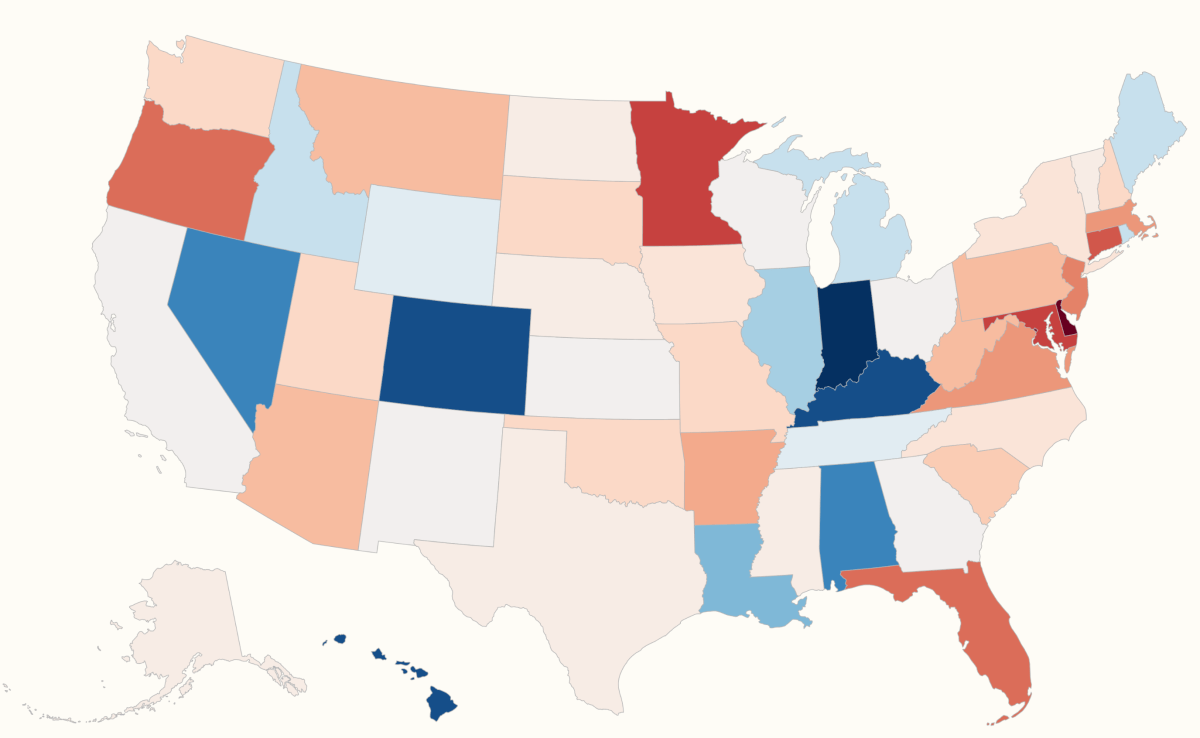

While many analysts consider the U.S. labor market to be going through a downturn, the reality is not uniform—with certain states seeing their unemployment rates improve, and others experiencing sizeable increases.

According to preliminary figures released by the Department of Labor’s Bureau of Labor Statistics (BLS) on Tuesday, among the 50 states and Washington, D.C., unemployment fell in eight month-over-month in December, increased in 21, and remained flat in 22.

Why It Matters

Months of weak hiring have fueled fears that the U.S. labor market is in a prolonged slowdown, with surveys also charting widespread unease about its underlying strength.

While many are forecasting that current conditions will persist in 2026—alongside the “low hire, low fire” trend diagnosed by Federal Reserve Chair Jerome Powell last year—some say the 2025 surge in job cut announcements could upset this fragile equilibrium and push unemployment sharply higher in 2026.

What To Know

According to the agency’s most recent jobs report, the nationwide unemployment rate dipped to 4.4 percent in December from a revised reading of 4.5 percent for November. The economy added 50,000 jobs during the month, slightly below November’s 56,000 total and consensus expectations of a 60,000 gain.

But despite the dip, unemployment remains 0.4 percent higher than last January, and months of sluggish—and occasionally negative hiring—resulted in 2025 proving the weakest year for job growth since 2020. In the entirety of 2025, there was no single month when employers added more than 168,000 jobs—the average monthly increase in 2024.

The BLS notes that its new figures may be revised when the reading for January is released in early February, but these provide a broad view of how employment conditions are changing across the U.S.

Hawaii and South Dakota had the lowest rate rates in December at 2.2 percent each, the former seeing a 0.8-point improvement compared to a year prior.

Washington, D.C., meanwhile, boasted the highest unemployment rate in the country at 6.7 percent, thanks to a 1.4-percent increase over the past 12 months. D.C. is home to most of the nation’s government agencies and a plurality of its federal workers.

According to the outplacement firm Challenger, Gray & Christmas in its year-end report, government jobs led all industries in layoff announcements in 2025 at 308,167—up 703 percent year over year—and this surge was attributed almost entirely to the actions of the now-dissolved Department of Government Efficiency (DOGE).

The next highest rates were in California and New Jersey at 5.5 percent and 5.4 percent, respectively.

In terms of year-over changes, Delaware led with a 1.6 percentage point jump, followed by D.C. at 1.4 percent, with both Maryland and Minnesota seeing a 1.1 percentage point increase. Meanwhile, Indiana saw the greatest improvements—its rate falling 0.9 percent—followed by Colorado, Hawaii and Kentucky with 0.8 percent drops.

What People Are Saying

Chris Zaccarelli, chief investment officer for Northlight Asset Management, wrote in a press note following December’s employment report: “In essence, we are seeing validation of the idea that job creation is very weak and companies have been letting workers go at a slow pace. There aren’t any red flashing lights indicating an imminent recession, but there are plenty of yellow warning lights flashing and there is the risk that we could approach stall speed.”

Navy Federal Credit Union chief economist Heather Long, quoted in CNBC: “It’s fair to say that 2025 was a hiring recession in the United States. The United States is experiencing a jobless boom where growth is strong, but hiring is not. It’s a great scenario for Wall Street, but an uneasy feeling on Main Street.”

Mark Zandi, chief economist at Moody’s Analytics, told Newsweek earlier this month: “The weaker job market expected in calendar year 2026 compared with 2025 is due to the Trump administration’s highly restrictive immigration policies and the resulting hit to labor supply, and the continued fallout on labor demand from the tariffs and increased productivity gains from the adoption of AI by more businesses.”

What Happens Next

Economists like Zandi have warned that many of the defining characteristics of 2025’s labor market—weak hiring and elevated unemployment—will persist in 2026, with surveys also capturing pessimism among many Americans about their employment prospects in the year ahead.