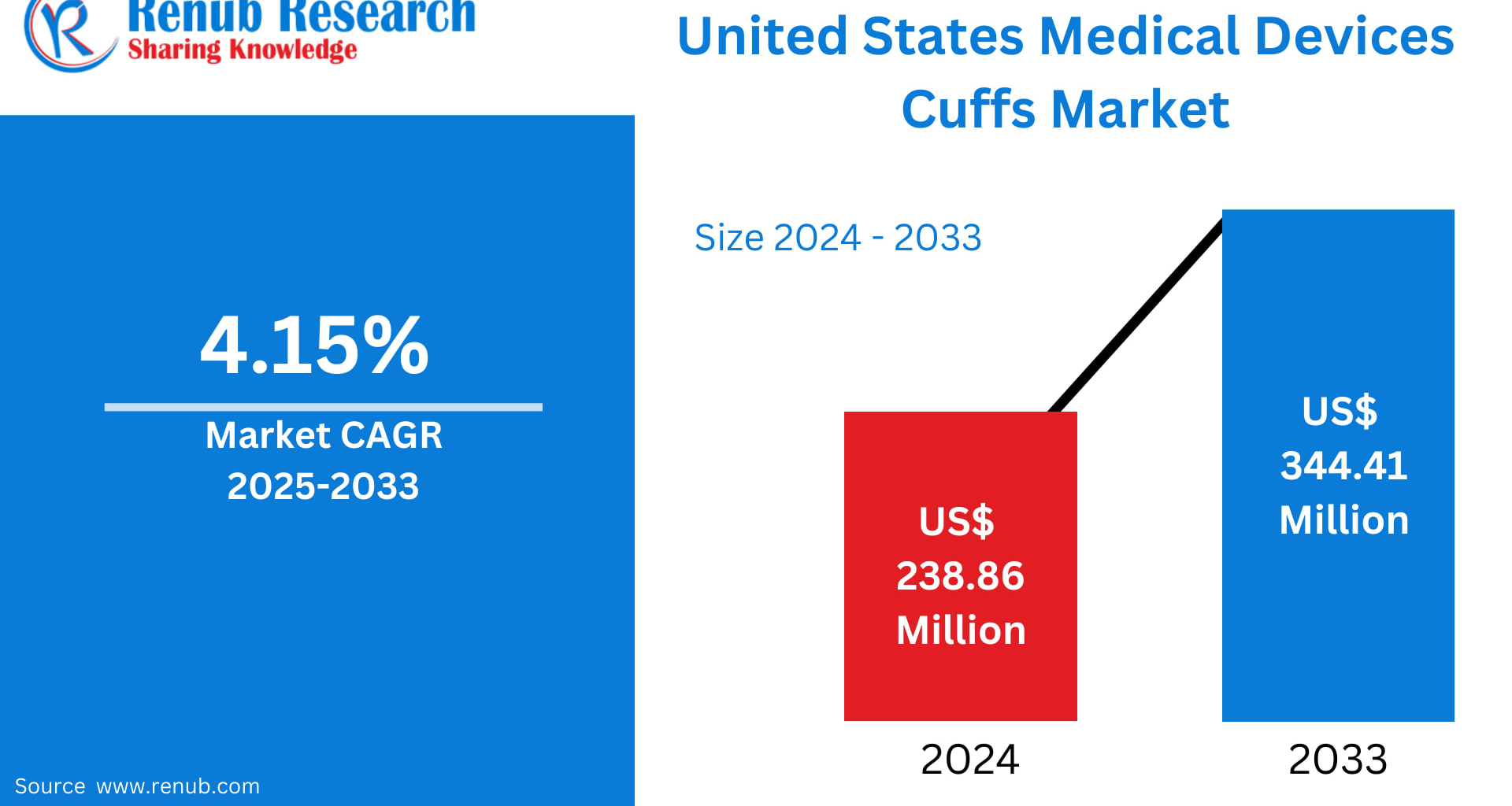

The United States Medical Devices Cuffs Market is projected to reach US$ 344.41 million by 2033, rising from US$ 238.86 million in 2024, progressing at a CAGR of 4.15% during 2025–2033, according to Renub Research.

