Dublin, Dec. 03, 2025 (GLOBE NEWSWIRE) — The “United States Auto Parts Manufacturing Market Report by Type, End User, Vehicle Type, States and Company Analysis 2025-2033” report has been added to ResearchAndMarkets.com’s offering.

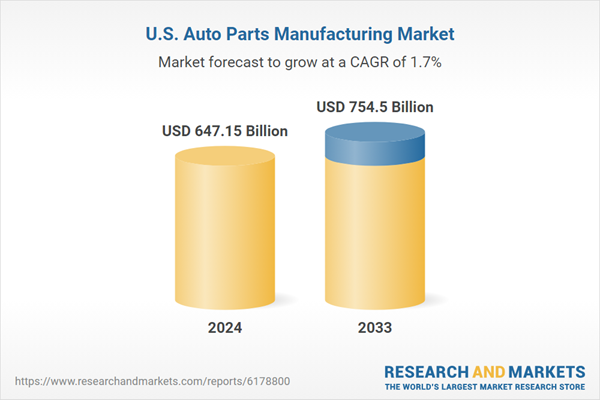

The United States Auto Parts Manufacturing Market is expected to reach US$ 754.5 billion by 2033 from US$ 647.15 billion in 2024, with a CAGR of 1.72% from 2025 to 2033

As a result of increased vehicle production, the growing demand for electric and hybrid components, aftermarket expansion, technological advancements, and more stringent regulations, the U.S. auto parts manufacturing market is expanding steadily across OEM supply chains and replacement parts industries across the country.

By providing OEMs and the aftermarket with necessary components, the US auto parts manufacturing market is a key contributor to the automobile industry. The demand for vehicles is growing, especially for electric and hybrid versions that need sophisticated electronics, battery systems, and lightweight materials. Automation and additive manufacturing are two examples of technological innovation that is increasing production efficiency and product quality.

Additionally, the aftermarket’s growth for upkeep and personalization is creating new options. Safety and pollution regulations also promote innovation in the design of parts. All things considered, the market exhibits robust flexibility and steady demand for both consumer and business automobiles.

Growth Drivers for the United States Auto Parts Manufacturing Market

Rising Vehicle Production

The volume of vehicles produced is one of the main factors propelling the US auto parts manufacturing market’s expansion. U.S. car production has started increasing after declines during the pandemic interruption; in July 2025, it was around 10.58 million units. The need for parts, such as engines, transmissions, and electronics, increases proportionately with increased production quantities.

To meet rising production requirements, auto OEMs want dependable component suppliers. Additionally, growing plant utilization (motor vehicle and parts output rose by 2.6% in August 2025) supports component orders. Production growth creates scale, which allows parts suppliers to invest in newer technologies, increased capacity, and better tooling.

Electric & Hybrid Vehicle Expansion

The growing popularity of electric (EV) and hybrid (HEV/PHEV) vehicles is another significant factor. EVs and hybrids accounted for almost 20% of new automobile and light truck sales in the United States in 2024, indicating a dramatic change in demand trends. For instance, sales of hybrid-only cars increased by almost 53% in 2023, reaching almost 1.2 million units, while sales of light-duty vehicles that included all three types of electrified vehicles (HEV, PHEV, and BEV) accounted for roughly 16.3% of total sales. This change forces automakers to develop and create EV-specific parts, such as battery modules, electric motors, and power electronics, and to modify supply chains appropriately. This expansion is also fueled by the growing regulations and incentive programs that favor greener automobiles.

Technological Advancements

One of the main factors propelling the American car parts industry forward is technological advancement. Manufacturers can now create parts that are lighter, more dependable, and more efficient thanks to developments in materials, automation, additive manufacturing (3D printing), and digitization. For instance, the drive for lighter materials increases energy efficiency; automation and robotics increase production speed while lowering waste and increasing precision.

Additionally, new component types are required due to the expansion of sensor and connectivity technologies (for ADAS, battery management, etc.). Parts manufacturers may now cater to both the established ICE vehicle market and the developing EV/HEV market thanks to the convergence of these advances. Suppliers have a competitive advantage in terms of quality, performance, and cost-effectiveness because to this technology-driven differentiation.

Challenges in the United States Auto Parts Manufacturing Market

Disruptions to the Supply Chain and Reliance on Raw Materials

One of the biggest problems facing the US car parts manufacturing industry is supply chain instability. A large portion of the raw materials used by manufacturers, including steel, aluminum, semiconductors, and rare earths, are imported. Any interruption, whether brought on by trade prohibitions, shipping delays, or geopolitical conflicts, can dramatically reduce output and raise expenses.

The vulnerability of U.S. providers is exemplified by recent worries about Chinese curbs on rare earth exports. Complexity is increased by port congestion and erratic freight services. In addition to affecting supply schedules, these dependencies also limit flexibility, which makes it more difficult for manufacturers to sustain steady output and profitability.

Tariff Uncertainty and Cost Pressures

The US car parts manufacturing sector is facing uncertainty and increased prices as a result of tariff policy. Import taxes on steel, aluminum, and some car parts immediately increase suppliers’ input costs, especially for smaller businesses with narrow profit margins. In addition to growing labor, energy prices, and inflationary pressures, manufacturers must strike a balance between profitability and automakers’ needs for competitive pricing.

Long-term planning and investment decisions are made more difficult by the unpredictability of trade policy, such as shifting tariffs and renegotiated trade agreements. In the end, these financial costs may affect the competitiveness of the U.S. auto parts industry in the global market by impeding innovation, discouraging growth, and straining supplier-OEM relationships.

Key Attributes:

Report AttributeDetailsNo. of Pages200Forecast Period2024 – 2033Estimated Market Value (USD) in 2024$647.15 BillionForecasted Market Value (USD) by 2033$754.5 BillionCompound Annual Growth Rate1.7%Regions CoveredUnited States

Key Players Analysis

Aisin CorporationAkebono Brake Industry Co. Ltd.Brembo S.p.A.Continental AGDENSO CorporationFaurecia SEGeneral Motors CompanyMagna International Inc.

United States Auto Parts Manufacturing Market Segments:

Type

BatteryCooling SystemUnderbody ComponentAutomotive FilterOthers

End User

Vehicle Type

Passenger CarsLight Commercial VehiclesHeavy Commercial VehiclesOthers

States-Market breakup in 29 viewpoints:

CaliforniaTexasNew YorkFloridaIllinoisPennsylvaniaOhioGeorgiaNew JerseyWashingtonNorth CarolinaMassachusettsVirginiaMichiganMarylandColoradoTennesseeIndianaArizonaMinnesotaWisconsinMissouriConnecticutSouth CarolinaOregonLouisianaAlabamaKentuckyRest of United States

For more information about this report visit https://www.researchandmarkets.com/r/x2eul1

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

U.S. Auto Parts Manufacturing Market