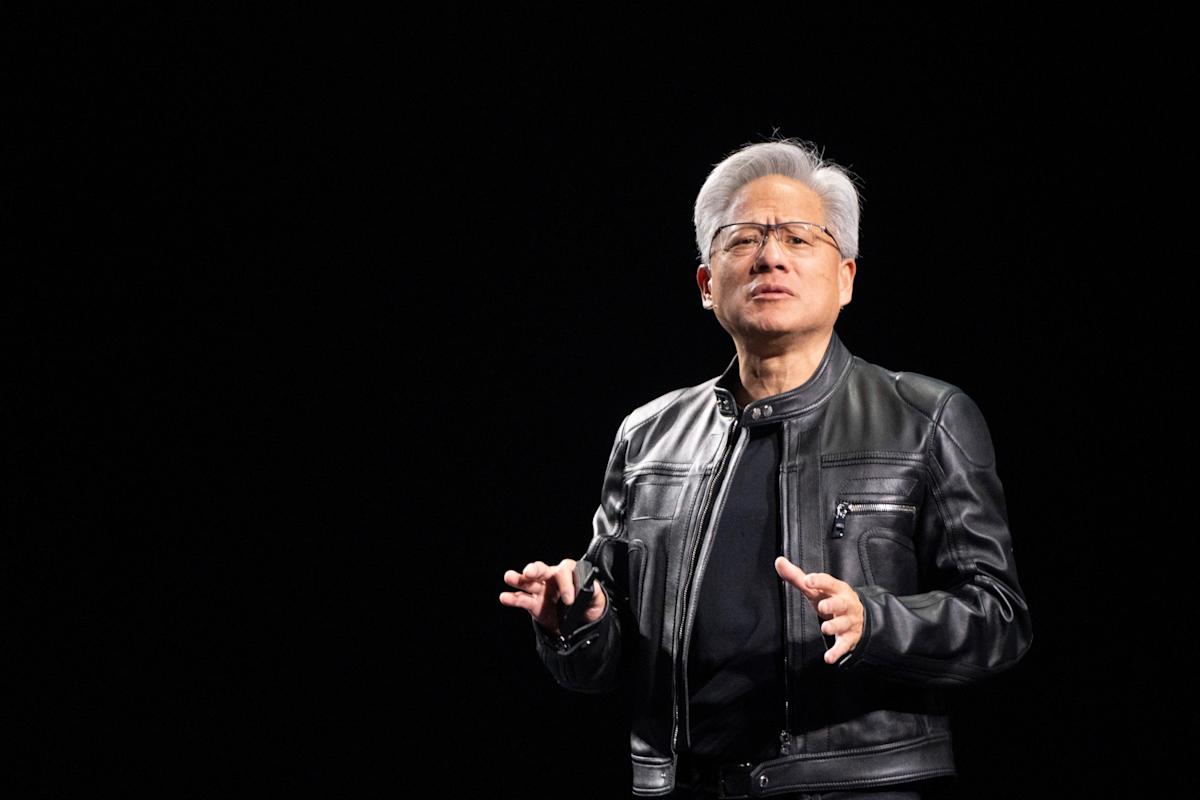

Jensen Huang speaking at the ‘Nvidia GTC’ meeting at the 2025 VivaTech conference in Paris in June.

(Bloomberg) — Nvidia Corp. has gradually become one of the most important players in the venture capital world, without being a VC firm.

Most Read from Bloomberg

The chipmaker said last month that it’s planning to invest $100 billion in OpenAI — a deal that would mark the largest startup investment of all time. It’s part of a growing string of bets on private artificial intelligence companies Nvidia has made across the world. At the company’s highly anticipated GTC event in Washington on Tuesday, Nvidia Chief Executive Officer Jensen Huang called out a number of private companies that his company’s taken stakes in by name, including the AI firm Perplexity, the Chinese autonomous vehicle company WeRide and the robotics startup Figure AI. He shouted out to several of their executives sitting in the audience.

“I’m delighted that AI startups build on Nvidia,” Chief Executive Officer Jensen Huang said during his keynote speech at the GTC conference on Tuesday. “They do so for several reasons. One: Of course, our ecosystem is rich. Our tools work great.”

This year the chipmaker has backed 59 AI startups as of mid-October, and at least 10 in just the last two months, according to PitchBook data. That’s already more than the 55 investments that Nvidia made in all of 2024, and a significant leap from the 12 it made in 2022. And it has plenty of capital to keep the bets coming: On Wednesday, Nvidia became the world’s first company to achieve a $5 trillion market capitalization, surpassing the economies of entire countries.

