Recent industry reports point to rising global demand for agricultural lime, as farmers focus more on sustainable practices and soil health. United States Lime & Minerals (USLM) features prominently as a key producer in this expanding niche.

See our latest analysis for United States Lime & Minerals.

Against this backdrop, United States Lime & Minerals’ share price is at $130.44, with a 7.84% year to date share price return and a 9.74% 1 year total shareholder return. The 3 year total shareholder return above 300% points to strong longer term momentum.

If this kind of niche materials story interests you, it could be a good moment to widen your search and see how other companies stack up using fast growing stocks with high insider ownership.

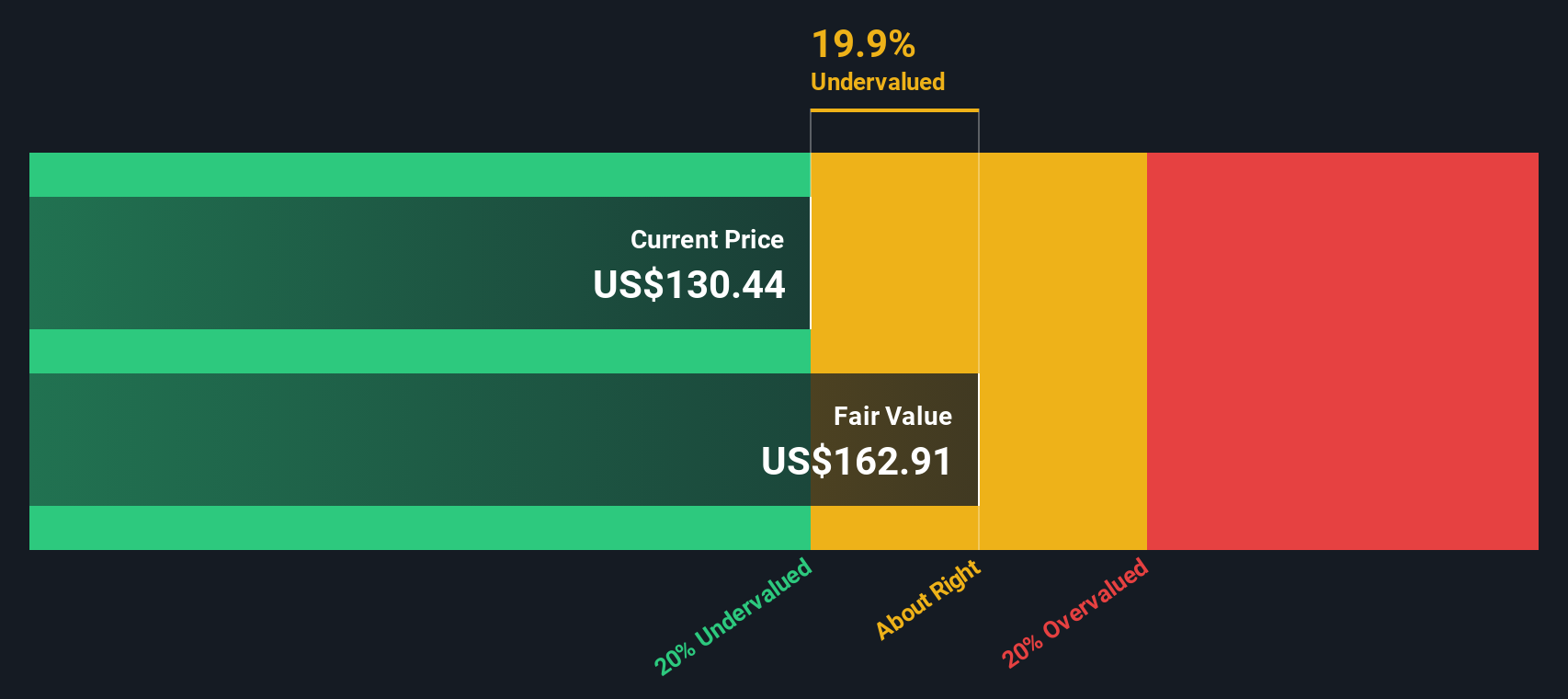

With the shares trading at $130.44, a value score of 1 and an indicated 19.5% discount to intrinsic value, is United States Lime & Minerals still underappreciated or is the market already pricing in its prospects?

Price-to-Earnings of 28.5x: Is it justified?

At a last close of $130.44, United States Lime & Minerals is trading on a P/E of 28.5x, which sits well above both its US and global Basic Materials peer averages.

The P/E ratio tells you how much investors are currently paying for each dollar of earnings, and it is a common way to compare companies in the same sector. For a mature producer like USLM, a higher P/E usually implies investors are comfortable paying a premium for its earnings profile.

Here, the market is assigning a richer earnings multiple than the peer averages of 20.6x in the US and 15.3x globally, while our DCF model indicates the shares trade at a 19.5% discount to an intrinsic value of $162.11. That combination suggests investors are accepting a higher price for each dollar of current earnings, even though a cash flow based view points to value still on the table.

Compared with both the US and global Basic Materials groups, USLM’s P/E stands at a clear premium, which signals stronger confidence being priced in than for the average peer.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Preferred multiple of 28.5x P/E (OVERVALUED)

However, you still have to weigh up risks such as exposure to cyclical construction demand and the potential for commodity input costs to pressure margins at a richer P/E.

Find out about the key risks to this United States Lime & Minerals narrative.

Another View: Cash Flows Tell a Different Story

While the P/E of 28.5x makes United States Lime & Minerals look expensive next to Basic Materials peers, our DCF model points in the opposite direction. On that cash flow view, the shares trade at a 19.5% discount to an estimated fair value of US$162.11.

This kind of split verdict, with a premium earnings multiple alongside a discounted DCF value, raises a practical question for you as an investor: which signal do you treat as more important when weighing risk versus potential upside?

Look into how the SWS DCF model arrives at its fair value.

USLM Discounted Cash Flow as at Jan 2026

USLM Discounted Cash Flow as at Jan 2026

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out United States Lime & Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own United States Lime & Minerals Narrative

If you look at this and feel differently, or simply prefer to work from the raw numbers yourself, you can build your own view in a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding United States Lime & Minerals.

Looking for more investment ideas?

If you are serious about building out your watchlist, do not stop at one stock, use the Simply Wall St screener to uncover more focused opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com