The United States continues to lead the global medical device landscape, especially across cardiovascular technologies where innovation often meets urgent clinical need. The United States Atherectomy Devices Market, driven by a combination of rising disease prevalence, modern procedural approaches, and continued investment in minimally invasive care, is on track for significant expansion.

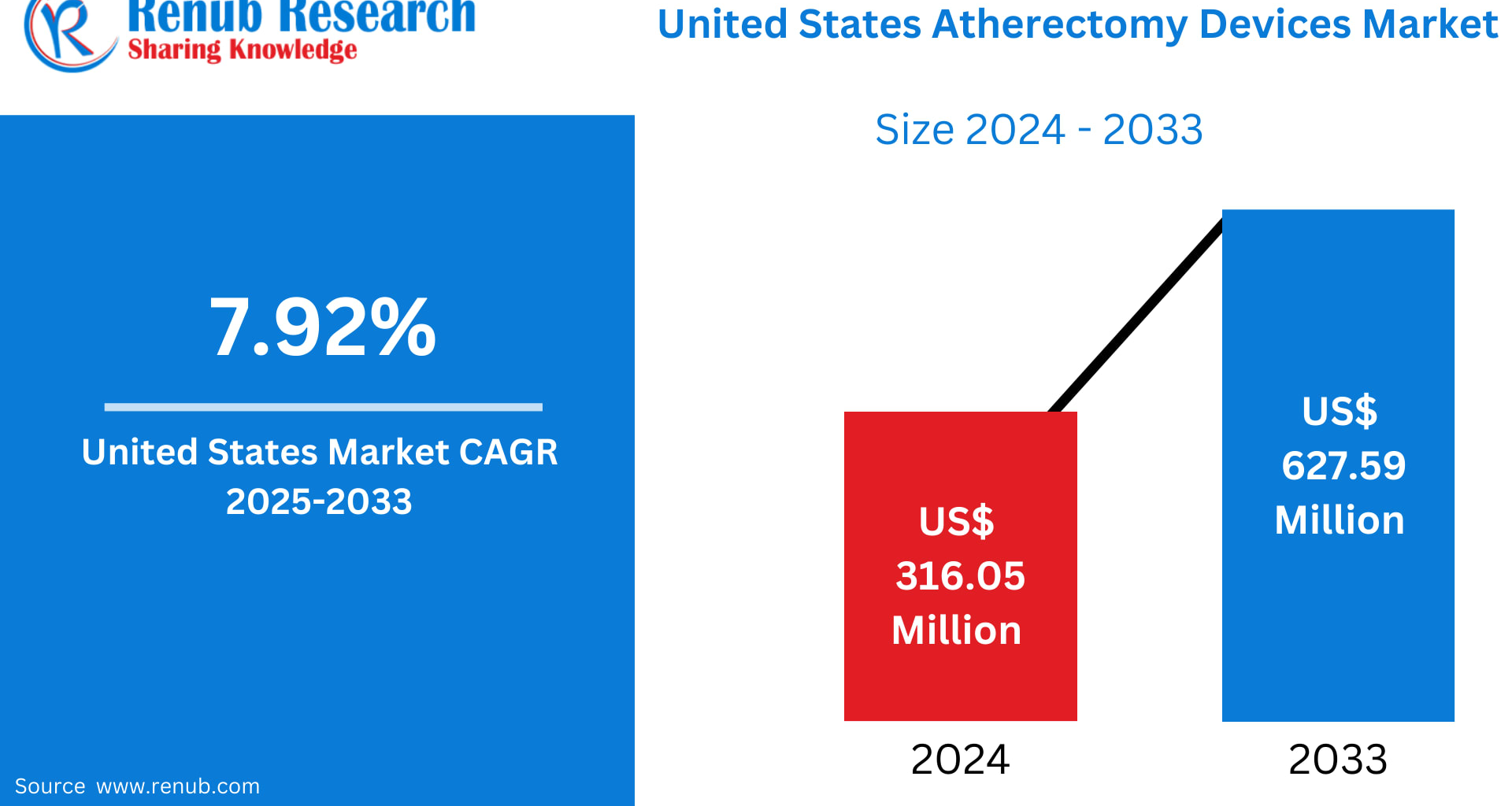

According to Renub Research, the market is projected to rise from US$ 316.05 Million in 2024 to US$ 627.59 Million by 2033, reflecting a strong CAGR of 7.92% during 2025–2033. This trajectory underscores how atherectomy devices—once niche tools used sparingly—have become crucial components in the treatment of peripheral and coronary artery disease.

