Computing Power Market Overview

Computing Power Market Size

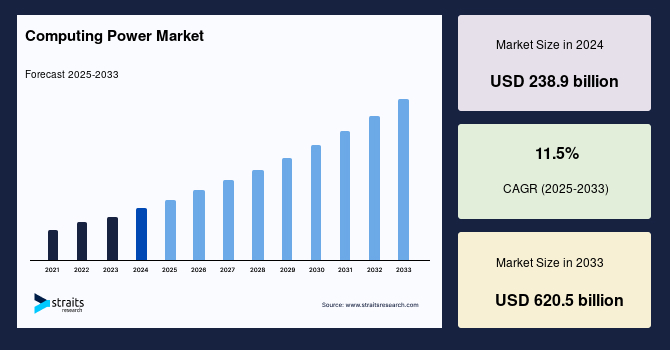

The global computing power market size was valued at USD 238.9 billion in 2024 and is projected to grow from USD 254.7 billion in 2025 to USD 620.5 billion by 2033, registering a CAGR of 11.5% during the forecast period (2025–2033). The global market fueled by surging demand for high-performance processing capabilities across cloud services, artificial intelligence (AI), big data analytics, and edge computing environments.

Key Market Indicators

North America dominated the computing power market in 2024, driven by hyperscale data centers, AI research labs, and strong presence of key players like NVIDIA, Microsoft, and AWS.

Asia-Pacific emerged as the fastest-growing region, fueled by government-backed AI strategies, digital transformation, and investments in semiconductor and cloud infrastructure.

Europe is witnessing significant growth, supported by initiatives like EuroHPC and the European Green Deal, focusing on digital sovereignty and sustainable HPC infrastructure.

Based on product type, high-performance GPU servers held the largest share in 2024 due to their critical role in AI training, simulation, and scientific workloads.

Based on application, AI model training accounted for the highest demand, driven by rapid adoption of large language models (LLMs) and generative AI systems.

Based on distribution channel, cloud service providers (CSPs) dominated the market in 2024, offering scalable, pay-as-you-go computing power solutions.

Based on end user, technology companies (AI startups, SaaS firms, hyperscalers) were the largest consumers, owing to their reliance on advanced compute infrastructure.

Market Size & Forecast

2024 Market Size: USD 238.9 billion

2025 Market Size: USD 254.7 billion

2033 Projected Market Size: USD 620.5 billion

CAGR (2025–2033): 11.5%

North America: Largest market in 2024

Asia-Pacific: Fastest-growing region

Computing Power Market Trend

Sustainability-driven expansion of energy-efficient AI infrastructure

The computing power market is undergoing a critical transformation as the explosion of AI workloads pushes organizations to rethink their data center strategies. Sustainability and energy efficiency are emerging as core requirements not just for cost savings, but as a response to regulatory pressures and environmental responsibility. This trend is reshaping investment priorities across cloud providers, enterprise IT, and chipmakers alike.

For example, in December 2024, Schneider Electric and NVIDIA announced a global partnership to develop AI-optimized energy and cooling reference architectures for high-performance data centers. These systems are designed to support up to 132 kW per rack using liquid cooling technology, enabling the infrastructure to handle dense AI workloads while reducing cooling-related energy consumption by 20%.

As more enterprises adopt ESG mandates and governments tighten carbon and water usage guidelines, energy-optimized computing platforms are fast becoming the backbone of next-generation digital ecosystems.

Computing Power Market Driver

Liquid cooling innovation accelerates AI-ready infrastructure adoption

A major driver behind the rapid growth in the computing power market is the rising need for thermal efficiency in AI and high-density computing environments. As large language models and generative AI systems push server loads to new extremes, traditional air-cooled systems are proving insufficient, prompting a shift toward advanced liquid cooling solutions.

For example, in February 2025, Vertiv announced the global launch of its Vertiv™ Liquid Cooling Services portfolio, a full-spectrum offering tailored to the demands of AI and high-density compute applications. The suite covers the entire lifecycle of liquid-cooled infrastructure, including design, deployment, coolant fluid management, and ongoing maintenance.

Vendors offering integrated solutions that address both power and heat are gaining a competitive edge in a market where performance-per-watt is now a mission-critical metric.

Market Restraint

Soaring energy consumption and grid dependency pose scalability challenges

The growing energy demand and dependence on regional power infrastructure restricts market growth. As AI models and hyperscale workloads become increasingly complex, the power required to operate and cool dense server racks has escalated to unsustainable levels in many locations. Many data centers now require 100 MW+ of power, pushing the limits of local utility grids and leading to delays in permitting, land acquisition, and energy provisioning.