This steady upward trajectory reflects America’s accelerating shift toward advanced patient monitoring, chronic disease management, and home-based healthcare solutions. Medical device cuffs—ranging from blood pressure and compression cuffs to endotracheal tubes and tracheostomy cuffs—have become indispensable across hospitals, clinics, ambulatory surgery centers, and households.

Today, the United States stands at the forefront of a digital transformation in healthcare, and cuffs are among the most frequently used diagnostic and therapeutic devices. Their evolution—from simple manual wraps to AI-powered, Bluetooth-enabled smart solutions—is shaping how Americans track their health and how clinicians deliver care.

United States Medical Devices Cuffs Industry Overview

The U.S. market for medical devices cuffs is expanding steadily, supported by a strong healthcare system and a rising need for diagnostic and therapeutic tools. Cuffs play a crucial role in:

Surgical procedures (tourniquets, endotracheal cuffs)

Cardiovascular monitoring (blood pressure cuffs)

Rehabilitation (compression cuffs)

Respiratory management (ET tube cuffs, tracheostomy tube cuffs)

Healthcare facilities across the country—from large hospitals to outpatient clinics—are increasingly adopting automated, accurate, and digitally integrated cuff systems.

The adoption is further fueled by:

An aging population

Higher obesity and chronic disease rates

Increasing home monitoring

Rise of telehealth and remote patient care

According to WHO, 1.28 billion adults worldwide have hypertension, while the CDC reports that cardiovascular disease claims one American life every 33 seconds. With 702,880 heart disease deaths in 2022 alone, monitoring tools like blood pressure cuffs remain essential for early diagnosis and ongoing management.

The U.S. hypertension statistics highlight how critical monitoring devices have become:

18–39 years: 23.4% prevalence

40–59 years: 52.5%

60+ years: 71.6%

Men aged 18–39 and 40–59 show significantly higher hypertension prevalence than women, emphasizing a continued need for widespread monitoring tools across demographics.

As the demand for frequent and precise patient monitoring accelerates, the medical devices cuffs market continues to evolve as a cornerstone of diagnostic reliability and therapeutic support.

Key Factors Driving Market Growth

1. Rising Burden of Chronic Diseases & Aging Population

The United States is experiencing unprecedented growth in chronic diseases, particularly hypertension, diabetes, and cardiovascular disorders. These conditions necessitate consistent monitoring through devices like:

Blood pressure cuffs

Compression cuffs

Tourniquet cuffs

The elderly population—a major healthcare-consuming demographic—relies on routine checks to manage chronic illnesses. Non-invasive and user-friendly cuff systems are especially favored in:

Homecare setups

Assisted living facilities

Telehealth programs

This combination of chronic disease prevalence and population aging ensures that cuff-based devices remain essential to patient care strategies through 2033 and beyond.

2. Technological Advancements & Smart Digital Integration

Healthcare technology is transforming traditional cuffs into intelligent, connected devices. Key innovations include:

Wireless & Bluetooth-enabled cuffs

Smart sensors for precise readings

AI algorithms for trend analysis

Integration with EHRs and telehealth platforms

Smart cuffs allow physicians and caregivers to monitor patients remotely, reducing hospital visits and ensuring timely intervention. These devices also improve patient engagement, which is crucial for managing chronic conditions.

As digital health continues expanding, connected cuff systems will play a defining role in preventive care, long-term monitoring, and early diagnostics—driving significant market growth.

3. Surge in Homecare & Outpatient Monitoring

Home-based healthcare is rising sharply in the United States due to:

High hospital costs

Increased comfort with self-monitoring

Growth of telemedicine

Preferences of elderly and chronic patients

Portable, easy-to-use cuffs—especially blood pressure and compression cuffs—are becoming household necessities. Outpatient centers also rely heavily on cuff devices for frequent assessments across rehabilitation and chronic disease programs.

As healthcare shifts away from hospital-exclusive care, medical device cuffs are emerging as essential tools for accessible, low-cost patient monitoring.

Challenges Restraining Market Growth

1. High Costs & Affordability Gaps

Advanced cuff systems with automated and wireless functionality often come at a premium price. This creates financial challenges for:

Smaller hospitals

Rural clinics

Underserved populations

Home-users with limited budgets

Besides initial purchase costs, additional expenses such as calibration, maintenance, and consumables widen the affordability gap. While low-cost alternatives exist, they often compromise on precision and durability.

