Robust tech, health care and infrastructure sectors boosted revenue for firms participating in ENR East’s Top Contractors list.

The inaugural ranking of the largest regional firms reflects ENR’s consolidation of its multiple U.S. regions into five new ones: East, Midwest, Mountain States & Southwest, Southeast & Texas and West.

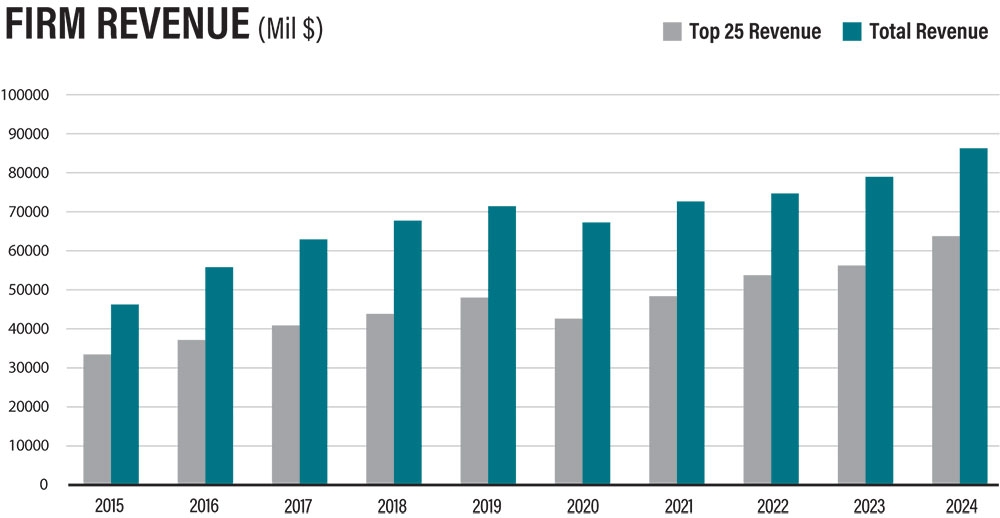

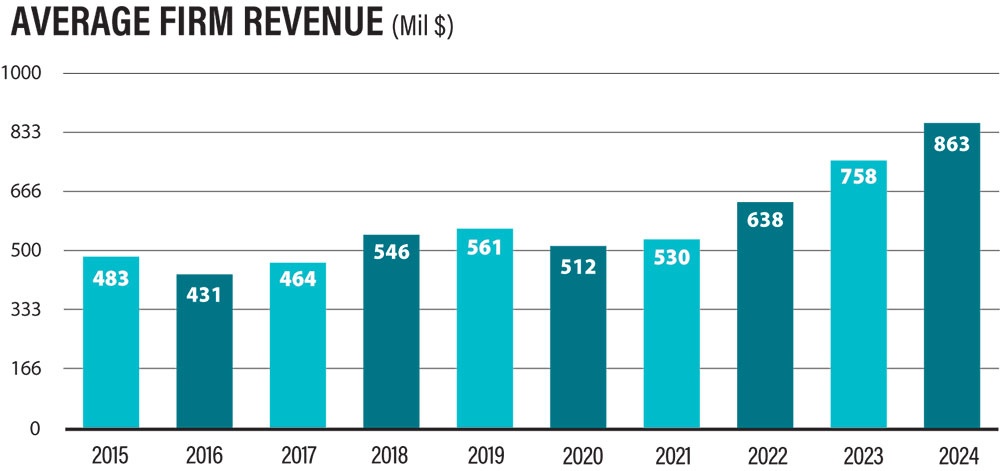

Listed on the ENR East ranking are 100 firms reporting a combined $86.37 billion in 2024 revenue from work in Connecticut, Delaware, District of Columbia, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, Vermont, Virginia and West Virginia. The top 10 firms alone accounted for $46.4 billion in work, with Whiting-Turner Contracting Co. leading the way with $5.98 billion in revenue, followed by Turner Construction with $5.75 billion. HITT Contracting rounded out the top three at $5.17 billion.

