Dublin, Dec. 17, 2025 (GLOBE NEWSWIRE) — The “United States Stoma or Ostomy Care Market Report by Product Type, Application, End User, Distribution Channel, States and Company Analysis, 2025-2033” has been added to ResearchAndMarkets.com’s offering.

The U.S. ostomy care market is growing as a result of increased surgical cases, technological advancements, and improved access to healthcare services. The key distribution channels are hospitals, clinics, and homecare providers. Ongoing product development in adhesives, skin barriers, and odor control improves patient experience. Still, cost pressures and patient awareness gaps continue to be issues. The market is trending towards patient-focused solutions that emphasize comfort, discretion, and enhanced self-care, making it a resilient healthcare niche.

Ostomy bags account for the biggest portion of the U.S. market for stoma care, as they are a necessary daily requirement for patients with colostomy, ileostomy, or urostomy. Advances in bag design – filter technology, low-profile designs, and longer wear-time – are boosting rates of adoption. The recurrent use guarantees constant demand, and subscription services offered over the Internet maximize patient convenience. This segment should continue to be the pillar of the U.S. ostomy care market.

Pastes, powders, and skin barrier rings are key in providing stoma security and skin protection. They stop leakage, cut down on skin irritation, and enhance ostomy bag adhesion. Though a smaller segment than bags, these devices are key in overall patient comfort and adherence. Increased understanding of the importance of skin health in ostomy care is driving demand for pastes and powders, with companies turning their attention to hypoallergenic and no-stick formats.

Colostomy care is one of the major segments of the U.S. ostomy market because of the widespread incidence of colorectal cancer. Reliable bags, pastes, and accessories are needed by the patient for long-term care. Odor control and skin protection are critical areas of innovation in this segment because most patients have difficulty in adjusting to lifestyle changes after surgery. Hospital and homecare are the major settings for product usage, with increasing focus on education programs facilitating the patient’s switch to self-care.

Hospitals continue to be a main avenue for ostomy care in the U.S. because they perform surgery and initial postoperative care. They are key to first exposure of patients to ostomy products, initial education, and referral to trusted suppliers. Hospitals also collaborate with manufacturers on bulk purchases of bags and accessories. As procedural volumes increase, hospital demand continues to be the foundation for market growth, though long-term patient dependence switches towards homecare and retail supply chains.

The internet sales channel for ostomy care supplies is expanding at a fast pace in the United States, fueled by patients’ desire for privacy, convenience, and timely delivery. Subscription-based delivery programs are offered by e-commerce sites and specialty medical distributors, so that patients never have to worry about running out of supplies. Educational materials and peer support groups are also available on internet sites, which help mitigate stigma and promote self-management. This digital shift is increasing market reach, especially among younger, technology-oriented patients and caregivers.

Key Attributes

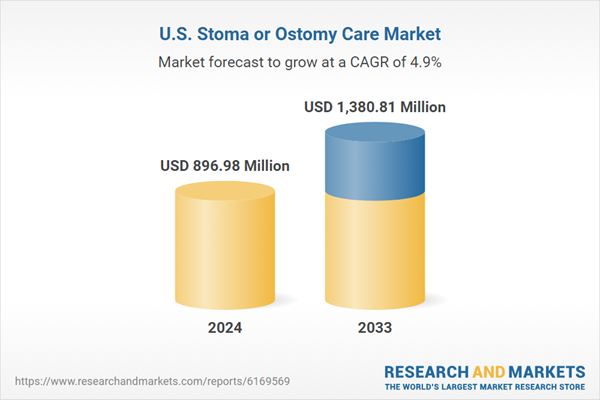

Report AttributeDetailsNo. of Pages200Forecast Period2024-2033Estimated Market Value (USD) in 2024$896.98 MillionForecasted Market Value (USD) by 2033$1.38 BillionCompound Annual Growth Rate4.9%Regions CoveredUnited States

Key Topics Covered

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United States Stoma or Ostomy Care Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Product Type

6.2 By Application

6.3 By End User

6.4 By Distribution Channel

6.5 By States

7. Product Type

7.1 Ostomy Bags

7.2 Skin Barriers

7.3 Pastes and Powders

7.4 Other Accessories

8. Application

8.1 Colostomy

8.2 Ileostomy

8.3 Urostomy

9. End User

9.1 Hospitals

9.2 Homecare

9.3 Ambulatory Surgical Centers

10. Distribution Channel

10.1 Online Pharmacy

10.2 Retail Pharmacy

10.3 Hospital Pharmacies

11. Top States

11.1 California

11.2 Texas

11.3 New York

11.4 Florida

11.5 Illinois

11.6 Pennsylvania

11.7 Ohio

11.8 Georgia

11.9 New Jersey

11.10 Washington

11.11 North Carolina

11.12 Massachusetts

11.13 Virginia

11.14 Michigan

11.15 Maryland

11.16 Colorado

11.17 Tennessee

11.18 Indiana

11.19 Arizona

11.20 Minnesota

11.21 Wisconsin

11.22 Missouri

11.23 Connecticut

11.24 South Carolina

11.25 Oregon

11.26 Louisiana

11.27 Alabama

11.28 Kentucky

11.29 Rest of United States

12. Value Chain Analysis

13. Porter’s Five Forces Analysis

13.1 Bargaining Power of Buyers

13.2 Bargaining Power of Suppliers

13.3 Degree of Competition

13.4 Threat of New Entrants

13.5 Threat of Substitutes

14. SWOT Analysis

14.1 Strength

14.2 Weakness

14.3 Opportunity

14.4 Threats

15. Pricing Benchmark Analysis

16. Key Players Analysis

16.1 Alcare Co. Ltd.

16.2 3M Co.

16.3 B. BRAUN

16.4 Coloplast A/S

16.5 Schena Ostomy Technologies Inc.

16.6 BAO Health Medical Instrument Co. Ltd.

16.7 ConvaTec Group PLC

16.8 Flexicare Medical Limited

16.9 Hollister Incorporated

For more information about this report visit https://www.researchandmarkets.com/r/3yd2b8

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

U.S. Stoma or Ostomy Care Market