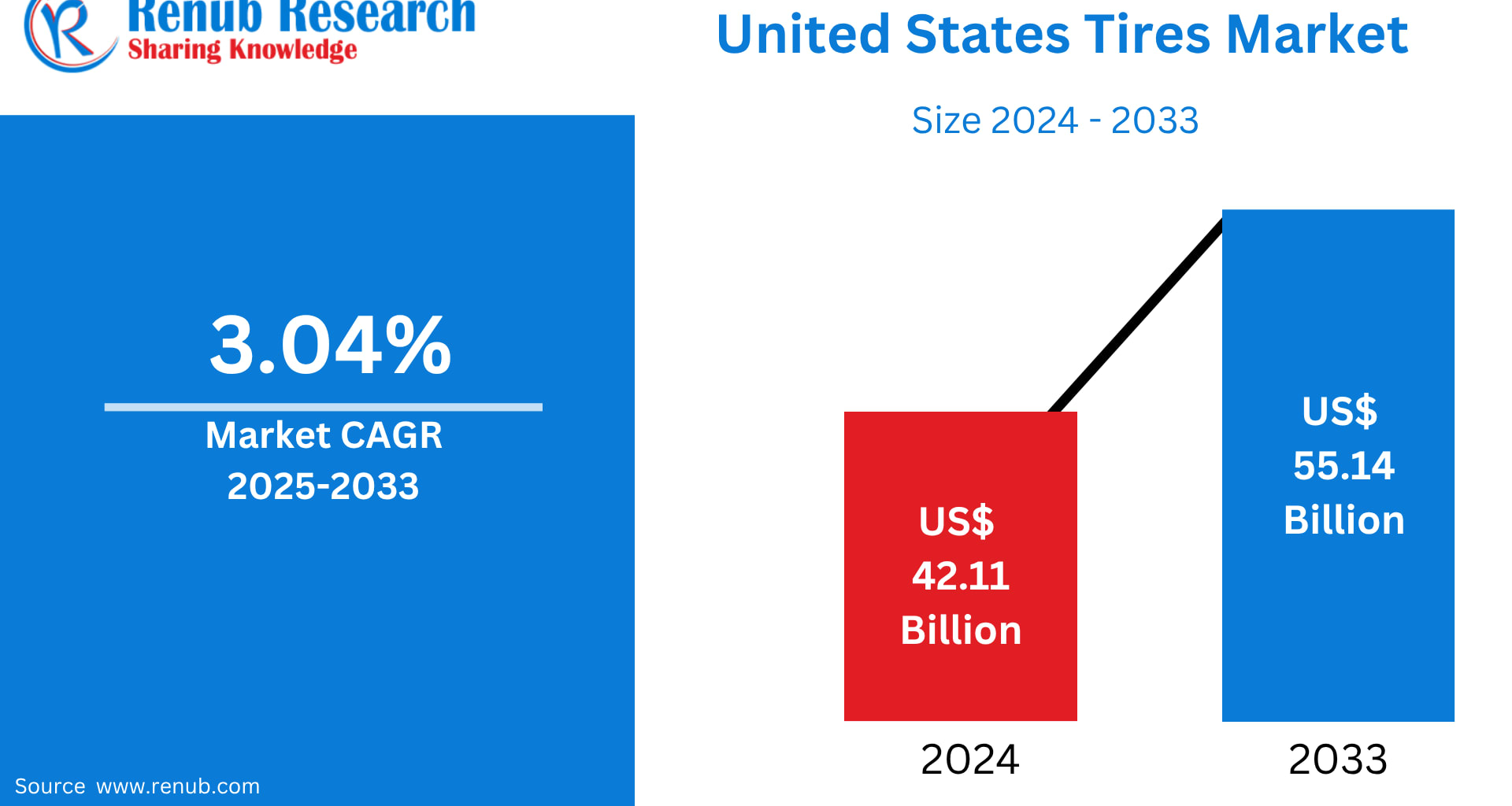

The United States Tire Market is entering a decade of steady expansion, shaped by rising vehicle ownership, electrification, aftermarket momentum, and technological innovation. According to Renub Research, the U.S. tire industry is projected to grow extensively—from US$ 42.11 billion in 2024 to US$ 55.14 billion by 2033, registering a CAGR of 3.04% between 2025 and 2033. This growth reflects not only the country’s dominant automotive ecosystem, but also shifting consumer priorities toward safety, fuel efficiency, and sustainability.

