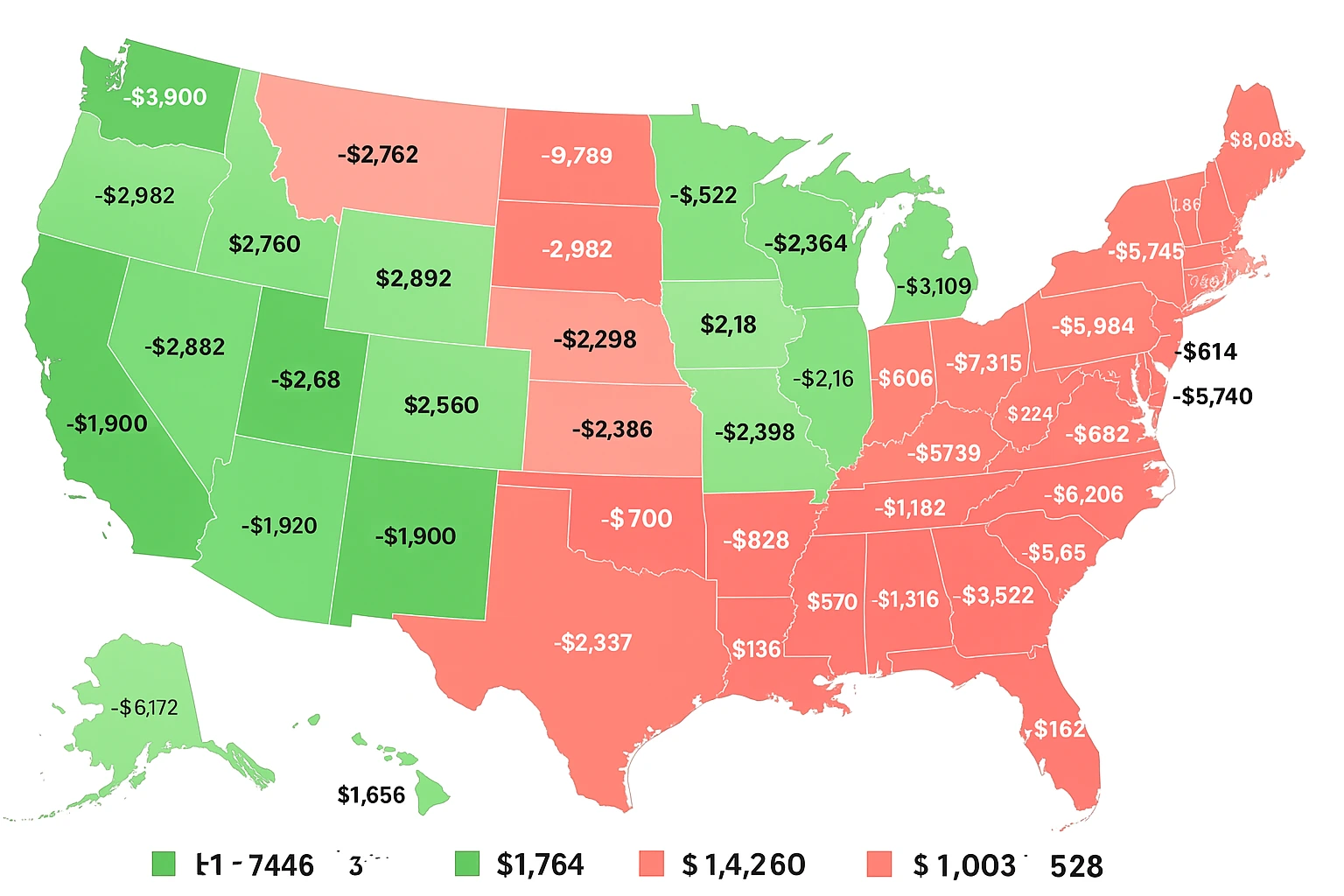

Realtor.com has done a new study that shows how this imbalance is getting worse all over the country. It found that Social Security benefits are only enough to cover the cost of living in ten states in the U.S. Retirees in other parts of the country are running out of money, sometimes by thousands of dollars a year. This is a worrying sign of how the retirement landscape is changing.

This article goes into great detail about the results, looks at which states are still affordable for retirees who only get Social Security, and breaks down the growing financial gaps in the rest of the country.

The Role of Social Security in American Retirement

Older Americans have relied on Social Security for their financial security for many years. The Senior Citizen’s League (TSCL) says that almost three-quarters of seniors rely on Social Security for more than half of their income.

Even more surprising, 39% of retirees say that Social Security is their only source of income. That means that about 22 million people in the U.S. rely solely on these monthly payments to live, with no help from pensions, savings, or investment income.

In 2025, the average monthly benefit for a retired worker will be about $1,915, which is about $22,980 a year. That might sound good in some states, but it’s getting harder to make ends meet in others, especially where housing and healthcare costs are going up faster than inflation.

