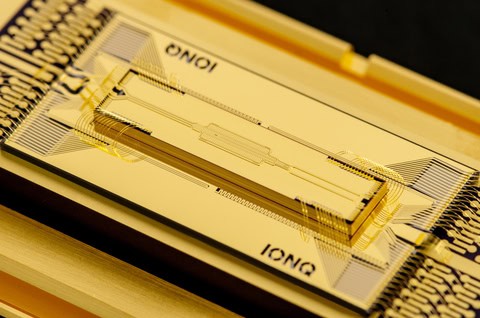

Courtesy of IonQ

Quantum computing has emerged as a prime target for investors chasing high-growth tech sectors. Over the past year, some stocks in this space have climbed by thousands of percent, drawing billions in capital from those betting on revolutionary advancements.

Companies like Rigetti Computing (NASDAQ:RGTI), D-Wave Quantum (NYSE:QBTS), and Quantum Computing (NASDAQ:QUBT) have seen share prices skyrocket, fueled by optimism around potential applications in drug design, optimization, and cryptography. Billions have poured into funds and direct investments, pushing market caps higher despite limited revenue streams.

Yet, skeptics point to ongoing technical hurdles and question short-term commercial viability, as most systems remain experimental. Investors, however, keep bidding up valuations, viewing quantum as the next AI-like boom. With such fervor, could IonQ (NYSE:IONQ) have just delivered a breakthrough that sends its stock soaring even further?

Today, IonQ announced a major technical milestone: it achieved 99.99% fidelity in two-qubit gates, setting a new world record. In simple terms, qubits are the building blocks of quantum computers, and two-qubit gates handle interactions between them. These gates are crucial because quantum computations rely on precise entanglements and operations; even minor errors can cascade, rendering results unreliable.

Historically, error rates have been a major bottleneck, forcing engineers to dedicate vast resources to error correction — they often require thousands of physical qubits to simulate just one reliable “logical” qubit. IonQ’s “four nines” fidelity — meaning just one error per 10,000 operations — beats the prior record of 99.97% and marks the first time any company has hit this threshold on mass-producible chips.

By using electronic qubit control (EQC) technology instead of traditional lasers, IonQ integrates all controls onto standard semiconductor chips. This approach, borrowed from classical computing manufacturing, makes systems cheaper to produce, more stable in operation, and far easier to scale up.

Unlike laser-based methods, which are prone to environmental interference and require specialized setups, EQC leverages precision electronics for better reliability. For IonQ, this milestone validates its acquisition of Oxford Ionics and accelerates its roadmap. The company now projects demonstrating 256-qubit systems by 2026, with ambitions for millions of qubits by 2030.

In broader quantum computing terms, it shortens the path to commercial viability. High fidelity reduces the overhead for error correction dramatically — IonQ claims up to a 10 billion times improvement over older 99.9% benchmarks. This means quantum machines can tackle real-world problems without needing impractically large hardware. Industries such as pharmaceuticals, where IonQ has already shown 20x speed-ups in drug discovery, stand to benefit first.

Story Continues

Overall, it signals that quantum computing is transitioning from theoretical promise to engineered reality, potentially compressing industry timelines by years and attracting more enterprise adoption.

But will this spark a breakout for IonQ shares? The stock has risen about 350% over the past year, a strong performance but trailing its peers amid volatile market conditions.

Rigetti’s shares, despite a recent 25% drop from mid-October highs, have still delivered outsized gains of 3,800% in the same timeframe. D-Wave has surged 3,200% — even after yesterday’s 10% tumble — by capitalizing on its focus on annealing quantum systems for optimization tasks, while Quantum Computing has posted 2,170% returns.

IonQ’s announcement could shift this dynamic, showcasing tangible progress in a field often criticized for hype over substance. With partnerships like those with Amazon’s (NASDAQ:AMZN) AWS and AstraZeneca (NYSE:AZN) already in place, this fidelity breakthrough might draw fresh investment, validating IonQ’s trapped-ion approach over competitors’ superconducting or photonic methods.

If it leads to new contracts or funding, a rally could follow, especially as quantum stocks often move on technical news rather than earnings.

As impressive as IonQ’s achievement is, it won’t land quantum computers in everyday use soon. Systems remain lab-bound, far from consumer shelves, with challenges like maintaining qubit coherence in larger arrays still unresolved. Competition is also fierce, from giants like IBM (NYSE:IBM) and Google to startups, and regulatory hurdles around quantum-safe encryption add uncertainty.

That said, investors have pumped up prices on slimmer news, so a surge isn’t out of the question — quantum enthusiasm often defies fundamentals. Valuations, though, are stretched: IonQ’s price-to-sales ratio hovers around 260, while Rigetti’s exceeds 1,770, D-Wave’s sits at 528, and Quantum Computing’s tops 14,700.

Even with triple-digit revenue growth, normalizing these could take years, as current sales are tiny — often in the low millions annually. Risks abound, including potential tech setbacks or economic downturns that dry up venture capital.

IonQ has advanced meaningfully, potentially extending its edge if you’re optimistic on quantum’s future in solving intractable problems like climate modeling or AI training. A small position makes sense for diversified portfolios, but it’s no cue to go all-in; these remain highly speculative plays with plenty of road ahead, where patience is key amid boom-and-bust cycles.