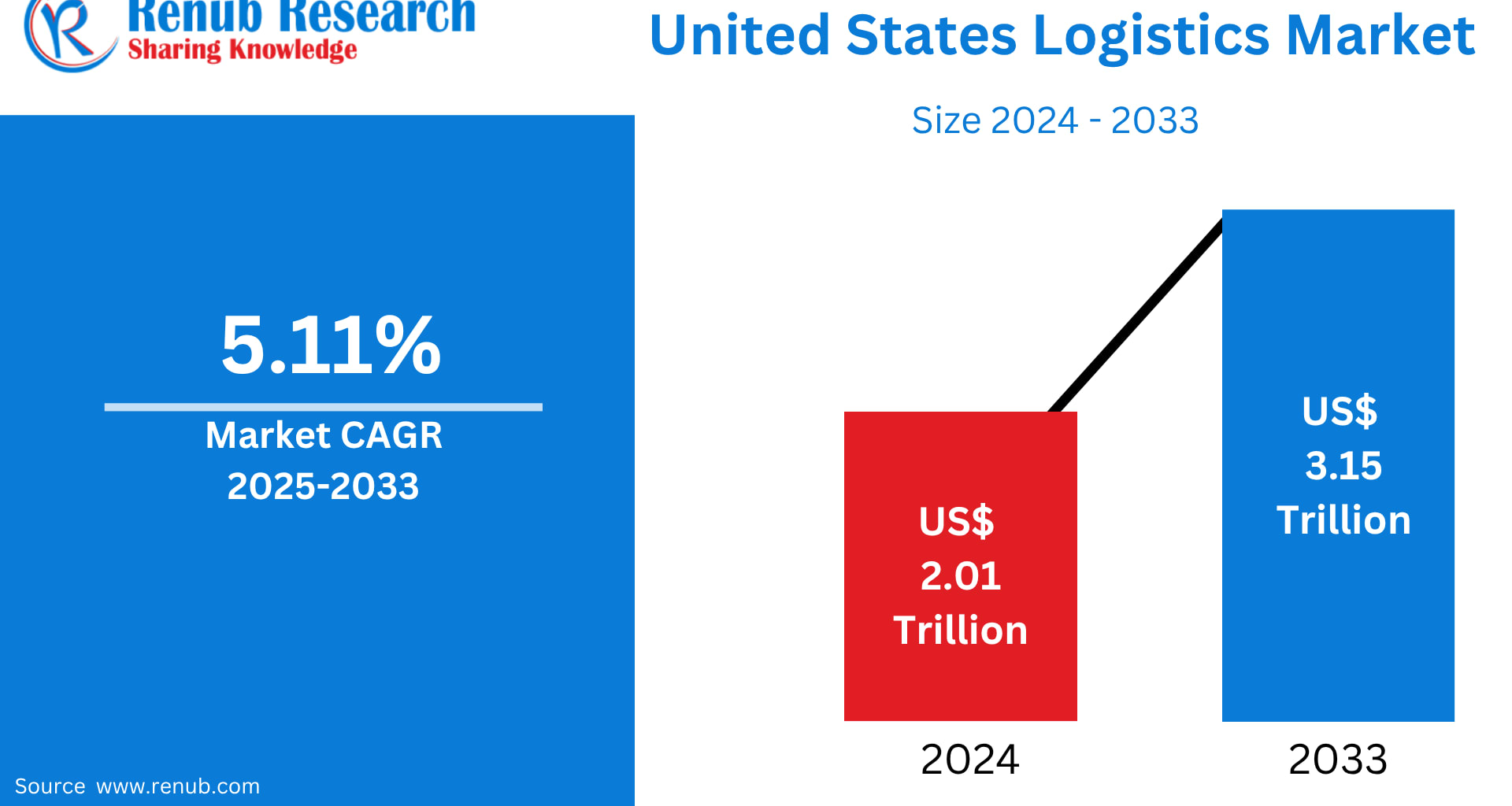

The United States Logistics Market is entering a transformative decade—one defined by rapid digitalization, the boom in e-commerce, and massive shifts in how businesses move products across the nation’s supply chain. According to Renub Research, the United States Logistics Market is expected to reach US$ 3.15 trillion by 2033, rising from US$ 2.01 trillion in 2024, expanding at a CAGR of 5.11% from 2025 to 2033. This surge reflects fundamental changes in consumer behavior, manufacturing strategies, and technological advancements that are reshaping logistics from the ground up.

