(TNND) — Amid falling consumer sentiment and widespread affordability concerns, a new Bank of America Institute analysis found that nearly one in four households is living paycheck to paycheck.

The good news is that the increase in those living paycheck to paycheck is slowing.

But the data showed lower-income folks are falling further behind.

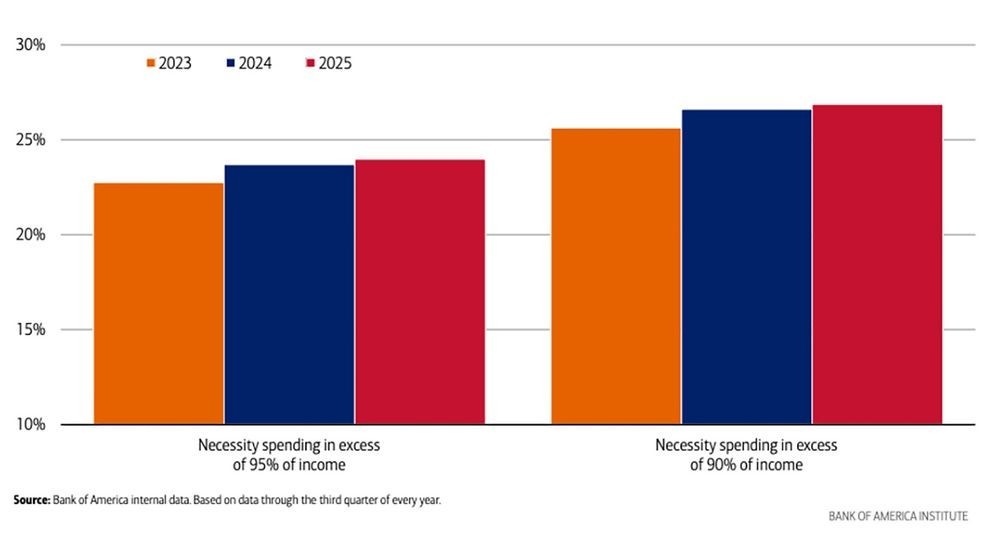

Around 24% of households are now living paycheck to paycheck, up from about 23% two years ago.

Bank of America Institute economist Joe Wadford said the pace of growth is down nearly threefold from a year ago.

And that’s because from 2023 to 2024, you saw an increase in the number of households living paycheck to paycheck across the income spectrum. But in the past year, you’ve only seen an increase in the number of lower-income households living paycheck to paycheck, whereas there’s been almost no increase in the share of middle- or higher-income households living paycheck to paycheck,” Wadford said. “And it’s because those lower-income households just can’t keep up with the cost of living increases due to their slow wage growth.”

This graph shows the share of Americans living paycheck to paycheck. (Bank of America Institute)

After-tax wage growth for lower-income families is just 1%, according to an analysis of Bank of America deposit data.

Wage growth has been 2% for middle-income people and 3.7% for higher-income households.

Meanwhile, the annual rate of inflation, as measured by the consumer price index, is 3%.

Food prices are up 3.1%.

Energy prices are up 2.8%.

Wadford said the gap between high- and low-income families is growing.

It’s been nearly 10 years since we’ve seen the salaries for higher income households growing this fast relative to the wages for lower income families,” he said.

Photo by Spencer Platt/Getty Images, file

And low-income folks who already cut it close to the bone are forced to make hard financial decisions.

“How much further can you cut down? But then when your wages are only increasing by 1% and the cost of living is increasing by 3%, what are you going to do?” Wadford said. “And the answer is that some of those households are just going to really struggle to keep up.”

Bankrate analyst Sarah Foster said the data in the Bank of America Institute report shows the “K-shaped” economy in action.

The line goes up for high-income households that are doing well in the economy. Their pay is keeping pace with inflation, while home equity and stock investments bolster their personal finances.

The line goes down for lower-income people, disproportionately hurt by inflation.

She said Bankrate surveys found higher-income earners (34%) were more likely to say their pay kept pace with inflation than those making less than $100,000 (26%).

FILE – People shop at a Target store on April 2, 2025, in New York City. (Photo by Michael M. Santiago/Getty Images)

Both Wadford and Foster said a stagnant jobs market suppresses wage growth.

As the companies have really entered this low-hire, no-fire environment, it’s been those entry-level positions that are getting cut the most,” Foster said. “It’s been really hard for younger Americans to break in, to grow their income, to kind of start that career ladder.”

And that’s left job seekers stuck, which saps leverage to negotiate for higher pay.

Labor economist Aaron Sojourner previously told The National News Desk that employers are “like deer in the headlights,” frozen by uncertainty in the economic and policy environment.

And that’s limited job creation of late.

“It’s hard to find greener pastures in this type of a labor market,” Wadford said.

The Bank of America Institute defined living paycheck to paycheck as those who spend more than 95% of their income on necessities, leaving very little for discretionary spending or savings.

“It’s always a top-heavy economy,” Wadford said.

Higher-income households are always spending significantly more than their share of the population, he said.

“But it’s becoming, the growth is becoming, consistently more dependent on higher-income households, if you will,” Wadford said.