NBS, Bloomberg

(Bloomberg) — The surge in the euro is set to loom large over the European Central Bank’s first policy meeting of the year.

Euro-zone inflation is at risk of being pushed further below target by a rally in the common currency, raising uncomfortable questions for officials convening in Frankfurt.

Most Read from Bloomberg

While the ECB hasn’t changed rates since June and no movement is expected on Thursday, there’s no shortage of things to talk about. Since policymakers last set rates on Dec. 18, there have been attacks on the Federal Reserve, new tariff threats by the US, and most recently, a dramatic slide in the dollar.

The greenback’s weakness — fueled by President Donald Trump’s comments that he isn’t concerned about it — briefly pushed the euro through $1.20, to its strongest level since 2021.

That hasn’t gone unnoticed by ECB officials. Bank of France Governor Francois Villeroy de Galhau said that the euro is “one of the factors that will guide our monetary policy,” while Austrian central-bank chief Martin Kocher stated that the currency will be monitored closely for additional gains.

Inflation in the bloc already dipped just below the 2% mark in December and a further slowdown is expected. Economists predict a reading of 1.7% for January when data are released on Wednesday.

While the ECB forecasts that price growth will settle at its goal over the medium term without more action, a further appreciation of the euro could reopen the debate on additional cuts.

What Bloomberg Economics Says:

“Europe has had a geopolitically turbulent start to the year, and the ECB will likely continue to focus on the forest instead of the trees. That means it will probably shrug off the recent US trade dispute linked to Greenland, the slight dip of inflation below its 2% target and the appreciation of the euro. However, these developments underscore that downside risks to the economic outlook are building.”

—David Powell and Simona Delle Chiaie, economists. For full preview, click here

The ECB, which also publishes quarterly surveys on bank lending and professional forecasters’ economic views in the coming week, is one of a dozen central banks due to set rates. The UK, Mexico and the Czech Republic are also expected to hold, while India and Poland may cut. Australia’s RBA might become the first major central bank to hike this year.

Click here for what happened in the past week, and below is our wrap of what’s coming up in the global economy.

US and Canada

In the US, results of the January jobs report will be juxtaposed against Fed policymakers’ views that the labor market is stabilizing after a sizable downshift in hiring during the second half of 2025. Payrolls probably increased by 68,000 — which would be the most in four months — based on the median projection in a Bloomberg survey of economists ahead of Friday’s scheduled publication.

The jobless rate is seen unchanged at 4.4%, just below the four-year high of 4.5% reached in November. It’s unclear whether the Bureau of Labor Statistics may delay the release of the report because of the federal shutdown that just kicked in — even if it’s likely to be short.

Government data releases only recently got back on schedule after the record-long shutdown that ended in November, which delayed the publication of most data and saw some canceled completely.

In addition to the usual monthly payrolls and unemployment data, the report also includes revisions to annual job growth, which are expected to show a substantial markdown in the pace of hiring. A preliminary estimate suggested job growth for the year through March 2025 would slashed by a record 911,000.

On Wednesday, US central bankers kept rates unchanged after three straight cuts and noted in their statement that “the unemployment rate has shown some signs of stabilization.” Trump has been extremely critical of the Fed for not delivering much lower borrowing costs that he says would provide additional fuel for the economy.

WATCH: Michael McKee examines Warsh’s career on Wall Street and his positions on monetary policy while serving on the central bank’s Board of Governors from 2006 to 2011.Source: Bloomberg

Long frustrated by Jerome Powell’s stewardship of the Fed, Trump on Friday announced that he’s replacing the Fed chair with former Kevin Warsh. Warsh aligned himself with the president in 2025 by arguing publicly for lower rates, going against his reputation as an inflation hawk, including from his previous stint as a Fed governor.

Other labor-related releases in the coming week include December job openings as well as January employment indexes contained in the Institute for Supply Management’s surveys of manufacturers and service providers. The University of Michigan’s initial February consumer sentiment report on Friday will offer a fresh glimpse of Americans’ perceptions of the job market.

Turning north, Canada’s January jobs report is likely to underscore ongoing labor-market weakness, despite stronger-than-expected hiring in late 2025. Unemployment has climbed back to 6.8%, and the Bank of Canada says youth joblessness remains elevated while firms’ hiring intentions are soft.

Governor Tiff Macklem — fresh off declaring that rules-based trade with the US is “over” — will outline the forces reshaping Canada’s economy during a speech in Toronto on Thursday.

