What is the RNA Interference Drug Delivery Market Size?

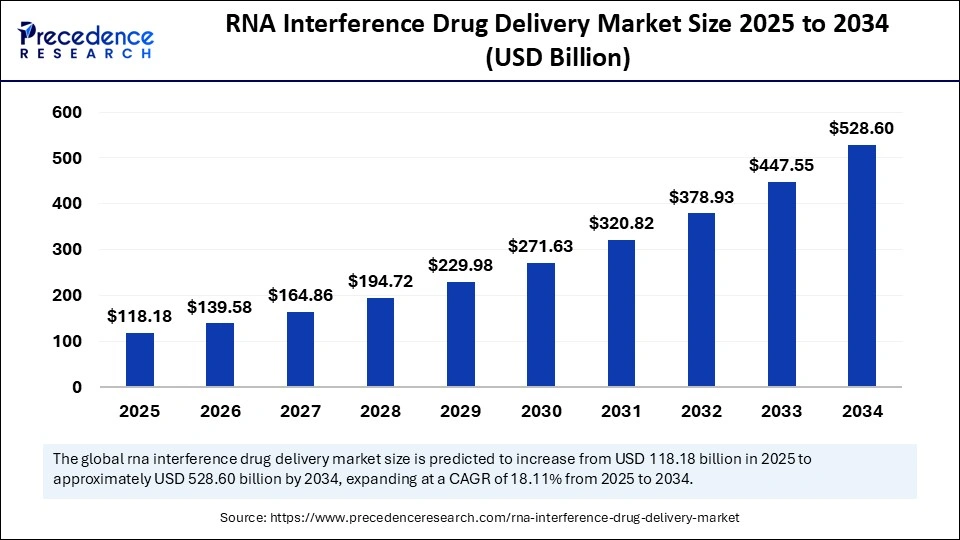

The global RNA interference drug delivery market size was calculated at USD 118.18 billion in 2025 and is predicted to increase from USD 139.58 billion in 2026 to approximately USD 528.60 billion by 2034, expanding at a CAGR of 18.11% from 2025 to 2034. The in vivo cell reprogramming market is experiencing significant growth and is expected to expand considerably in the coming years.

Market Highlights

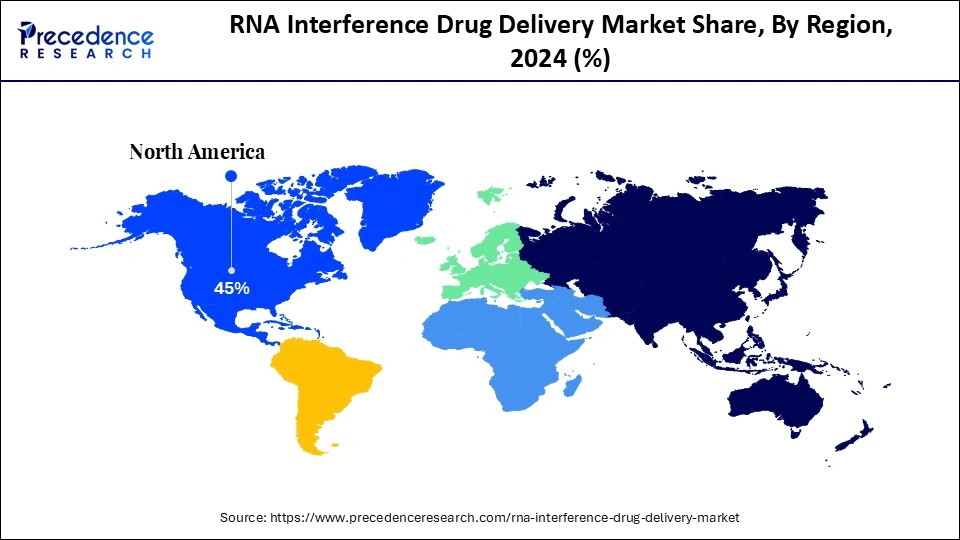

North America dominated the market, holding the largest share of 45% in the market during 2024.

The Asia Pacific is expected to grow at the highest CAGR of 30% between 2025 and 2034.

By technology, the siRNA segment held the largest share of 65% in the RNA interference drug delivery market during 2024.

By technology, the shRNA segment is expected to grow at a remarkable CAGR of 23.6% between 2025 and 2034.

