This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

Sugar prices hold steady amid government shutdown. The lack of federal data and wet harvest conditions added uncertainty to the market. Per-capita sweetener deliveries fell to multi-year lows as sales and contracting slowed.

Sugar Prices Steady as Government Shutdown Stalls Data

The US cash sugar market plodded along at a slow but steady pace during the week ending October 10. Bulk refined sugar prices were unchanged.

Market participants continued to search for direction as mounting layers of uncertainty built, especially following the October 1 federal government shutdown.

The trade had been awaiting the latest updates to the balance sheet expected in the October 9 WASDE report, but updates to nearly all USDA Reports, including the WASDE, will not be issued until the shutdown ends. It is likely that many of the reports not updated during the shutdown will not be released at all.

The last US government shutdown occurred during the first Trump administration in December 2018. It lasted 35 days and was the longest government shutdown in history.

Weekly data on harvest progress and crop condition ratings were not released due to the shutdown. However, the short-term outlook map from the National Oceanic and Atmospheric Administration website indicated above-normal chances for precipitation across the key Red River Valley, which likely will slow harvest activities.

While too much rain at harvest can be detrimental to sugar content, a slow harvest may not be entirely negative, as the short-term temperature outlook continues to show above-average levels across the entire Central Plains region, making it unsuitable for outdoor sugar beet piling. The slower harvest also raised concerns about potential frost.

US Sugar and Sweetener Deliveries Slip to Multi-Year Lows

Sales for 2025–26 continued at a slow pace, which some processors said they expected to last through the end of the year as companies assess their needs and chew through current inventories.

Sugar deliveries moved at an improved pace compared with earlier months of the year but have not been as strong on a year-to-date basis.

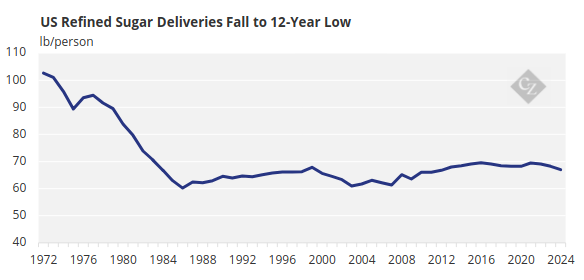

According to data released by the USDA’s Economic Research Service (prior to the October 1 shutdown), deliveries of refined sugar for domestic food and beverage use in calendar year 2024 totalled 67 lbs per person, down 1.8% from 2023 and the lowest since 66.7 lbs per person in 2012. The recent high in per capita refined sugar deliveries was 69.6 lbs in 2016. The all-time high (in records dating back to 1966) was 102.6 lbs in 1972.

Source: USDA

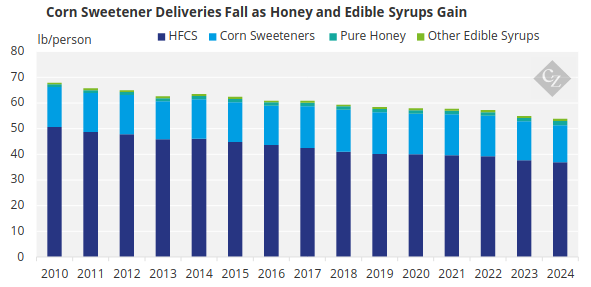

Per capita high-fructose corn syrup (HFCS) deliveries were 36.9 lbs, down 1.9% from 2023. HFCS deliveries peaked at 67.5 lbs per person in 1999 and have declined by 41% since 2003. Total per capita corn sweetener deliveries were 51.3 lbs, down 1.5 lbs, or 2.8%, from 2023. Deliveries of honey and other edible syrups were 2.4 lbs per person in 2024, up 14.3% from 2023.

Source: USDA

Total per capita deliveries of caloric sweeteners were estimated at 120.7 lbs in 2024, down 1.9% from 2023 and the lowest since 119.6 lbs in 1983. Estimated per capita deliveries are higher than actual consumption due to losses along the food chain and waste at the consumer level.

Annual contracting of corn sweeteners for 2026 remained slow, with some buyers holding out for lower prices.