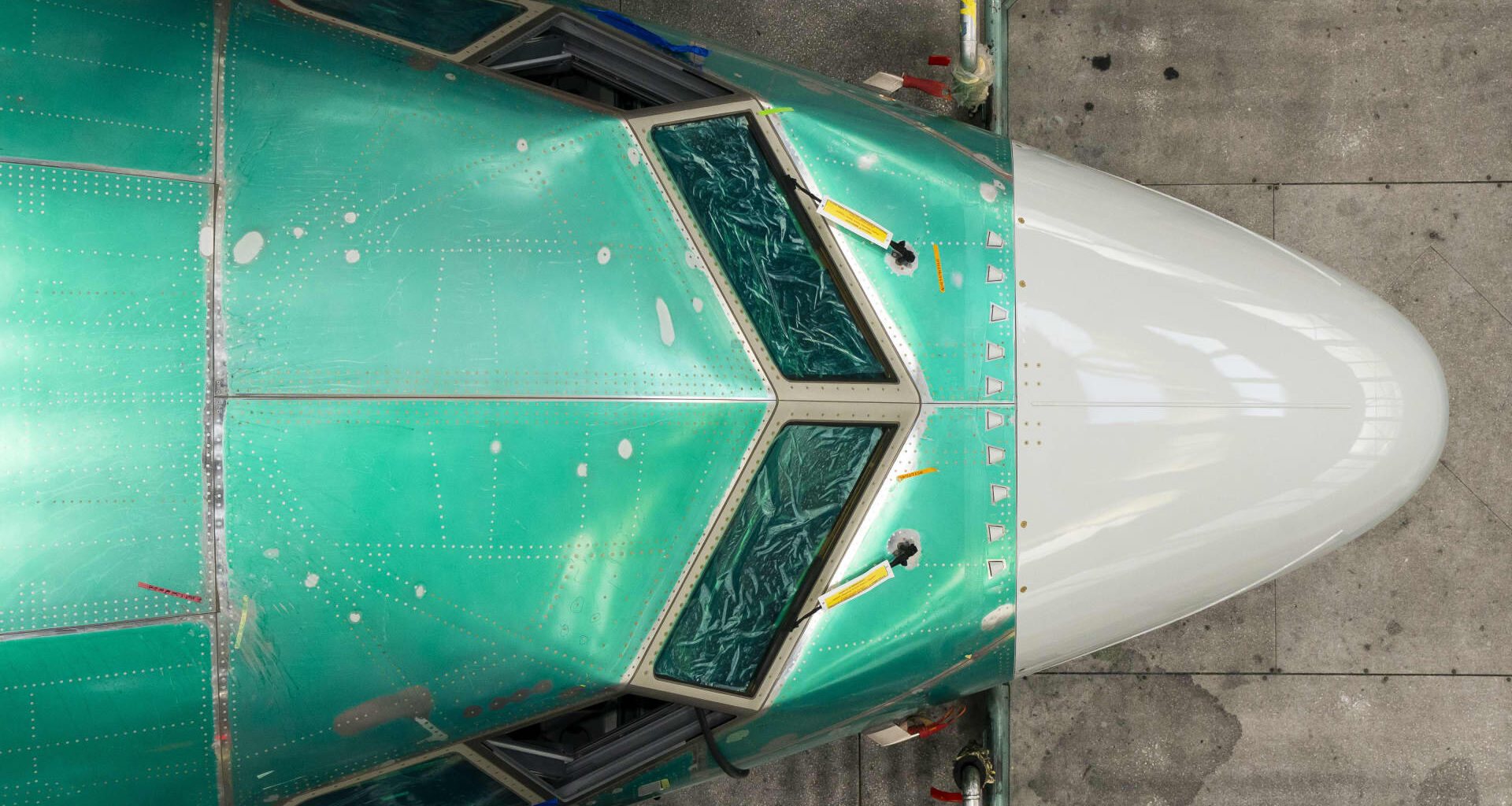

Every weekday, the CNBC Investing Club with Jim Cramer holds a “Morning Meeting” livestream at 10:20 a.m. ET. Here’s a recap of Tuesday ‘s key moments. 1. The S & P 500 and Dow are down on Tuesday from the previous session’s record closing highs. Investors are digesting JPMorgan’s latest earnings along with December’s inflation reading, which came in just below expectations. This follows Monday’s notable rebound, in which the market shrugged off the Justice Department’s criminal investigation into Federal Reserve Chair Jerome Powell. Separately, President Donald Trump said any country conducting business with Iran will face a 25% tariff. “China’s a big importer of crude from Iran, so an additional 25% tariff on them could have some implications for a lot of multinationals,” said Jeff Marks, director of portfolio analysis for the Club. 2. Microsoft announced a new five-point plan aimed at offsetting the costs of powering AI data centers in local communities. The company pledged to replenish more water than it uses, expand the local tax base in the areas where its data centers are located, create jobs, invest in local AI training, and provide greater transparency. The news comes as power bills across the U.S. rise amid data center buildouts. Shares of Microsoft are down over 1%. “As a whole, we are seeing this continued weakness across the Mag Seven as the market tries to broaden out in other areas,” said Marks, noting Amazon and Apple as exceptions. 3. Boeing shares hit a new 52-week intraday high of $245.85. This comes amid reports that the company outsold its European rival Airbus last year for the first time since 2018. The plane maker also received two new orders. Delta ordered up to 60 Boeing 787 Dreamliners, with deliveries expected to start in 2031, and Aviation Capital Group ordered 50 Boeing 737 MAX aircraft, with deliveries scheduled from 2032 to 2033. Separately, a Citi analyst raised its price target on Boeing to $270 from $265 a piece. Boeing’s stock “is starting to look a little bit overbought to me,” said Marks, citing the strong rally over the past three months. (Jim Cramer’s Charitable Trust is long BA, MSFT. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.