Tesla has approved the award of 96 million shares — worth about $29 billion — to its chief executive, Elon Musk.

As long as Musk remains the company’s chief executive, the shares will vest in two years at which point he will be able to buy them for $23.34 each — a fraction of their current value.

This mirrors the structure of his 2018 compensation, which was voided last year by a Delaware court which decided it was unfair to shareholders.

Tesla shares are up 2.1 per cent to $309.07 in pre-market trading in New York after the news. Tesla is at a turning point as Musk, its largest shareholder with a 13 per cent stake, shifts focus from a promised affordable electric vehicle platform to robotaxis and humanoid robots, positioning the company as more of an AI and robotics company rather than a carmaker.

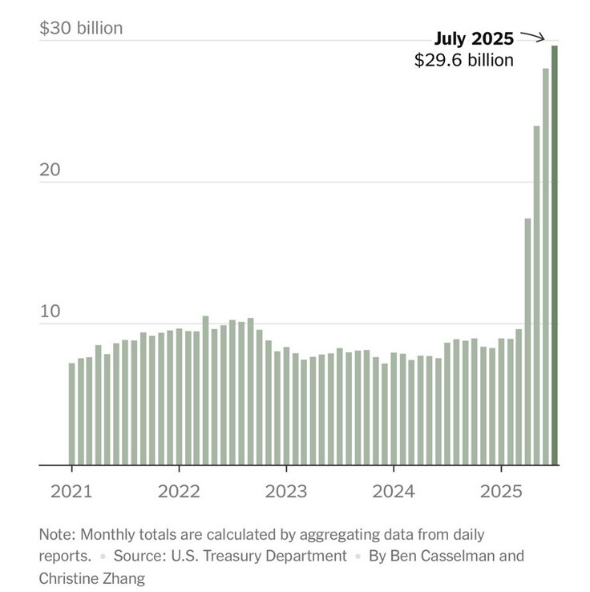

US tariff revenue rises in July

President Trump has posted a graph on his Truth Social site named “Tariff revenue rose in July”. It shows monthly government revenue from customs duties and certain excise taxes.

He made no comment.

US tariff revenue rose in July

Redress scheme ‘completely impractical’, lenders say

The car finance compensation scheme that could end up costing lenders as much as £18 billion is “completely impractical”, the industry has warned.

Speaking on BBC Radio 4’s Today programme, Stephen Haddrill, the director general of the Finance & Leasing Association, said that having the redress scheme cover loans going back as far as 2007 “is not the right thing to do”.

“I just think that’s completely impractical,” he said. “It’s not just firms that don’t have the details about contracts back then; customers don’t either. If we’re going to have to take careful decisions about who gets redress and who doesn’t, you need that information.”

The potential outlay is much lower than the £44 billion analysts were fearful this mis-selling saga could end up costing the sector. Lenders’ shares are still markedly higher on Monday morning: Lloyds Banking Group is up 7.6 per cent to 81½p; Close Brothers has risen 21.9 per cent to 484¾p; and S&U shares have gained 13.3 per cent to £19.71.

EU-US trade deal hits confidence

Investors are not impressed by the European Union’s tariff deal with the US, data from the Sentix economic index showed.

The survey of 1,050 investors, conducted from July 31 to August 2, found a decline in the current economic situation, and also in future expectations.

According to the latest report: “The negative factors clearly outweigh the positive ones for the global economy. The EU and Switzerland are being punished severely. The US and Donald Trump may feel like winners in the short term, but falling expectations here too indicate that this type of trade policy will mainly produce losers.”

Please enable cookies and other technologies to view this content. You can update your cookies preferences any time using privacy manager.

Enable cookiesAllow cookies onceGold dips after rise on Friday

Gold edged lower as investors booked profits after a sharp rise in the previous session driven by weaker-than-expected US jobs data that increased hopes of a US Federal Reserve interest rate cut next month.

Spot gold dipped 0.1 per cent to $3,358.78 an ounce after rising by more than 2 per cent on Friday.

The rise on Friday was helped by a sharp drop in the dollar against a basket of currencies after jobs data showed that non-farm jobs increased by just 73,000 in July, well below forecasts. Markets are now pricing in an 81 per cent chance of a Fed rate cut in September.

Gold has been trading about $3,000 an ounce since April.

Clarkson profits fall amid freight rate slide

Clarkson’s results were slightly better than investors and analysts had expected

JOE GIDDENS/PA

Half-year profits at Clarkson, the shipping broker, fell by a quarter as the “shifting tariff environment” brought about a softening of freight rates.

The FTSE 250 group turned a pre-tax profit of £37.5 million on revenues of £297.8 million in the six months to the end of June, down from a £50.1 million profit and revenues of £310.1 million in the same period of 2024.