The Study: Measuring Affordability for Retirees

The Realtor.com study compared each state’s median Social Security benefit with the Elder Economic Security Standard Index (Elder Index), which calculates the cost of basic needs for older adults.

The index factors in:

Housing (including property taxes, insurance, utilities, and maintenance)

Food and household expenses

Transportation costs

Healthcare costs

Miscellaneous essentials

What the researchers found was revealing: in just 10 states, Social Security benefits could fully cover these costs. In all others, retirees fell short—sometimes dramatically.

The Housing Factor: The Silent Cost of Retirement

Housing is the biggest factor in how affordable retirement is, while healthcare, food, and transportation stay pretty much the same across regions.

The “hidden costs” of owning a home have gone up a lot, even for people who don’t have a mortgage. According to Realtor.com, housing costs have gone up 26% in the last five years, mostly because of property taxes, insurance premiums, utilities, and maintenance costs.

Retirees’ budgets are directly affected by these rising costs. The study found that the average retiree is still about $2,762 short each year, or about $230 per month, even after paying off their mortgage.

Social Security goes a lot further in states where housing is less expensive. In states with high costs, even small homes can take up half of a retiree’s monthly check.

Comparing Costs: Surplus vs. Shortfall States

Let’s look at the clear divide revealed by the data.

Category

Surplus States (10)

Shortfall States (40)

Average monthly housing cost

$510

$933

Housing as % of retiree budget

27%

32%

Average annual balance

+$792

-$2,762

Typical monthly Social Security benefit

$2,050

$1,940

Cost difference driven by

Lower taxes, utilities, insurance

Higher property costs, insurance, energy

In simple terms, retirement affordability depends largely on ZIP code. Living in Delaware or Indiana can mean a small financial cushion. Living in Vermont or New Jersey, on the other hand, can leave retirees thousands of dollars in the red each year.

States Where Social Security Covers the Cost of Living

States Where Social Security Covers the Cost of Living

Only 10 states currently allow retirees to meet their essential living expenses with Social Security alone. These are the so-called “surplus” states, where modest costs and stable housing expenses provide breathing room.

Rank

State

Annual Surplus (+)

Median Monthly Benefit

Monthly Living Costs

Average Housing Cost

1

Delaware

$1,764

$2,139

$1,992

$512

2

Indiana

$1,392

$2,016

$1,900

$504

3

Arizona

$1,224

$2,003

$1,901

$530

4

Utah

$888

$2,045

$1,971

$536

5

South Carolina

$828

$1,978

$1,909

$525

6

West Virginia

$660

$1,974

$1,919

$510

7

Alabama

$576

$1,954

$1,906

$515

8

Nevada

$432

$2,040

$1,978

$522

9

Tennessee

$156

$1,931

$1,918

$518

10

Michigan

$132

$1,984

$1,973

$520

Why These States Fare Better

Several factors make these states more affordable for retirees relying on Social Security:

Moderate housing costs: Property taxes and insurance are lower than the national average.

Reasonable healthcare expenses: States like Indiana and Utah have relatively affordable Medicare supplement premiums and prescription drug costs.

Tax friendliness: Many surplus states have no state tax on Social Security benefits.

Lower energy and utility bills: In southern states, utilities tend to be less expensive, helping stretch budgets further.

States Where Retirees Face the Largest Shortfalls

On the opposite side of the spectrum are the 10 toughest states for retirees relying solely on Social Security. In these areas, even with mortgage-free housing, the cost of essentials far exceeds average benefits.

Rank

State

Annual Shortfall (-)

Median Monthly Benefit

Monthly Living Costs

Average Housing Cost

1

Vermont

-$8,088

$1,954

$2,628

$1,056

2

New Jersey

-$7,512

$1,956

$2,581

$1,304

3

Massachusetts

-$7,345

$2,010

$2,624

$1,007

4

New York

-$7,248

$1,978

$2,583

$1,082

5

New Hampshire

-$6,564

$1,994

$2,541

$996

6

Connecticut

-$6,132

$2,015

$2,526

$982

7

California

-$6,048

$2,046

$2,551

$1,094

8

Maryland

-$5,972

$2,040

$2,538

$1,072

9

Rhode Island

-$5,740

$2,025

$2,503

$1,011

10

Hawaii

-$5,652

$2,110

$2,580

$1,210

Why These States Struggle

These shortfalls are driven primarily by housing costs, which often exceed $1,000 per month even for mortgage-free owners. Other contributing factors include:

High property taxes in the Northeast and coastal states.

Expensive homeowners’ insurance, particularly in storm-prone regions.

Rising energy costs, especially in older housing stock.

Costly healthcare and supplemental insurance premiums.

The National Picture: A Growing Divide

When viewed across the entire country, the pattern becomes clear: housing affordability determines retirement security.

The gap between the most and least affordable states now exceeds $9,000 per year. That’s a major challenge for retirees on fixed incomes, and it’s widening every year.