By delivery system, the lipid nanoparticles (LNPs) segment held the largest share of 60% in the market for RNA interference drug delivery during 2024.

By delivery system, the polymeric nanoparticles segment is growing at a remarkable CAGR of 20.70% between 2025 and 2034.

By route of administration, the intravenous segment held the largest market share of 55% in 2024.

By route of administration, the subcutaneous segment is expanding at a strong CAGR of 17.80% between 2025 and 2034 in the RNA interference drug delivery market.

By target disease, the cancer segment held the largest market share of 40% in 2024.

By target disease, the genetic disorders segment is expected to grow at a remarkable CAGR of 23.40% between 2025 and 2034.

By target tissue, the liver segment held the largest market share, at 50%, in 2024.

By target tissue, the brain segment is expected to expand at a solid CAGR of 17.60% between 2025 and 2034.

By end-user, the pharmaceutical companies segment held the largest market share of 50% in 2024.

By end-user, academic institutions segments is poised to grow at a notable CAGR of 20% between 2025 and 2034.

Market Size and Forecast

Market Size in 2025: USD 118.18 Billion

Market Size in 2026: USD 139.58 Billion

Forecasted Market Size by 2034: USD 528.60 Billion

CAGR (2025-2034): 18.11%

Largest Market in 2024: North America

Fastest Growing Market: Asia Pacific

What is the RNA Interference Drug Delivery Market?

The RNA interference (RNAi) drug delivery market focuses on the development and delivery of RNA-based therapeutics that utilize RNAi mechanisms to silence specific genes associated with diseases. This approach enables targeted treatment of various conditions, including genetic disorders, cancers, and viral infections, by inhibiting the expression of disease-causing genes. The market encompasses the technologies, delivery systems, and applications related to RNAi-based therapies.

The RNA interference drug delivery market is experiencing substantial growth, fueled by advancements in gene silencing technologies and a rising demand for targeted therapies. This market focuses on innovative RNA-based therapeutics designed to silence genes associated with various diseases, including genetic disorders and cancers. Currently, North America leads the market, while the Asia Pacific region is poised for rapid expansion in the coming years. The dominance of the siRNA segment highlights its significance in RNAi drug delivery, emphasizing the effectiveness of this technology. Additionally, lipid nanoparticles have emerged as a leading delivery system, underscoring their significant market importance. Overall, the RNAi Drug Delivery Market is set for significant growth as the industry continues to evolve and address complex medical challenges.

Key Technological Shift in the RNA Interference Drug Delivery Market

The defining technological shift in the RNA interference drug delivery market is the transition from empirical, systemic delivery to precision, tissue-directed platforms that combine chemical conjugation with engineered nanoparticle carriers. Innovations in ligand targeting, cleavable linkers, and biodegradable LNP backbones improve cell specificity and reduce systemic exposure. Concurrently, chemically modified oligonucleotides enhance nuclease resistance and reduce innate immune activation, allowing for lower and less frequent dosing. Analytical advances in single-cell biodistribution assays and sensitive immunogenicity panels refine candidate selection and safety profiling, enhancing the accuracy of these processes. Manufacturing innovations, such as continuous oligo synthesis and microfluidic LNP assembly, compress costs and variability. Together, these advances turn RNAi from an experimental tool into a pragmatic therapeutic class.

RNA Interference Drug Delivery Market Outlook

Industry Growth Overview: Industry expansion is underwritten by convergent forces, including successful proof-of-concept clinical data, improved vector chemistries, and the proliferation of CDMOs capable of handling oligonucleotide workflows. Large pharmaceutical companies are increasingly linking licensing and acquisition deals to secure differentiated delivery assets, while specialist biotech firms concentrate on niche targeting and conjugation chemistries. Manufacturing capacity investments for GMP lipid nanoparticle (LNP) production and oligo synthesis are rising to meet projected demand. Parallel growth in analytical assays and lot-release testing ensures quality control across all stages of scale-up. Thus, growth is both platform-driven and ecosystem-dependent, requiring alignment across discovery, manufacturing, and regulation.

Sustainability Trends: Sustainability narratives are emerging around greener oligonucleotide synthesis, solvent recovery, and reduced energy intensity in cold-chain logistics. Companies are exploring less wasteful chemistries, recyclable packaging, and process intensification to minimise environmental footprints. Biomanufacturing sites are evaluating the integration of renewable energy for process heating and refrigeration. Circularity is beginning to inform packaging and single-use consumable choices in GMP operations. Stakeholders are increasingly demanding lifecycle carbon accounting as part of the supplier selection process. Consequently, sustainability is becoming a competitive differentiator rather than a compliance afterthought.