From last-mile delivery innovations to AI-powered predictive maintenance, the U.S. logistics ecosystem is evolving into a more connected, efficient, and automated marketplace. Meanwhile, infrastructure investments, expanding 3PL services, and advancements in inventory management and warehousing continue to power the sector’s momentum.

United States Logistics Industry Overview

At its core, logistics is the strategic planning, execution, and coordination of the movement of goods, services, and information across the supply chain. It includes transportation, warehousing, inventory control, packaging, order fulfillment, and distribution—each critical for ensuring timely delivery and customer satisfaction.

In today’s landscape, the logistics industry has become deeply intertwined with emerging technologies. Automated warehouses, GPS tracking systems, robotics, AI-powered route optimization, and data analytics have become essential tools for achieving operational visibility and cost-efficiency. This integration is vital as supply chains become increasingly complex, global, and interconnected.

In the United States, logistics has grown into one of the country’s most significant economic engines, supporting industries such as manufacturing, e-commerce, retail, healthcare, construction, and agriculture. With the rise of online retail and demand for faster delivery, logistics networks have had to expand capacity, reconfigure transportation routes, and adopt smarter systems to stay competitive.

E-commerce giants like Amazon, Walmart, and Shopify have played a significant role in reshaping the entire supply chain ecosystem. Today’s consumers want same-day or next-day deliveries—and the logistics sector must deliver on these expectations every single day.

Key Growth Drivers for the United States Logistics Market

1. E-Commerce Expansion

The explosive growth of e-commerce remains the single most influential driver of logistics market expansion. Online retail has fundamentally changed consumer behavior—speed, accuracy, and convenience have become the norm.

This shift has created unprecedented demand for:

Urban and suburban fulfillment centers

Last-mile delivery fleets

Micro-warehouses

Reverse logistics for returns

Automated sorting and packaging systems

Seasonal surges—particularly during the holiday shopping season—place additional pressure on logistics networks, forcing companies to scale operations quickly. Reverse logistics has also grown significantly, as the volume of returns continues to rise with online shopping.

To meet these challenges, logistics companies increasingly rely on robotics, automated vehicle routing, intelligent inventory systems, and AI-enabled forecasting. As e-commerce continues expanding its footprint across the nation, its influence on logistics will only intensify.

2. Infrastructure Investments

Infrastructure remains the backbone of logistics efficiency. The United States is currently undergoing major improvements in ports, airports, highways, and rail systems—developments that are critical for reducing bottlenecks and enhancing supply chain connectivity.

Key enablers include:

Smart warehouses equipped with automation and IoT systems

Port expansions to reduce congestion

Upgraded rail networks to support intermodal operations

Enhanced airport cargo facilities to boost air freight movement

Government initiatives such as the Bipartisan Infrastructure Law are injecting billions into modernization efforts, ensuring smoother freight movement across states and strengthening America’s position as a global trade hub.

3. Growth of Third-Party Logistics (3PL)

As supply chains grow more complex, businesses increasingly turn to third-party logistics providers for expertise, flexibility, and cost savings. 3PLs now manage critical functions such as warehousing, transportation, freight forwarding, inventory planning, and last-mile delivery.

Drivers behind 3PL expansion include:

Rising complexity in global supply chains

Demand for scalable logistics solutions

Integration of advanced technologies

Sector-specific logistics needs (e.g., healthcare, retail, automotive)

From start-ups to Fortune 500 companies, businesses increasingly rely on 3PL and even 4PL providers to streamline operations, manage risks, and ensure supply chain continuity. This trend will only accelerate as companies navigate global disruptions, labor shortages, and rising transportation costs.

Challenges in the U.S. Logistics Market

Despite its strong growth trajectory, the U.S. logistics market faces several challenges that complicate operations and increase costs.

1. Rising Fuel and Transportation Costs

Fuel prices remain a volatile variable for trucking, shipping, and air freight operations. Additionally, logistics companies grapple with:

Driver shortages

Higher insurance premiums

Costly last-mile delivery operations

Maintenance and fleet management expenses

These cost pressures often lead to higher consumer prices and slimmer margins for logistics providers. Many companies are responding by investing in electric vehicles, fuel-efficient fleets, and route optimization tools—but widespread adoption requires significant capital.

