Nvidia (NVDA) CEO Jensen Huang has just cut through the big debate over AI chipmaking, saying that the future of advanced chips runs through Taiwan.

By extension, it still runs through the crown jewel of the chipspace in Taiwan Semiconductor Manufacturing (TSM), regardless of the number of fabs being announced elsewhere.

In an interview with The Times (UK), Huang made it clear that the efforts to diversify production need to be viewed from an angle of resilience, not replacement.

Over the past year or so, we’ve seen the U.S. adding capacity alongside Europe, but the deep, decades-long ecosystem producing advanced silicon remains concentrated.

Nevertheless, the AI trade continues to evolve, and Mr. Market is getting selective.

Over the past week, memory stocks stood out, with Micron Technologies delivering nearly a 10% gain on the back of the growing demand/supply imbalance in its space.

TSM stock held steadier, but over the past six months has delivered almost a 40% gain.

Zooming out, the semiconductor space, represented by the SOXX ETF, posted a super 5% gain over the past week, with investors betting on “picks-and-shovels” names such as Applied Materials, among others.

Meanwhile, AI bellwethers like Nvidia, which is coming off another ambitious CES showing, have mostly been sluggish.

Since I last covered Nvidia on January 7, 2026, it has fallen from $189.11 to $184.86 as of January 9, 2026 (-2.25%).

Nevertheless, recent market moves have shown the AI trade is alive and well, and Huang’s comments have added fuel to the fire.

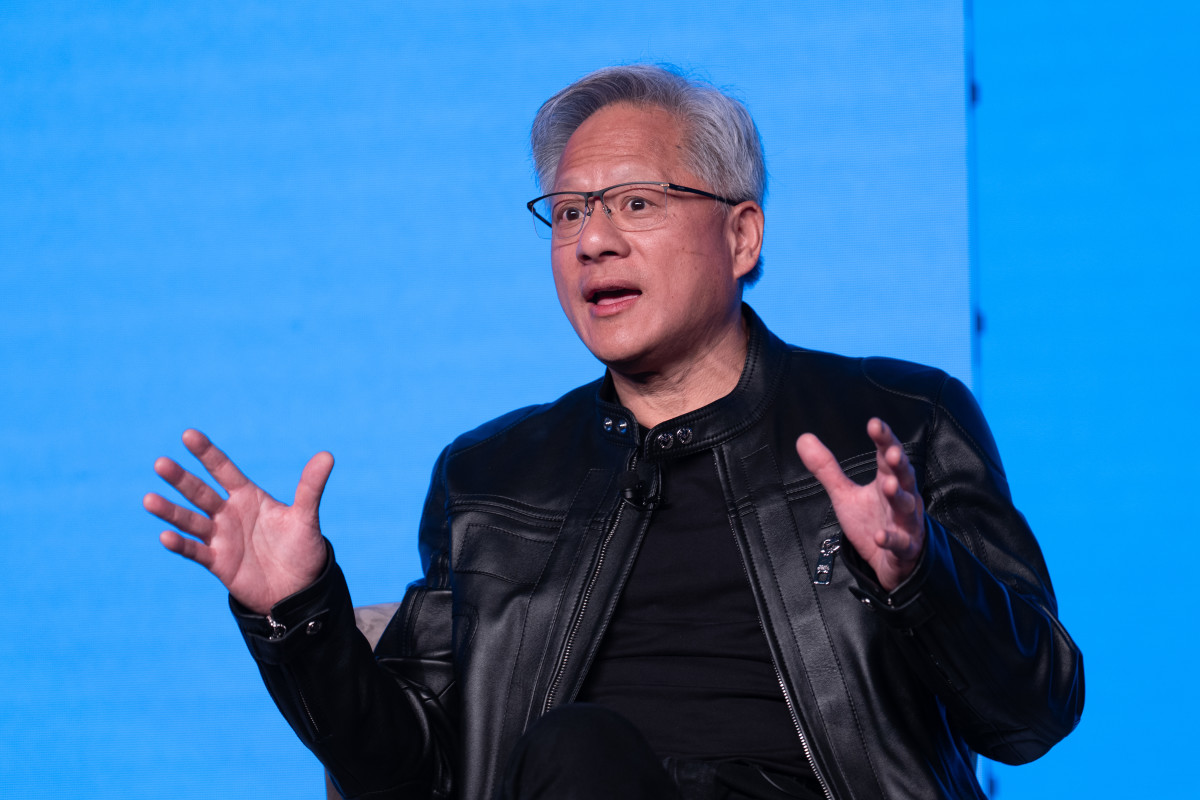

Comments from Nvidia CEO highlight why Taiwan Semiconductor remains pivotal amid rising AI bubble concerns.Photo by PATRICK T. FALLON on Getty Images

Huang said in a Time interview that the reshoring initiatives from the U.S. and other countries have more to do with insurance than with substitution.

In doing so, he hailed Taiwan as being structurally central to the development of advanced computing over the next several years.

For perspective, the Semiconductor Industry Association’s report from July last year said that an incredible 100+ projects in 28 states had been announced, totaling over half a trillion dollars in private investment, with U.S. chip capacity expected to triple by 2032.

More Nvidia:

That view lands squarely on TSMC, which is clearly at the center of Nvidia’s latest chips and the bulk of the AI supply chain.

Huang said that Taiwan’s advantage isn’t just linked to cutting-edge nodes, but spearheaded by a potent ecosystem of suppliers, packaging, talent, and speed.

That reality reinforces TSMC’s robust positioning as a critical backbone of the AI buildout, having less to do with the near-term cycle noise or bubble-related debates.

Fears about the AI bubble are growing louder as spending numbers surge and stock valuations skyrocket.

For perspective, Nvidia stock boasts a market cap of about $4.5 trillion, having added more than $1 trillion since the start of 2025.

Despite those jaw-dropping figures, Huang feels investors are looking at it the wrong way. He says what looks like excess is actually the early phase of a deeper shift in computing itself.

Clearly, AI spending is enormous, which can be seen from the latest capex figures from the Big 3 hyperscalers:

Amazon (AWS): CFO Brian Olsavsky said the tech giant expects full-year 2025 capex of nearly $125 billion (and higher in 2026), largely due to AI projects, Reuters reported.

Microsoft (Azure): Microsoft reported nearly $35 billion in capex in its fiscal Q1 2026, according to Reuters, warning that spending will continue rising as it builds AI data-center capacity.

Alphabet (Google Cloud): Alphabet bumped 2025 capex guidance to a whopping $91 billion to $93 billion, linked to AI/cloud demand. (Source:Reuters)

Additionally, Huang describes AI as a wholesale shift from general-purpose computing to accelerated computing, spearheaded by AI agents, models, and applications that are layered above that foundation.

Additionally, Huang pushed back on the concerns that Nvidia’s ecosystem investing creates some systemic risk.

Given the current dynamics, TSMC controls the bottlenecks in the AI supply chain, and that rare pricing power is showing its fundamentals.

As of Q3 2025, HBM made up a massive 57% of sales, with its cutting-edge 3nm nodes at 23% of wafer sales only a few quarters into ramp.

Also, as we witness a ramp-up in 2nm wafer production soon, and them being priced over $30,000 along with 5%–10% hikes on sub-5nm nodes, customers like Nvidia and Apple have little choice but to pay.

Related: Top analyst drops eye-popping price target on ASML stock

This story was originally published by TheStreet on Jan 11, 2026, where it first appeared in the Technology section. Add TheStreet as a Preferred Source by clicking here.