Credit card giant Mastercard (MA) is forecasting that U.S. retail spending will grow 3.6% this holiday season as consumers hunt for bargains and make lifestyle-driven purchases.

TipRanks Black Friday Sale

The forecast from Mastercard runs from November 1 to December 24, the day before Christmas. The company foresees stronger growth in e-commerce spending, which it projects will rise 7.9% year-over-year, while in-store sales are likely to grow 2.3% from 2024 levels.

Mastercard adds that it expects value to dominate consumers’ shopping behavior this holiday season as people “trade down” to cheaper products, shift spending more towards experiences, and seek out promotions. Gift cards, which help buyers to fix their budgets, are expected to be more popular this season as well.

Inflation to Play a Role

Mastercard warns that inflation is likely to play a role in consumer shopping this November and December, reflecting tariff-related price increases on popular items such as clothing, toys, and beauty products.

While some U.S. retailers have said they will partially absorb those cost increases to remain competitive on price, other outlets will offer fewer deals than in previous Thanksgiving and Christmas sales periods. In the end, Mastercard expects American consumers to remain resilient, saying that steady wage growth and stock market gains throughout the year will help to support overall spending.

Is MA Stock a Buy?

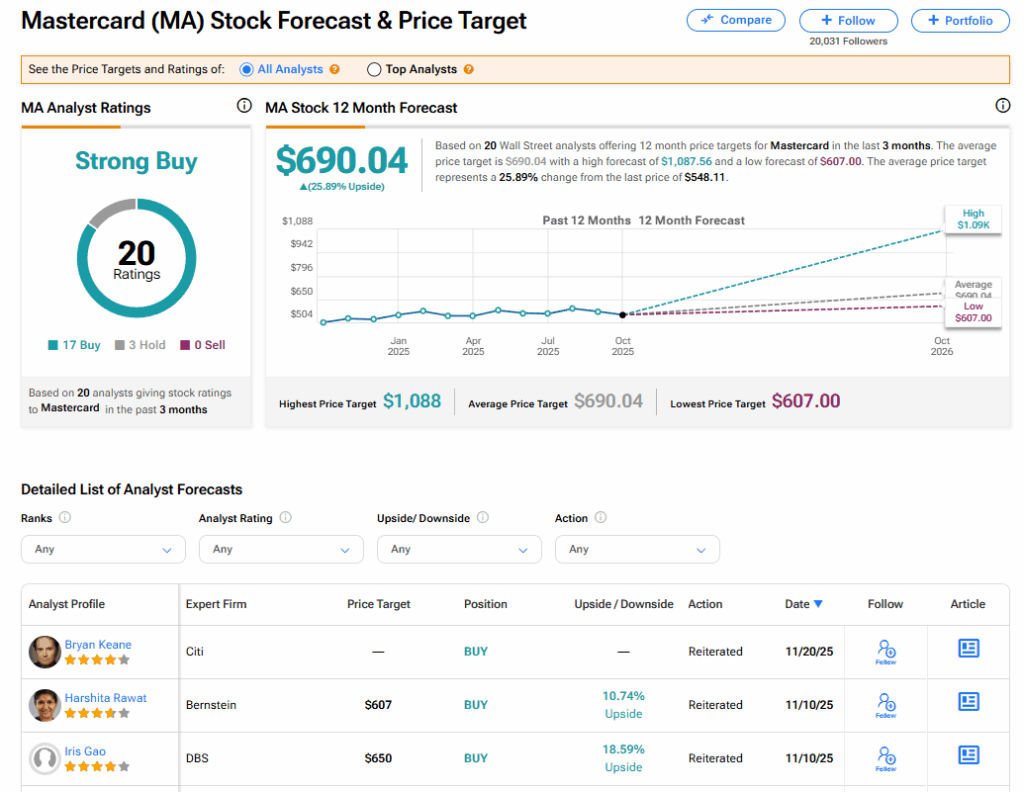

The stock of Mastercard has a consensus Strong Buy rating among 20 Wall Street analysts. That rating is based on 17 Buy and three Hold recommendations issued in the last three months. The average MA price target of $690.04 implies 25.89% upside from current levels.