LAS VEGAS (FOX5) — From casual gamblers to professional gamblers, plenty of people are concerned over changes to gambling deductions and new taxes passed by Congress in the Big Beautiful Bill.

Derek Stevens, the owner of Circa Resort & Casino, has been vocal on social media about the looming ripple effect on Nevada’s primary industry and countless hospitality jobs: added taxes could discourage professional or casual play in the U.S.

“It’s going to significantly reduce revenues to the state of Nevada,” Stevens told FOX5. “This is something that that a lot of people don’t understand how impactful it will be… No one wants to pay tax on phantom income. You could owe on income that you never received. That’s really not the way the way things ought to be set up,” he said.

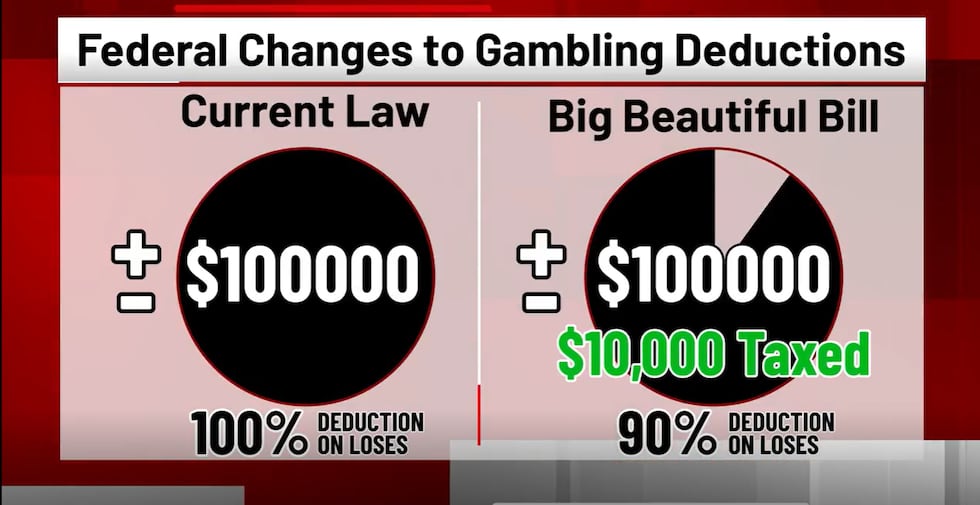

Currently, gamblers can deduct 100% of their losses against their winnings.

In the below example, if a player loses $100,000 and then wins $100,000 in a “wash,” the player can claim 100% of their losses and owe nothing to the IRS.

The Big Beautiful Bill decreases the loss deduction to 90%.(FOX5)

The Big Beautiful Bill decreases the loss deduction to 90%.(FOX5)

However, the Big Beautiful Bill decreases the loss deduction to 90%.

In the same scenario, if a player loses $100,000 and then wins $100,000, the player can only deduct 90% of their losses, or $90,000; the remaining $10,000 of losses becomes subject to federal taxes.

If you win a certain threshold, casinos report your win to the IRS; in slot machines, a single spin of $1,200 and more triggers the need for a W-2 G. For sports betting, it would require winnings from a 300-1 wager.

Gary Kondler, a CPA from Kondler & Associates has had numerous frantic calls from clients for days. He illustrates a less-expensive scenario:

“For the player that goes to Bingo, has $10,000 on that form and they come to me and they say ‘Gary, dead-break even, $0 loss, $0 gain that client is now going to have to pay tax on $1,000,” Kondler said.

Kondler warns of other impacts during tax filing.

“What a lot of people also need to start to understand is that not only are they going to go and pay tax, because they drew up W-2 G’s and deducted them as losses through their return, it also affected their standard deduction,” he said.

The changes have players at the World Series of Poker very worried, Kondler said.

“Poker players are pretty freaked out right now. Obviously, a lot of these players are coming in with big buy-ins, big cash-outs. Not only is it for my U.S. clients, but every person down here today at the main event. There’s also international clients who are taxed 30% when they go and cash out at the cage,” he said.

Stevens worries changes will drive high-rollers overseas or underground.

“For Circa Sports, very conservatively, we think we’re going to drop 20% of our handle could be potentially 40% of our handle. That’s going to affect the states that we’re in. I think a lot of people just don’t really understand that forcing people to bet illegally or bet offshore is not a good long-term solution,” Stevens said.

Congresswoman Dina Titus has been efforting the Fair Bet Act to restore the 100% deduction, updating social media followers on bipartisan efforts. “Now it’s time to eliminate this unfair tax on phantom income,” she posted on X.

Thursday, an effort in the Senate by Sen. Catherine Cortez Masto for her Full House Act to restore full deductions was blocked. “Their tax hike is a bad deal for Nevada, and I’ll keep working to repeal it,” she said on X.

Copyright 2025 KVVU. All rights reserved.