Additionally, the lack of standardized carbon reporting protocols and inconsistent incentives for green compute infrastructure creates uncertainty for operators attempting to balance performance, cost, and sustainability. The result is a challenging environment for scaling AI-ready computing infrastructure especially in geographies where grid expansion or renewable integration is lagging behind compute demand.

Market Opportunity

On-premise AI edge systems create new avenues for scalable, localized computing solutions

The growing demand for on-premise AI and edge computing systems especially in industries where data sovereignty, real-time processing, and latency reduction are critical. While hyperscale cloud continues to grow, many enterprises are now seeking localized compute solutions that allow them to deploy AI models closer to the point of data generation.

For instance, in May 2025, Intel launched its Gaudi 3 AI accelerators, specifically designed for edge and private data centers to handle large-scale AI training and inference workloads. These accelerators deliver double the performance-per-watt compared to the previous generation, while maintaining a compact footprint suitable for on-premise environments such as hospitals, manufacturing plants, and smart city hubs.

This trend presents a strategic opportunity for server OEMs, chipmakers, and infrastructure providers to deliver GPU/TPU-based units, localized storage, and efficient cooling solutions tailored for mid-sized enterprises.

📊 Preview Report Scope and Structure – Gain immediate visibility into key topics, market segments, and data frameworks covered.

📥 Evaluate Strategic Insights – Access selected charts, statistics, and analyst-driven commentary derived from the final report deliverables.

Regional Analysis

North America- Dominant region

North America commands a dominant share in the global computing power market, particularly in high-performance computing (HPC) and AI infrastructure. The region benefits from an advanced digital economy, high R&D intensity, and a dense concentration of hyperscale data centers and cloud service providers. Major technology players like NVIDIA, AMD, Intel, and Google are headquartered in the region, actively driving innovations in GPU acceleration, chip architecture, and distributed computing frameworks. Moreover, early adoption of generative AI and data-heavy applications in sectors such as finance, healthcare, and defense continues to drive demand for scalable, low-latency compute infrastructure.

United States Market Trends

The U.S. is the global leader in computing power infrastructure, driven by massive demand from hyperscale cloud providers, AI research labs, and data-centric enterprises. Major tech companies such as Microsoft, Amazon, and NVIDIA are investing in new AI data centers equipped with advanced GPU clusters and liquid cooling technologies to support generative AI and machine learning workloads. The rapid adoption of AI across sectors, including healthcare, defense, and autonomous systems, continues to fuel innovation in high-density computing. Additionally, regulatory emphasis on digital resilience and chip sovereignty is spurring localized manufacturing and development of custom compute hardware, reinforcing the U.S.’s dominance in the global market.

Canadian Market Trends

Canadais emerging as a strategic computing power hub, especially for AI R&D and sustainable data center operations. Universities such as the University of Toronto and McGill are collaborating with tech companies on deep learning projects, fueling demand for high-throughput GPUs and scalable compute clusters. Canada’s cooler climate and renewable energy mix are also attracting international investments in hyperscale data centers. Firms like Google and Amazon Web Services have expanded their server farms in Quebec and Alberta, citing favorable energy economics. The Canadian computing power landscape is characterized by a balance of academic innovation, enterprise AI adoption, and environmentally conscious infrastructure.

Asia-Pacific- Fastest-growing market

Asia-Pacific represents the fastest-growing region in the global computing power market, driven by rapid digitization, government-backed AI strategies, and expanding tech ecosystems. China, Japan, South Korea, and India are leading regional hubs, with China spearheading investments in supercomputing, AI chip manufacturing, and national AI cloud platforms.

Governments across the region are prioritizing domestic semiconductor production, STEM education, and cloud infrastructure development, which in turn boosts demand for high-performance GPU and CPU solutions. Furthermore, local hyperscalers and telecom giants are building massive edge data centers and distributed AI frameworks, making Asia-Pacific a critical zone for scalable, energy-efficient computing power deployment.

China’s Market Trends

China’s computing power market is experiencing rapid expansion, driven by national digital transformation goals and massive state-backed investments in AI and supercomputing. Tech giants like Alibaba Cloud and Huawei are deploying AI-specific chips and full-stack computing systems to support smart city initiatives and autonomous mobility. Additionally, China’s focus on self-sufficiency in semiconductor design and production is leading to domestic alternatives for high-density compute, such as the Kunpeng and Ascend processor lines. The push for AI compute power across sectors is making China one of the most aggressive markets in terms of growth and scale.

India is swiftly scaling up its computing power capabilities to support its AI ambitions and digital economy. The establishment of regional AI compute clusters in cities like Bengaluru, Hyderabad, and Pune is enabling new use cases in language processing, agriculture analytics, and digital governance. Private sector firms like TCS and Reliance are also investing in on-premise HPC systems and edge computing nodes for industrial automation and AI model training. Furthermore, India’s growing engineering talent base and cloud-native startup ecosystem are fostering demand for flexible, scalable GPU and TPU services.

