Legacy PC maker Dell Technologies, Inc. (DELL) has positioned itself to benefit from the growing momentum behind AI technology by aggressively expanding into the AI infrastructure sector. However, this AI momentum is yet to be baked into its valuation as the company is still trading at a forward P/E multiple of just 16x despite reporting record-breaking revenue in the second quarter of Fiscal 2026.

Elevate Your Investing Strategy: Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

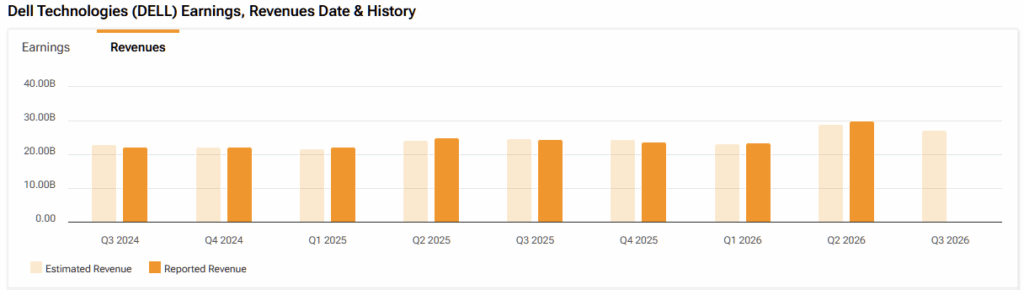

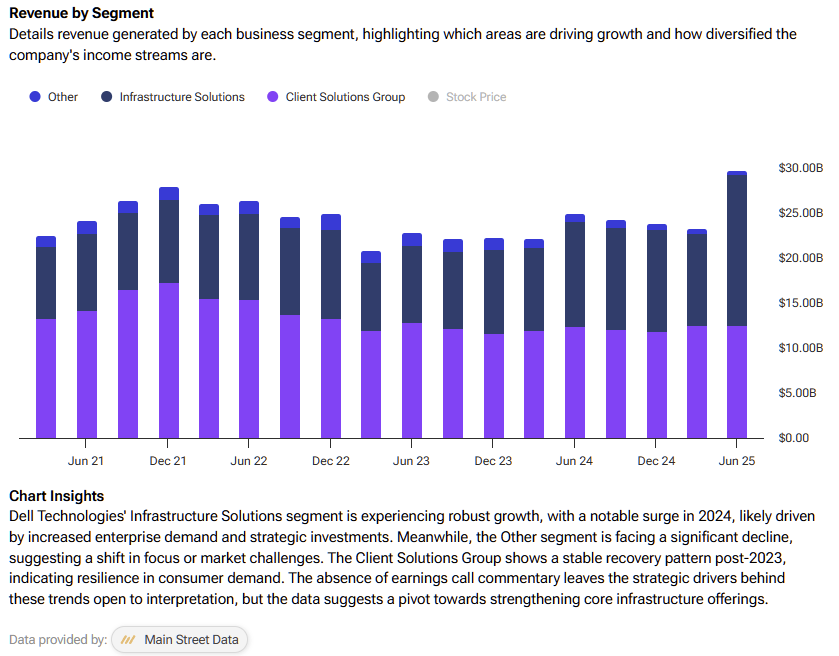

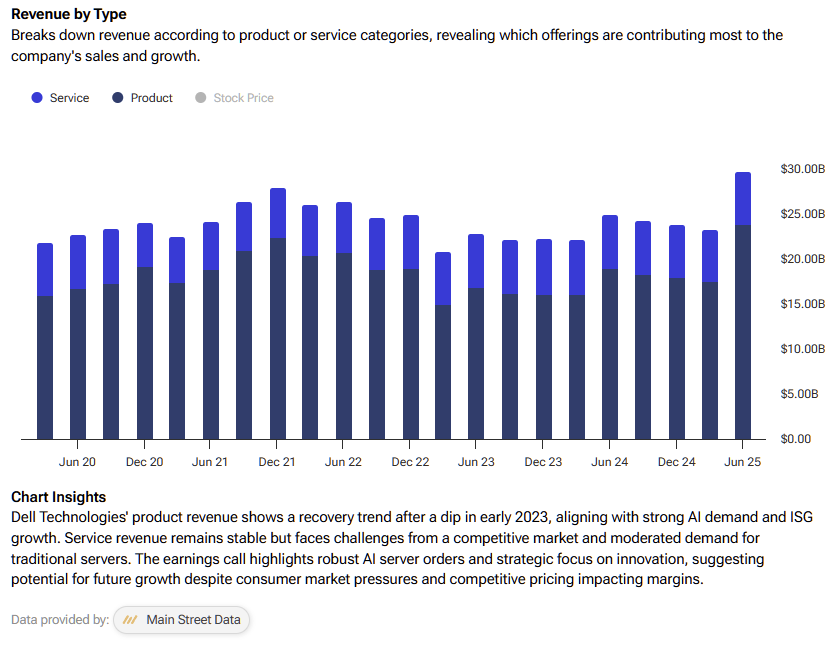

Furthermore, DELL’s Infrastructure Solutions Group (ISG) marked its sixth consecutive quarter of double-digit growth earlier this year, with total revenue rising 44% and hitting a record $16.8 billion. Meanwhile, when it comes to servers and networking specifically, DELL delivered a ~70% boost, hauling in almost $13 billion last quarter. Product still dominates DELL’s revenue mix over Service.

I remain stoutly Bullish on the prospects for Dell stock as I believe the company’s AI progress will trigger a valuation re-rating in the long run, leading to a much higher stock price.

How Dell’s End-to-End AI Portfolio Is Powering the Next Wave

My bullish stance on Dell stems from the company’s comprehensive strategy to capture the broad AI infrastructure market. Instead of zeroing in on individual AI server racks, Dell has developed a complete portfolio of AI-focused solutions that span hardware (servers and storage systems), cooling technologies (including liquid cooling and Dell PowerCool), and a suite of services (consulting, rack installation, and managed services).

This integrated approach has enabled Dell to attract large enterprise customers over the past year, as it offers a seamless, one-stop solution for organizations scaling their AI capabilities.

The centerpiece of Dell’s AI hardware lineup is its PowerEdge server portfolio—equipped with cutting-edge technology capable of handling the most demanding AI workloads, including those powered by Nvidia’s Blackwell platform. Complementing these servers are Dell’s PowerSwitch networking products and AI Data Platform storage solutions, both of which have gained momentum recently for their ability to manage large-scale, data-intensive workloads with industry-leading efficiency.

Demand for AI Solutions Remains Robust

My bullish stance on Dell is further reinforced by the strong, quantifiable demand for its AI solutions amid the broader surge in AI infrastructure spending. In the fiscal second quarter of 2026, Dell reported $5.6 billion in new AI server bookings. The company also recorded $8.2 billion in AI server shipments, bringing total AI-optimized server shipments to $10 billion for the first six months of fiscal 2026—already surpassing the total for all of fiscal 2025. This underscores the accelerating demand for Dell’s AI hardware offerings.