To achieve equitable access, the U.S. healthcare ecosystem must address pricing challenges and expand reimbursement options.

2. Regulatory Complexity & Standardization Issues

To be used clinically, medical devices cuffs must meet strict FDA standards. This translates to:

Lengthy certification procedures

Higher R&D and testing costs

Potential delays in product launches

Variations in device quality—especially among low-cost or homecare models—complicate product standardization. Healthcare providers need confidence in consistency, accuracy, and safety.

Balancing innovation with regulatory compliance remains one of the biggest hurdles for manufacturers in the U.S. cuffs market.

United States Medical Devices Cuffs Market Overview by States

Regional adoption is strongest in California, Texas, New York, and Florida, backed by high healthcare spending, large populations, and advanced medical ecosystems.

California

California stands as one of the largest markets for medical device cuffs due to:

Extensive hospital networks

High prevalence of chronic diseases

Strong digital health adoption

Aging population

Leading medical R&D hubs

Urban centers like Los Angeles, San Francisco, and San Diego are early adopters of smart cuffs and telemonitoring technologies. Homecare adoption is rising rapidly, especially among seniors managing hypertension or cardiovascular conditions.

Texas

Texas represents a dynamic, fast-growing market driven by:

Large population base

High rates of obesity, diabetes, and hypertension

Expanding rural healthcare systems

Rapid growth of outpatient services

Metropolitan hubs—Houston, Dallas, Austin—lead in integrating advanced cuff devices. Meanwhile, rural Texas increasingly depends on affordable, portable monitoring tools to bridge healthcare access gaps.

New York

New York’s strong healthcare ecosystem bolsters adoption of medical cuffs through:

A concentrated network of hospitals & specialty clinics

High chronic disease prevalence

Integration of connected devices in telehealth

Collaboration between healthcare providers and manufacturers

New York City remains a hotbed for innovation, with academic institutions and medical technology firms driving next-generation cuff development.

Florida

Florida is one of the fastest-growing markets for medical devices cuffs. Its demographics—primarily an older population—create sustained demand for:

Blood pressure cuffs

Compression therapy devices

Rehabilitation cuffs

Telehealth penetration and the growth of homecare services are accelerating cuff adoption across the state. Florida’s healthcare institutions are investing in digital patient monitoring to meet the needs of seniors and chronic disease patients.

Market Segmentation

By Type

Blood Pressure Cuffs

Cuffed Endotracheal Tube

Tracheostomy Tube

By End Use

Hospitals

Clinics

Ambulatory Surgery Centers

Others

By States

California, Texas, New York, Florida, Illinois, Pennsylvania, Ohio, Georgia, New Jersey, Washington,

North Carolina, Massachusetts, Virginia, Michigan, Maryland, Colorado, Tennessee, Indiana, Arizona,

Minnesota, Wisconsin, Missouri, Connecticut, South Carolina, Oregon, Louisiana, Alabama, Kentucky,

Rest of United States

Competitive Landscape

The U.S. medical devices cuffs market is competitive yet innovation-driven. Key players include:

Cardinal Health

ConvaTec Inc.

Cook Medical

GE Healthcare

Omron Healthcare Inc.

Pulmodyne Inc.

Smiths Medical

SunTech Medical Inc.

Teleflex Incorporated

Welch Allyn Inc.

Coverage Includes:

Company Overviews

Key Executives

SWOT Analysis

Recent Developments

Revenue Analysis

Strategic Initiatives

These companies are actively innovating through digital integration, portable designs, improved durability, and enhanced patient comfort.

Final Thoughts

The United States Medical Devices Cuffs Market is entering a transformative growth phase. As homecare expands, telehealth becomes mainstream, and chronic diseases surge, the demand for accurate, user-friendly, and connected cuff systems will only intensify.

With a projected value of US$ 344.41 million by 2033, the market is poised for long-term stability, shaped by technological innovation, demographic trends, and evolving patient needs.

Manufacturers that prioritize smart integration, affordability, and compliance will emerge as leaders in this steadily growing landscape.