California helped make them the rich. Now a small proposed tax is spooking them out of the state.

California helped make them among the richest people in the world. Now they’re fleeing because California wants a little something back.

The proposed California Billionaire Tax Act has plutocrats saying they are considering deserting the Golden State for fear they’ll have to pay a one-time, 5% tax, on top of the other taxes they barely pay in comparison to the rest of us. Think of it as the Dust Bowl migration in reverse, with The Monied headed East to grow their fortunes.

The measure would apply to billionaires residing in California as of Jan. 1, 2026, meaning that 2025 was a big moving year month among the 200 wealthiest California households subject to the tax.

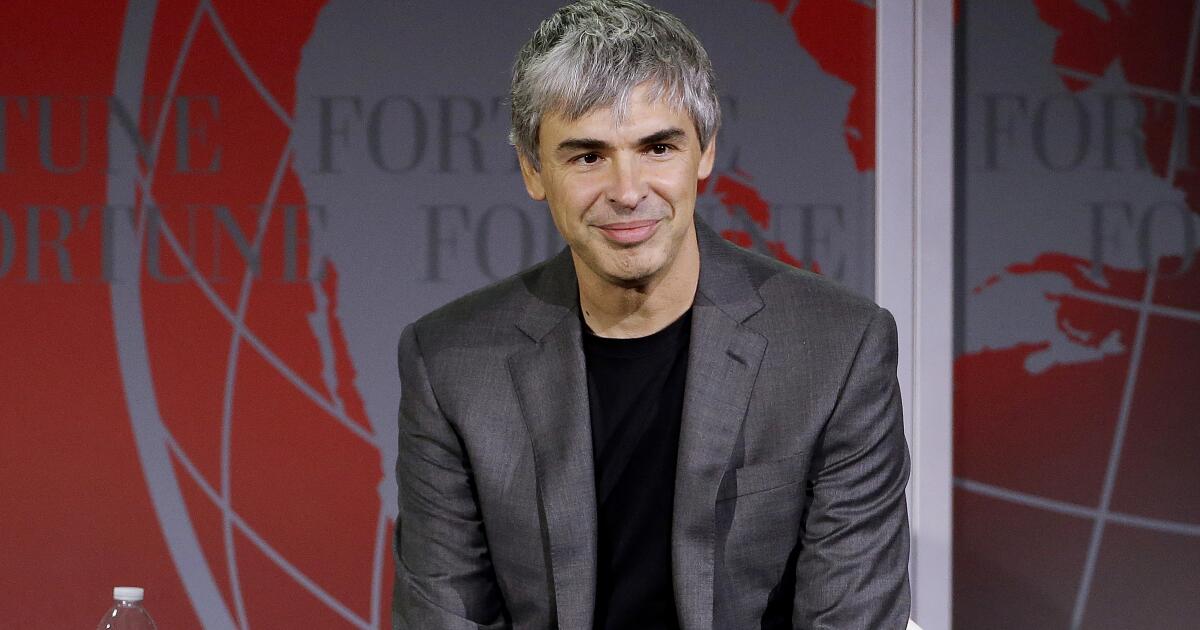

The recently departed reportedly include In-n-Out Burger owner and heiress Lynsi Snyder, PayPal co-founder and conservative donor Peter Thiel, Venture Capitalist David Sacks, co-founder of Craft Ventures, and Google co-founder Larry Page, who recently purchased $173 million worth of waterfront property in Miami’s Coconut Grove. Thank goodness he landed on his feet in these tough times.

The principal sponsor behind the Billionaire Tax Act is the Service Employees International Union-United Healthcare Workers West (SEIU-UHW), which contends that the tax could raise a $100 billion to offset severe federal cutbacks to California’s public education, food assistance and Medicaid programs.

The initiative is designed to offset some of the tax breaks that billionaires received from the One Big Beautiful Bill Act recently passed by the Republican-dominated Congress and signed by President Trump.

According to my colleague Michael Hiltzik, the bill “will funnel as much as $1 trillion in tax benefits to the wealthy over the next decade, while blowing a hole in state and local budgets for healthcare and other needs.”

The drafters of the Billionaire Tax Act still have to gather around 875,000 signatures from registered voters by June 24 for the measure to qualify on November’s ballot. But given the public ire toward the growing wealth of the 1%, and the affordability crisis engulfing much of the rest of the nation, it has a fair chance of making it onto the ballot.

If the tax should be voted into law, what would it mean for those poor tycoons who failed to pack up the Lamborghinis in time? For Thiel, whose net worth is around $27.5 billion, it would be around $1.2 billion, should he choose to stay, and he’d have up to five years to pay it.

Yes, it’s a lot … if you’re not a billionaire. It’s doubtful any of the potentially affected affluents would feel the pinch, but it could make a world of difference for kids depending on free school lunches, or folks who need medical care but can’t afford it because they’ve been squeezed by a system that places much of the tax burden on them.

According to the California Budget & Policy Center, the bottom fifth of California’s non-elderly families, with an average annual income of $13,900, spend an estimated 10.5% of their incomes on state and local taxes. In comparison, the wealthiest 1% of families, with an average annual income of $2.0 million, spend an estimated 8.7% of their incomes on state and local taxes.

“It’s a matter of values,” Rep. Ro Khanna (D-Fremont) posted on X. “We believe billionaires can pay a modest wealth tax so working-class Californians have Medicaid.”

Many have argued losing all that wealth to other states will hurt California in the long run.

Even Gov. Gavin Newsom has argued against the measure, citing that the wealthy can relocate anywhere else to evade the tax. During the New York Times DealBook Summit last month, Newsom said, “You can’t isolate yourself from the 49 others. We’re in a competitive environment.”

He has a point, as do others who contend that the proposed tax may hurt California rather then help.

Sacks signaled he was leaving California by posting an image of the Texas flag on Dec. 31 on X and writing: “God bless Texas.” He followed with a post that read, “As a response to socialism, Miami will replace NYC as the finance capital and Austin will replace SF as the tech capital.”

Arguments aside, it’s disturbing to think that some of the richest people in the nation would rather pick up and move than put a small fraction of their vast California-made — or in the case of the burger chain, inherited — fortunes toward helping others who need a financial boost.