Europe- Significant growth

Europe is emerging as a strategic contributor to the global computing power market, bolstered by its focus on digital sovereignty, secure infrastructure, and green computing. Countries like Germany, France, and the Netherlands are investing heavily in AI compute clusters, national supercomputers, and HPC centers of excellence. Initiatives like EuroHPC and the European Green Deal promote the development of energy-efficient, sovereign computing architectures tailored for academic research, public services, and industry 4.0 applications. The region’s regulatory frameworks around data privacy (e.g., GDPR) and emphasis on ethical AI encourage the use of secure, high-performance, in-region computing resources.

Germany’s Industry Growth Factors

Germany is a key European computing power market, driven by its industrial automation expertise, strong AI policy framework, and commitment to digital sovereignty. German firms such as SAP and Siemens are deploying private AI clusters for real-time manufacturing analytics and enterprise software optimization. Academic institutions, including Forschungszentrum Jülich and the Technical University of Munich, are major users of advanced supercomputing platforms for simulations in materials science and climate research. Germany’s focus on data privacy, decentralized compute, and green infrastructure places it at the forefront of responsible AI compute growth in Europe.

France is strengthening its role in the European computing power landscape through strategic state investment and public-private partnershipsKey deployments include sovereign AI training clusters in Île-de-France and Bordeaux, operated by institutions like CNRS and INRIA. French firms in aerospace, healthcare, and finance are increasingly adopting AI-specific compute solutions to enhance productivity and competitiveness. Additionally, France’s leadership in climate tech is prompting the development of low-carbon, water-efficient data centers. The combination of a highly skilled AI workforce and a strong commitment to ethical AI adoption makes France a significant force in shaping Europe’s computing power future.

Market Segmentation

The computing power market is segmented into product type, application, distribution channel, and end-user.

Product Type Insights

High-Performance GPU servers dominate due to their unmatched capability in executing parallel processing tasks essential for AI, simulation, and scientific workloads. These systems are engineered with specialized accelerators that drastically reduce training time for complex models while maintaining high precision. Their scalability, compute density, and flexibility make them the go-to infrastructure for both hyperscale data centers and enterprise AI labs. As generative AI adoption spreads across sectors, the demand for GPUs with multi-teraflop capacity is accelerating rapidly.

Application Insights

AI model training stands out as the most compute-intensive and rapidly growing application. Whether it’s training foundation models, generative AI engines, or decision-making systems, this process requires extensive computational resources over prolonged periods. Demand is fueled by sectors including finance, healthcare, and autonomous systems, where accurate, data-driven insights offer significant operational advantages. With large language models (LLMs) surpassing hundreds of billions of parameters, enterprises are increasingly investing in optimized compute clusters tailored for long-duration model training pipelines.

Distribution Channel Insights

Cloud service providers (CSPs) lead the distribution landscape by enabling scalable, on-demand access to high-end computing infrastructure. They eliminate the need for capital-heavy hardware purchases and offer flexibility in choosing compute power based on workload intensity. This pay-as-you-go model supports everything from startups running AI experiments to global corporations managing enterprise-wide simulations, making CSPs the most accessible and scalable distribution channel. Major CSPs are also integrating proprietary AI chips and offering pre-configured instances for industry-specific needs, thus expanding their appeal to a wider customer base.

End User Insights

Technology Companies are the largest consumers of computing power. These include AI startups, SaaS firms, and hyperscalers developing digital platforms, algorithms, and data products that form the backbone of the modern digital economy. Their constant pursuit of innovation through deep learning, automation, and real-time analytics drives continuous upgrades in computing infrastructure, positioning them as both early adopters and high-volume users in this market. The rapid scaling of AI services, cloud-native tools, and on-device inference has further heightened their reliance on cutting-edge computing solutions that deliver both speed and energy efficiency.

Market Size By Product Type

High-Performance GPU

Central Processing Units (CPUs)

Cloud Computing Infrastructure

AI Accelerators & Tensor Processing Units (TPUs)

Quantum Computing Platforms

Company Market Share

The global computing power market is moderately concentrated, with several tech giants commanding a large share of high-performance compute infrastructure, AI training capacity, and data center services. Companies are driven by dominance in GPU clusters, hyperscale data centers, and AI-optimized infrastructure. These companies serve diverse sectors, including AI R&D, cloud-native enterprises, government labs, autonomous systems, and fintech, where latency, scalability, and compute density are mission-critical.