As tires remain one of the most essential vehicle components—responsible for traction, stability, and on-road control—the market’s evolution highlights how mobility trends, environmental pressures, and technological innovation will redefine one of the automotive sector’s most indispensable product categories.

✅ Understanding the U.S. Tire Market Landscape

Tires are more than rubber rings on wheels—they are engineered systems designed to deliver comfort, control, and safety across varied terrains and climates. From all-season models to winter, off-road, and performance tires, each category caters to specific driving needs.

The U.S., with one of the world’s largest vehicle populations, relies heavily on tires for both its personal mobility and commercial logistics ecosystem. Passenger cars, SUVs, pickup trucks, commercial fleets, and electric vehicles all contribute to steady, recurring tire consumption. The increased emphasis on fuel economy and environmental responsibility has led to broader interest in low-rolling-resistance and eco-friendly tire technologies.

In short, tires are no longer a routine necessity—they’re becoming a strategic purchase shaped by performance, sustainability, and digital innovation.

✅ Key Growth Drivers in the United States Tire Market

1. Expanding Automotive Sector & Rising Vehicle Ownership

The U.S. automotive sector remains a powerful engine for tire demand. Higher sales of passenger, commercial, and electric vehicles directly translate to increased tire consumption—both original equipment (OE) and replacement. Growing disposable incomes, suburban expansion, and a thriving logistics ecosystem tied to e-commerce are all boosting mobility requirements.

One critical insight is the aging U.S. vehicle fleet. The average age of vehicles on U.S. roads reached 12.8 years in 2025, according to S&P Global Mobility. With 289 million light vehicles currently in operation and scrappage rates remaining low, replacement cycles are intensifying. Older cars require more frequent tire changes, making this segment a reliable long-term demand generator.

Even with a rebound in new vehicle registrations, replacement tires—not OEM sales—remain the market’s backbone.

2. Electrification: The EV & Hybrid Transformation

Electric and hybrid vehicles are reshaping tire design and performance standards. EVs exert higher torque, carry heavier battery loads, and require low-noise, low-resistance tire solutions. This is spurring specialized innovation across materials, tread design, and durability.

According to IEA data, the United States recorded 1.6 million EV sales in 2024, making up over 10% of total vehicle sales. While growth slowed from earlier peaks, the market still expanded with 24 new EV models introduced in 2024, broadening consumer choice.

As automakers scale electrification, tire manufacturers are racing to develop:

Low rolling resistance tires for increased battery range

Durable compounds for higher EV torque

Noise-absorbing designs for quieter drives

Smart tires equipped with sensors and monitoring systems

Furthermore, government incentives and charging infrastructure expansion are expected to accelerate EV penetration—driving a premium, high-margin tire segment.

3. Replacement Tire Boom & Aftermarket Dominance

The U.S. tire market is fueled most significantly by replacements rather than OEM demand. Older cars, longer driving distances, diverse climates, and seasonal shifts make replacement cycles highly predictable.

What’s accelerating market growth further?

Increased used-vehicle ownership

Greater consumer awareness of tire safety and efficiency

Rise of online tire retailing

Expanding fleet-based logistics

In late 2024, AISIN CEO Scott Turpin emphasized a shift toward integrated aftermarket services and broader parts access—signaling deeper transformation in how replacement products reach consumers. From winter tires to off-road models, the aftermarket is becoming a convenience-driven, tech-enabled retail ecosystem.

⚠️ Challenges Confronting the U.S. Tire Market

1. Raw Material Price Volatility & Supply Constraints

Tire production is heavily dependent on natural rubber, synthetic rubber, and petroleum derivatives. Price fluctuations in these inputs can sharply impact margins. Global shipping disruptions, geopolitical conflicts, and pandemic-era logistic delays exposed vulnerabilities in supply chains.

Despite growing interest in domestic production and recycled materials, the U.S. tire industry still relies heavily on imported inputs—making volatility a persistent risk.

2. Environmental Regulations & Waste Management Pressures

The U.S. generates millions of end-of-life tires (ELT) annually, posing waste and pollution challenges. EPA regulations require strict compliance on emissions, chemical usage, and disposal practices. Non-compliance can lead to financial penalties and manufacturing disruptions.