Major Investors: Capital is flowing from a mix of life-science venture funds, strategic corporate venture arms of major pharmaceutical companies, and mission-oriented public grants supporting translational platforms in the RNA interference drug delivery market. Large biopharmaceutical players deploy buy-and-build strategies to secure proprietary delivery technologies, while VC syndicates underwrite high-risk, high-reward platform startups. Infrastructure funds are selectively financing manufacturing capacity for oligo and LNP production as long-duration industrial plays. Philanthropic grants and government translational awards also subsidise early clinical work in rare genetic diseases. The investor ecosystem thus blends strategic, financial, and public-interest capital.

Startup Economy: A vibrant startup cohort focuses on novel conjugates, biodegradable nanoparticle formulations, extracellular vesicle mimetics, and targeted receptor-mediated uptake technologies. Many spinouts emerge from academic oligonucleotide labs and compete on IP around tissue tropism and immunomodulation. Startups often partner with CDMOs for scale and with incumbents for regulatory navigation. While capital needs are substantial for GMP and clinical programs, successful proof points lead quickly to strategic exits or large partnering agreements. The startup economy is therefore both the innovation engine and an acquisition target pool for larger players.

Market Key Trends

Increasing adoption of targeted conjugates (GalNAc and beyond) for hepatocyte and extra-hepatic delivery.

Scaling of LNP manufacturing and regional capacity expansion to meet global demand.

Conjugation chemistries and biodegradable carriers to reduce immunogenicity and dosing frequency.

Vertical collaborations linking discovery platforms with specialised CDMOs.

Emergence of hybrid modalities combining RNAi with gene editing or ASO strategies.

Market Scope

Report Coverage

Details

Market Size in 2025

USD 118.18 Billion

Market Size in 2026

USD 139.58 Billion

Market Size by 2034

USD 528.60 Billion

Market Growth Rate from 2025 to 2034

CAGR of 18.11%

Dominating Region

North America

Fastest Growing Region

Asia Pacific

Base Year

2025

Forecast Period

2025 to 2034

Segments Covered

Technology, Delivery System, Route of Administration, Target Disease, Target Tissue, End-User, and Region

Regions Covered

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa

Market Dynamics

Drivers

Precision Silencing: Targeting the Untargetable

A principal driver in the market for RNA interference drug delivery is the unique capacity of RNAi to silence previously undruggable genes, offering mechanistic therapies where small molecules or antibodies falter. This capability opens treatments for genetic, metabolic, and infectious diseases with direct causal pathways. Improved delivery modalities multiply therapeutic windows by enabling tissue selectivity and acceptable safety margins. The promise of durable biological effects and potential for disease modification reinforces commercial incentives. Clinical validation in high-visibility indications attracts both capital and regulatory focus. Thus, the promise of precision silencing fuels sustained market momentum.

Restraint

Delivery and Durability: The Twin Gauntlets

The most salient restraint in the RNA interference drug delivery market remains the technical and commercial challenge of delivering oligonucleotides safely to diverse tissues while achieving durable, therapeutically relevant responses. Extra-hepatic targeting remains limited compared to hepatic delivery, thereby constraining indications. Immunogenicity concerns, off-target effects, and the need for repeat dosing complicate safety profiles and payer willingness. Manufacturing complexity and supply-chain bottlenecks for critical raw materials can inflate timelines and costs. Regulatory expectations for long-term surveillance and biomarker validation extend the time to broad adoption. Consequently, delivery and durability jointly temper the speed of market expansion.

Opportunity

Beyond the Liver: Expanding the Tissue Map

The most attractive opportunity lies in enabling safe, efficient delivery to non-hepatic tissues, CNS, lung, muscle, and tumoral microenvironments, where large unmet needs persist. Success here would unlock oncology, neurology, and respiratory indications, vastly enlarging addressable markets. Companion diagnostics and stratified patient selection will enhance response predictability and reimbursement narratives. Investment in scalable, regional manufacturing and logistics would lower cost barriers and improve global access. Ancillary opportunities include service businesses for long-term safety registries and analytic contract offerings. Thus, expanding the tissue map transforms RNAi from niche therapy into platform medicine.

