The healthcare business process outsourcing (BPO) sector is undergoing a major transformation, with the global healthcare BPO market valued at US$417.7 billion in 2025, up from US$337.6 billion in 2024. It is projected to grow at a compound annual growth rate (CAGR) of 10.7%, reaching an estimated US$694.3 billion by 2030. The United States healthcare BPO market remains at the forefront of this expansion, driven by a combination of regulatory shifts, digital transformation, and the increasing need to reduce operational costs across healthcare systems.

Download PDF Brochure of Healthcare BPO Market

As the healthcare industry grapples with rising costs and complex compliance requirements, outsourcing administrative, financial, and clinical processes to specialized service providers has become a strategic imperative. Key drivers shaping the market include the shift to ICD-10 coding standards, the anticipated transition to ICD-11, the growing shortage of qualified healthcare professionals, and the adoption of artificial intelligence (AI) for automation and data management.

Key Market Drivers: Standardization and Technological Change

The transition from ICD-9 to ICD-10 coding standards—mandated by the Health Insurance Portability and Accountability Act (HIPAA)—has been one of the most influential factors in driving demand for outsourced healthcare operations. ICD-10 includes 68,000 diagnosis codes and 72,000 procedure codes, compared to ICD-9’s 13,000 and 11,000 respectively. The increased complexity of these codes requires specialized expertise, making outsourcing a cost-effective solution for healthcare organizations that lack in-house resources.

Furthermore, the upcoming ICD-11 standard is expected to intensify this need. Healthcare organizations are preparing for another wave of transition that will require retraining, new technology infrastructure, and process realignment—all of which can be efficiently managed through BPO partnerships. The demand for professional coders, billing specialists, and revenue cycle management experts continues to grow, particularly in the United States, where in-house costs remain among the highest globally.

In addition to coding transitions, automation and AI integration are accelerating efficiency and accuracy across outsourced operations. BPO providers are increasingly deploying advanced AI models for claims processing, fraud detection, and data management, enabling faster turnaround times and reduced human error.

Restraints: Control and Oversight Challenges

Despite its many advantages, outsourcing healthcare functions introduces several challenges, most notably the loss of visibility and control over business processes. As healthcare organizations delegate critical operations to third-party vendors, maintaining oversight becomes more complex. This often raises concerns related to data quality, service consistency, and compliance.

Additionally, there is the potential for goal misalignment between healthcare providers and outsourcing partners. Vendors may not always share the same performance objectives or operational standards, which can impact the quality of outcomes. As the healthcare sector becomes increasingly data-driven, establishing robust governance frameworks and contractual transparency between providers and BPO vendors is essential to mitigate these concerns.

Opportunities: AI and Drug Discovery Innovation

The integration of artificial intelligence into healthcare BPO services represents one of the most promising growth opportunities. AI and machine learning technologies are revolutionizing the drug discovery process, particularly in identifying new molecules and predicting therapeutic efficacy.

Pharmaceutical and biotechnology firms are leveraging AI algorithms to analyze massive datasets, accelerate target identification, and optimize compound selection. By outsourcing these processes to specialized BPO providers equipped with AI-driven infrastructure, companies can significantly reduce research and development timelines and costs.

This trend is particularly impactful in the oncology sector, where AI tools are helping identify potential cancer-fighting compounds faster than traditional research methods. As such, healthcare BPO firms that integrate AI capabilities into their offerings are positioned to play a pivotal role in future drug development pipelines.

Challenges: Data Security and Cyber Risks

With the digitization of patient and clinical data, data security has become a paramount concern for healthcare BPO providers. Sensitive information such as medical records, insurance claims, and treatment histories are frequent targets for cyberattacks, including ransomware and phishing schemes.

The distributed nature of outsourcing—often involving multiple vendors and cloud service providers—adds layers of complexity to data protection efforts. To address these risks, leading BPO providers are investing in advanced encryption systems, zero-trust security frameworks, and compliance with global data protection standards such as HIPAA and GDPR. However, maintaining consistent security across all levels of outsourcing remains a formidable challenge.

Segment Insights

Claims Adjudication Services Lead Claims Management Segment

Within the payer services category, claims adjudication services represented the largest share of the healthcare BPO market in 2024. Efficient claims adjudication is vital for verifying coverage, assessing medical claims, and ensuring timely reimbursements. Delays or inaccuracies in claims processing can lead to financial losses, compliance violations, and dissatisfaction among both providers and patients. Outsourcing claims adjudication to experienced BPO vendors has proven to enhance accuracy, reduce turnaround times, and improve patient satisfaction metrics.

Sales and Marketing Outsourcing Dominates Non-Clinical Services

Among life sciences BPO segments, sales and marketing services accounted for the largest market share in 2024. Pharmaceutical companies are increasingly outsourcing these functions to focus on their core R&D activities. External partners bring marketing expertise, access to regional market insights, and digital engagement capabilities that help enhance brand visibility and product adoption.

Regional Analysis

While the healthcare BPO market is global in nature, North America remains the largest regional contributor, driven primarily by the United States healthcare BPO market. Factors such as stringent regulatory compliance, a large base of private and public healthcare payers, and a high incidence of claims denials continue to propel outsourcing demand.

The presence of major market participants—including Cognizant Technology Solutions Corporation, IQVIA Holdings Inc., Conduent Incorporated, and UnitedHealth Group—has further reinforced the region’s leadership position. These firms continue to expand service portfolios through strategic acquisitions, partnerships, and digital transformation initiatives.

