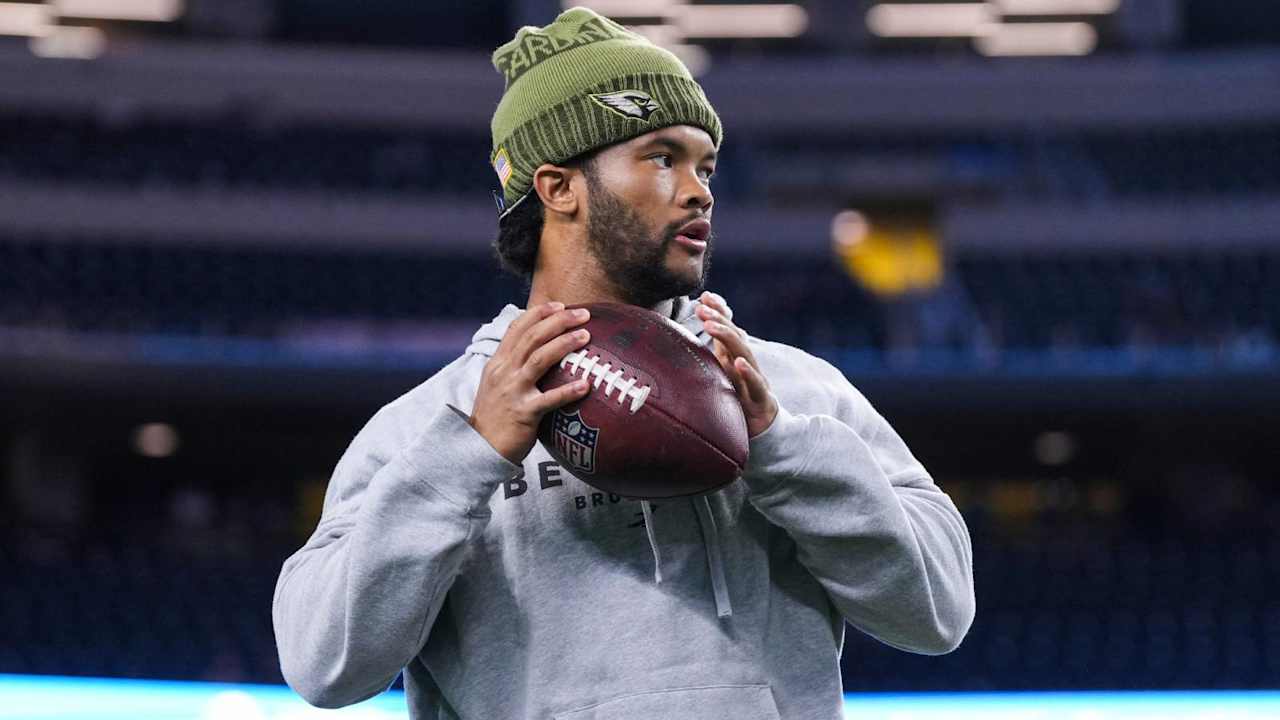

As for the offseason, it’s an open question about whether Murray returns. The former No. 1 overall pick signed a five-year, $230.5 million contract in July of 2022, locking him in with Arizona for the long-term. Through this season, he’ll have earned $140.5 million of it, with another $36.835 million fully guaranteed for 2026.

If they cut him, they’ll be on the hook for all of it. Additionally, there is a deadline because if he’s on the roster on the fifth day of the league year this March, $19.5 million in 2027 becomes fully guaranteed (a year early, essentially).

Said simply, the Cardinals must cut him before March to not be on the hook for any of his 2027 salary. A release triggers a $57.7 million cap hit that can be split up between 2026 and 2027, while a trade triggers a manageable $17.9 million dead cap hit but saves $35.3 million.

And a trade would no doubt be better for the Cardinals, escaping some money but also meaning they’d have to find another starter. That said, a trade would take coordination between three parties (Arizona, Murray and an interested team), an agreement that the Cardinals would take on some or all the money and then a mutually agreed upon trade partner. It’s possible. But it has proven in the past to be a challenge with so many moving parts.

From Murray’s side, being released ahead of the 2026 league year — if he’s not going to be a member of the Cardinals — is preferable because his deal will be offset, similar to Russell Wilson‘s recent situation with the Steelers. He’ll be able to sign with a team at the minimum, making Murray an incredible value for a playoff-ready team without a QB.

With a variety of factors up in the air, Murray’s future will be a huge topic of discussion this offseason.