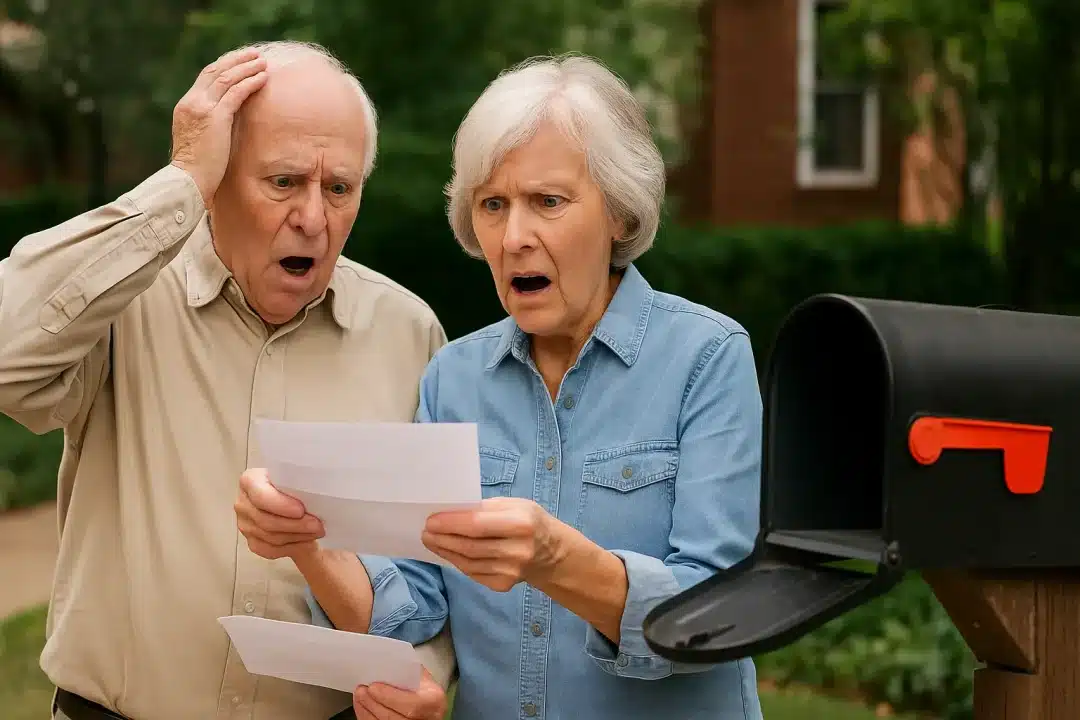

Millions of Social Security recipients are receiving smaller checks this summer—and many are just now finding out why.

Whether it’s due to increased Medicare premiums, higher-than-expected income, or repayment of prior overpayments, beneficiaries across the country are reporting surprising reductions to their monthly deposits.

The Social Security Administration (SSA) says it’s part of routine benefits administration—but for retirees on fixed incomes, the impact feels anything but routine.

Why Are Social Security Payments Being Reduced?

There are several reasons why your Social Security check might be smaller this month:

Medicare Part B or D Premium Increases: If you’re enrolled in Medicare, the cost of your premiums is automatically deducted from your Social Security check. When premiums go up, your net benefit drops.Withholding for Taxes: Beneficiaries who choose to withhold federal taxes from their Social Security payments may see changes in their net benefit if tax rates or filing status shifts.Overpayment Recovery: The SSA has stepped up efforts to recover overpayments, sometimes years after the original error. In many cases, beneficiaries are receiving reduced checks—or no check at all—until the debt is repaid.Exceeding Income Thresholds: If you’re receiving Social Security and still working or collecting other income, your benefit could be reduced or subject to the Retirement Earnings Test.

A Real-Life Impact on Retirees

For many seniors, the change is alarming. A $30–$100 reduction might not seem like much, but when every dollar counts, it can affect everything from prescription coverage to grocery bills.

Retired workers are not always notified in advance of the deduction. Some discover it only when their deposit is lower than expected or when checking their Social Security statement online.

How to Check If You’re Affected

If your payment is less than usual, take the following steps:

Review your Social Security statement via SSA.gov or the My Social Security portal.Check for changes in Medicare premiums or tax withholding elections.Look for a notice of overpayment from the SSA, which may have been mailed or sent electronically.Confirm your reported earnings, especially if you’re still working part-time or seasonally.Can You Dispute a Payment Reduction?

Yes. If the SSA claims you’ve been overpaid or made an error in calculating your benefit, you have the right to appeal. You can:

Request a reconsideration of the SSA’s decision.Apply for a waiver if the overpayment wasn’t your fault and repaying it would cause hardship.Set up a repayment plan instead of losing your entire check.How to Avoid Future Surprises

The best way to stay ahead of future reductions is to be proactive:

Monitor your income and earnings.Update your SSA profile regularly.Watch for Medicare premium changes each fall.Read every piece of mail and email from the SSA—even if it doesn’t look urgent.Bottom Line

If your Social Security check is smaller this month, you’re not alone. But you can find out why—and in some cases, fight back. Stay connected to your SSA account, and seek help from a financial advisor or benefits counselor if you’re unsure what steps to take next.

Stay informed and plan ahead. Social Security remains a lifeline for over 71 million Americans — knowing your payment dates and any upcoming changes is key to staying financially secure.

If you’re unsure about your benefits or need personalized guidance, visit SSA.gov or call 1-800-772-1213.

📌 RELATED READS:

Get the latest headlines delivered to your inbox each morning. Sign up for our Morning Edition to start your day. FL1 on the Go! Download the free FingerLakes1.com App for iOS (iPhone, iPad).

This content is brought to you by the FingerLakes1.com Team. Support our mission by visiting www.patreon.com/fl1 or learn how you send us your local content here.