In just five years, the cost of homeownership (even without a mortgage) has jumped 26 percent. Meanwhile, the annual cost-of-living adjustment (COLA) for Social Security benefits has averaged around 2.8 percent during the same period—barely keeping pace with inflation, let alone housing spikes.

If this trend continues, the number of states where Social Security covers living costs may shrink even further.

Why Retirees Depend So Heavily on Social Security

Social Security was never designed to be the sole source of retirement income—it was meant to supplement savings and pensions. However, the disappearance of traditional pensions and rising economic insecurity have changed that reality.

Key reasons for dependency include:

Erosion of private pensions: Defined benefit pensions have declined from covering 38% of workers in 1980 to less than 15% today.

Inadequate savings: Roughly 45% of Americans aged 55–64 have no retirement savings at all.

Longer life expectancy: Retirees today must stretch benefits over 20–30 years.

Market volatility: Many who depend on 401(k) plans or IRAs have seen inconsistent returns.

For millions, Social Security is not just a supplement—it’s survival.

Regional Trends: Where Retirees Are Moving

The affordability gap is also reshaping migration patterns.

Inbound migration: States like Arizona, South Carolina, and Tennessee continue to attract retirees for their lower taxes and manageable cost of living.

Outbound migration: High-cost states like New York, New Jersey, and California are seeing retirees relocate to more affordable regions.

According to U-Haul’s 2025 migration data, seven of the top 10 inbound states for retirees overlap with Realtor.com’s surplus list. This highlights a clear economic motivation for many seniors seeking to stretch their Social Security income further.

The Hidden Cost of “Aging in Place”

Many retirees express a strong desire to remain in their longtime homes. But staying put comes with hidden financial burdens.

Even without a mortgage, property tax assessments tend to rise annually, particularly in markets where home values have appreciated. Insurance costs have soared, especially in areas prone to hurricanes, wildfires, or flooding.

For example:

In Florida, average homeowner insurance premiums jumped by 42% between 2020 and 2024.

In California, maintenance and energy costs increased 18% during the same period.

As a result, “aging in place” can often be more expensive than downsizing or relocating, even though many seniors underestimate these ongoing costs.

Can Social Security Keep Up with Inflation?

The annual Cost-of-Living Adjustment (COLA) is meant to protect benefits against inflation. However, COLA is tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which does not accurately reflect retirees’ expenses.

While food and fuel costs weigh heavily in CPI-W, healthcare and housing—major expenses for seniors—carry less weight.

This mismatch means retirees often face real-world inflation that outpaces COLA adjustments. For instance, from 2018 to 2023:

Category

Cumulative Inflation (%)

COLA Adjustment (%)

Net Impact

Housing (owners without mortgage)

+26%

+15%

-11%

Healthcare

+22%

+15%

-7%

Food

+19%

+15%

-4%

Overall CPI-W

+17%

+15%

-2%

As a result, each year’s modest COLA often fails to restore purchasing power lost to cost increases in essentials.

Planning Ahead: Strategies for Retirees

For current and future retirees, understanding how to maximize Social Security and control living costs is critical.

Tips for Making Social Security Stretch Further

Relocate strategically: Moving to a low-cost or no-tax state can free up hundreds per month.

Downsize housing: Selling a large home and purchasing something smaller can reduce taxes and maintenance.

Delay claiming benefits: Each year you delay claiming past full retirement age increases your benefit by roughly 8%.

Track expenses: Understanding where money goes helps identify potential savings in insurance, utilities, and food.

Consider part-time work: Even limited income can close the gap between benefits and expenses.

The Broader Policy Question

The widening gap between Social Security income and real living costs raises larger policy concerns. Should Social Security benefits be recalculated to better reflect housing and healthcare realities? Should the federal government provide additional assistance to retirees in high-cost areas?

Advocates argue that without structural changes—such as updating the COLA formula to the Consumer Price Index for the Elderly (CPI-E)—millions of seniors will continue to lose purchasing power each year.

Conclusion

The most recent data backs up what many retirees already know: in most of America, Social Security alone is no longer enough.

Only ten states, Delaware, Indiana, and Arizona being the most notable, allow retirees to pay for their basic needs with Social Security benefits alone. In the other 40 states, retirees have to deal with annual shortfalls of $8,000 or more, mostly because housing costs are going up.

As costs keep going up faster than benefits, the problem of growing old with dignity is becoming one of the most important issues of our time. To make sure that Social Security stays strong for future generations, we need to close this affordability gap, either by making personal plans smarter or changing policies.

I’m Anderson, an education expert with a passion for helping students and educators thrive. With years of experience in shaping effective teaching strategies, I focus on blending traditional methods with modern approaches to create engaging and inclusive learning environments. I’ve had the privilege of working with schools, teachers, and policymakers to improve education, and I’m always excited to share my insights and help others make a lasting impact in the classroom.