Asia

The week kicked off with India’s budget presentation, with Finance Minister Nirmala Sitharaman on Sunday outlining several new programs to boost manufacturing and infrastructure to support an economy grappling with global risks and steep US tariffs.

In central banking, Asia may see a pair of institutions adjusting policy in opposite directions. Traders have increased bets that the Reserve Bank of Australia will raise its cash rate target to 3.85% on Tuesday after a key inflation gauge registered 3.4% year-on-year growth in the fourth quarter, above the RBA’s 2-3% range.

There’s at least a chance India’s Reserve Bank will trim its repurchase rate on Friday after consumer price gains stayed below the midpoint of the RBI’s inflation target for an 11th straight month in December — although not all agree. A strong autumn harvest suggests food prices will stay deflationary for some time, according to Bloomberg Economics.

The Bank of Japan’s summary of opinions from its January meeting, due on Monday, may shed light on how soon Japan will see its next rate increase.

On the data front, the week gets underway with a Monday round of January manufacturing PMI reports.

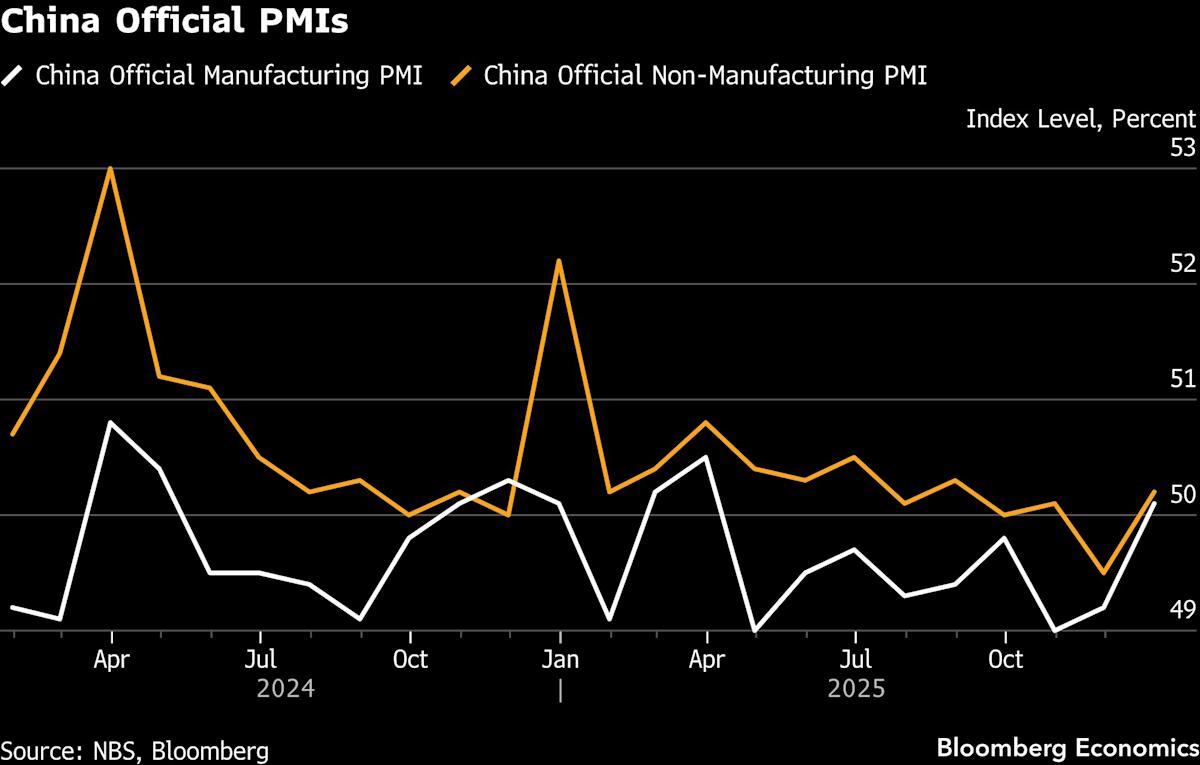

China’s gauge is expected to hold steady at 50, the dividing line between contraction and expansion. Also publishing PMI figures that day are Indonesia, South Korea, Malaysia, the Philippines, Thailand, Taiwan and Vietnam. China’s services and composite PMI indexes follow on Wednesday.

The same day, New Zealand releases fourth-quarter labor statistics, with a focus on the jobless rate after it rose to 5.3%, the highest in nine years, in the previous quarter.

Consumer inflation updates are due during the week from Thailand, Taiwan, Vietnam and South Korea.

