SUMMARY

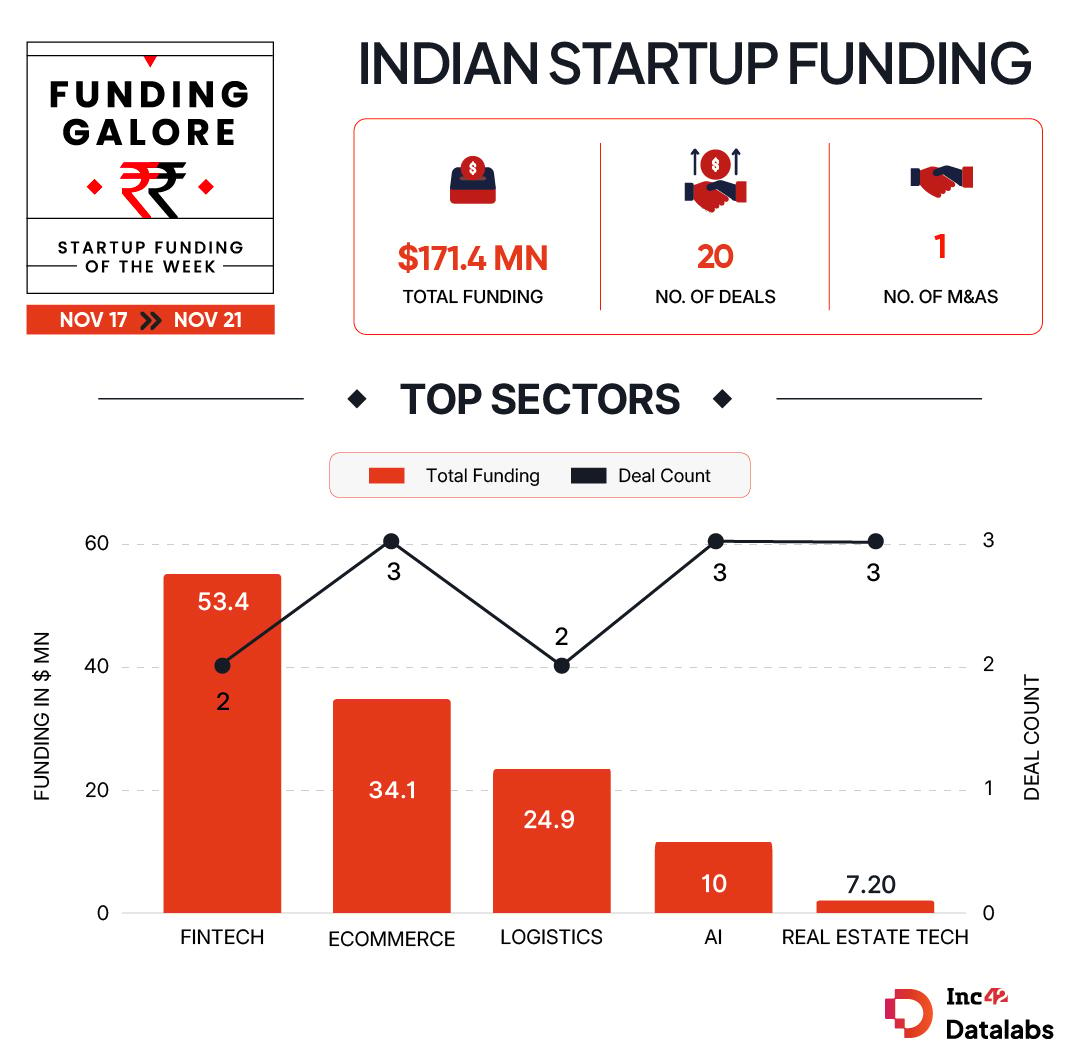

Between November 17 and November 21, twenty startups cumulatively raised $171.4 Mn, marking an over 5% uptick from the $162.9 Mn bagged by 22 startups in the previous week

Inflection Point Ventures and Titan Capital were the most active investors this week, backing two startups apiece

Seed funding continued to remain strong this week, with nine startups at this stage raising $24 Mn

After a three weeks of consecutive decline in fresh capital infusion in the Indian startup ecosystem, startup funding showed some signs of revival in the third week of November.

Between November 17 and November 21, twenty startups cumulatively raised $171.4 Mn, marking an over 5% uptick from the $162.9 Mn bagged by 22 startups in the previous week.

Funding Galore: Indian Startup Funding Of The Week [ Nov 17 – 21 ]

Date

Name

Sector

Subsector

Business Model

Funding Round Size

Funding Round Type

Investors

Lead Investor

21 Nov 2025

Yubi

Fintech

Lending Tech

B2B

$46.4 Mn*

–

EvolutionX Debt Capital, Gaurav Kumar (Yubi)

–

20 Nov 2025

AgroStar

Agritech

Farmtech/Agri & Farm Inputs

B2B

$30 Mn

–

Just Climate

Just Climate

19 Nov 2025

Tractor Junction

Ecommerce

Vertical Marketplace

B2B, B2C

$22.5 Mn*

Series A

Astanor, Info Edge Ventures, Omnivore

Astanor

19 Nov 2025

Pidge

Logistics

Logistics SaaS

B2B

$13.6 Mn

Series A

La Vida es Chula (LVEC).

La Vida es Chula (LVEC).

