What recent moves in United States Antimony mean for investors

United States Antimony (UAMY) has drawn fresh attention after a strong recent share price move, with the stock showing double digit returns over the past week and single digit gains over the past month.

See our latest analysis for United States Antimony.

The latest 1 day share price return of 15.9% and 7 day share price return of 32.6% sit against a 90 day share price decline of 27.8%, while the 1 year and 3 year total shareholder returns are very large. This suggests momentum has recently picked up again after earlier weakness.

If UAMY’s sharp moves have caught your eye, it can be useful to compare this setup with other materials related names or broaden the search to fast growing stocks with high insider ownership for more potential ideas.

With United States Antimony trading at US$6.87 and sitting at a large discount to analyst and intrinsic value estimates, the key question for you is whether this is a genuine mispricing or if the market is already factoring in future growth.

Most Popular Narrative: 28.9% Undervalued

With United States Antimony last closing at US$6.87 versus a narrative fair value of about US$9.67, the valuation gap rests on some punchy long term assumptions.

US Antimony is expanding its domestic processing capacity (for example, a sixfold increase at the Thompson Falls facility is expected by year end) and increasing ore supply both from its own Montana and Alaska projects and multiple new international sources. This combination is expected to support higher production volumes and sustained revenue growth through increased throughput and supply security.

Want to see what kind of revenue ramp, margin shift, and earnings profile are baked into this view? The narrative leans on aggressive growth, rising profitability, and a richer future earnings multiple. Curious how those moving pieces add up to that fair value tag?

Result: Fair Value of $9.67 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, there are real pressure points here, including permitting setbacks at Alaska and Ontario projects, as well as potential ore quality or supply issues that could disrupt production and revenue plans.

Find out about the key risks to this United States Antimony narrative.

Another Angle on Valuation

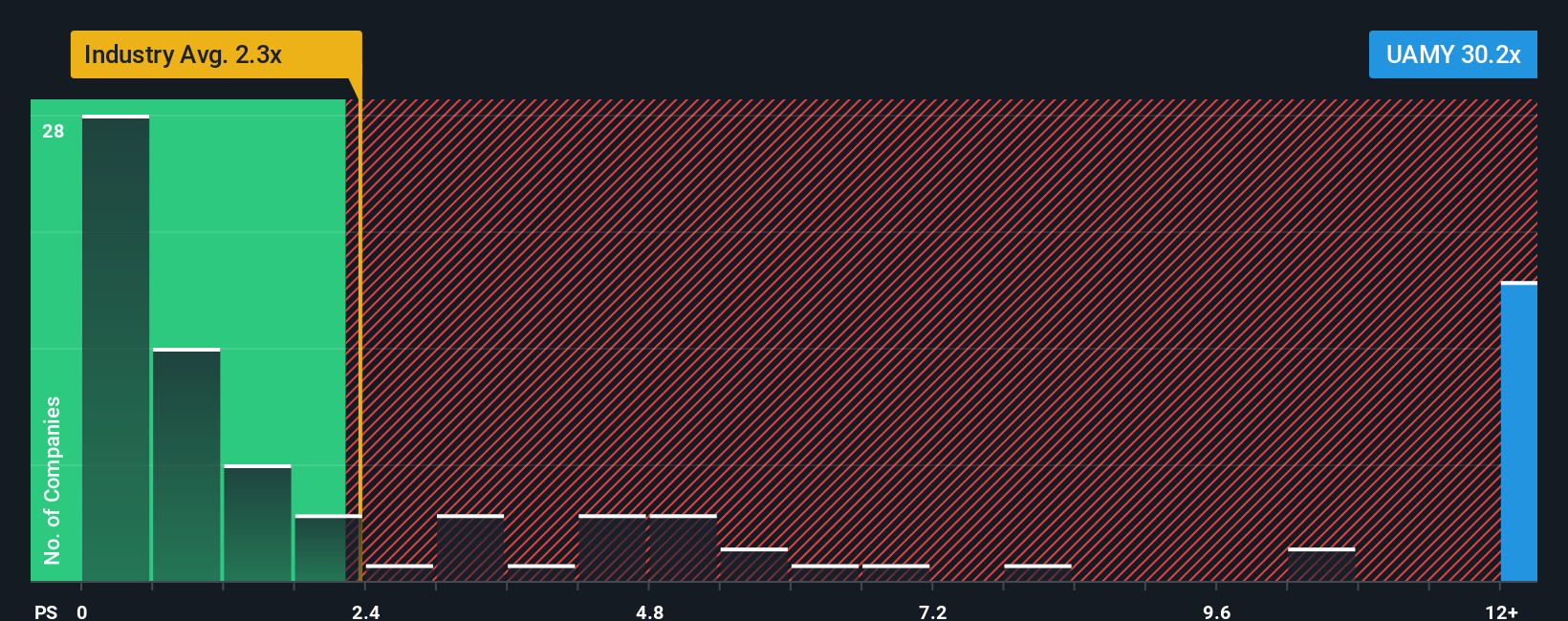

So far, the story leans on a fair value of about US$9.67, implying United States Antimony is undervalued. On simple sales-based pricing, though, the current P/S of 30.2x is far higher than the US Metals and Mining industry at 2.3x, peers at 8.3x, and an estimated fair ratio of 2.7x. That kind of gap can either signal a rerating risk if expectations cool, or conviction that current forecasts still do not fully capture the upside. Which side of that trade do you think you are on?

See what the numbers say about this price — find out in our valuation breakdown.

NYSEAM:UAMY P/S Ratio as at Jan 2026 Build Your Own United States Antimony Narrative

NYSEAM:UAMY P/S Ratio as at Jan 2026 Build Your Own United States Antimony Narrative

If you read this and think the story looks different once you run the numbers yourself, you can build your own narrative in a few minutes, Do it your way.

A great starting point for your United States Antimony research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If United States Antimony has sparked your curiosity, do not stop here. The screener can surface other opportunities you might wish you had seen earlier.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com