Segment Insights

Technology Insights

Why Are siRNAs Dominating the RNA Interference Drug Delivery Market?

The siRNA is dominating the in-RNA interference drug delivery market, holding a 65% share, as its precision in post-transcriptional gene silencing has made it the cornerstone of targeted therapeutics. The ease of design, robust manufacturing pipelines, and successful regulatory approvals of siRNA-based drugs have accelerated their adoption. Furthermore, siRNA exhibits potent gene knockdown efficiency with minimal off-target effects, enhancing its therapeutic reliability. Pharmaceutical companies are increasingly integrating siRNA into oncology and rare disease portfolios. This segment’s stability reflects both its technological maturity and the trust it has earned in clinical translation.

The shRNA segment is expanding at strong CAGR of 23.60% from 2025 to 2034, because of the expected growth in sustainable gene silencing technologies through stable genomic integration. This durability is drawing attention in applications for chronic and hereditary diseases. Biotech innovators are exploring vector-based shRNA systems for prolonged efficacy with controlled expression levels. Additionally, advancements in non-viral shRNA vectors are addressing prior safety concerns, enhancing their appeal. As delivery technologies evolve, shRNA is poised to transition from laboratory research to mainstream therapeutic pipelines.

Delivery System Insights

Why Are Lipid Nanoparticles (LNPs) Leading the RNA Interference Drug Delivery Market?

Lipid nanoparticles (LNPs) are dominating the RNA interference drug delivery market, holding a 60% share due to the technology’s proven success in mRNA and siRNA delivery, which has elevated them to a gold-standard status in nucleic acid therapeutics. LNPs encapsulate and protect fragile RNA molecules while ensuring efficient cellular uptake and endosomal escape. The flexibility of lipid composition enables the tuning of biodistribution and tissue specificity. Moreover, their scalability in manufacturing supports commercial viability. As RNA-based therapies proliferate, LNPs remain the backbone of safe, efficient, and reproducible delivery.

Polymeric nanoparticles is growing at a solid CAGR of 20.70% from 2025 to 2034, due to their tunable surface chemistry and biodegradability, which offer unparalleled versatility in RNA delivery. Researchers are leveraging their ability to prolong circulation times and modulate release kinetics, thereby enhancing therapeutic windows. Innovations in stimuli-responsive polymers are enabling the controlled, site-specific release of RNA. Moreover, these nanoparticles exhibit superior stability compared to traditional lipid systems. As polymer science advances, this segment is becoming a crucible for next-generation RNA therapeutics with enhanced precision and durability.

Route of Administration Insights

How is Intravenous Leading the RNA Interference Drug Delivery Market?

Intravenous administration holds a commanding 55% share, as it is the most preferred and effective method for administering RNA interference drugs. It ensures rapid systemic distribution and controlled dosing in acute and complex conditions. The direct bloodstream delivery maximizes bioavailability and therapeutic impact, particularly for oncology and metabolic indications. Pharmaceutical manufacturers favor this route due to predictable pharmacokinetics and regulatory familiarity. Moreover, IV-compatible formulations integrate seamlessly into existing clinical infrastructure. Its dominance underscores the preference for reliability, control, and proven efficacy in high-stakes therapeutic interventions.

The subcutaneous delivery segment is emerging as a patient-centric alternative, expected to grow at a CAGR between 17.80% due to its increased convenience, reduced dependency on healthcare professionals, and the promise of self-administration. Advances in formulation have enhanced the stability of RNA molecules under physiological conditions, making subcutaneous injection a feasible option. The approach enhances patient adherence and comfort, particularly in chronic conditions that require long-term therapy. Furthermore, the integration of sustained-release technologies is extending dosing intervals. As healthcare pivots toward personalized and home-based treatment, subcutaneous administration embodies the ethos of accessible medicine.

Target Disease Insights

Why Is the Cancer Segment Leading the RNA Interference Drug Delivery Market?

The cancer segment remains the predominant target disease, accounting for nearly 40% of the RNA interference market. The development of advanced therapeutics, which rely on the technology’s precision in silencing oncogenes and modulating tumor microenvironments, has made it indispensable in oncology. Pharmaceutical giants are investing substantial resources in R&D for siRNA-based oncology pipelines. RNAi therapies offer novel mechanisms against previously undruggable cancer targets, expanding therapeutic frontiers. Moreover, their compatibility with immunotherapy and targeted delivery systems enhances clinical synergy. As precision oncology advances, RNA interference emerges as both a powerful tool and a window into next-generation cancer therapeutics.

