Swimming in a Sea of Crude

Continued crude oil supply builds seen as likely

Chinese restocking has supported global crude prices

Low refined products inventories could prime the pump

Late season heat warms the bears

Sincerely,

David Thompson, CMT

Executive Vice President

Powerhouse

(202) 333-5380

The Matrix

Bank research teams, trade groups, and governmental agencies are now in near universal agreement that global crude oil supplies will build significantly over the course of Q4 2025 and into at least the first half of 2026. This collective point of view has been developing over several weeks which begs the question, why, until recently, had the price of crude oil (both WTI and Brent) been staying in a choppy range as opposed to selling off in anticipation of this excess supply?

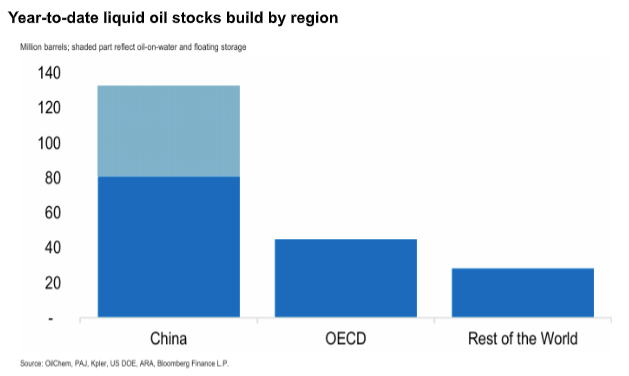

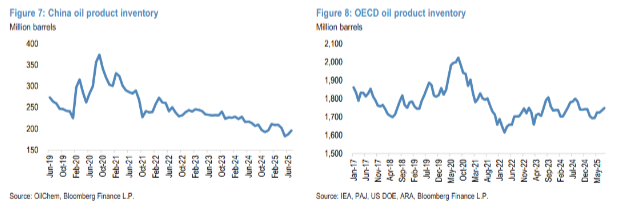

A key part of the answer to this question is China. China has been aggressively refilling its crude oil storage. The U.S. Energy Information Administration estimates that Chinese crude inventories built by roughly 900,000 barrels per day between January and August

this year. The total volume of oil soaked up by Chinese storage refills is estimated to be close to 140 million barrels. One bank estimates that Chinese underground oil storage now sits at 1.3 billion barrels surpassing the highwater mark of 2020 at the height of the COVID shutdown. If Chinese crude buying tapers off in the coming months, the largest (current) pillar of price support would be gone and bearish sentiment would likely start intensifying.

Of note to U.S. fuel marketers is the fact that even as Chinese crude reserves have swelled, the global supply of refined products still remails relatively tight. Chinese refiners have not been turning their crude into refined products to be pushed on to global markets.

If refined product inventories fail to build over the next two months during the period of seasonally weaker demand, then the spring price rally could launch with a noticeable tailwind.

Supply/Demand Balances

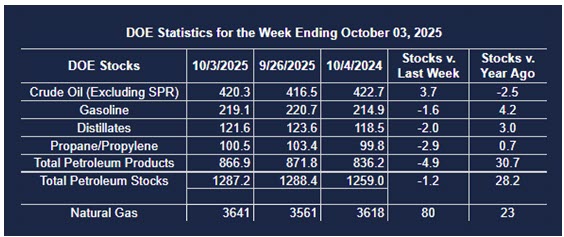

Supply/demand data in the United States for the week ending October 3, 2025, were released by the Energy Information Administration.

Total commercial stocks of petroleum decreased (⬇) 1.2 million barrels to 1.2872 billion barrels during the week ending October 3rd, 2025.

Commercial crude oil supplies in the United States were higher (⬆) by 3.7 million barrels from the previous report week to 420.3 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Down (⬇) 0.3 million barrels to 6.7 million barrels

PADD 2: Down (⬇) 0.9 million barrels to 100.7 million barrels

PADD 3: Up (⬆) 6.2 million barrels to 244.5 million barrels

PADD 4: Down (⬇) 0.4 million barrels to 22.4 million barrels

PADD 5: Down (⬇) 0.8 million barrels to 46.0 million barrels

Cushing, Oklahoma, inventories were down (⬇) 0.8 million barrels to 22.7 million barrels.