From device advancements to state-by-state growth patterns, here’s a comprehensive outlook on what’s driving the U.S. atherectomy boom.

Understanding Atherectomy Devices: A Lifeline for Plaque-Blocked Arteries

Atherectomy devices are specialized systems designed to remove or debulk plaque from the arteries in patients with atherosclerosis. Instead of compressing plaque (as with angioplasty), atherectomy physically removes it, often improving long-term vessel patency and patient outcomes.

In U.S. clinical practice today, atherectomy plays a growing role in:

Percutaneous coronary interventions (PCI)

Peripheral artery interventions (PAI)

Treatment of calcified, fibrotic, or eccentric lesions

Management of in-stent restenosis

Several major atherectomy technologies dominate the market:

Directional atherectomy – shaves and removes targeted plaque

Rotational atherectomy – uses a high-speed burr to break blockages

Orbital atherectomy – utilizes a spinning crown to sand plaque

Laser atherectomy – vaporizes plaque using ultraviolet light

Each device category brings unique strengths, allowing cardiologists and vascular surgeons to tailor interventions based on lesion type and patient anatomy.

Market Growth Drivers: Why Demand is Accelerating

1. Increasing Burden of Peripheral Artery Disease (PAD) and Cardiovascular Illness

More than 12 million Americans suffer from PAD, with many cases going undiagnosed until they progress to advanced stages.

The rise in:

Obesity

Diabetes

Hypertension

Aging populations

Sedentary lifestyles

has created a perfect storm for cardiovascular disease in the United States.

As plaque accumulation becomes more common, so does the need for effective, minimally invasive treatments. Atherectomy devices offer shorter recovery times, reduced hospital stays, and improved outcomes—benefits that resonate strongly with both patients and physicians.

The CDC notes a particularly troubling rise in late-stage PAD, making atherectomy a preferred method for restoring blood flow in complex lesions.

2. Rapid Technological Advancements and Product Innovation

The U.S. is a hub for medical device R&D, and atherectomy technologies have benefitted immensely from this innovation ecosystem.

Modern systems now offer:

Real-time imaging capabilities

Greater crossability and navigation

Reduced procedural complications

Improved plaque removal efficiency

Compatibility with advanced stents and balloons

Laser and orbital atherectomy systems, in particular, have experienced notable upgrades in speed, precision, and safety.

A key milestone arrived in November 2024, when Royal Philips announced the enrollment of the first U.S. patient in its THOR IDE trial. The trial evaluates a next-generation device that combines laser atherectomy with intravascular lithotripsy—a promising hybrid approach for managing severe PAD.

These innovations are driving rapid adoption across U.S. hospitals, outpatient centers, and specialty clinics.

3. Expanding Reimbursement Coverage Across the Healthcare System

Favorable reimbursement is one of the strongest catalysts for growth.

Medicare and private insurers are:

Increasing coverage for atherectomy procedures

Enhancing payment models for outpatient vascular care

Reducing barriers that historically limited patient access

Hospitals and clinics are far more willing to invest in expensive atherectomy platforms when they can be reimbursed reliably. This is especially impactful in the management of older patients, most of whom rely on Medicare and represent the largest share of PAD cases.

Market Challenges: Obstacles Slowing Wider Adoption

1. High Cost of Devices and Procedures

Atherectomy systems are among the most expensive tools used in endovascular care.

Challenges include:

High upfront capital investment for hospitals

Costly disposable components

Patient out-of-pocket expenses despite insurance

Budget constraints in smaller facilities and rural hospitals

These cost pressures threaten equitable access and may temper market penetration in lower-income regions.

2. Procedural Risks and Shortage of Skilled Specialists

Although atherectomy is minimally invasive, it is not risk-free. Potential complications include:

Distal embolization

Arterial perforation

Dissection

Restenosis

Such risks require operators with advanced training—yet the U.S. faces a shortage of interventional cardiologists and vascular surgeons skilled in complex atherectomy.

Rural states and underserved communities feel this gap most acutely. As training programs expand, the market will likely see broader adoption, but progress will remain gradual.