The genetic disorders segment represents the fastest-growing frontier, poised to expand at a robust 23.40% CAGR. The surge is fueled by advancements in genomic sequencing and the development of personalized medicine. RNA interference offers unparalleled precision in silencing mutated genes at their transcriptional source. Emerging therapies are targeting rare inherited conditions once deemed untreatable. Collaborations between genetic testing companies and biotech startups are catalyzing translational breakthroughs. This segment epitomizes the convergence of diagnostics, therapeutics, and innovation in rewriting the narrative of hereditary diseases.

Target Tissue Insights

Why Is the Liver Segment Dominating the RNA Interference Drug Delivery Market?

The liver segment dominates as the preferred target tissue, making up 50% of the market share, due to the organ’s natural propensity for nanoparticle uptake via the reticuloendothelial system, which makes it a prime site for RNA delivery. Numerous FDA-approved RNAi drugs target hepatic disorders, underscoring the therapeutic significance of the liver. The liver’s robust vascularization ensures efficient biodistribution and uptake of RNA therapeutics. Furthermore, established safety data in hepatic delivery reduces developmental hurdles. As metabolic and genetic liver diseases proliferate, hepatic targeting remains a key driver of the field’s growth trajectory.

The brain is witnessing rapid exploration as delivery technologies transcend the blood-brain barrier, with an estimated CAGR of 17.60%. Novel carriers such as exosomes, peptide shuttles, and polymeric nanogels are redefining CNS-targeted delivery. This frontier holds immense promise for treating neurodegenerative diseases like Alzheimer’s and Parkinson’s. Researchers are achieving unprecedented precision in neuronal gene silencing with minimal immunogenicity. Collaborative efforts between neuroscientists and nanotechnologists are accelerating breakthroughs. The brain’s emergence as a viable target marks a paradigm shift toward neurological RNA therapeutics once deemed implausible.

End-User Insights

Why Are Pharmaceutical Companies Leading the RNA Interference Drug Delivery Market?

Pharmaceutical companies are leading the market for RNA interference drug deliveries, with an approximately 50% share, influencing commercialization and regulatory advancements. Their deep pockets and manufacturing expertise have driven the scaling of RNA interference therapeutics. Strategic alliances with biotech startups are fostering innovation pipelines and reducing the risk of early-stage discoveries. Pharma’s infrastructure enables global clinical trials, accelerating time-to-market. Moreover, their capacity for integrated drug development ensures seamless transition from bench to bedside. Their dominance underscores the industry’s evolution from experimental science to therapeutic mainstream.

Academic institutions, expanding at an estimated 20% CAGR, remain the intellectual crucible of RNAi innovation. Universities and research centers continue to pioneer novel delivery systems, chemical modifications, and therapeutic strategies. Supported by government grants and translational collaborations, academia bridges the gap between discovery and development. Many RNAi-based startups trace their origins to university spin-offs, underscoring academia’s role as an incubator of breakthroughs. The open exchange of knowledge accelerates collective progress in this rapidly evolving field. Academic ingenuity thus sustains the foundational momentum propelling RNA interference toward widespread clinical application.