Breakout listings include contractors ranked by state revenue and various sectors as well as rankings for the MidAtlantic, New York-New Jersey and New England regions that now make up ENR East. The top 15 MidAtlantic firms reported $27.23 billion in regional revenue, up 15.38% from last year’s top 15 total of $23.60 billion. The top 15 firms from New York-New Jersey reported $22.58 billion in total 2024 revenue, up 7.93% from the previous year’s $20.92 billion. New England’s Top 15 posted $13.85 billion, up slightly from $13.71 billion.

Headwinds

Executives at some ranked firms say advanced technology that is driving regional revenue—along with mission-critical facilities, affordable housing, adaptive reuse and clean energy work—is still shaded by economic and policy uncertainties.

Jason Bell, senior vice president of Holder Construction Co.—whose firm ranks No. 13 with $2.05 billion in revenue—says AI, machine learning and massive capital investment are powering hyperscale data center growth on a scale even bigger than in the early 2000s. “Back then, the shift was from kilowatts to megawatts; today, we’re moving from megawatts to gigawatt-scale campuses,” he says.

But commercial office development continues to struggle amid persistent vacancy and hybrid work trends, others note—“even in places like D.C. where there’s a need for trophy buildings,” says Camilo Garcia, regional DPR Construction leader, which ranks No. 11 with $2.14 billion in revenue. The once hot life sciences sector has also cooled, he adds. Speculative lab space development has slowed significantly in Cambridge, Mass., and in suburban Maryland, Garcia says, noting that investment is pivoting to targeted retrofits and build-outs by established pharmaceutical players.

No. 11-ranked DPR Construction is building BeOne Medicine’s 42-acre manufacturing and research campus in Hopewell, N.J.

Photo by Jeffrey Totaro, courtesy DPR Construction

Dave Margolius, executive vice president of Shawmut Design and Construction’s New York metro region, adds that life sciences work shifted “toward targeted renovations and repositioning versus large-scale core-and-shell speculative projects.”

The executive, whose firm ranks No. 15 with $1.43 billion in revenue, says higher education, which already has faced demographic shift “headwinds” now contends with “potential endowment tax hikes, federal grant funding changes and a pullback in international student applications.”

“The full impact of these tariffs has yet to materialize, but the market is bracing for ripple effects across procurement and planning.”

—Camilo Garcia, Regional Leader, DPR Construction

Garcia says most of the sector’s investments are “focused on targeted renovations or specialized research facilities.”

Health care remains another core sector for contractors, although National Institutes of Health-funded work slowed when the agency’s federal funding was slashed. Garcia sees sustained investment in ambulatory care, behavioral health clinics and specialty facilities, while renovation projects are still helping health systems optimize operations.

Meanwhile, housing is gaining momentum in the region as cities seek long-term affordability, which “remains one of New York City’s most pressing challenges,” says Margolius. He notes that the city’s zoning reform initiative, City of Yes, and growing support for office-to-residential conversions are enabling development.

Similar housing pressures are felt in Boston, where modular construction is gaining traction to accelerate delivery, according to Margolius. Shawmut also sees the hotel sector rebounding as the New York City tourism recovery fuels capital upgrades for pandemic-delayed renovations. “The sector’s performance will continue to hinge on global travel trends and potential policy shifts and travel bans,” he says.

Boston University’s Warren Towers, the second-largest nonmilitary dormitory in the country, is a signature project for Shawmut Design and Construction, which ranks No. 15 on the Top Contractors list.

Photo courtesy of Shawmut Design & Construction

DPR expects segmented growth in the next 12 to 24 months as supply chain volatility and tariffs force owners to be more selective about where and how to build. “The full impact of these tariffs has yet to materialize, but the market is bracing for ripple effects across procurement and planning,” Garcia says. “Overall, owners are expected to remain cautious yet engaged.”