Kenya’s fixed broadband market has posted impressive growth, with subscriptions surging 42.9% to 2.14 million by June 2025, according to new data from the Communications Authority (CA).

The surge reflects rising demand for high-speed internet, aggressive competition among Internet Service Providers (ISPs), and the ongoing rollout of national fiber infrastructure.

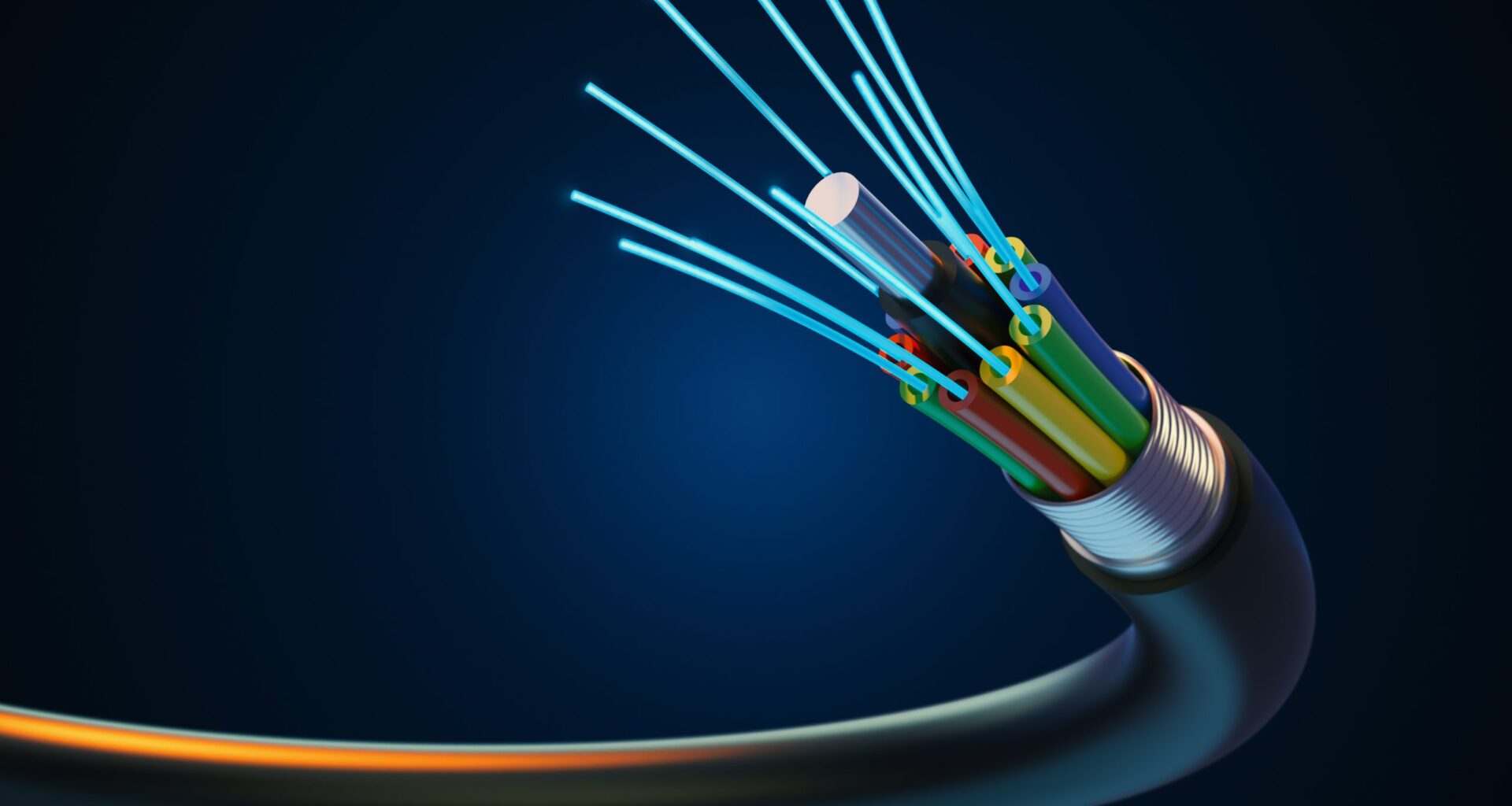

Fiber and Wireless Lead Growth

The report shows that fiber-to-the-home (FTTH) and fixed wireless continue to dominate the market. FTTH accounts for over 1.1 million subscriptions, while fixed wireless follows closely with 721,000 connections.

Fiber-based enterprise services (FTTO) also grew steadily, hitting 101,677 subscriptions, highlighting the shift by businesses to dedicated high-capacity internet.

When it comes to speed, most Kenyans are connecting through mid-tier packages. Over 870,000 subscriptions fall within the 10–30 Mbps range, followed by more than 717,000 in the 2–10 Mbps bracket.

Notably, ultra-high-speed plans above 1 Gbps remain niche, mostly adopted by offices on fiber networks.

Safaricom Leads, but Rivals Are Catching Up

The competition among ISPs is heating up. Safaricom PLC still leads the market with 735,749 subscriptions, translating to a 34.3% share.

However, Jamii Telecommunications (Faiba) has grown to 20.6%, consolidating its position as Safaricom’s main challenger.

Zuku (Wananchi Group) holds 12.7%, but it is facing pressure from newer players like Poa Internet (12.5%) and Ahadi Wireless (7.5%), both of which have grown by aggressively targeting estates and peri-urban markets.

Smaller players such as Vilcom (4.1%), Mawingu (3.6%), and satellite newcomer Starlink (0.8%) add to the increasingly diverse ISP ecosystem.

The growth is partly attributed to the government’s ongoing National Optic Fiber Backbone Initiative (NOFBI) and county-level connectivity programs, which are lowering barriers for ISPs and improving reach to underserved regions.

Given the importance of internet adoption for e-commerce, education, and remote work, Kenya’s fixed broadband market is poised to continue being one of the fastest-growing segments in the ICT sector.

The 43% surge highlights Kenya’s growing appetite for home and business connectivity, while intensifying competition among ISPs is expected to drive down prices and improve service quality.

With fiber and fixed wireless leading the charge, Kenya’s digital transformation is entering a new phase where reliable broadband is becoming essential.