United States Antimony recently caught the attention of investors as its shares moved lower this week, slipping about 10% in a single session. The activity comes amid its ongoing efforts to expand in niche materials markets, prompting some to revisit its recent performance.

See our latest analysis for United States Antimony.

Despite the sharp 10% share price dip this week, United States Antimony’s year-to-date rally stands out. Momentum remains robust with a 216.76% share price return since January and a remarkable 458.67% total shareholder return in the last twelve months. While volatility has spiked lately, the bigger picture is still dominated by strong long-term gains that reflect both renewed optimism and shifting expectations in the niche materials sector.

If this run has sparked your curiosity about what’s gaining traction elsewhere, now is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With such rapid gains and a still-substantial discount to its analyst price target, investors face a pivotal question: does United States Antimony remain undervalued, or is all the future growth already priced in?

Most Popular Narrative: 43% Undervalued

United States Antimony’s narrative fair value sits well above its last close, suggesting that market pricing has not fully caught up to bullish expectations. The narrative points to dynamic expansion drivers and industry shifts that could re-rate the stock far higher.

US Antimony is expanding its domestic processing capacity. For example, a sixfold increase at the Thompson Falls facility is expected by year-end. The company is also increasing ore supply both from its own Montana and Alaska projects and multiple new international sources, which should drive higher production volumes and sustained revenue growth through increased throughput and supply security.

Think this sounds optimistic? The story hinges on a bold leap in revenues and earnings, with numbers big enough to surprise even the bulls. Ready to see how analysts justify this upside and what assumptions are hiding behind those projections? The details behind this high fair value might change what you thought possible for a materials stock.

Result: Fair Value of $9.67 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, significant permitting delays and persistent regulatory hurdles remain. These factors pose real threats that could disrupt United States Antimony’s ambitious growth outlook.

Find out about the key risks to this United States Antimony narrative.

Another View: Looking at Price Ratios

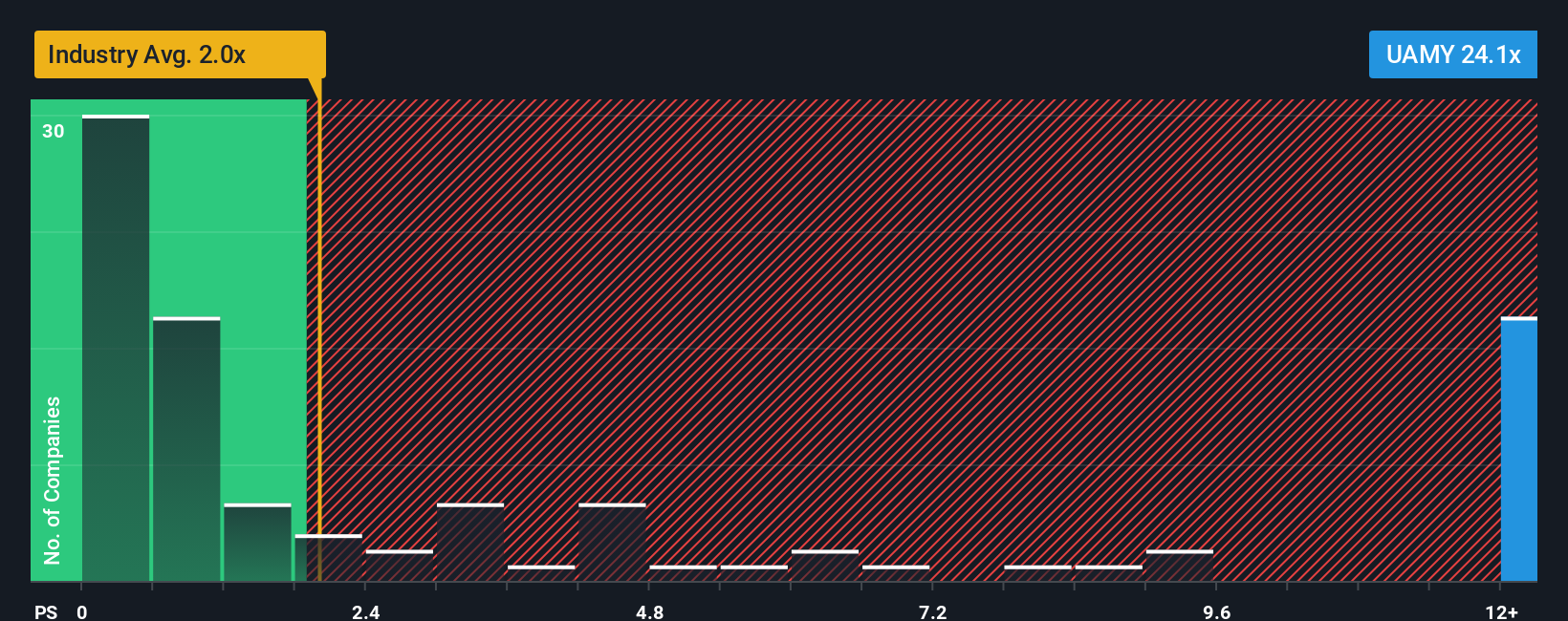

While the narrative approach signals big upside, a quick look at widely used price ratios tells a different story. United States Antimony is currently trading at a sales ratio of 24.1x, which is much higher than both the US Metals and Mining industry average of 2x and its peer average of 6.6x. Even the fair ratio, what the market could shift toward, is just 3.4x. This kind of gap highlights significant valuation risk if sentiment shifts or growth expectations stumble. So, is the market simply too far ahead, or are investors betting on a true outlier?

See what the numbers say about this price — find out in our valuation breakdown.

NYSEAM:UAMY PS Ratio as at Dec 2025 Build Your Own United States Antimony Narrative

NYSEAM:UAMY PS Ratio as at Dec 2025 Build Your Own United States Antimony Narrative

If the story here does not quite align with your own view, or you would rather dig into the numbers personally, you can create your own perspective with just a few clicks. Do it your way

A great starting point for your United States Antimony research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Now is the perfect time to seize unique opportunities and benefit from big market moves. Don’t let these trends work for others while you watch from the sidelines.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com