Microsoft Corporation is a global technology leader founded in 1975, known for its software, cloud services, and hardware products. It operates major segments including productivity tools, cloud computing (Azure), and personal computing. Microsoft consistently drives strong revenue growth, fueled by its expanding cloud and AI businesses.

In Q1 2025, Microsoft Azure held around 23% of the global cloud infrastructure market, second to AWS at 31%. Azure’s growth was driven by strong enterprise demand for AI services, deeper OpenAI integration, and major investments in next-gen data centers with liquid-cooled, GPU-rich infrastructure.

List of key players in Computing Power Market

NVIDIA Corporation

Amazon Web Services (AWS)

Microsoft Corporation (Azure)

Google LLC (Google Cloud Platform)

Alibaba Cloud (Alibaba Group)

IBM Corporation

Oracle Corporation (Oracle Cloud Infrastructure)

Intel Corporation

Advanced Micro Devices, Inc. (AMD)

Tencent Cloud

Huawei Technologies Co., Ltd.

Lenovo Group Limited

Samsung Electronics Co., Ltd. (Samsung Foundry/Data Center Solutions)

Recent Developments

March 2025- SoftBank announced a $6.5 billion cash acquisition of Ampere Computing, a leading developer of AI-optimized server processors based on Arm architecture. This acquisition strengthens SoftBank’s portfolio in scalable and energy-efficient compute hardware designed for hyperscale and enterprise AI systems.

May 2025- AMD finalized the acquisition of Enosemi, a Silicon Valley startup specializing in photonic integrated circuits (PICs). This strategic move positions AMD to compete directly with Nvidia in the emerging field of next-generation data center interconnects, which promise significantly higher bandwidth and improved energy efficiency compared to traditional electronic links.

May 2025- NVIDIA announced the expansion of its DGX supercomputing lineup with two new desktop-scale AI systems DGX Spark and DGX Station designed to bring supercomputer-class performance to researchers, developers, and AI teams in a personal form factor. These systems are set to be distributed through major partners including Dell, HP, Acer, and MSI, with availability beginning mid-2025.

Computing Power Market Segmentations

By Product Type (2021-2033)

High-Performance GPU

Central Processing Units (CPUs)

Cloud Computing Infrastructure

AI Accelerators & Tensor Processing Units (TPUs)

Quantum Computing Platforms

By Application (2021-2033)

AI model training

Scientific Research & Simulation

Financial Modeling & Risk Analysis

Healthcare Imaging & Genomic Analysis

Digital Twin & IoT Analytics

3D Rendering & Gaming Graphics Processing

By Distribution Channel (2021-2033)

Cloud service providers (CSPs)

Direct Sales via OEMs (e.g., NVIDIA, AMD, Intel)

Cloud Service Providers (e.g., AWS, Azure, Google Cloud)

Online Sales Platforms (e.g., Newegg, CDW)

Government and Institutional Procurement Agencies

By End User (2021-2033)

Technology Companies (AI, SaaS, Cloud-Native Firms)

Academic & Research Institutions

Government & Defense Organizations

Healthcare Providers & Genomic Labs

Financial Services & High-Frequency Traders

By Region (2021-2033)

North America

Europe

APAC

Middle East and Africa

LATAM

Frequently Asked Questions (FAQs)

The global computing power market size was valued at USD 238.9 billion in 2024 and is projected to grow from USD 254.7 billion in 2025 to USD 620.5 billion by 2033, registering a CAGR of 11.5% during the forecast period (2025–2033).

Sustainability-driven expansion of energy-efficient AI infrastructure is the latest trend shaping the market growth.

High-Performance GPU servers dominate due to their unmatched capability in executing parallel processing tasks essential for AI, simulation, and scientific workloads.

The global market is characterized by the presence of major players such as NVIDIA Corporation, Amazon Web Services (AWS), Microsoft Corporation (Azure), Google LLC (Google Cloud Platform), Alibaba Cloud (Alibaba Group), IBM Corporation, Oracle Corporation (Oracle Cloud Infrastructure), Intel Corporation, Advanced Micro Devices, Inc. (AMD), Tencent Cloud, Huawei Technologies Co., Ltd., Lenovo Group Limited, and Samsung Electronics Co., Ltd. (Samsung Foundry/Data Center Solutions).

North America commands a dominant share in the global computing power market, particularly in high-performance computing (HPC) and AI infrastructure.

In March 2025, SoftBank acquired Ampere Computing for $6.5 billion, boosting its AI-focused, energy-efficient compute hardware portfolio. In May 2025, AMD acquired Enosemi, a photonic integrated circuits (PICs) startup, strengthening its position against Nvidia in next-gen data center interconnects with higher bandwidth and efficiency.