In Japan, household spending data on Friday will provide a glimpse into the willingness of the nation’s consumers to spend before voters deliver a verdict on Prime Minister Sanae Takaichi on Sunday. One focus will be food, as recent data have shown the proportion of food spending within overall consumption at a record high.

A weak yen has compounded the pressure by driving up costs of groceries, energy and other imports. While Japan managed to secure breathing space for its currency without intervening in markets last month, any comments by policymakers are in focus. That pushed Prime Minister Sanae Takaichi clarify earlier comments on Sunday.

Trade numbers are also due from Indonesia, Pakistan and Australia. Data for South Korea published Sunday showed exports extended their growth streak in January, underpinned by robust semiconductor demand and an increase in the number of working days from a year earlier because of the effects of a favorable calendar.

Europe, Middle East, Africa

The Bank of England is likely to leave rates on hold at 3.75% on Thursday, as UK officials debate how much further to go in their cutting cycle.

The rate-setters are weighing a faster-than-expected cooling in inflation against surveys pointing to stubbornly high wage growth and a strengthening economy. It will unveil new forecasts that are expected to show inflation falling close to the BOE’s 2% target over the spring, following measures in the Labour government’s recent budget to ease cost-of-living pressures.

The same day, policymakers in Prague are likely to hold rates at 3.5% as they await evidence that inflationary pressures are easing.

A day earlier, Polish officials could resume cuts, while Iceland’s central bank is seen holding off on further reductions until the second quarter.

Rate decisions are also scheduled in Albania, Armenia, Madagascar and Moldova.

Beyond monetary policy, Saudi data on Sunday showed that the economy expanded at the fastest pace in three years in 2025, with the oil sector emerging as a stronger engine of growth under new OPEC+ supply policy.

Turkish numbers on Tuesday are expected to reveal annual inflation easing to about 30% in January from 30.9% a month earlier. The central bank recently slowed the pace of rate cuts amid concerns about a surge in food prices.

Germany’s factory order, industrial production and trade data on Thursday and Friday will be scoured for signs of recovery in the region’s largest economy.

Friday also sees the publication of Swedish inflation, with data predicted to show a slight downtick. Even so, after holding rates on Thursday, Bloomberg Economics expects Riksbank policymakers to stick with that stance, as much of the slowdown reflects temporary tax effects and medium-term risks remain tilted to the upside.

That day also sees Russia’s gross domestic product data for 2025. The Economy Ministry’s September forecast predicted 1% growth, a sharp slowdown from 2024, when heavy state spending on the war effort drove an expansion of 4.3%.

Latin America

Banco Central do Brasil’s January meeting minutes get the week rolling. Keeping the Selic unchanged yet again didn’t surprise, but the overtly explicit guidance — to expect a cut in March — was a bit of an eye-opener.

At the same time, Brazil watchers hoping for more on BCB’s potential rate path may be disappointed. Industrial production and monthly trade data are also due out from Brazil.

In Chile, December GDP-proxy results should show the economy bouncing back from November’s weak results on the back of rising copper prices, while the peso’s gains help curb inflationary pressures.

As if on cue, Chile’s January consumer prices report may see inflation actually drop below the 3% target while the minutes of the central bank’s dovish rate hold in December may help pin down the timing of the next cut.

In LatAm’s No. 2 economy, Mexico’s central bank has done a fairly thorough job of telegraphing clear intent to pause a 12-meeting, 400 basis-point easing cycle at Thursday’s rate decision.

Slack in the economy is a concern, though potentially volatile US trade policies and an upcoming review of Mexico’s free trade accord with the US and Canada argue for some caution.

The central theme of three separate reports from Colombia will be inflation — which looks to be a major headache for policymakers now and for the foreseeable future.

Colombia’s BanRep posts minutes on Wednesday of its shock move to deliver a full-point rate hike, to 10.25%, as a double-digit minimum wage increase is set to heat up the economy. It will also issue its quarterly monetary policy report.

The nation’s January consumer prices report on Friday should underscore those concerns: the early consensus sees monthly headline and core prints of better than 1%, with the annual headline rate pushing up over 5.4% from 5.1%.

–With assistance from Robert Jameson, Laura Dhillon Kane, Kati Pohjanpalo, Tom Rees, Greg Sullivan, Monique Vanek, Beril Akman, Patrick Donahue, Mark Evans, Brian Fowler and Vince Golle.

(Updates with yen in Asia section, Saudi Arabia in EMEA section)

Most Read from Bloomberg Businessweek

©2026 Bloomberg L.P.