Domestic crude oil production increased (⬆) 124,000 barrels per day from the previous report to 13.629 million barrels per day.

Crude oil imports averaged 6.403 million barrels per day, a daily increase (⬆) of 570,000 barrels. Exports decreased (⬇) 161,000 barrels daily to 3.590 million barrels per day.

Refineries used 92.4 percent of capacity; an increase (⬆) of 1.0 percent from the previous report week.

Crude oil inputs to refineries increased (⬆) 129,000 barrels daily; there were 16.297 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, increased (⬆) 173,000 barrels daily to 16.777 million barrels daily.

Total petroleum product inventories decreased (⬇) by 5.0 million barrels from the previous report week, up to 866.9 million barrels.

Total product demand increased (⬆) 1,824,000 barrels daily to 21.990 million barrels per day.

Gasoline stocks decreased (⬇) 1.6 million barrels from the previous report week; total stocks are 219.1 million barrels.

Demand for gasoline increased (⬆) 401,000 barrels per day to 8.919 million barrels per day.

Distillate fuel oil stocks decreased (⬇) 2.0 million barrels from the previous report week; distillate stocks are at 121.6 million barrels. EIA reported national distillate demand at 4.346 million barrels per day during the report week, a increase (⬆) of 730,000 barrels daily.

Propane stocks fell (⬇) 2.9 million barrels from the previous report to 100.5 million barrels. The report estimated current demand at 1,474,000 barrels per day, an increase (⬆) of 941,000 barrels daily from the previous report week.

Natural Gas

Bearish sentiment continues to control the natural gas futures market as late season heat is thwarting the accumulation of HDDs. Meteorologists expect warmer than normal temps to prevail in the continental U.S. for the next two weeks.

U.S. Lower 48 natural gas production is estimated at 106.5 billion cubic feet per day (bcfd) so far in October, off from August’s record monthly high of 108.3 bcfd.

According to the EIA:

Net injections into storage totaled 80 Bcf for the week ending October 3, compared with the five-year (2020–24) average net injections of 94 Bcf and last year’s net injections of 78 Bcf during the same week. Working natural gas stocks totaled 3,641 Bcf, which is 157 Bcf (5%) more than the five-year average and 23 Bcf (1%) more than last year at this time.

The average rate of injections into storage is 14% higher than the five-year average so far in the refill season (April through October). If the rate of injections into storage matched the five-year average of 9.6 Bcf/d for the remainder of the refill season, the total inventory would be 3,910 Bcf on October 31, which is 157 Bcf higher than the five-year average of 3,753 Bcf for that time of year.

Was this helpful? We’d like your feedback.

Please respond to [email protected]

This material has been prepared by a sales or trading employee or agent of Powerhouse Brokers, LLC and is, or is in the nature of, a solicitation. This material is not a research report prepared by Powerhouse Brokers, LLC. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

DISTRIBUTION IN SOME JURISDICTIONS MAY BE PROHIBITED OR RESTRICTED BY LAW. PERSONS IN POSSESSION OF THIS COMMUNICATION INDIRECTLY SHOULD INFORM THEMSELVES ABOUT AND OBSERVE ANY SUCH PROHIBITION OR RESTRICTIONS. TO THE EXTENT THAT YOU HAVE RECEIVED THIS COMMUNICATION INDIRECTLY AND SOLICITATIONS ARE PROHIBITED IN YOUR JURISDICTION WITHOUT REGISTRATION, THE MARKET COMMENTARY IN THIS COMMUNICATION SHOULD NOT BE CONSIDERED A SOLICITATION.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that Powerhouse Brokers, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

Copyright 2025 Powerhouse Brokers, LLC, All rights reserved