Regional Insights

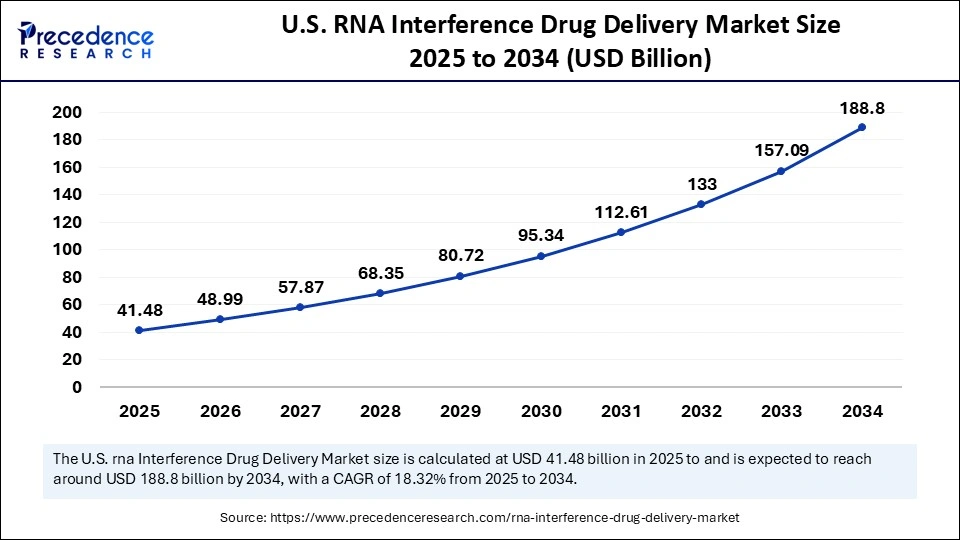

U.S. RNA Interference Drug Delivery Market Size and Growth 2025 to 2034

The U.S. RNA interference drug delivery market size is evaluated at USD 41.48 billion in 2025 and is projected to be worth around USD 188.80 billion by 2034, growing at a CAGR of 18.32% from 2025 to 2034.

How Is North America the Rising Star in the Market for RNA Interference Drug Delivery?

North America accounted for the largest market share of 45% in 2024, thanks to its concentration of biotech innovators, deep capital markets, and advanced GMP infrastructure for oligonucleotide and LNP production. The region benefits from a dense clinical trial ecosystem, experienced regulatory consultants, and access to specialist CDMOs capable of bridging discovery to scale. Major pharma and venture investors actively pursue platform acquisitions, while translational grant funding de-risks early innovation. The combined effect is rapid iteration of delivery concepts into clinical testing and commercial partnerships. Consequently, North America remains the fulcrum of both scientific progress and commercialisation strategy.

Will the United States Continue to Chart the Course of RNAi Therapeutics?

The U.S. leadership is reinforced by clustering effects, as academic laboratories, start-ups, CMOs, and regulatory expertise co-locate to create virtuous cycles of innovation. This proximity speeds problem-solving for complex CMC issues and reduces time to IND filing. Buoyant capital markets also enable later-stage fundraising and high-value licensing deals. The region’s sophisticated payer frameworks, while exacting, support premium pricing for transformative therapies. Together, these factors sustain North America’s dominant position.

How Is Asia Pacific the Fastest Growing in the RNA Interference Drug Delivery Market?

The Asia Pacific is expected to expand at a notable CAGR of 30% between 2025 and 2034, driven by expanding biotech ecosystems, increasing domestic capital, and strategic investments in manufacturing capacity for oligonucleotides and LNPs. Governments and private sponsors in the region are prioritizing life sciences clusters, enabling rapid scale-up of GMP facilities and clinical trial networks. Lower manufacturing costs and growing CDMO sophistication make the region attractive both for global supply diversification and cost-sensitive market entry. Local innovators focus on niche indications and affordable delivery solutions tailored to regional disease burdens. With regulatory pathways maturing and cross-border collaborations increasing, the Asia Pacific is poised to evolve from a manufacturing hub to a clinical innovation Center.

Is India Ready to Lead the RNA Interference Drug Delivery Revolution?

India’s RNA interference (RNAi) drug delivery market is on the brink of significant growth, driven by a combination of advanced research institutions and a burgeoning biotechnology sector. The country has seen a surge in investments from both domestic and international players, eyeing its vast pool of talent and expertise in biopharmaceuticals. Indian pharmaceutical companies are increasingly embracing RNAi technologies for targeted therapies, particularly in oncology and genetic disorders. Moreover, government initiatives aimed at boosting research and development have further stimulated the market environment.

RNA Interference Drug Delivery Market Value Chain Analysis

Raw Material Sources: Primary inputs include modified nucleotides, phosphoramidites for oligo synthesis, lipids for nanoparticle formulations, and ligands for receptor targeting. Secure sourcing of high-purity reagents and single-use consumables is crucial to ensure GMP consistency and supply chain resilience.

Technology Used: Core technologies encompass solid-phase oligonucleotide synthesis, lipid nanoparticle microfluidic assembly, receptor-targeted conjugation chemistries, and analytical platforms such as mass spectrometry and next-generation sequencing for biodistribution. Complementary tools include formulation screening, robotics, and advanced in vitro organoid models for translational assessment.

Investment by Investors: Investors favor platform companies with differentiated delivery IP, established CMC pathways, and early clinical proof-of-concept; CDMOs with scalable LNP and oligo capabilities also attract infrastructure capital. Strategic biopharma partnerships remain the common exit and commercialization route.