Dell ended the quarter with an AI server backlog of $11.7 billion, signaling a strong pipeline for future revenue. In a clear vote of confidence, management raised its full-year AI server shipment guidance from $15 billion to $20 billion, reflecting robust visibility into continued demand over the next two quarters.

This strong performance comes as the broader AI infrastructure industry experiences explosive growth, fueled by record capital expenditures from major technology players. According to Bloomberg, Alphabet (GOOGL), Amazon (AMZN), Meta (META), and Microsoft (MSFT) together are expected to spend more than $320 billion in CapEx this year, with the majority directed toward AI initiatives.

During its recent Analyst Day presentation, Dell noted that global AI-related CapEx investments are now projected to reach $400 billion this year, double the initial estimate of $200 billion. With its expanding AI portfolio and growing order backlog, Dell appears exceptionally well-positioned to capture a meaningful share of this unprecedented investment cycle.

Dell’s Upgraded Long-Term Financial Goals Strengthen the Thesis

Dell’s bullish outlook is further supported by the company’s recently updated long-term financial targets. At its Analyst Day event earlier this month, Dell raised its long-term revenue growth guidance from a midpoint of 3.5% to 8% CAGR. The company also lifted its diluted EPS growth projection from 8% to 15%, signaling that management expects stronger revenue growth to translate meaningfully into bottom-line expansion.

In other words, Dell anticipates that incremental sales growth will directly fuel earnings growth—an encouraging indicator of sustainable profitability. The company also reaffirmed its shareholder-friendly capital allocation strategy, pledging to return approximately 80% of adjusted free cash flow to investors through dividends and share repurchases.

A closer look at Dell’s revised outlook shows that most of the incremental growth is expected to come from its Infrastructure Solutions Group (ISG), which includes the company’s rapidly expanding AI server business. Encouragingly, the Client Solutions Group (CSG)—home to Dell’s PC operations—is also projected to grow faster than previously expected, with management now targeting 2% to 3% growth, mainly driven by an anticipated global PC upgrade cycle in the coming years. As mentioned earlier, product still dominates over service at DELL.

