A Labour review could pave the way for Britain to copy other European nations and raise the state pension age to 70.

Dr Suzy Morrissey has been appointed to prepare an independent report as part of the Government’s review of the official retirement age that is due to conclude in 2029.

The expert said she had been asked to ‘make recommendations on a framework’ that ministers can use ‘when considering future state pension age arrangements’.

In her call for evidence, published yesterday, Dr Morrissey said her work was taking place amid the ‘long-term demographic pressures the country faces’.

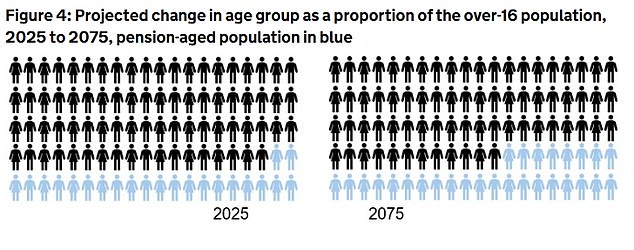

She set out how pensioners are forecast to make up a quarter of the adult population within the next 50 years because of improvements in life expectancy.

Dr Morrissey revealed she would consider factors such as the ‘merits of linking state pension age to life expectancy’ and the ‘role of state pension age in managing the long-term sustainability of the state pension’.

She said she would examine the experience of other countries in using ‘automatic adjustment mechanisms’ for making decisions about the state pension age.

These have been used to link state pension age to life expectancy in various ways across the world, including in Denmark.

Since 2006, Denmark has tied its official retirement age to life expectancy and has revised it every five years. It is currently 67 but will rise to 68 in 2030 and to 69 in 2035.

Earlier this year, it was announced that Denmark would have the highest retirement age in Europe after the country adopted a law raising it to 70 by 2040.

Chancellor Rachel Reeves has said a review into raising the state pension age is needed to ensure the system is ‘sustainable and affordable’

Pensioners are forecast to make up a quarter of the adult population within the next 50 years because of improvements in life expectancy

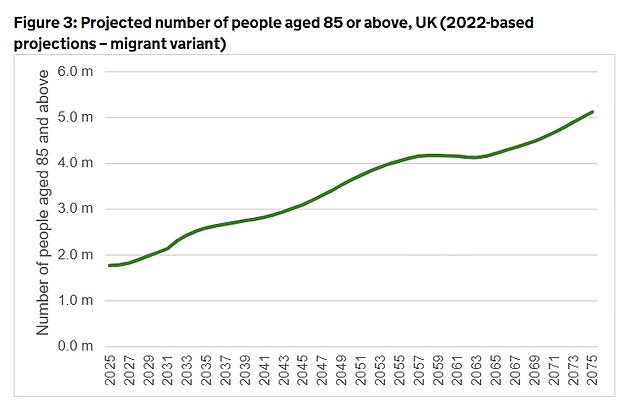

The number of people aged 85 years and over is expected to increase by 189% over the next 50 years, rising from 1.8 million people in 2025 to 5.1 million by 2075

Dr Morrissey’s call for evidence set out how the number of people of state pension age or over in the UK is expected to grow by 55 per cent over the next 50 years, from 12.6 million people in 2025 to 19.5 million people in 2075.

Around one-fifth (22 per cent) of the adult population in the UK are currently over state pension age. But this is expected to increase to 28 per cent in 2075.

The number of people aged 85 years and over is expected to increase by 189 per cent over the next 50 years, rising from 1.8 million people in 2025 to 5.1 million by 2075.

Last month, Chancellor Rachel Reeves said a review into raising the state pension age was needed to ensure the system is ‘sustainable and affordable’.

The Government review is due to report in March 2029 and Ms Reeves said it was ‘right’ to look at the age at which people can receive the state pension as life expectancy increases.

The state pension age is currently 66, rising to 67 by 2028, and the Government is legally required to periodically review the age.

Sir Steve Webb, a former pensions minister and a partner at the consultancy LCP, warned against a ‘completely automatic formula’ for determining the state pension age.

He told the Telegraph: ‘Having a completely automatic formula to move from changes in life expectancy to changes in state pension age could cause chaos for people’s financial planning.

‘Every time the population projections are updated, this could move the dates for pension age changes by up to a decade, which would make it impossible for people to plan for their retirement finances.

‘Having a rigid rule for setting pension ages creates more volatility and uncertainty than an approach, which is more based on judgement and taking into account a wider range of factors.’

David Pye, client consulting director at Broadstone said: ‘The state pension age review’s consideration of AAMs (automatic adjustment mechanisms) highlights how seriously the Government is now looking at the balance between fiscal sustainability and intergenerational fairness.

‘It sets out a data-led mechanism to depoliticise state pension decisions and introduce a framework that adapts automatically to underlying trends.

‘AAMs don’t automatically mean poorer outcomes for retirees whether that is manifested through faster increases to the State Pension age or lower amounts.

‘It would depend on how the mechanism is designed and the factors that are included.

‘However, in practice, if demographic pressures continue to intensify and public finances remain constrained, then an AAM could indeed result in more frequent or earlier rises in state pension age compared with the status quo.

‘The key concern would be whether such a system would give individuals enough notice and certainty to plan effectively for the long-term.’