AI Advancements: AI accelerates sequence selection, predicts off-target interactions, optimizes conjugation linkers, and models biodistribution from physicochemical properties, thereby shortening lead discovery and enhancing safety profiling. Machine learning also streamlines manufacturing yield optimization and predictive quality control

Company-Wise Investments in the RNA Interference Drug Delivery Market

Company

Country

Investment made

Aim/Objective

Product/ focus area

Outcome/ expected impact

Alnylam Pharmaceuticals

U.S.

$250 million

Expand RNAi therapeutic pipeline

siRNA-based drugs for rare diseases

Strengthened market leadership in RNAi therapies

Silence Therapeutics

U.K.

$120 million

Develop targeted delivery systems

Lipid nanoparticle RNAi delivery

Improved delivery efficiency and reduced toxicity

Takeda Pharmaceutical

Japan

$100 million

Advance technology

Cancer-targeted RNAi therapeutics

Enhanced precision in tumor suppression

Top RNA Interference Drug Delivery Market Companies

Alnylam Pharmaceuticals: is the global leader in RNA interference (RNAi) therapeutics, with four FDA-approved siRNA drugs: ONPATTRO®, GIVLAARI®, OXLUMO®, and AMVUTTRA®. The company’s proprietary GalNAc conjugate delivery platform enables targeted gene silencing for rare genetic, cardiometabolic, and hepatic diseases, positioning it at the forefront of RNA drug innovation.

Ionis Pharmaceuticals: Ionis pioneered antisense oligonucleotide (ASO) therapy and developed landmark drugs, including SPINRAZA (for spinal muscular atrophy) and TEGSEDI. With over three decades of RNA expertise, Ionis continues advancing next-generation ASOs for neurological, cardiovascular, and rare disorders through its Ligand Conjugate Antisense (LICA) platform.

Moderna, Inc.: Best known for its COVID-19 mRNA vaccine (mRNA-1273), Moderna is expanding into oncology, rare diseases, and personalized cancer vaccines. Its mRNA platform combines computational design, AI-driven optimization, and lipid nanoparticle (LNP) delivery systems, redefining RNA-based therapeutics at scale.

Arrowhead Pharmaceuticals: Arrowhead develops RNA interference therapies using its Targeted RNAi Molecule (TRiM) platform, with a focus on liver, cardiometabolic, and pulmonary diseases. Its precision delivery approach enables the development of long-acting RNAi drugs, with key partnerships established with Takeda, Janssen, and Amgen.

Arcturus Therapeutics: Arcturus specializes in self-replicating mRNA and lipid nanoparticle delivery technologies via its LUNAR® platform. The company’s pipeline includes mRNA vaccines, rare disease therapies, and its ARCT-810 candidate for urea cycle disorders, positioning it as a key player in next-gen mRNA therapeutics.

Other Companies in the RNA Interference Drug Delivery Industry

In October 2025, in his will outlining the details for the Nobel Prize, Alfred Nobel designated physiology or medicine as the third prize category. In 2024, the award was valued at 11 million Swedish krona, which is approximately $1.06 million. (Source: https://www.livescience.com)

In October 2025, experts in the industry believe that the recent revisions to the Promotion of Research and Innovation in the Pharma-MedTech Sector (PRIP) scheme by the government may not be adequate for fostering an environment conducive to the development of new drugs in India. The cost of developing a new drug molecule with a new chemical entity ranges between $2 billion and $ 4 billion. With an estimated budget of Rs 5,000 crore, the scheme is deemed lacking, especially when considering that a significant portion of the funding is expected to come from pharmaceutical companies in the form of equity or debt.

(Source: https://www.financialexpress.com)

Segments Covered in the Report

By Technology

siRNA (Small Interfering RNA)

miRNA (MicroRNA)

shRNA (Short Hairpin RNA)

Others

By Delivery System

Lipid Nanoparticles (LNPs)

Polymeric Nanoparticles

Exosomes

Others

By Route of Administration

Intravenous

Subcutaneous

Intranasal

Others

By Target Disease

Cancer

Genetic Disorders

Viral Infections

Metabolic Diseases

Others

By Target Tissue

Liver

Lungs

Brain

Heart

Others

By End-User

Pharmaceutical Companies

Biotechnology Companies

Academic and Research Institutions

Hospitals and Clinics

By Region

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa