Eager investors have been lining up outside a gold dealer all week as the price of the precious metal surged to a record high.

The line outside ABC Bullion in Sydney‘s Martin Place has stretched out the door for days, as gold hit a record high of AU$6,033.80 per troy ounce.

An increasing number of investors are now turning to gold, which is regarded as a safe haven at times of market instability and the steady devaluing of currency due in inflation.

‘Gold has benefited from multiple catalysts this year, including tariff uncertainty, stubborn inflation, and a falling US dollar,’ said analyst Bret Kenwell at eToro.

‘Uncertainty around the government shutdown and prospects of lower interest rates have only seemed to fan the flames of this year’s rally,’ he added.

Global Head of Institutional Markets at ABC Refinery, Nicholas Frappell, told Daily Mail that more people are becoming attracted to gold’s ‘protection.’

‘A lot of our retail customers have long been believers in gold as an asset and as a wealth protection metal, and I think the difference now is that the understanding is much broader than it was two years ago,’ Mr Frappell said.

‘People are looking at gold as one of the alternatives, and there’s a wider awareness of how acceptable it is.

A line has been out the door for most of the week at ABC Bullion in Martin Place as Aussies look to buy up gold

‘That’s driven by concerns over debt that drives a lot of the interest in gold now.’

John and Margaret are currently on holiday in Sydney, having flown over from South Australia, and admitted it was their second trip to ABC Bullion in less than a week.

They’ve been buying gold for about a decade and couldn’t resist purchasing more on Tuesday.

‘At any time of conflict or any time of threat, gold is a sure thing in a time of upheaval. The paper money, the fiat money, can go up and down and collapse,’ John told Daily Mail.

‘We’re not big buyers We’re pensioners, but that’s the way we manage ourselves,’ Margaret said.

While visiting family, their two pre-teen grandsons asked if they could also buy some of the precious metal with the small amount of money they had saved.

‘We buy gold and trade it so we’re just encouraging our grandchildren to do the same thing,’ John said.

‘This morning it’s about $5,112 after coming down a bit. We took them in on Tuesday because we were doing some transfers and they said, “oh can we buy some too”.

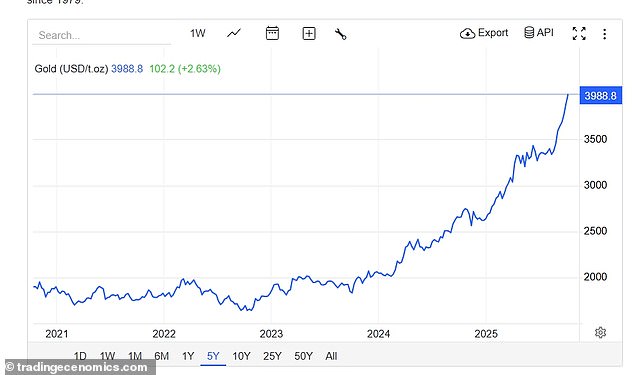

The rise of gold prices marks a dramatic moment that the commodity surged about 50 per cent so far this year which puts it on track for its strongest annual performance since 1979

Australia is one of the biggest producers of gold and there’s plenty more undiscovered

‘Their pocket money is going to it. They’re good investors.’

Mr Frappell said gold had ‘been a very good contributor to returns’.

‘It’s had a very long history of preserving and maintaining wealth and there’s a good case for it to be part of people’s wealth portfolio,’ he said.

Much of the faith in gold’s value is due to it being regarded as a semi-finite mineral due to supposed exhaustive mining of it through history, but Mr Frappell said there is much more that could be discovered and mined.

‘I would say, in terms of undiscovered gold, if you look at the geology of Australia, I’d say there’s plenty out there,’ Mr Frappell said.

Finch Financial managing director Julian Finch said: ‘Gold is classified as a world standard in terms of currency and a precious metal, it’s got an intrinsic value.’

‘It’d be nice if we all had a kilo of gold under our bed at home, because we would have found ourselves with new riches overnight,’ Mr Finch said.

The going rate for New York spot gold rose this week to $3,960.60 (AU$6,033.80) per troy ounce

People queue outside the ABC Bullion store as gold hit a record price this week

Gold investments have performed steadily in recent years with prices rising almost 10 per cent per annum over the past two decades.

Australia is one of the biggest producers of the yellow metal in the world, alongside China, the US, South Africa, Russia, Peru and Indonesia.

Gold earnings are due to increase to $60billion this financial year, which could mean a $4billion rise in the forecast over three months.

That means the yellow metal could overtake Liquefied Natural Gas as Australia’s second-highest value export this financial year.

Tim Harcourt, Industry Professor and Chief Economist at the Institute for Public Policy and Governance at the University of Technology in Sydney said this was good news for Australia’s economy.

‘The price of gold is going to increase our exports, increase our revenue, help our budget’s bottom line and make a lot of gold miners quite wealthy,’ he told Daily Mail.

‘For people who supply gold, like Australia, it’s probably quite good news.

‘We’ve had bigger gold rushes before. Whenever there’s a bit of uncertainty in the world economy, people tend to return to gold because it is regarded as secure.’

Professor Harcourt highlighted that a key cause for the current ‘gold rush’ is the risk of war which will lead to more government borrowing and money printing which devalues currency.

More Aussie are turning to gold as a sound investment amid global tensions

‘There’s been a lot of general disquiet about tariffs from China and the United States,’ he said.

‘There is also a view that countries like China, Iran and Russia are trying to set up an alternative international monetary system to the United States and that makes people quite frightened.’

‘People tend to buy gold as a sort of a flight to safety,’ the economist said.

‘There’s a general tendency for that happen, but it particularly happens when global tensions are at their highest.’

Professor Harcourt suggested to Daily Mail that a reason people ‘hoard’ gold is because they see it as a tangible, long-term investment, similar to buying property.

‘It’s something that people believe, like property won’t ever go down in value. It can (lose value) but, at the moment, people have done quite well recently,’ he said.

‘Australia’s got this thing about ‘red bricks, blue chips and gold’.

‘You buy property – red bricks. You buy blue chips (which are) corporate stocks, particularly in mining, and that includes gold. That tends to be our mantra.’