20 Nov 2025

Agraga

Logistics

Shipping & Delivery

B2B

$11.3 Mn

Pre-Series B

Bajaj Finserv Group, IvyCap Ventures

Bajaj Finserv Group

20 Nov 2025

Ultrahuman

Ecommerce

D2C

B2C

$11.2 Mn

Debt

Alteria Capital

Alteria Capital

20 Nov 2025

Pibit.AI

Fintech

Insurtech

B2B

$7 Mn

Series A

Stellaris Venture Partners, Y Combinator, Arali Ventures

Stellaris Venture Partners

19 Nov 2025

Synthio Labs

AI

Application Layer

B2B

$5 Mn

Seed

Elevation Capital, Peak XV Partners, Y Combinator

Elevation Capital

20 Nov 2025

Kaaj

AI

Application Layer

B2B

$3.8 Mn

Seed

Kindred Ventures, Better Tomorrow Ventures, Karman Ventures, Pythia Ventures and Coughdrop Capital.

Kindred Ventures

18 Nov 2025

Axirium Aerospace

Advanced Hardware & Technology

Aerial Vehicles

B2B

$3.5 Mn

Seed

Shastra VC, BEENEXT, Ashish Gupta (Helion Advisors), PVS Raju (AIG Hospitals)

Shastra VC, BEENEXT

19 Nov 2025

Stylework

Real Estate Tech

Property Listing & Discovery

B2B, B2C

$3.4 Mn

Pre-Series B

Equentis Angel Fund, Karekeba Ventures, Cogniphy AIF Fund, LetsVenture Fund, MoneyVyapaar

Equentis Angel Fund

17 Nov 2025

Tribe Stays

Real Estate Tech

Property Listing & Discovery

B2C

$2.8 Mn

Seed

Artha Venture Fund, Riverwalk Holdings, Kunal Khanna (Vivaldis)

Artha Venture Fund, Riverwalk Holdings

20 Nov 2025

CtrlB

Enterprise Tech

Horizontal SaaS

B2B

$2.5 Mn

Seed

Chiratae Ventures, Equirus, InnovateX Fund, Campus Fund, Point One Capital

Chiratae Ventures

19 Nov 2025

STAN

Media & Entertainment

Gaming

B2C

$2 Mn**

Series A

Sony Innovation Fund, Hyderabad Angels Fund

–

21 Nov 2025

Sophrosyne Technologies

Advanced Hardware & Technology

Semiconductors

B2B

$2 Mn

Seed

Bluehill Capital

Bluehill Capital

20 Nov 2025

Thimblerr

Enterprise Services

Manufacturing Solutions

B2B

$1.4 Mn

–

Inflection Point Ventures, 3one4 Capital, Mount Judi Ventures, Venture Catalysts, We Founder Circle

Inflection Point Ventures

18 Nov 2025

Pype AI

AI

Application Layer

B2B

$1.2 Mn

Pre-Seed

Kalaari Capital, Wyser Capital, Tenity

Kalaari Capital

19 Nov 2025

HomeRun

Real Estate Tech

Construction

B2C, B2B

$1 Mn

Seed

Titan Capital, Sparrow Capital, Consumer Collective by Atrium, Anupam Mittal (Shaadi.com), Abhishek Goyal (Tracxn), Suraj Nalin (PlaySimple), Raj Sheth (Inuka Capital), Gautam Shewakramani (Inuka Capital)

Titan Capital, Sparrow Capital

18 Nov 2025

Hoopr

Media & Entertainment

OTT

B2C

$451K

Pre-Series A

Inflection Point Ventures

Inflection Point Ventures

18 Nov 2025

Circle

Ecommerce

Horizontal Marketplace

B2C

$383K

Pre-Seed

Titan Capital, Raveen Sastry (Myntra)

Titan Capital

Source: Inc42

* A combination of debt and equity investment

** Part of a larger round

Note: Only disclosed funding rounds have been included

Key Startup Funding Highlights Of The Week

Fintech segment continued to be the investor favourite segment this week with two startups — Yubi and Pibit.AI — raising the highest $53.4 Mn.

Ecommerce trailed fintech in terms of fresh capital infusion, with three startups raising $34.1 Mn this week. A similar number of deals materialised in AI and real estate tech segments as well.

Inflection Point Ventures (IPV) and Titan Capital were the most active investors this week, backing two startups apiece.

Seed funding continued to remain strong this week, with nine startups at this stage raising $24 Mn. Funding at this stage doubled week-on-week.

Startup IPO Updates This Week

After closing its IPO with a robust 52.95X oversubscription, SaaS major Capillary Technologies made a muted debut on the bourses on Friday. While the company’s shares listed at a 3% discount on the BSE from its IPO price, they ended the first trading session up 8.38% at INR 606.9.

After closing its IPO with an oversubscription of 1.8X last week, PhysicsWallah made a stellar debut on the bourses on Tuesday. The stock got listed at INR 143.10 on the BSE, a premium of 31.39% to the issue price of INR 109.

Snapdeal’s parent entity AceVector Group secured SEBI’s approval to go ahead with its INR 500 Cr initial public offering (IPO). The company had pre-filed its DRHP in July.

Ecommerce major Meesho is targeting a listing in the month of December at a valuation of over $6 Bn for its IPO.

Other Developments Of The Week

Venture debt firms BlackSoil Capital and Caspian Debt formally completed their merger to create an INR 1,900 Cr venture debt NBFC.

SIDBI Venture Capital announced the first close of the government’s spacetech focussed VC fund, Antariksh Venture Capital Fund (AVCF), at INR 1,005 Cr. The fund has a total corpus of INR 1,600 Cr, along with an investment of INR 1,000 Cr investment from state-backed IN–SPACe.

At Bengaluru Tech Summit 2025, Karnataka government secured investment commitments to the tune of INR 2,600 Cr from companies including the Drone Federation of India, Global HDI, Tsuyo Manufacturing, among others.

SaaS unicorn Icertis acquired AI-led legal tech platform Dioptra for an undisclosed amount.

]]>