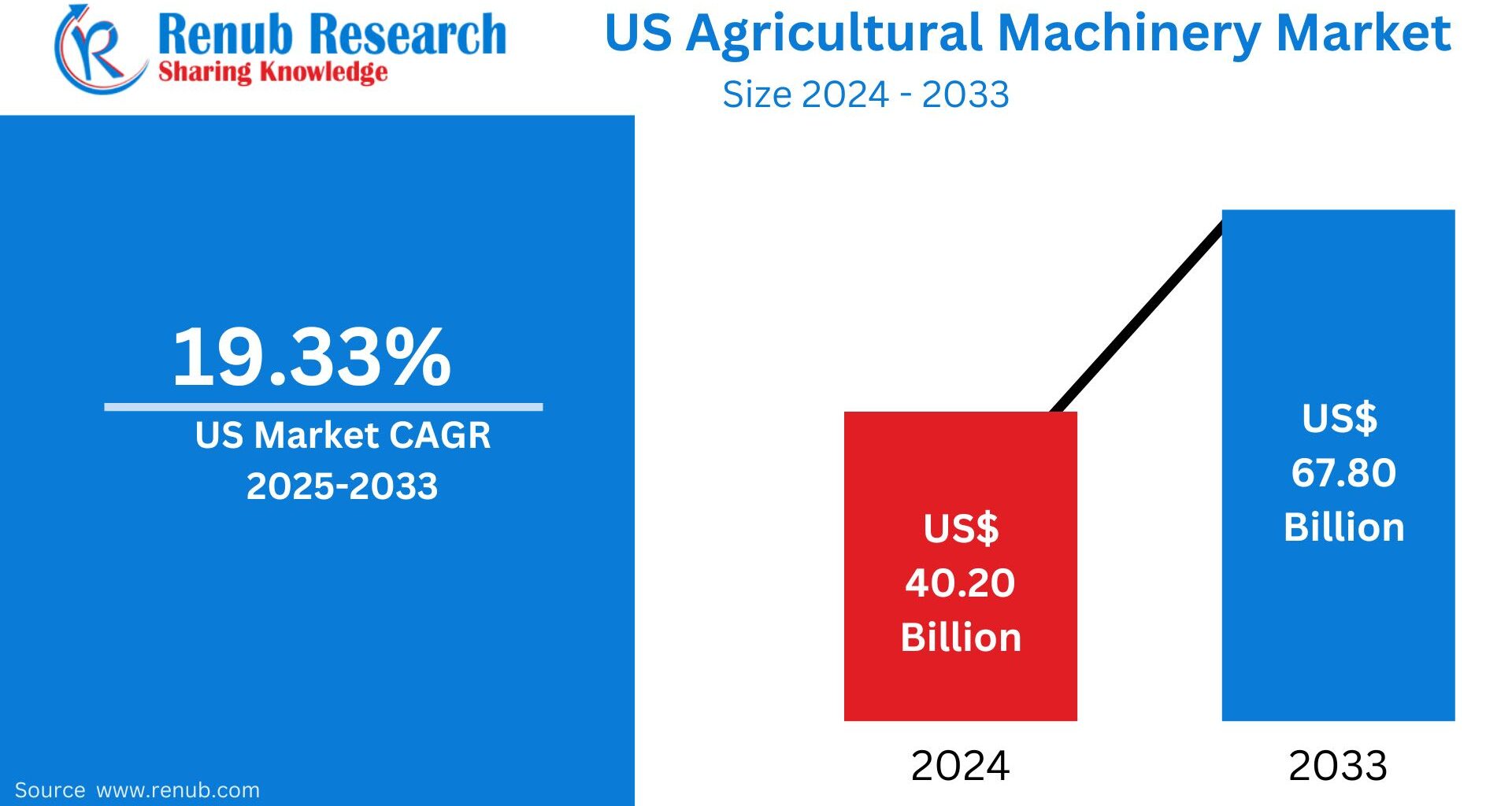

The United States Agricultural Machinery Market is entering a period of rapid transformation, powered by automation, precision agriculture, and sustainability-driven innovation. According to Renub Research, the market is projected to reach US$ 67.80 billion by 2033, rising from US$ 40.20 billion in 2024, at a strong CAGR of 5.98% during 2025–2033. This steady climb reflects growing demand for efficient, productive, and environmentally responsible farming systems across the U.S.

From automated tractors to AI-powered harvesters and smart irrigation systems, the modern American farm is evolving rapidly. As a result, machinery segments such as tractors, harvesting equipment, planting systems, and high-tech irrigation tools have become essential pillars of the agricultural supply chain. These innovations enable farmers to maintain productivity despite labour shortages, fluctuating climatic conditions, and environmental constraints.

This article provides an in-depth exploration of the factors driving market growth, the machinery categories shaping the industry, technology trends, challenges, and competitive dynamics.

United States Agricultural Machinery Market Overview

Agricultural machinery includes the equipment and tools used to automate farming operations, enhance productivity, and improve efficiency across planting, cultivation, irrigating, and harvesting. This category includes a wide array of machines such as:

Tractors

Ploughs and tillers

Harvesters

Sprayers

Seeders and planters

Irrigation systems

Modern agricultural machinery is deeply integrated with technologies like GPS, automation, IoT, and precision farming solutions, enabling farmers to reduce waste, conserve resources, optimize input usage, and increase yields.

As U.S. farms expand in size and complexity, the need for high-performance machinery becomes more urgent. Additionally, environmental concerns and the pressure to produce more food with fewer resources are pushing farmers to adopt machinery designed for sustainable and data-driven agricultural practices.

