Middle class Americans are being swamped by credit card debt as the US cost of living crisis spirals, a leading charity has warned.

The share of people struggling with debt who have a four-year university degree or a masters has surged from 34pc in 2021 to 43pc this year, according to American Consumer Credit Counseling (ACCC), which offers debt advice.

Kenneth Mohammed, from the ACCC, said credit card debt was becoming a problem not just for the poorest households but for wealthier, educated Americans too.

The trend will stoke fear in the White House amid fears a cost of living crisis will derail Donald Trump’s presidency.

Mr Trump promised to bring down prices from “day one” during his election campaign last year.

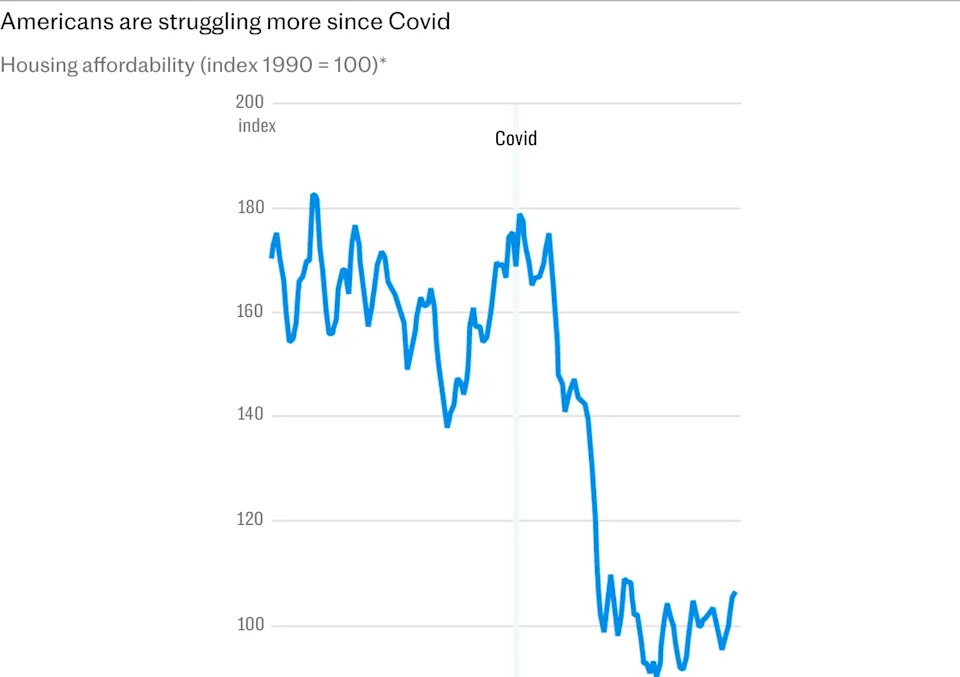

High housing costs and the long legacy of a post-pandemic surge in credit card spending are forcing more people to spend beyond their means.

b’

‘

Calls to the service hit 61,000 in the first 11 months of the year, up 11pc compared to 2024 and the highest since ACCC records began in 2015.

According to the ACCC, about three in four people asking for help are employed – but their incomes are not enough to cover their costs. This is despite the average household income of struggling families surging from $55,000 to $76,000.

The problem is also getting worse despite the fact that inflation has cooled from a four-decade high of 9.1pc in June 2022 to 2.7pc in November.

Mr Mohammed said: “Inflation has slowed down, but what people don’t realise is that consumers have been financing the inflation this whole time.

“They’ve been using credit card debt to keep themselves above water. Then you get to a point where you’re overextended and you can’t borrow any more.”

He added: “Most of the people if they’re calling us today, their problems started probably three or four years ago.

“They are living pay cheque to pay cheque, and they see it getting worse.”

Mr Trump has pointed to falling prices of particular goods such as eggs and Thanksgiving turkeys as a sign that cost pressures are easing. He also plans to pay a $2,000 (£1,480.92) “tariff dividend” cheque to low income households to help with their incomes.

But a slower pace of inflation is not the same as price falls – and the President’s ratings are tanking.

However, polling shows the share of Americans who approve of how Mr Trump is handling the economy slumped from 40pc in March to 31pc in December, according to AP-Norc.

Even among Republican voters, the proportion has dropped dramatically from 78pc to 69pc.

Torsten Slok, chief economist at Apollo Global Management, warned that if more middle class households are struggling it will become a threat to the wider US economy.

The poorest fifth of households make up just 8pc of consumer spending, whereas the richest fifth account for 40pc.

This means that when the poorest households in America are struggling, the ripple effects across the wider economy are limited.

If cost pressures spread to the middle two fifths of earners, however, this becomes a larger drag on the economy, Mr Slok said.

He added: “Then we are talking about 60pc of the population and they of course account for a more and more meaningful share of total consumer spending.

“Once those headwinds get substantial enough, then the richest households are not going to be enough to outweigh the negative effects.”

The share of Americans falling seriously behind on their credit card debt hit a 15-year high this year, while subprime car loan delinquencies are also at record levels.

The share of student loans whose borrowers have missed more than 90 days of payments has soared to a record 14.26pc, up from 9.21pc before the pandemic, after a Covid-era moratorium on payments ended in May.

Both are further signs that cost pressures are spreading to the middle classes, who are more likely to be university-educated.