The results were slightly better than investors and analysts had expected. Andi Case, the chief executive, called it a “good performance … in what remains a highly complex global environment”.

Clarkson shares are up 241.5p, or 7.1 per cent, on Monday morning to £36.57, although they remain almost a fifth of where they were before President Trump first started talking about his “Liberation Day” tariffs.

Wizz Air passenger numbers rise

The budget airline focused on central and eastern Europe carried 6.35 million passengers in July, a year-on-year increase of 6.8 per cent.

However, Wizz Air’s load factor fell to 92.8 per cent from 93.8 in July last year due to the geopolitical crisis in the Middle East and the late loading of Tel Aviv cancellation-driven replacements.

The London-quoted, Budapest-based budget carrier last month pulled its services to Abu Dhabi, ending its ambitions to expand east into the Gulf to service the burgeoning budget aviation market into and out of India. It blamed “supply chain constraints, geopolitical instability and limited market access” for the decision.

Shares in Wizz Air rose 1 per cent, or 13p, to £12.66. At the end of last week Barclays upgraded the budget carrier to “overweight”, meaning it expects the stock to outperform its sector.

Swatch chief urges talks to reduce 39% tariff

Swatch, the Swiss watch company

EDDY RISCH/AP

Nick Hayek, the Swatch chief executive, has called on President Keller-Sutter of Switzerland to meet President Trump to negotiate a better deal than the 39 per cent tariffs announced on Swiss imports into the United States.

Hayek said the Swiss president “should take the plane and go to Washington”, adding: “It’s not doomsday. Of course a settlement can be reached. Why would Donald Trump say tariffs are coming on August 1 and not implement them until the 7th? The door is always open.”

The Swiss market index opened 1.8 per cent lower in the first day of trading since the tariff announcement was made. Markets were closed on Friday for the Swiss national day.

Richemont, the Swiss luxury goods company, and Swatch, which have major markets in the US, saw their shares open down 3 per cent. Roche and Novartis, the pharmaceutical companies, were less affected, with their stocks slipping 2.29 per cent and 1.1 per cent respectively. Exports of pharmaceuticals were not included in the tariffs announced on Friday.

Auction Technology cuts profit outlook

Auction Technology Group has lowered its profit outlook for the year on the back of a change in revenue mix.

The FTSE 250 company, which enables auction houses to conduct sales online, warned that its profit margin would be between 42 and 43 per cent this year, down from previous guidance of 45 to 46 per cent.

The company’s update came as it announced an $85 million acquisition of Chairish, an online marketplace for vintage furniture, decor and art, which is expected to generate operational synergies of about £8 million. Chairish is expected to deliver double-digit revenue growth and achieve adjusted profit margins of about 30 per cent in the medium term, the company said.

Shares in Auction Technology dropped 103p, or 21 per cent, to 377p.

FTSE 100 rises after last week’s decline

London’s leading index edged higher on Monday morning after closing down on Friday following weak US jobs data that showed the economy created fewer jobs than expected in July while the unemployment rate rose.

The FTSE 100 rose 0.29 per cent, or 27 points, to 9,095.50, with Lloyds Banking Group up 5.9 per cent after it said that any further provisioning for car finance compensation above the £1.2 billion it has already set aside is “unlikely to be material”.

Close Brothers, the FTSE 250 bank that had been facing a potentially big car finance compensation bill, jumped 23 per cent after the the financial watchdog set out plans for a redress scheme of up to £18 billion on Sunday. This was far less than expected after the Supreme Court overruled key elements of an earlier judgment that could have put the motor finance industry on the line for compensation payments of more than £30 billion.

A fall in the oil price buoyed IAG, the British Airways, owner while Melrose, the aero-parts maker, and Babcok, the defence company, were also higher.

The fall in the gold price left Fresnillo, the precious metal miner, down. Convatec, the wound care company, dipped after its chief executive took medical leave.

Oil prices dip after Opec+ agrees to increase production

Oil prices fell on Monday after Opec+ agreed to another large production increase in September.

Benchmark Brent crude futures fell 0.2 per cent to $69.49 a barrel after closing about $2 a barrel lower on Friday.

Opec+, which includes the Organization of the Petroleum Exporting Countries and its allies, including Russia, agreed on Sunday to raise oil production by 547,000 barrels a day for September.

It is the latest in a series of accelerated output increases aimed at regaining market share. The decision was attributed to a healthy economy and low stockpiles. While the move added to global supply, worries about disruptions in Russian oil shipments to India, a major importer, limited losses.