Key Growth Drivers of the U.S. Agricultural Machinery Market

1. Sustainable Farming Practices

Sustainability has become a major force shaping the U.S. agricultural machinery landscape. As farmers aim to reduce their environmental footprint and comply with sustainability norms, they are increasingly shifting toward equipment designed to:

Reduce water consumption

Minimize fertilizer and pesticide runoff

Lower carbon emissions

Improve soil health

Support renewable energy usage

The rise of precision farming machinery—such as GPS-guided tractors, variable-rate sprayers, and smart soil sensors—allows farmers to apply inputs with pinpoint accuracy. This reduces waste and environmental impact while enhancing production efficiency.

The development and adoption of no-till and low-till equipment also help protect soil structure, reduce erosion, and retain moisture—all crucial for long-term sustainability. As consumer and regulatory pressure continue to grow, sustainability-oriented agricultural equipment will remain a strong driver of market expansion.

2. Rising Food Demand

With the world population increasing and domestic food consumption rising, the U.S. agriculture sector must produce more with the same amount of land—or sometimes less. Demand for:

High-efficiency planters

High-capacity harvesters

Precision sprayers

Large-engine tractors

continues to rise as farmers aim to cover more acreage in less time, boost yields, and reduce labour dependency.

In an era where arable land is limited, the push toward mechanical advancement becomes essential. Automation, high-speed planting, and digitally integrated machinery are no longer optional—they are critical for meeting national and global food supply demands.

3. Technological Advancement and Automation

Technology remains the most influential growth catalyst in the U.S. agricultural machinery industry. Innovations across automation, robotics, and smart farming tools have modernized the entire farming lifecycle.

Today’s machinery can autonomously:

Steer tractors

Monitor crop conditions

Measure soil health

Adjust planting speed

Determine irrigation needs

Optimize harvesting operations

Precision agriculture technologies, including real-time data analytics, drone surveillance, IoT-enabled devices, and AI-powered robotics, have transformed traditional farming.

A landmark moment came in December 2022, when CNH Industrial expanded its Ag-Tech solutions in Phoenix, introducing advancements such as:

Autonomous tillage systems

Driverless harvest solutions

Balers with automated functionality

Backed by Case IH, New Holland, and Raven, these technologies allow farmers to overcome labour shortages and adopt fully autonomous operations on the field. As innovations continue to evolve, adoption of advanced machinery will grow exponentially.

Challenges Impacting the U.S. Agricultural Machinery Market

1. High Maintenance and Repair Costs

As machinery becomes more advanced and technologically sophisticated, maintenance and repair costs have also increased. Modern agricultural equipment often requires:

Specialized technicians

Proprietary parts

Software updates

Diagnostic tools

For small and medium farms, these costs can place sizable pressure on budgets. Equipment downtime can disrupt critical farming cycles, particularly during planting and harvest seasons. The shortage of skilled technicians in rural areas adds another layer of difficulty, further intensifying repair challenges.

2. High Initial Investment Costs

One of the biggest barriers to adoption is the high upfront cost of advanced machinery. Cutting-edge solutions like autonomous tractors, combine harvesters, and precision irrigation systems require significant capital investment.

Although they offer long-term savings, productivity improvements, and resource efficiency, small-scale farmers often struggle to afford these technologies. As a result, the unequal adoption of modern machinery between large and small farms remains a persistent challenge in the U.S. agricultural landscape.

Market Segmentation: United States Agricultural Machinery Market

Below is a detailed breakdown of the market based on machinery types and categories:

By Machinery Type

Irrigation Machinery

Tractors

Ploughing and Cultivation Machinery

Harvesting Machinery

Haying and Forage Machinery

Planting Machinery

Sprayers

Irrigation Machinery

Gravity Irrigation

Micro-Irrigation

Sprinkler Systems

Micro-irrigation systems, particularly drip irrigation, are seeing fast adoption due to their ability to save water and maximize plant health.

Tractors by Engine Power

Less than 40 HP

41 to 100 HP

More than 100 HP

The mid-power segment (41–100 HP) remains dominant in the U.S., given its suitability for mixed and large-scale farming operations.

Ploughing and Cultivation Machinery

Cultivators and Tillers

Harrows

Ploughs

Others

Advanced tillage machinery helps improve soil aeration and preparation while supporting minimum tillage practices for sustainability.

Harvesting Machinery

Combine Harvesters

Harvesting Robots

Self-Propelled Forage Harvesters

Robotic harvesting technologies are gaining traction, especially in labour-intensive crop segments.

Haying and Forage Machinery

Mowers

Balers

Tedders and Rakes

Forage Harvesters

These machines support livestock-dependent farms and play a vital role in the feed production supply chain.

Competitive Landscape: Major Companies

Companies in the market have been analysed across five viewpoints:

Company Overview

Key Personnel

Product Portfolio

Recent Developments

Sales Analysis

Key Players

John Deere

CNH Industrial

AGCO Corporation

Kubota Corporation

Titan Machinery Inc.

CLAAS

Lindsay Corporation

Alamo Group Inc.

These companies are leading the technological race, focusing on automation, sustainability-driven machinery, and advanced power systems to enhance productivity across U.S. agricultural landscapes.

Final Thoughts

The United States Agricultural Machinery Market is entering a transformative decade as farmers rapidly adopt automation, precision technology, and sustainability-focused equipment. With production demands growing faster than ever, advanced machinery has become indispensable. Renub Research’s projection of the market reaching US$ 67.80 billion by 2033 reflects a sector powered by innovation and necessity.

As climate challenges, labour shortages, and food demand pressures intensify, U.S. farmers will continue to invest in cutting-edge technologies. Manufacturers that prioritize autonomy, AI, precision tools, and eco-friendly equipment will shape the future of modern agriculture.

The next decade will not just redefine machinery—it will redefine farming itself.