Alex Oxlade-Chamberlain, the former England star engaged to Little Mix singer Perrie Edwards, is an investor in Conor Finn’s Pod1um

KARWAI TANG/WIREIMAGE

Pod1um, Conor Finn’s online sports performance hub, has bagged some big-time investors. Finn is a former strength and conditioning coach for Mayo GAA and obviously has the stamina to get a start-up to work.

I’m told that Danny Welbeck, the Brighton striker, the former Arsenal full-back Kieran Gibbs and Alex Oxlade-Chamberlain, the former Liverpool winger whose fame soared when he started dating the Little Mix pop star Perrie Edwards, have all put some money in to help expand the digital business. Barry Solan, the strength and conditioning coach at Arsenal, where Welbeck, Gibbs and Oxlade-Chamberlain all played at various stages in their careers, is also a shareholder.

Pod1um is a one-stop shop for performance athletes and coaches, providing everything from personalised coaching programmes to athlete monitoring systems. It connects athletes of all levels with the top coaches in the world. The Dublin-headquartered firm has also moved into the content and sales space, allowing its clients to post content and sell on its marketplace. It’s a treasure trove of nifty warm-ups and tips on how to heal a hamstring. Frankly I got exhausted just looking at it, but it’s clearly got cred.

Mary Dunphy is bringing her nous from Accenture and CoderDojo to Cuban investments at Ceiba

Dunphy lights up boardroom at Cuban-focused fund

I see where Mary Dunphy, former Accenture partner and one-time global boss of the CoderDojo movement, has joined the board of the Cuban-focused investment group Ceiba. Dunphy is chairwoman of Andy Byrne’s SME-focused investment outfit Mashup, which is trying to sell an old denim factory in Co Longford.

Ceiba is a listed, Guernsey-headquartered closed-end investment fund that invests in Cuban real estate projects, often through joint ventures. Its biggest investment is a chunk of the operating company behind the Miramar Trade Centre in Havana. It also owns part of a company that owns hotels in the cities of Havana and Trinidad and resort town of Varadero. Trevor Bowen, the former Ulster Bank director and U2 business adviser, is also a board member of the Cuban-focused group.

Not sure about the director’s fees but the post-board meeting cigars should be good.

O’Flanagan’s software firms have successful format

Entrepreneurs Hugh O’Flanagan and Martin Dreymann have just pulled off a below-the-radar funding round for their tech start-up Format, which is still in stealth mode. I believe that the firm has developed a way of using artificial intelligence to hoover up all the data generated by a company’s customer interactions and scrunching it together to provide useful information that can boost sales and profitability. The product has not yet launched but, my spies tell me, all will be ready in the autumn.

It’s not O’Flanagan’s first rodeo. He sold his first software company, Lua, in 2021 at the age of 28. Lua was acquired by Beekeeper, which this month announced its own acquisition by LumApps. The latter deal, financed by Bridgepoint, values the combined company at more than $1.1 billion. I believe that O’Flanagan’s new backers include a few that rolled the dice successfully on Lua.

KPMG man Quigley is quids in on house next door

Eoghan Quigley, the KPMG partner who made a fortune from the €655 million sale of Richard Hayes’s fintech Global Shares, looks to be expanding his footprint. I hear that he has picked up the house next door to him in Dublin 6 and is looking at creating a monster pad.

Quigley, who is also the new president of Dublin Chamber, is involved with another venture backed by Hayes, called Alt21, and I see where he and four other KPMG amigos and Global Shares beneficiaries are riding with the pet food king Philip Reynolds and his AI-powered corporate finance adviser Bertie.

Reynolds is also in the property market, on the sell side, seeking €8 million for his jaw-dropping estate in Co Westmeath.

