One of Wall Street’s AI darlings is turning into a nightmare for investors.

In just six weeks, CoreWeave — a tech company most consumers have never heard of — has shed 60 percent of its stock value, wiping out about $33billion in paper wealth.

That’s sending a chill through the entire AI trade. Wall Street had already been on edge about a potential investment bubble.

CoreWeave is not an AI company like OpenAI or Anthropic, in that it doesn’t build chatbots or video-generating apps for consumers.

Instead, the eight-year-old company buys massive quantities of Nvidia’s highest-end AI chips, installs them in 32 energy-hungry data centers, and rents that computing power to trillion-dollar customers like OpenAI, Microsoft, and Meta.

At first, investors loved the company.

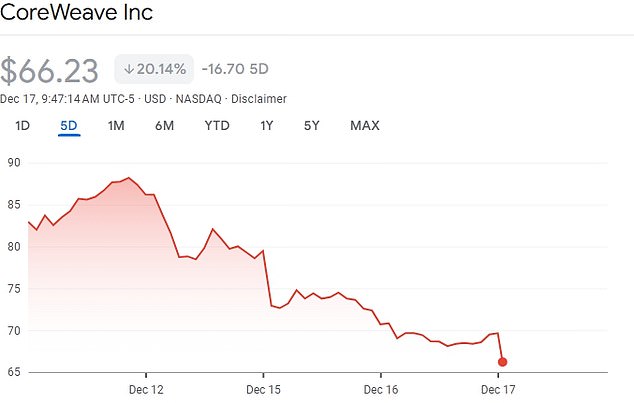

CoreWeave launched its IPO in March, valuing its shares at $40. Wall Street flooded the company with a shocking amount of cash, sending the stock’s value to a peak of over $183 a share by mid-June.

The stock today is still up 67 percent from its IPO price due to the initial three-month boost, but has fallen 61.2 percent from its June high to just around $66.

CoreWeave hit the market in March with a $40 initial stock offering. It climbed to over $180 before crashing to $66 today

CEO Michael Intrator doesn’t think his company is in a bad position. ‘The world will find ways to finance an enormous amount of business,’ he said

The firm’s deep strategic ties to Nvidia — which is both an investor and hardware supplier — have sparked significant ‘circularity’ concerns among financial analysts.

The cycle begins with Nvidia injecting millions of dollars into CoreWeave.

CoreWeave then uses that investment to purchase back Nvidia’s expensive H100 and Blackwell chips, effectively returning the money to the supplier and boosting Nvidia’s reported sales.

To pay for the latest Nvidia tech, CoreWeave is taking on an estimated $18.8billion in debt, according to Company Market Cap trackers.

Wall Street’s unease starts with how CoreWeave will pay all of that back. But the company’s CEO, Michael Intrator, isn’t worried about the balance.

‘If you’re building something that accelerates the economy and has fundamental value to the world, the world will find ways to finance an enormous amount of business,’ he told the Wall Street Journal.

The company’s wild ride has attracted some high-profile skeptics. Jim Chanos, an investor who famously predicted Enron’s collapse, revealed a short position in CoreWeave, effectively betting the firm will drop even lower.

He’s among a chorus of big Wall Street names that have grown worried about AI debt.

CoreWeave’s stock has slumped since June, evaporating $33billion from the company’s overall value

This year, major indexes have relied heavily on companies investing in AI. Nearly 30 percent of the S&P 500 is concentrated in five companies: Google parent Alphabet, Nvidia, Microsoft, Apple and Amazon, according to CNBC.

Many of those companies are making enormous bets on firms with astounding amounts of debt and limited revenue — like OpenAI or CoreWeave — to build the infrastructure that powers AI.

The debt and limited revenue have worried investors about a potential bursting of the bubble, much like the dot-com bust in the early 2000s or the housing crash in 2008.

But few see those risks tipping the market toward an immediate crash, and investment heavyweights still advise Americans to hold on to their portfolios.

For example, Steve Eisman, a former portfolio manager who found fame when Steve Carell portrayed him in The Big Short, doesn’t see a 2008-like crash coming to stocks today.

‘Look at the speed of adoption of ChatGPT, which reached 800 million users in only three years,’ he previously told the Daily Mail.

‘The internet took 13. AI is already delivering.’

On Wednesday, CoreWeave’s stock was down another six percent in early-morning trading. The company didn’t immediately respond to the Daily Mail’s request for comment.