Segment Outlook: Product Types, Applications & End Users

Product Type

Directional

Rotational

Orbital

Laser

Application Areas

Cardiovascular

Neurovascular

Peripheral Vascular

End Users

Hospitals

Ambulatory Care Services

Medical Research Institutes

Directional Atherectomy Devices: Precision Driving Adoption

Directional atherectomy is popular among U.S. physicians due to its unmatched precision. It enables clinicians to remove targeted plaque while preserving healthy vessel tissue—critical in treating complex or eccentric lesions.

Enhanced catheter designs, improved cutter mechanisms, and better integration with intravascular imaging have made directional systems a go-to choice in PAD care. Favorable reimbursement policies further support adoption.

Laser Atherectomy Devices: The Fastest-Growing Segment

Laser atherectomy is gaining significant momentum, particularly for treating:

In-stent restenosis

Long or complex lesions

Heavily calcified blockages

The ability to vaporize rather than mechanically remove plaque reduces trauma to vessel walls. With hospitals and ambulatory centers increasingly equipped for laser procedures—and with ongoing R&D—this segment is expected to claim a rising share of the U.S. market through 2033.

Cardiovascular Atherectomy: Addressing America’s Leading Cause of Death

Cardiovascular diseases remain the number-one cause of death in the United States, making interventions like atherectomy critical tools in cardiology.

Atherectomy is increasingly being used alongside:

Balloon angioplasty

Stent placement

Intravascular imaging

Drug-coated balloons

The aging U.S. population and widespread screening support continuous growth. As clinical evidence backing atherectomy’s efficacy builds, physician confidence and utilization rates continue to rise.

Hospitals: The Backbone of the U.S. Atherectomy Devices Market

Hospitals dominate atherectomy procedure volumes due to their:

Broader device portfolios

Experienced specialists

Stronger financial infrastructure

Access to advanced imaging

Participation in clinical research and trials

Robust Medicare and private insurance support

Hospitals provide an ecosystem where complex cardiovascular cases can be treated safely. They remain, and will continue to be, the largest end-user segment in the market.

State-Level Analysis: California, New York, and New Jersey Lead Growth

California

California’s massive healthcare ecosystem, aging population, and concentration of medical device companies make it a powerhouse market. High rates of diabetes, advanced hospitals, and medical tourism further strengthen demand.

New York

With one of the highest population densities and cardiovascular disease rates, New York depends heavily on atherectomy technologies. Its major hospitals serve as referral hubs for the most complex PAD cases.

New Jersey

Though smaller, New Jersey is a rapidly growing market supported by:

High prevalence of lifestyle-related cardiovascular conditions

Proximity to top-tier medical centers in New York and Philadelphia

Strong insurance networks

Expanding outpatient vascular programs

These states—alongside Texas, Florida, Pennsylvania, Ohio, North Carolina, and others—represent high-value pockets of opportunity for device makers.

Top U.S. States in the Market

The leading states include:

California • Texas • New York • Florida • Illinois • Pennsylvania • Ohio • Georgia • New Jersey • Washington • North Carolina • Massachusetts • Virginia • Michigan • Maryland • Colorado • Tennessee • Indiana • Arizona • Minnesota • Wisconsin • Missouri • Connecticut • South Carolina • Oregon • Louisiana • Alabama • Kentucky • Rest of the U.S.

Key Companies in the U.S. Atherectomy Devices Market

Each profiled across 5 critical viewpoints—Overview, Key Personnel, Recent Developments, SWOT, and Revenue Analysis:

Boston Scientific Corporation

Abbott Laboratories

Medtronic plc

Cardinal Health

Terumo Corporation

Integer Holdings Corporation

Becton, Dickinson and Company (BD)

AngioDynamics Inc.

These companies are continually expanding R&D pipelines, launching next-generation products, and enhancing their market presence through acquisitions and clinical trial leadership.

Final Thoughts: A Market Poised for Robust Long-Term Growth

The United States Atherectomy Devices Market is entering a transformative decade. With cardiovascular disease rates rising and the demand for minimally invasive interventions increasing, the industry is primed for sustained expansion through 2033.

Key strengths—such as strong reimbursement frameworks, active R&D pipelines, and advanced healthcare infrastructure—continue to offset challenges related to cost and training gaps. As innovations accelerate and device safety improves, atherectomy is set to play a defining role in the future of cardiovascular care.

This market isn’t just growing—it’s evolving, modernizing, and reshaping how vascular disease is treated in the United States.