Ramsey invests only in his business, paid-for real estate, and mutual funds while avoiding single stocks and Bitcoin.

Peter Lynch grew Fidelity Magellan from $20M to $14B AUM with 29% annual returns from 1977 to 1990.

A rancher Ramsey knows is worth $200M primarily by investing in farmland within his area of expertise.

A recent study identified one single habit that doubled Americans’ retirement savings and moved retirement from dream, to reality. Read more here.

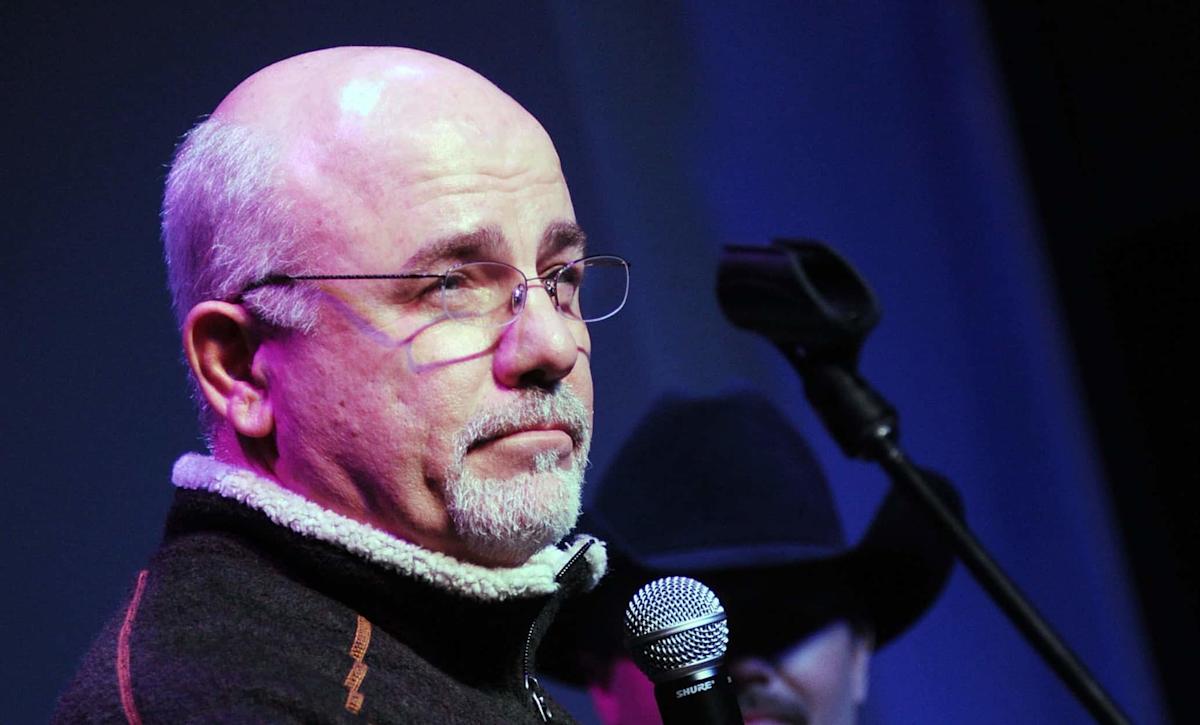

Financial expert Dave Ramsey is known for his ability to cut through the noise surrounding how ordinary, everyday people can build wealth.

On an episode from his “The Ramsey Show” podcast, Ramsey argues that the path to financial success isn’t shrouded in mystery or complexity. He says too many people think the rich are wealthy because they have some secrets they use to get that way. But Ramsey says, “well let me tell you what the secrets of the rich are: they’re not a secret.” Rather, what they do is grounded in simple common sense because they focus on what they understand.

24/7 Wall St. · 24/7 Wall St.

Ramsey uses the example of a rancher he knows who is worth $200 million. He doesn’t do anything special. Instead he invests primarily in farmland, his area of expertise.

It illustrates that wealth building isn’t about chasing the latest trends or complex financial instruments; it’s about investing in what you know and are comfortable with.

Ramsey emphasizes that investing in things you understand is paramount and cautions against chasing “cool” investment opportunities, especially those recommended by friends or acquaintances who may not have the expertise to guide you.

In particular, he noted the infamous Bernie Madoff Ponzi scheme was able to draw in so many people because they thought they were getting in on a some super secret scheme only available to select individuals to make money, but it was just the same old fraud people have used forever.

It serves as a stark reminder of the dangers of blindly following advice from someone who seems “sophisticated” but lacks transparency.

Ramsey advocates for a straightforward approach to investing. He says it is okay, even preferable, to use the KISS principle. He uses the “keep it simple stupid” method himself.

The finance guru says he sticks to just three core investments: his business, paid-for real estate, and mutual funds. He avoids single stocks, gold, Bitcoin, and other speculative investments, emphasizing that “cool” doesn’t equate to success.

Story Continues

Ramsey is dismissive of the allure of complex financial strategies like limited family partnerships and double backflip trusts, calling them “crap.” He stresses that simplicity and clarity are essential for sound financial decision-making.

While I think stock investing is a perfectly valid approach you can pursue via the KISS principle, Ramsey’s advice is very reminiscent of that given by investing legend Peter Lynch who recommended investors buy what they know.

Lynch took Fidelity Magellan from $20 million in assets under management (AUM) in 1977 to $14 billion in AUM in 1990 when he retired, a better than 29% annual average return. That means had you invested $10,000 in a stock, it would have turned into $280,000 13 years later.

Of course, Lynch didn’t suggest just blindly buying every company with a product you put into your shopping cart, but it is a good place to begin. You still needed to do due diligence on the stocks.

I’m also pretty certain you wouldn’t find Lynch buying cryptocurrencies, NFTs, or other arcane asset classes today. Most people really don’t understand the crypto world and they are constantly having the rug pulled on them because they are buying into coins created by their favorite social media influencers.

Yet like Madoff before them who used an old con, these people are operating old pump-and-dump schemes to fleece their followers.

While I’m not a financial advisor, so these are just my opinions, but Ramsey’s message seems very clear: building wealth is not about chasing secrets, getting an inside scoop, or imitating cool influencers. It is about understanding your finances, investing in what you know, and sticking to a simple, well-defined plan.

Most Americans drastically underestimate how much they need to retire and overestimate how prepared they are. But data shows that people with one habit have more than double the savings of those who don’t.

And no, it’s got nothing to do with increasing your income, savings, clipping coupons, or even cutting back on your lifestyle. It’s much more straightforward (and powerful) than any of that. Frankly, it’s shocking more people don’t adopt the habit given how easy it is.