BP makes oil discovery off Brazil

BP: The oil company has announced an oil and gas discovery at the Bumerangue prospect in the deepwater offshore Brazil. The exploration well is located in the Santos Basin, 218 nautical miles from Rio de Janeiro, in a water depth of 2,372 metres. The well was drilled to a total depth of 5,855 metres.

BP said it planned to increase its global upstream production to 2.3-2.5 million barrels of oil equivalent a day in 2030, with the capacity to increase production out to 2035. Production in 2024 was 2.4 million barrels of oil equivalent. BP expects production to be lower in 2025.

In other corporate news:

Senior: The engineering specialist has reported a 5 per cent rise in revenue to £371 million and a 14 per cent increase in adjusted operating profit to £31.7 million, boosted by a stronger performance from its aerospace division. The £200 million sale of its aerostructures business is on track to completed by the end of the year, the company said.

Clarkson: The shipping broker has reported a sharp fall in first-half profits as it navigates “a highly complex global environment”. Pre-tax profits dropped by a quarter to £37.5 million from £50.1 million in the six months to the end of June. Revenue fell to £297.8 million from £310.1 million.

Convatec: The FTSE 100 wound care company said Karim Bitar, its chief executive, is taking a medical leave of absence from the company. Jonny Mason, the chief financial officer, will become interim chief, and Fiona Ryder, the group financial controller, will take up the role of interim chief financial officer.

Lloyds: extra car finance provisions ‘unlikely to be material’

Individuals could receive payments of almost £950 each as part of a redress scheme

ANNA BARCLAY/GETTY IMAGES

Shares in Lloyds Banking Group, Close Brothers, and other major motor finance providers will be in focus on Monday after the City regulator said on Sunday that it would consult on launching a redress scheme for millions of consumers who bought a vehicle from a dealership that failed to properly disclose commission arrangements.

The scheme, which could cost lenders between £9 billion and £18 billion, should cover car loans dating back to 2007. Individuals could receive payments of almost £950 each.

Lloyds said on Monday morning that while there remained “a number of uncertainties” over provisions it had already made for potential customer redress, any change in the amount set aside was “unlikely to be material” for the lender.

Close Brothers said it looked “forward to engaging with the FCA in respect of the consultation”.

• Lenders in car finance scandal brace for judgment from investors

Metlen starts trading in London

Evangelos Mytilineos, the chairman and chief executive of Metlen

SIMON DAWSON/GETTY IMAGES

The Greek energy and metals group begins trading on the London Stock Exchange on Monday.

Metlen, which was formerly known as Mytilineos Energy and Metals, is building four gas-fired plants across Britain, has completed the Cleve Hill solar park in Kent earlier this month, and is part of the £1 billion consortium building the east coast subsea link.

The company has switched its primary listing from Athens, where it will retain a secondary listing. Metlen will not raise any fresh capital as part of the move.

With a market value of about £5.4 billion, the company is poised for inclusion in the FTSE 100 when the index is reshuffled next month.

Boeing union to strike over pay

A Super Hornet, one of the aircraft made by Boeing in St Louis, on the flight deck of the USS Theodore Roosevelt

HAMAD I MOHAMMED/REUTERS

Union members who assemble Boeing’s fighter jets in the St Louis area have rejected the aircraft maker’s latest contract offer and will go out on strike at midnight on Monday, the International Association of Machinists and Aerospace Workers union said.

The move is bad news for Boeing, amplifying financial pressure on its defence and space division, which accounted for about 30 per cent of revenue in the second quarter.

It will be the first time in nearly 30 years that Boeing’s defence union will halt work at its St Louis-area factories. Its original proposal included a 20 per cent general wage increase over four years and a $5,000 ratification bonus, as well as more vacation time and sick leave.

The union had rejected the offer as insufficient. Boeing said it was disappointed but was ready for the action and had a contingency plan in place.

Nikkei drops on jitters over US economy

The Nikkei 225 dropped 2 per cent at one stage in trading on Monday

AFP

Japanese shares fell by the largest amount in almost four months as concerns mounted over the US economy after Friday’s disappointing jobs data and a potential upheaval in domestic politics. The Nikkei 225 dropped 1.5 per cent and was set for its steepest decline since April 11.

In mainland China, Hong Kong and South Korea, stock markets edged higher on the prospect of US interest rate cuts in September, the one upside to the jobs data in which downward revisions left the three-month average of jobs growth at 35,000 from 231,000 at the start of the year.

Wall Street led global equities lower on Friday as traders dumped stocks and the dollar and bought government bonds after the weak US jobs figure. The FTSE 100 was not immune to sell-off on Friday and snapped a five-week winning streak with a fall of 0.6 per cent over the five days. London’s leading share index is forecast to bounce when trading begins shortly, rising 42 points.