The strategy, according to Huang, is to support the broader AI ecosystem. So far, Nvidia has been the largest recipient of the massive surge in spending on AI infrastructure. For that to continue, analysts say, it needs AI adoption to take off in the broader economy, buoyed by a slew of new uses pioneered by startups. “Many of these start-ups are now starting to create even more ways to enjoy our GPUs,” Huang said, referring to the chips central to AI capabilities. By becoming a supporter of AI upstarts, Nvidia is following a standard pattern for corporate venture arms — but doing it at a faster rate with much higher stakes.

“Clearly for Nvidia, as this stuff gets built out, they want it built out on their technology,” Bernstein analyst Stacy Rasgon said. “Once you get entrenched, it’s much more difficult for competitors to come in and take it away.”

Huang has also stressed that he doesn’t believe that the AI industry is in a bubble, as his company piles more resources into the sector. “Nvidia’s just making a bet that this will turn profitable, as many others are,” Rasgon said.

In addition to its big bet on OpenAI, Nvidia has backed a diverse range of AI companies large and small. Those include Reflection AI, which builds autonomous coding agents, Reka AI, which makes models that analyze videos, and Perplexity AI, an AI-powered search engine that aims to unseat Google.

The investments can be helpful for startups both because of the capital as well as access to Nvidia’s leadership and coveted computing resources. In a meeting with Nvidia executives, Perplexity Chief Executive Officer Aravind Srinivas asked for technical resources to help a product demo run more smoothly, he told Bloomberg last year. Huang instructed someone to grant the request, and Perplexity had what it needed within a half hour, Srinivas said.

“I’ve made requests of this nature of other CEOs, and usually it’s routed through the next director or VP, and then they take another meeting to understand your use case better,” Srinivas said. “With Jensen — boom, boom, it’s done.”

Some of the startups’ cash will go toward buying Nvidia’s advanced chips, which are essential for training cutting-edge AI models. Each chip retails for tens of thousands of dollars, and while companies have different computing needs, most aim to stock up on thousands of processors. Nvidia does not require its funding to go toward buying its products, but they’re often one of a startup’s top expenses.

Reka, for example, secured $110 million in a funding round this year backed by Nvidia. Some of that money will go toward paying for processing power, said CEO Dani Yogatama. The company is also part of Nvidia’s Inception program, which guides AI startups through Nvidia’s platform and promises close cooperation with the chipmaker. Yogatama said that access to Nvidia’s engineers and distribution network was a game-changer as Reka looks to expand its customer base and develop its product.

“A company like Nvidia has a lot of visibility all over the world, and it can help distribute our technology,” Yogatama said. “A small company like ours, we can make the best technology, but if no one uses it, it won’t be helpful.”

Nvidia has found itself in a unique position: dominating the advanced chip market has helped expand the business, and soaring sales have led to a lot of free cash flow. “Nvidia is going to have more cash than it knows what to do with,” Morningstar analyst Brian Colello said.

The company “is also likely not in a position where a lot of its deals will be approved by the FTC,” Colello said, referring to the US Federal Trade Commission. “So I tend to think that smaller deals make more sense for the business at this point.”

Betting on startups could also eventually help the company diversify its customer base, which is disproportionately made up of the biggest tech companies.

Nvidia has five customers that make up nearly 50% of its revenue: the four major hyperscalers — Microsoft Corp., Meta Platforms Inc., Amazon.com Inc. and Alphabet Inc. — who fill their data centers with Nvidia’s chips; and Super Micro Computer Inc., which fills its server racks with Nvidia’s chips before they’re placed in data centers. Nvidia can also count OpenAI as one of its biggest customers, although the company is still unprofitable, despite its promises to spend trillions on AI infrastructure.

At the same time, many large companies are working to lessen their reliance on Nvidia’s chips. OpenAI inked a partnership on Oct. 6 with Nvidia rival Advanced Micro Devices Inc., and plans to deploy tens of billions of dollars’ worth of its chips. The following week, OpenAI also agreed to buy custom chips from Broadcom Inc. to power the ChatGPT-maker’s artificial intelligence services. Google has also developed its own chips with Broadcom, allowing the Gemini maker to cut costs.

Long term, Nvidia’s bets on AI companies signal an optimism about the future of the industry, despite some analysts’ concerns about the circular nature of the AI ecosystem. The recent wave of deals and partnerships involving Nvidia and a small handful other key AI players have escalated fears that an increasingly complex and interconnected web of business transactions is artificially propping up the trillion-dollar AI boom.

But Huang has said he thinks the industry is still poised for huge growth. “We’ve made some really terrific investments,” the CEO said on CNBC this month. “Largely, my only regret is that we didn’t invest more.”

–With assistance from Joshua Brustein and Ian King.

(Adds detail from Nvidia’s event in Washington starting in second paragraph)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.