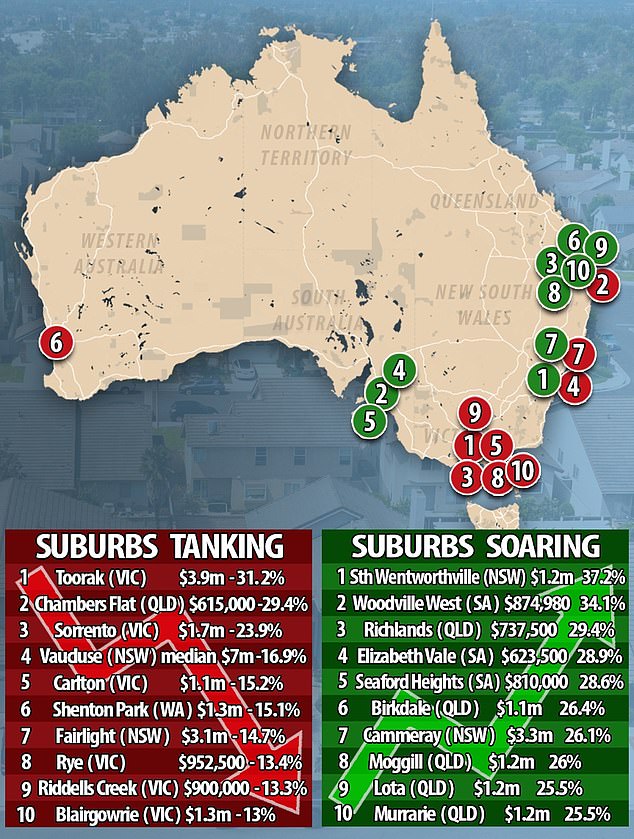

Australia’s property market has taken a dramatic turn, with house prices in some of the country’s most luxurious areas plunging by more than 30 per cent.

Ritzy suburbs such as Melbourne’s Toorak, and Sydney‘s Vaucluse and highly sought-after Fairlight, have stumbled their way into the top ten list of the worst performing postcodes.

In Toorak, the median house price was down 31.2 per cent to $3.9million, according to the latest Domain House Price Report for the June quarter.

This was followed by a 23.9 per cent fall in median prices in prestigious Sorrento to $1.7million; Carlton, down 15.2 per cent to $1.1million; and Rye, where prices dropped 13.4 per cent to $952,500.

Chambers Flat, the only Brisbane suburb to appear in the list of worst performers, recorded the second biggest price fall, dropping 29.4 per cent to a new median house price of $615,000.

In Vaucluse, average house prices fell nearly 17 per cent to $7million while the northern beaches suburb of Fairlight recorded similar falls to reach a new median house price of $3.1million.

Despite house prices plummeting in some of NSW and Victoria’s most affluent suburbs, overall, the value of homes has now hit record highs in Sydney, Brisbane, Adelaide and Perth.

Melbourne and Hobart have reached their strongest levels in years.

Domain has released a list of the best and worst performing suburbs across Australia

South Wentworthville, in Sydney’s west, recorded the biggest price gain over the quarter, lifting 37.2 per cent to a high of $1.2million.

It was one of two Sydney suburbs to feature on the top ten list of best performing suburbs, with median prices in Cammeray also jumping 26 per cent to $3.3million.

Brisbane suburbs dominated the list of the best performers.

The median price for a home in Richlands was up 29.4 per cent to $737,500, followed by Birkdale, up 26.4 per cent to $1.1million, and Moggill, up 26 per cent to $1.2million.

The million-dollar suburbs of Lota and Murarrie saw house prices boom by 25 per cent.

At the same time, soaring house prices are pushing more buyers towards the unit market, where affordability and demand are fuelling robust gains, often outpacing houses.

Domain’s Chief of Research and Economics, Dr Nicola Powell, said another interest rate cut expected for August would likely spur more buyers, and push prices higher, just ahead of the spring selling season.

But she warned the road ahead may be rocky.

In Sydney’s prestigious suburb of Vaucluse (above), average house prices fell nearly 17 per cent to $7million

‘Another rate cut could expand borrowing capacity, though regulators may tread carefully if investor activity accelerates,’ she said.

‘Supply remains the key wildcard. We’re still not building fast enough to meet population growth.

‘Without a substantial boost in new housing, price pressures will remain, regardless of further rate cuts.’

Property Predictions director Brendan Kelly said suburbs with higher median house prices were bearing the brunt of the downturn.

‘If you are in the suburbs of the top 25 per cent and are forced to sell, then you may be a little disappointed in the result at the moment, particularly if you purchased your property three years ago,’ he said.

In the case of Toorak, Mr Kelly pinned the suburb’s price drop on several factors, including a shortage in new listings.

‘Not only are there fewer properties being purchased in Toorak, but there are fewer of the high-priced properties sold in the last six months than in the previous six months,’ he said.

‘I believe it speaks to the economic issues and circumstances being faced by those that can afford the more luxury homes.

‘Throughout Melbourne, we are seeing a growing number of properties remaining on the market for longer than six months, including in Toorak.’

A growing number of properties are languishing on the market in Melbourne (stock)