Is DELL Stock a Good Buy Now?

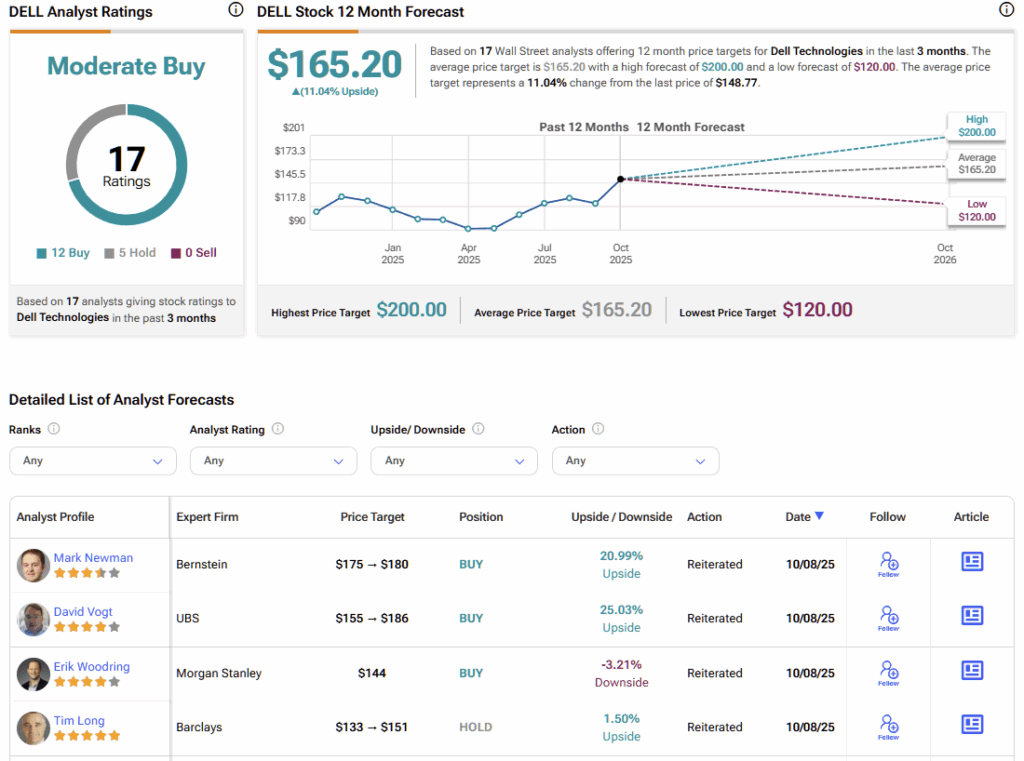

Following Dell’s Analyst Day event, Wall Street analysts responded positively, with several firms reiterating or strengthening their bullish views on the company. KeyBanc analyst Brandon Nispel highlighted that Dell is well-positioned to capitalize on the accelerating growth in AI infrastructure spending.

Raymond James analyst Simon Leopold also maintained an optimistic outlook but advised investors to monitor Dell’s profit margins closely as AI server solutions begin to represent a larger share of total revenue.

Morgan Stanley’s Erik Woodring was even more upbeat, suggesting that Dell’s AI server revenue could accelerate by as much as 25% in a best-case scenario—underscoring the strong potential embedded in the company’s AI portfolio.

Overall, according to 17 Wall Street analysts, Dell carries an average stock price target of $165.20, representing an upside potential of ~8% over the next 12 months.

After closely evaluating Dell’s current valuation, I believe the market has yet to fully price in the upside potential from its expanding AI server business. With a forward P/E of 16 and a forward price-to-sales multiple of just 0.95x, Dell continues to trade like a mature consumer electronics company with limited growth prospects.

The reality, however, tells a different story. Year-over-year revenue growth accelerated to 19% in the most recent quarter, and as noted earlier, management has doubled its long-term revenue growth outlook. In my view, these factors position Dell for a valuation re-rating, as the market begins to recognize its transformation into a key player in the AI infrastructure space.

AI Servers Set to Become DELL’s Next Big Catalyst

Dell is firing on all cylinders with the help of its fast-growing AI server business. Encouragingly, the company seems focused on building a comprehensive, 360-degree AI infrastructure solutions portfolio, which I believe is the right strategy to win and retain large-scale customers. At a reasonable valuation level, I find Dell attractively priced with the potential for a re-rating in the coming weeks.