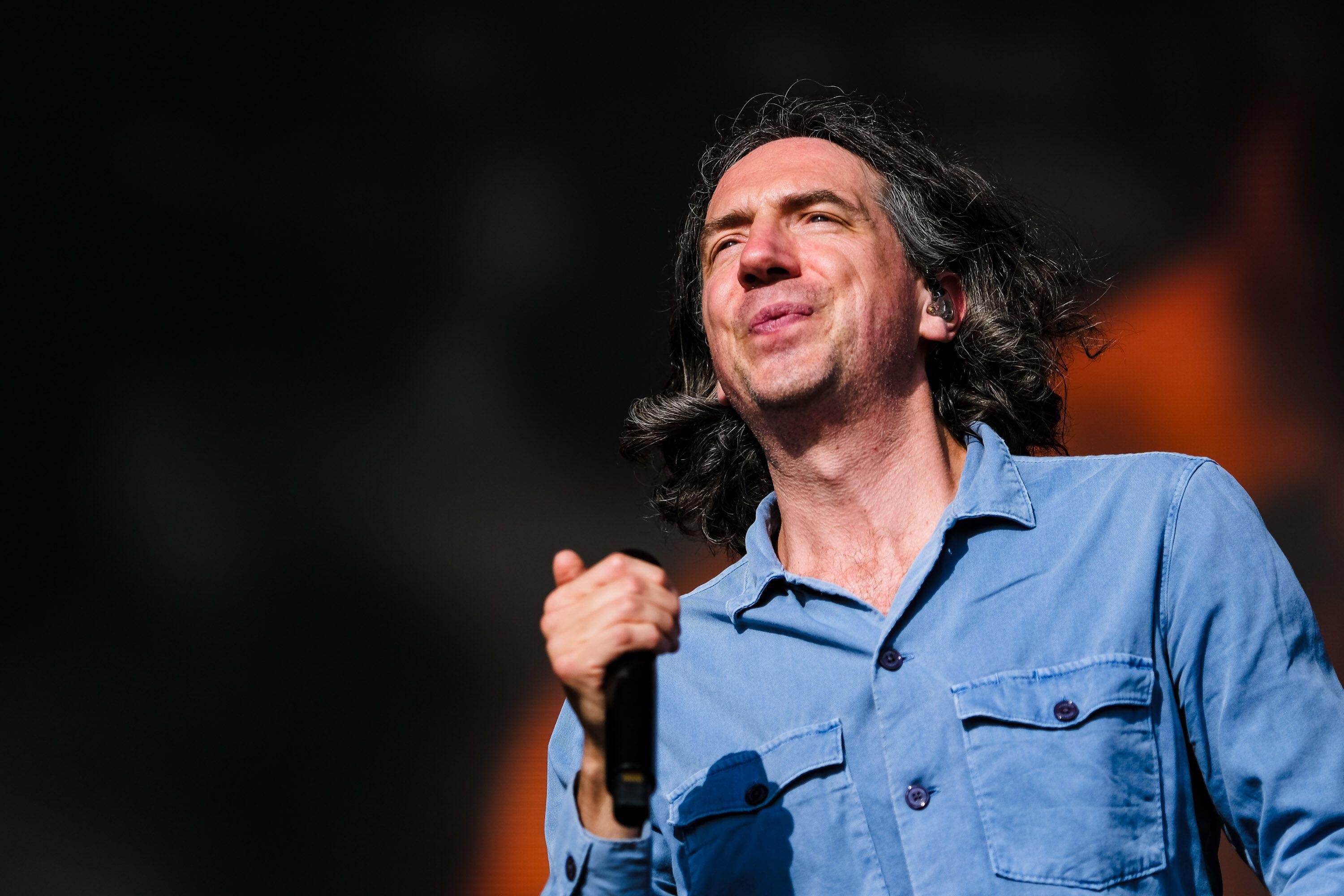

Gary Lightbody of Snow Patrol is chasing CBD investments in the form of Goodrays

JULIE EDWARDS/ALAMY

Cannabis‑based drinks brand gets celebrity blessing

Trinity College Dublin alumnus Eoin Keenan has just picked up funding from Snow Patrol’s Gary Lightbody and the TV stars Tess Daly and Vernon Kay for his cannabidiol brand Goodrays as it seeks to grow its functional drinks range.

Keenan set up Goodrays to capitalise on the growth of CBD products for health and wellness benefits. Raising almost €6 million from Guinness Ventures — the asset manager, not the stout brew — and a bunch of celebrity investors, the Irishman plans to step up development of new products as well as boosting sales efforts.

Keenan has also brought in Ben Dando, the former international head of the Liquid Death canned water brand, to become the new chief executive of Goodrays. Ed Leigh, the snow sports commentator, and Ben Skinner, a prizewinning British surfer, are other backers of the brand, which has doubled revenues and profitability in each of the past three years. Last year it landed listings with four of the UK’s biggest retailers, which helped catapult its sales higher.

The European CBD and hemp-infused drinks market is in its infancy, with overall sales barely topping €1 billion. The growth prospects are staggering.

McVicar does heavy lifting in property finance

Combilift founder and serial entrepreneur Martin McVicar is a chap who recognises an opportunity when he sees one. Very few people would have thought that Monaghan would become one of the global hotbeds for the design and construction of forklifts of different shapes and sizes. But McVicar had the vision and now he employs more than 1,000 people and his engineering firm has revenues of over €450 million. Given that he’s such a big supplier to the construction sector, it’s no great surprise to see that McVicar is trying to figure out one of its biggest problems: the lack of finance for small and mid-sized developers.

I see that his McVicar Holdings is now helping to fund Padraig McKenna and Barry Kerr’s Kmck Real Estate and has taken charges over a property consisting of a shop with four apartments overhead in Mullingar that had been on the market for €450,000.

Skanking with the former Primark supremo

You never quite know who you’ll bump into at a concert, especially when the mosh pit is made up of rockers of a certain vintage. I happened to be at the Beat in the Purty Kitchen last weekend when I chanced upon the Dalkey resident Paul Marchant, who recently resigned as Primark supremo following an “error of judgment” at a social event some time ago. Marchant had served as chief executive of the low-cost fast-fashion giant for almost 20 years. Would it have been Bad Manners or even Madness to discuss his future plans at a ska concert?