2. Regulatory and Environmental Pressures

Logistics companies must navigate increasingly stringent environmental and regulatory requirements, including:

Emissions reduction targets

Clean fuel standards

Carbon reporting mandates

Sustainable packaging requirements

Federal, state, and global regulations add operational complexity, particularly for trucking and shipping. Companies face pressure to transition toward greener logistics practices—from electric delivery vans to solar-powered warehouses and eco-friendly packaging.

While these initiatives help build long-term resilience, the transition demands substantial investments in technology, training, and infrastructure.

Regional Overviews: Key U.S. Logistics Markets

California Logistics Market

California is a logistics powerhouse, anchored by the Ports of Los Angeles and Long Beach, which together manage some of the nation’s largest cargo volumes. The state’s massive consumer base and thriving industries—technology, retail, and agriculture—drive high demand for transport and warehousing.

Challenges include:

Port congestion

High labor costs

Stringent environmental regulations

However, ongoing upgrades in port automation, green logistics, and advanced distribution centers continue to strengthen California’s logistics infrastructure.

Texas Logistics Market

Texas boasts one of the fastest-growing logistics markets, supported by:

A central U.S. geographic location

A strong energy and manufacturing sector

Key trade routes with Mexico

High-growth urban hubs like Dallas–Fort Worth and Houston

Ports such as Houston and a vast highway/rail system enhance intermodal connectivity. Rapid population growth and e-commerce expansion are fueling the construction of new warehouses and distribution centers.

New York Logistics Market

New York’s logistics environment is shaped by its high-density population and role as a global financial and trade hub. The Port of New York and New Jersey is among the busiest in the country.

Major forces include:

Strong retail demand

Micro-fulfillment centers for fast delivery

High operational costs and congestion

Despite its challenges, New York remains indispensable for domestic and international freight flows.

Florida Logistics Market

Florida’s strategic location makes it a vital logistics gateway to Latin America and the Caribbean. Key advantages include:

Major ports such as Miami, Tampa, and Jacksonville

Strong tourism and retail demand

Robust cold-chain logistics for perishables

However, environmental vulnerabilities—especially hurricanes—pose risks to operations and infrastructure stability.

Recent Developments in the U.S. Logistics Market

May 2024 – A.P. Moller-Maersk opened a 90,000-square-foot air freight gateway in Miami to strengthen Asia–U.S.–Latin America connectivity.

November 2023 – UPS completed its acquisition of MNX Global Logistics, expanding its time-critical and healthcare logistics capabilities.

July 2023 – FedEx, in partnership with the U.S. Department of Transportation, launched a USD 40 million AI-powered predictive maintenance platform to boost fleet performance and minimize supply chain disruptions.

United States Logistics Market Segmentation

By Service

Transportation

Warehousing & Distribution

Freight Forwarding

Inventory Management

Value-Added Logistics

Integration & Consulting

By Category

Conventional Logistics

E-Commerce Logistics

By Model Type

2PL

3PL

4PL

By Type

Forward Logistics

Reverse Logistics

By Operation

Domestic

International

By Mode of Transport

Roadways

Railways

Airways

Waterways

By End Use

Manufacturing, Retail, Consumer Goods, Healthcare, Construction, Automotive, Chemicals, Food & Beverages, Telecom, IT Hardware, Oil & Gas, and others.

By State (29 States)

Includes California, Texas, New York, Florida, Illinois, Pennsylvania, Ohio, Georgia, New Jersey, and more.

Key Companies Profiled

Deutsche Post AG

United Parcel Service of America, Inc. (UPS)

FedEx

Maersk

CEVA Logistics (CMA CGM Group)

DB Schenker

Kuehne + Nagel

Nippon Express

Each company is covered based on:

Company Overview • Key Persons • Recent Strategies • SWOT Analysis • Sales Analysis

Final Thoughts

The United States Logistics Market is on a clear upward trajectory. With e-commerce surging, infrastructure modernizing, and digital transformation accelerating, the next decade promises unprecedented growth across transportation, warehousing, fulfillment, and supply chain technologies.

However, this growth will be accompanied by challenges—rising fuel costs, environmental regulations, and supply chain volatility will require constant innovation and adaptability. Companies that invest in automation, sustainability, and digital intelligence will lead the future of the American logistics landscape.

As the sector evolves, logistics will remain a critical contributor to U.S. economic strength, shaping how goods move across states, industries, and international borders.