Although recycling and retreading initiatives are gaining traction, illegal dumping and landfill burdens persist. The push toward a circular economy—through pyrolysis, rubber reprocessing, and sustainable material sourcing—will define the industry’s next phase. Striking the balance between eco-friendly production and cost efficiency remains a core challenge.

✅ Segmental Insights

1. Radial Tires Lead the Market

Radial tires dominate due to:

Longer tread life

Better fuel efficiency

Higher comfort and traction

Increased compatibility with EVs and SUVs

Technologies such as silica-based compounds, smart sensors, and advanced tread engineering are further enhancing radial performance, securing their status as the industry standard.

2. OEM Tires: Linked to Automaker Production Trends

OEM tire demand fluctuates with vehicle manufacturing volumes. As automakers introduce new EV and luxury models, partnerships with tire brands are becoming more specialized. Custom, high-performance tires for efficiency, handling, and safety are gaining prominence.

However, OEM sales remain secondary to the replacement market and remain sensitive to production cycles.

3. Passenger Car Tires: The Market’s Largest Segment

Passenger vehicles—including sedans, SUVs, and electric cars—account for the largest share of tire use. Daily commuting, regional weather changes, and increasing urban mobility are fueling recurring purchases. The popularity of SUVs and crossovers is also driving demand for all-season and all-terrain models.

Smart, connected tire technologies may soon enable real-time monitoring, predictive maintenance, and enhanced safety—transforming consumer expectations.

4. Three-Wheeler Tires: A Niche but Emerging Category

Though still small, three-wheeler tire demand is rising in:

Last-mile delivery

Micro-mobility

Recreational and cargo applications

The rise of electric trikes and lightweight commercial vehicles could broaden this market segment in the coming years.

5. Offline Retail Remains Dominant

Despite rapid online growth, physical tire outlets still account for the majority of sales due to:

On-the-spot installation

Alignment and balancing services

Expert consultation

Fleet servicing contracts

Digital tools, appointment scheduling, and inventory tracking are enhancing the offline experience rather than replacing it.

✅ Top State Markets Driving U.S. Tire Growth

California

Home to the largest EV population, California is a hub for fuel-efficient and sustainable tire technologies. Its diverse terrains and sustainability mandates make it a cornerstone of innovation and aftermarket expansion.

New York

Urban density, seasonal weather changes, and high commercial fleet usage fuel steady tire replacement cycles across both premium and budget segments.

Washington

With strong clean-energy policies, wet-weather driving patterns, and expanding logistics corridors, Washington is becoming a balanced and fast-growing market for both consumer and commercial tires.

✅ Market Segmentation Snapshot

By Design:

Radial

Bias

By End Use:

OEM

Replacement

By Vehicle Type:

Passenger Cars

Light Commercial Vehicles

Medium & Heavy Commercial Vehicles

Two-Wheelers

Three-Wheelers

Off-The-Road (OTR)

By Distribution Channel:

Offline

Online

Top States Covered:

California, Texas, New York, Florida, Illinois, Pennsylvania, Ohio, Georgia, New Jersey, Washington, and more through the Rest of the United States.

✅ Key Companies Covered

Apollo Tyres Ltd.

Bridgestone Corporation

Continental AG

Hankook Tire & Technology Co., Ltd.

MRF Tyres

Sumitomo Rubber Industries, Ltd.

The Goodyear Tire & Rubber Company

The Michelin Group

Toyo Tire Corporation

Yokohama Tire Corporation

Each company can be evaluated based on:

Overview

Key Personnel

Recent Developments

SWOT Analysis

Revenue Performance

⭐ Final Thoughts

As the U.S. tire market accelerates toward 2033, its future will be shaped by three defining forces:

✅ Electrification and mobility innovation

✅ Replacement-driven aftermarket growth

✅ Sustainability and circular economy adoption

With a projected rise to US$ 55.14 billion by 2033, the market is poised for steady, technology-driven expansion. From smart tires and EV-specific designs to recycling breakthroughs and digital retailing, the next decade promises a transformation that will take the tire industry well beyond rubber and tread.

In a world where mobility is evolving, the humble tire is becoming a high-tech catalyst for safer, cleaner, and more efficient transportation.