Competitive Landscape

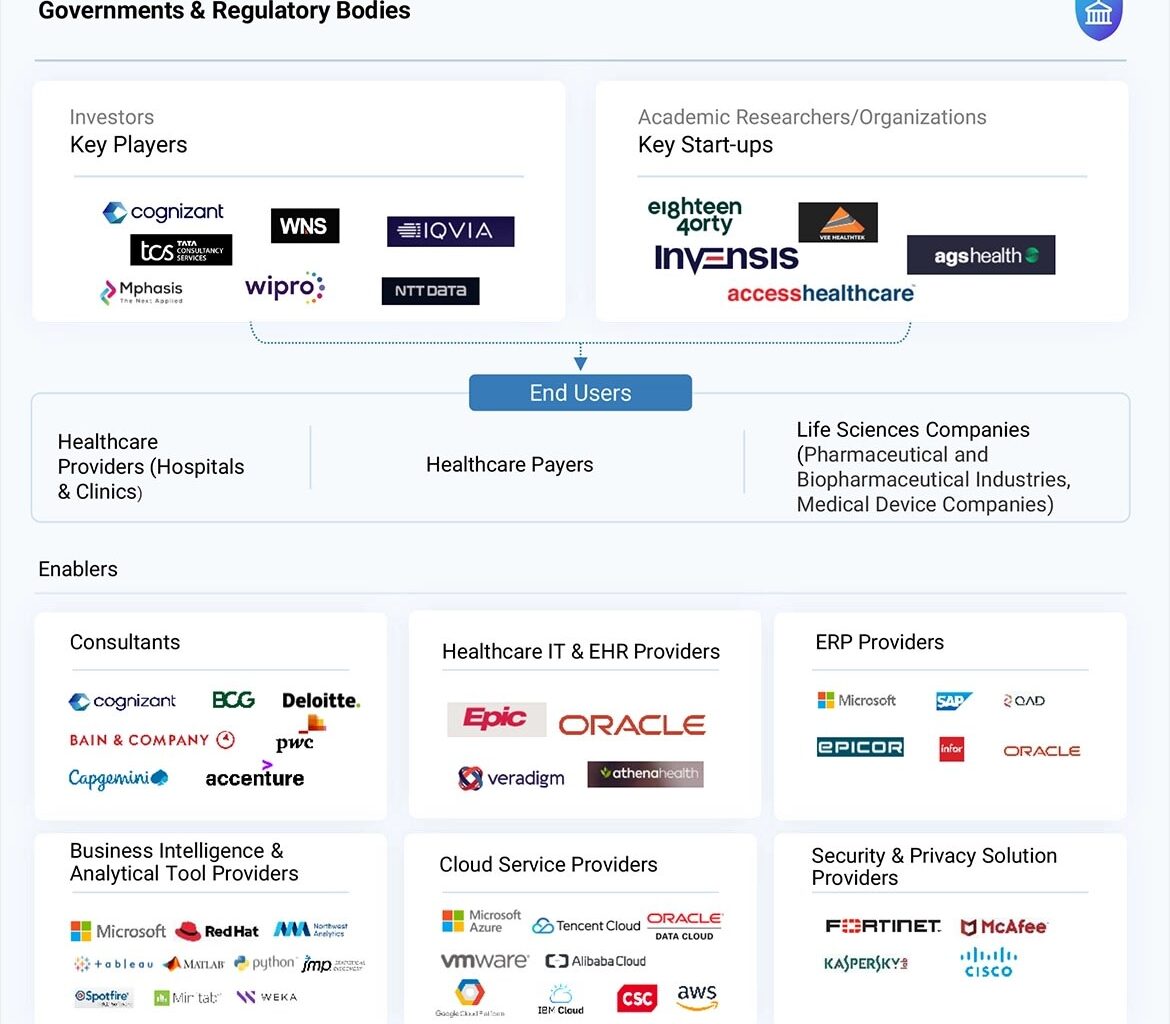

The healthcare BPO ecosystem is highly competitive and fragmented, featuring a mix of multinational corporations and specialized outsourcing firms. Key players include:

Accenture plc (Ireland)

Cognizant Technology Solutions Corporation (US)

Tata Consultancy Services Limited (India)

Conduent Incorporated (US)

WNS (Holdings) Limited (India)

NTT Data Group Corporation (Japan)

IQVIA Holdings Inc. (US)

Genpact Limited (US)

Wipro Limited (India)

Omega Healthcare Management Services (India)

UnitedHealth Group (US)

Parexel International (MA) Corporation (US)

Vee Healthtek, Inc. (US)

AGS Health (US)

These organizations continue to invest in next-generation digital platforms, AI-enabled automation, and global delivery centers to enhance efficiency, scalability, and regulatory compliance.

Future Outlook

Looking ahead, the United States healthcare BPO market is expected to witness steady growth as healthcare organizations increasingly embrace outsourcing as a strategic tool to achieve operational resilience. As regulatory environments evolve and technology reshapes healthcare delivery, BPO providers will play a crucial role in enabling digital transformation, improving patient care, and supporting financial sustainability.

With AI-driven analytics, secure cloud infrastructure, and global process standardization, the sector is poised to redefine how healthcare organizations operate—shifting from administrative complexity to data-driven precision.