Scott Pape has doubled down on his criticism of the Albanese government’s expansion of the five per cent deposit scheme, after being labelled a moron.

The Barefoot Investor initially shared his doubts about the Home Guarantee Scheme last week, labelling it ‘insulting’ and claiming it would drive up house prices.

The Albanese government expanded the scheme on October 1, allowing first home buyers to purchase a property with just a five per cent deposit, instead of the usual 20 per cent, to avoid lenders’ mortgage insurance.

The scheme had previously been limited to singles with a taxable income of less than $125,000, and couples earning less than $200,000, before it was expanded to include every Australian, regardless of salary.

Angry reader Tim wrote to Mr Pape on Sunday, calling him a moron, and argued that he thought it was a good idea as it meant he could buy a house sooner.

Tim, said he’d saved $35,000 for a $700,000 and didn’t see why he should keep saving before getting a loan.

‘By then, house prices will have shot up another 20-30 per cent and I’ll be completely priced out. Meanwhile, my rent keeps going up and my landlord just sold the place out from under me,’ Tim wrote.

Mr Pape argued that while Tim’s current situation is tough, a higher mortgage would definitely make life a lot harder, and eventually break Australians in a similar circumstances.

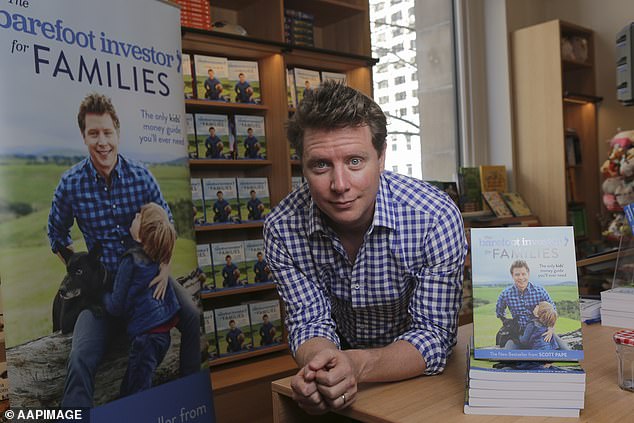

Pape (pictured) warned the low equity means just one ‘bad year’ for scheme participants could cause financial ruin

‘Right now you’re on Australia’s most depressing treadmill: running flat out while prices and rents keep rising faster than you can save,’ he said.

‘Albo has helped you off the treadmill and straight on to the stepper machine.’

On top of higher loan repayments, due to the lower deposit, Mr Pape warned the mounting bills that come with homeownership could quickly become overwhelming.

‘Here’s the kicker: with only five per cent equity, one bad year – job loss, health scare, divorce – and you’re wiped out,’ he said.

‘You can’t refinance, can’t sell without tipping in cash. You’re trapped.

‘Mate, with maximum debt and minimum buffer, you’re one bad year away from disaster.’

Mr Pape added the scheme is not something he’d recommend to his children, so can’t recommend to his readers.

The median home price in Australia today is $844,000, meaning a five per cent deposit is $42,200.

Albanese (pictured with fiancee Jodie Haydon) set the scheme into effect on October 1

The last time $42,200 covered the 20 per cent deposit for a median home was 2002.

‘We want to help young people and first home buyers achieve the dream of home ownership sooner,’ Albanese said.

‘Bringing the start date of our five per cent deposit scheme forward will do just that – getting more Australians into their own home quicker, while saving them money along the way.

‘Labor was re-elected with a clear mandate to bring down the deposit hurdle for first home buyers, and we’re delivering.’

However, Mr Pape believes the scheme actually does ‘the exact opposite’ of making homeownership more attainable.

‘More buyers with more leverage chasing the same properties equals higher prices,’ he said.

Mr Pape added that while it’s easy for him to tell readers to ‘save more’ having already paid off his own home, he’d rather be honest than let them ‘climb onto a step machine that’s designed to break you’.